The best dividend stocks are less volatile than other stocks, and provide investors with a consistent, reliable income stream in the form of quarterly dividend payments. Plus, over the long-term, dividend-paying stocks consistently outperform their non-dividend-paying counterparts.

If you’re looking for the best dividend stock to buy today, I expect dividend-paying stocks in the following industries to do especially well in the final quarter of 2017 and into 2018:

- Industrials and Materials Stocks

- Housing Stocks

- Financial Stocks

Industrial stocks, materials stocks and stocks of companies that work on major infrastructure projects got a nice boost after Donald Trump was elected President, because of promises he made on the campaign trail. The Basic Materials SPDR (XLB) rose 8% between the election and the inauguration, while the Industrials SPDR (XLI) gained 9%.

But the sectors cooled off after the inauguration, as the President’s big promises ran up against political reality. The XLB and XLI both stalled out for about three months after the inauguration. However, both sectors got moving again in the second half of the year, and have been outperforming the broad market more recently.

Best Dividend Stock #1: Caterpillar (CAT)

My favorite stock to play the trend is Caterpillar (CAT), which makes heavy machinery and vehicles used in the construction, mining, energy and transportation industries. CAT isn’t just benefiting from the rally in building stocks, it’s leading it. CAT is up more than twice as much as the XLI year-to-date, and gapped up on earnings in April, July and September.

[text_ad]

Caterpillar’s equipment is used all over the world, so the company can benefit from almost any industrial, commodity or infrastructure boom, from investments in American roads to higher production at South American mines to stronger demand for energy in China. That makes Caterpillar (CAT) a great way to play the rebound in multiple heavy industries in a single stock. Higher commodity and energy prices are also a tailwind, since they mean many of Caterpillar’s customers have more cash to invest.

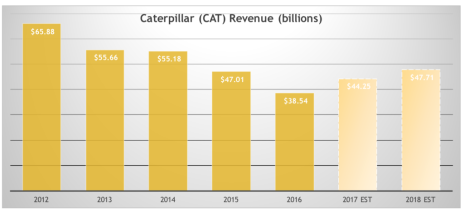

Of course, the inverse is true as well: when commodity prices, industrial production and infrastructure investment fall, so do CAT’s fortunes. And that’s exactly what happened in 2014 and 2015, when CAT stock fell 45% from peak to trough. Revenues declined in 2013, 2014, 2015 and 2016. CAT even stopped increasing its dividend. (But didn’t reduce it; Caterpillar has paid dividends since 1925 so the payout is very safe).

Last year saw the beginning of a solid recovery for many industrial sectors and Caterpillar. The company beat earnings estimates by double digits in each of the last four quarters. And EPS are now expected to rise by over 50% this year and by over 20% next year!

Best Dividend Stock #2: PulteGroup (PHM)

My next favorite place to look for the best dividend stocks today is the housing sector. The SPDR S&P Homebuilders Index (XHB) started the year strong, but treaded water for most of the summer. So it has plenty of gas in the tank as we enter the last quarter of the year. The U.S. housing market continues to strengthen—however, while home prices are rising, existing home sales remain muted because demand is continually outstripping supply.

That’s good news for builders of new homes, like PulteGroup (PHM). Pulte is a homebuilder—one of the largest and most diverse in the U.S. The company’s largest market, responsible for about 21% of revenue, is California and the Southwest. The remainder of revenue comes from the mid-Atlantic region (18% of revenue), Florida (17%), the mid-west (another 17%), Texas (15%) and the Northeast (12%). About a third of customers are first-time homebuyers and another third are older adults moving into “lifestyle communities.”

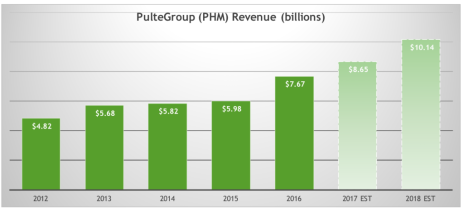

Revenues have increased in each of the past five years, and are expected to grow by 13% this year and by 17% next year. EPS are expected to grow 19% this year, and a whopping 32% next year.

Plus, the stock pays regular dividends, for a 1.3% dividend yield, and is in a steady uptrend.

Best Dividend Stock #3: Citigroup (C)

Last but not least, financial stocks were expected to be major outperformers in 2017, but lost their footing over and over again. The Financial SPDR (XLF) traded flat from January to June, as interest rates slid and President Trump’s tax reform plans got pushed to the back burner.

But tax reform is now before Congress, and interest rates bottomed in early September. That helped the XLF to finally break out to a new 52-week high at the end of the month. And financial stocks are expected to deliver the second-highest earnings growth of any sector this quarter (after energy stocks, which are still recovering from years of low oil prices.)

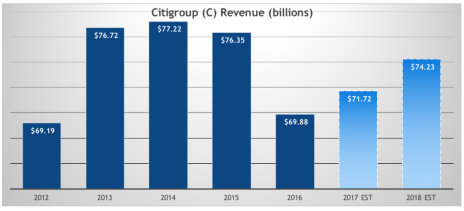

My favorite dividend stock play on the sector today is Citigroup (C), the huge bank that was one of the worst-hit by the financial crisis. Citi has spent the years since the crisis raising capital, recruiting talent, buying back shares and expanding internationally. Today, only 47% of the bank’s revenues come from North America, an advantage given still-low U.S. interest rates.

Citi’s transformation was recognized by the U.S. government this summer, when regulators gave the bank permission to double its dividend and increase share buybacks by more than $15 billion.

That huge dividend hike is likely only the start, and investors have been piling into the stock in anticipation of more growth ahead. That helped C break out of a four-year trading range earlier this year, and the stock is currently trading at its highest level since 2008. Analysts expect revenues to rise 3% this year and 4% next year, fueling 13% and 12% EPS growth.

[author_ad]