Oil prices have come a long way from negative $37 a barrel. Almost four years removed from West Texas Intermediate crude oil futures going negative for the first time in history in May 2020, oil prices are once again approaching $90 per barrel. Meanwhile, energy stocks, which spent most of 2023 trading sideways, have bounced back and then some. But individual energy stocks can still seem a tad unpredictable. Oil ETFs are a more efficient way to play the rebound.

As we so often say here at Cabot Wealth Network, we’re stock pickers. We prefer to recommend individual stocks—growth stocks, value stocks, small-cap stocks, etc. However, there are occasions when we recommend exchange-traded funds (ETFs). One of those occasions is when there’s a red-hot or rebounding sector and you want to take full advantage of its momentum. Rather than pick one or two stocks, it can make sense to buy an ETF that tracks a whole basket of stocks in that sector.

[text_ad]

That’s why oil ETFs are a good option right now. Here are three that have shown particular strength as oil prices have gained steam.

3 Oil ETFs to Play the Crude Rally

iShares U.S. Oil & Gas Exploration & Production ETF (IEO)

As the name suggests, this ETF holds oil and gas companies specifically focused on exploration and production. It counts ConocoPhillips (COP), Marathon Petroleum (MPC) and EOG Resources (EOG) among its 10 largest holdings (out of 49). IEO has returned about 19% so far in 2024 and is trading at fresh all-time highs. It should stay strong as long as oil stocks stay in gear.

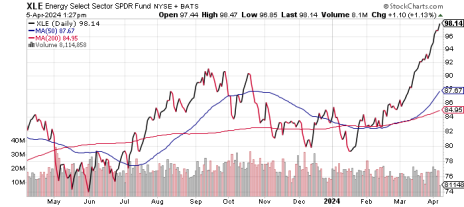

Energy Select Sector SPDR Fund (XLE)

The XLE is essentially a proxy for energy stocks as a group, with holdings that include all of the biggest names in the sector (Exxon (XOM), Chevron (CVX), Phillips 66 (PSX), SLB (SLB), etc.), the 10 largest of which account for 76% of the fund’s total assets. So as crude oil prices have accelerated, so has the XLE; it’s up 16% YTD.

PowerShares DB Oil Fund (DBO)

This one’s a bit more niche, but it’s based on the value of crude oil futures contracts, which is where the DBO invests 100% of its assets. When oil prices rise, this fund rises even faster. To wit: since oil futures started accelerating in February, DBO is up 16%.

Bottom line: Oil prices are once again above $80/barrel and could approach triple-digit levels as we get into the summer months. And that makes energy stocks a good place to be. Investing in any one of these oil ETFs is a nice catch-all way to play the rebound, gaining access to an entire chunk of a fast-recovering sector.

Do you own any energy stocks or ETFs not on this list? Tell us about them in the comments below.

[author_ad]

*This post is periodically updated to reflect market conditions.