The one thing analysts like to do more than recommending the best stocks to buy is constantly trying to predict the next stock market bubble; they all want to be the one to say, “I told you so.” (And they all want Brad Pitt to play them in the next version of “The Big Short.”) So serious investors always take headlines like these with a grain of salt:

But I have to admit, Wall Street’s latest target does have all the elements of a good bubble.

- First, there’s the bubbliness: The U.S. has “overbuilt” shopping malls, with five times as many malls per capita as the U.K.

- Then, there’s the pop: The “demand” for malls has fallen off a cliff because people are doing more shopping online.

- Lastly, the timing could be right: Mall-related real estate transactions fell to $15 million last year, from $25 million in 2014 and 2015.

So, if these analysts are right, what’s the best way to make money from this knowledge?

[text_ad]

Well, you can be sure that the analysts themselves will be buying fancy derivatives that pay off when malls default on their debt—and they have a lot of debt. But that’s a little hard for the average investor to participate in.

So you could short the stocks of mall-based retailers, like Abercrombie & Fitch (ANF) or L Brands (LB), whose stocks are falling as they close increasingly deserted stores.

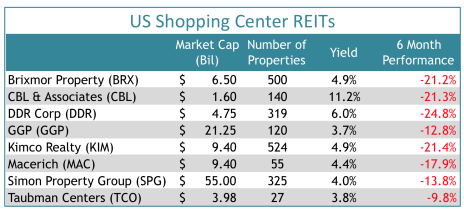

Or, you can bet directly against the malls themselves. Many of the malls in the U.S. are owned by big management companies organized as real estate investment trusts (REITs). The largest mall REITs include Simon Property Group (SPG), GGP (GGP), Kimco Realty (KIM) and Macerich (MAC), all of which have seen their stocks decline significantly in recent months.

But what if you don’t particularly like shorting stocks? (It’s not our favorite strategy, for a few reasons.)

For investors who prefer to go long, there are plenty of ways to invest in the other side of this trade. The flipside of the collapse of brick-and-mortar retail is the rise of online shopping, and there are plenty of winners to be found there. And, in my opinion, most of them have much further to run than their brick-and-mortar counterparts have to fall. Here are my top 20 best stocks to buy in the retail sector, in alphabetical order.

20 Best Stocks to Buy in the Retail Sector

Best Stock to Buy #1: Alphabet (GOOGL)

There isn’t much that happens online that doesn’t involve Google (Alphabet is its parent company)—and shopping is no exception. The company owns the largest ad network on the internet, and is constantly snapping up smaller competitors to maintain its dominance. Online sellers have little choice but to work with Google at some point, and they generate plenty of revenue for the search giant—whether by paying directly for eyeballs and clicks, or just for analytics tools.

Alphabet’s revenues hit $90 billion last year, and are expected to grow by 18% this year and 16% next year. GOOGL just hit a new all-time high in mid-March, and has now pulled back to its 50-day moving average—probably a decent buying opportunity for long-term investors.

Best Stock to Buy #2: Alibaba (BABA)

The world’s largest retailer since April 2016, Alibaba is a Chinese company with a hand in every aspect of the e-commerce pie. The company hosts web portals for consumer-to-consumer, business-to-consumer and business-to-business sales, and also offers electronic payments services, a shopping search engine and cloud computing services.

Alibaba is growing quickly through M&A, most recently buying a mobile gaming distribution network and a ticketing platform called Damai. The company is also investing heavily in expanding beyond China.

Technically, BABA looks strong; the stock broke out of a nice consolidation pattern in March and the next stop is resistance at 110 that dates all the way back to late 2014.

Best Stock to Buy #3: Amazon (AMZN)

The first company most people associate with online shopping, Amazon.com is the granddaddy of the space, started as an online bookstore way back in 1994. The company has a real talent for identifying the pain points of shopping online, and tends to set the standard for all of its competitors by continually making shipping cheaper and faster.

For years, this was a money-losing strategy for Amazon, which raked in cash but continually failed to turn a profit. But soaring revenue eventually began to fall to the bottom line, and earnings have grown by 36% in each of the past five years, on average. Analysts expect 47% EPS growth this year and 73% growth next year. It’s no wonder that AMZN is currently trading at all-time highs.

Best Stock to Buy #4: AutoHome (ATHM)

Another pick from China, AutoHome is the leading website for Chinese car buyers. AutoHome connects automakers and dealers and with shoppers, and also offers financing and car-related information. Revenues have more than doubled over the past two years.

ATHM came public (as an ADR) in 2013, at just under 30 per share. The stock rallied all the way to 50 by the end of its first year, but was soon dragged down by a selloff in Chinese stocks and a contentious shareholder-management battle. The stock bottomed at 20 in mid-2016, and has now started what looks like a sustainable rebound.

Best Stock to Buy #5: Criteo (CRTO)

Criteo, based in France, is a leading retargeting company. Retargeting is when you look at a product online but don’t buy it ... and then it follows you around the internet for days. (I’m currently seeing a bedside lamp I haven’t decided on yet pop up everywhere—plus about a dozen similar lamps.) The ads work well, and Criteo’s operating income shot from $53 million in 2014 to $121 million last year. The stock is young—another late-2013 IPO—and is knocking at its all-time highs around 50 for the third time in its short life. We’ll see if it can break through this time.

Best Stock to Buy #6: eBay (EBAY)

More mature than many of the companies on this list, eBay had a brief heyday in the early 2000s, then went through a major reorganization. The company’s current turnaround plan includes offering fast free shipping (to compete with Amazon Prime), and improving search results. Investors are optimistic; the stock is just a few points below its all-time high and analysts expect 7% EPS growth this year, and 10% next year.

Best Stock to Buy #7: Etsy (ETSY)

This one’s for the bargain hunters. Etsy is an online marketplace for handmade and vintage goods, popular for hipster home furnishings and twee baby clothes. ETSY came public at 30 per share in early 2015, but hasn’t been anywhere near there since. Investors bailed as revenue growth slowed; revenues are still increasing, but 2013’s 67% year-over-year growth rate slid to 56% in 2014, 40% in 2015, and 33% last year. On top of that, earnings are negative. On the bright side, the company has no debt, and the stock trades just above 10 bucks.

Best Stock to Buy #8: Facebook (FB)

Like Google, Facebook’s piece of the e-commerce pie is a nice chunk of ad revenue. The company’s fastest-growing revenue stream is from mobile ads, where Facebook has recently become a standout. Mobile ads now account for 84% of Facebook’s total sales, driven by ads in fairly new places, such as Instagram and Facebook Live. Three years ago, Facebook’s mobile and desktop ad sales were on virtually equal footing, and the company was barely turning a profit. Now that mobile ads make up the lion’s share of Facebook’s total sales, profits have grown 50% or better for five straight quarters.

Facebook’s revenues and EPS have both risen by almost 50% per year over the last five years, on average. Earnings have beaten estimates in each of the last four quarters, and are expected to grow 28% this year and 23% next year. It’s no surprise that FB is up 23% year-to-date, and hit a new all-time high last week.

Best Stock to Buy #9: HubSpot (HUBS)

A late-2014 IPO, HubSpot is a cloud software company. Online businesses use HubSpot’s tools to attract visitors to their websites and then get them to buy things (they obviously have more technical language for it).

Earnings per share are still negative, but revenues are growing quickly—sales increased 57% in 2015 and 49% last year. Sales growth is decelerating as the company gets larger; analysts expect revenues to grow 30% this year and 26% next year. On the bright side, HubSpot’s losses have been smaller than expected in each of the last four quarters.

The stock has been in a gradual uptrend since its IPO, with one major shakeout in early 2016. HUBS is now a couple points off all-time highs, and could be an interesting speculation here.

Best Stock to Buy #10: JD.com (JD)

JD.com is a massive Chinese online shopping site. The company has a market cap of $45.8 billion and earned $181 billion in sales last year. Revenues have grown every year since JD’s 2014 debut on U.S. markets (as an ADR) but earnings are still negative. However, EPS have been positive in each of the last four quarters. In the latest quarter, revenue rose 46% year-over-year, and JD made a profit of $0.06, instead of the six-cent loss analysts were expecting.

JD the stock hasn’t really made any progress since its IPO, chopping around between 20 and 35, but our emerging markets analyst, Paul Goodwin, says he’d buy it on a breakout through 32.

Best Stock to Buy #11: NetEase (NTES)

NetEase is also based in China, but the company’s stock has had a much better introduction to the U.S. market than JD’s. NTES came public in the U.S. (as an ADR) way back in 2000, and over the past 10 years, it’s gained over 1,400%. Cabot Global Stocks Explorer (formerly Cabot Emerging Markets Investor)has owned it on and off several times since then; their latest buy was last year and is showing a 69% profit today. NetEase started off as an internet portal (often called the Yahoo! of China) but has recently become a major computer and video game publisher. Paul says you can use the latest pullback as a buying opportunity, but for his ongoing advice, consider a subscription.

Best Stock to Buy #12: PayPal (PYPL)

Online payment processor PayPal has been doing well since its spinoff from eBay in 2015. The stock is up 23%, and revenues and earnings are growing. EPS have met estimates in each of the last three quarters, and analysts expect 15% profit growth this year and 19% growth next year.

PayPal’s growth is especially closely tied to the growth of smaller online stores, where customers don’t have their credit card information saved already (as opposed to Amazon). Small merchants also like PayPal because it makes it easier for them to process transactions—no matter how customers pay. Since 2014, both the number of active PayPal users and the number of transaction per user have increased every quarter. About 47% of revenues are international.

Best Stock to Buy #13: RocketFuel (FUEL)

Got a soft spot for penny stocks? FUEL has surged from under two bucks to 5 over the past three months, but it’s still dirt cheap.

RocketFuel is essentially an online ad company, although they call themselves a Predictive Marketing Platform. (As far as I can tell, that means they’ll show you an ad for Denny’s right before you realize you’re hungry for pancakes.)

FUEL hasn’t always been this cheap; the stock IPO’d at 56 back in 2013, traded around 60 for a while, and then began a long, slow slide to the sub-two-dollar level. Investors didn’t like the huge losses and year-over-year sales declines, I guess.

But FUEL has beaten estimates in each of the last four quarters (they’re still losing money), and analysts think sales might actually increase next year. FUEL is still highly speculative, obviously.

Best Stock to Buy #14: Shopify (SHOP)

Shopify is one of the purest online shopping plays you’ll find. Small online businesses use Shopify’s cloud-based software to host their stores, facilitate payments and even interface with social media platforms. It’s a large market, and Shopify’s share of it is growing quickly; the company had 375,000 clients at year-end, up 50,000 from the quarter before. Recurring revenue from monthly fees was up 63% in the fourth quarter and gross merchandise volume sold through Shopify’s platform was up 95%. Earnings are hovering around breakeven as the company invests in its product and grabs as many clients as it can. But when earnings start ramping up (probably this year), they should be very impressive.

SHOP was recommended in Mike Cintolo’s Cabot Top Ten Trader earlier this year, but is now pulling back. Click here if you’re interested in getting his latest advice on the stock.

Best Stock to Buy #15: Square (SQ)

Square is best known for its tiny square credit card reader, which plugs into the headphone jack of any mobile device. But the company qualifies for our list because they also facilitate digital payments, through their software and the Square Cash app. (They also have payroll software and a business financing arm called Square Capital.)

Square isn’t profitable yet, but revenues are growing. It’s possible (although not likely at this point) that the company will turn a profit in 2018. But that doesn’t matter to forward-thinking investors, who have pushed SQ to all-time highs this year. The company’s next big move is entering the U.K. market—and later the rest of Europe.

Best Stock to Buy #16: TrueCar (TRUE)

TrueCar is the AutoHome of the U.S. In other words, it lets people shop for cars online (although they still ultimately buy from local dealers).

The company came public around 10 in 2014, and topped out short of 25 late that year. Then it ran into legal trouble for “acting like a dealer” without the required licenses. The stock fell to the single digits, but TRUE put in a strong bottom early last year and the rebound since has been orderly. TRUE is now trading around 15 and sales are expected to grow by low-double-digits over the next couple of years. The company could even turn a profit for the first time next year.

Best Stock to Buy #17: Verizon (VZ)

Verizon makes our list because of its ad network. The telecom giant is combining recent acquisitions AOL and Yahoo into a subsidiary called Oath, which will make it even better at tracking users around the internet (even inside apps) and serving them relevant ads. It’s not the telecom’s biggest cash cow (that would be mobile phone service) but it’s growing in importance.

Right now though, challenges on the mobile phone front are holding back revenue growth (and the stock), so VZ is most attractive for its dividend. Verizon has paid dividends since 1984, and has increased the dividend every year since 2007. Over the past five years, increases have averaged 3.5% per year.

Best Stock to Buy #18: Wal-Mart (WMT)

Wal-Mart doesn’t seem like it fits on our list, but after years of losing customers to Amazon, the largest retailer in America is finally getting ahead of the curve online. Wal-Mart has acquired a slew of online retail companies, including Jet.com, Modcloth.com and Shoebuy.com. The company also started a technology incubator, called Store No. 8.

The investments could solve the stagnation in Wal-Mart’s earnings. EPS are expected to stay flat this year, but analysts are hoping for 5% growth next year.

The stock has significant overhead resistance though. WMT hit an all-time high at the start of 2015, but went on to lose 30% of its value that year, as revenues and earnings leveled off. Signs of a rebound could send the company’s stock back toward 90, but it would likely face resistance there.

Best Stock to Buy #19: Wayfair (W)

Wayfair sells home goods online through five websites: Joss & Main, All Modern, Birch Lane, Dwell Studio and Wayfair.com. Active customers have increased every quarter since 2013, and revenues grew 50% last year and 70% the year before. But the company isn’t profitable yet, and some detractors doubt it will ever be. That’s kept the stock from making much progress since its 2014 IPO, so it doesn’t have much appeal on a technical basis either. I’d just watch for now if you’re interested.

Best Stock to Buy #20: Wix.com (WIX)

The last company on our list, Wix.com, market cap $3.4 billion, came public in late 2013, laid low for a few years, and then took off early last year. Since February 2016, the stock is up 268%.

It’s not profitable (bet you’re getting tired of that phrase) but sales rose over 40% in each of the last two years. Revenues come from small online businesses who create and host websites on Wix’s platform, then pay for ongoing e-commerce services including hosting, virtual shopping carts, marketing services and email campaigns. Premium subscriptions have increased in every quarter since 2012. The stock may be overbought short-term, but momentum is definitely positive.

[author_ad]