Marijuana stocks today remind me a bit of internet stocks around the turn of the century. Let me explain.

Over the summer, I reviewed my great success buying Amazon (AMZN) in 1998 and selling in 2000—for a gain of 1,185%. Some of that success was due to good stock picking, but a larger part was due to the Internet Mania that swept investors at the time, driving stocks like America Online and Yahoo (YHOO) and eBay (EBAY) and CMGI to the moon …

… and also stimulating the IPOs of hundreds of companies that in saner times would never have seen the light of day.

[text_ad use_post='137724']

For example:

Book4Golf.Com

Take To Auction.Com

Hip Interactive Corp.

Divine Interventures (Michael Jordan was on the board!)

Chinadotcom Corp.

and Drkoop.Com.

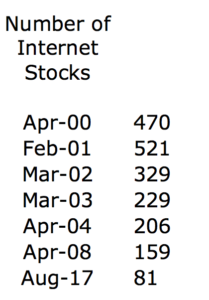

Just after the market top, in 2000, there were 470 internet stocks to choose from!

(I know because that’s when I started saving lists of internet stocks.)

A year later, after even more stocks had come public (as the market was trending down), there were 521 internet stocks to choose from!

And then came the great contraction, with companies either going bankrupt or being acquired as the industry consolidated.

Here’s my table, which I’ve updated less and less frequently as time has gone by.

So much for Buy-and-Hold. For a lot of those companies, it was Buy-and-Disappear!

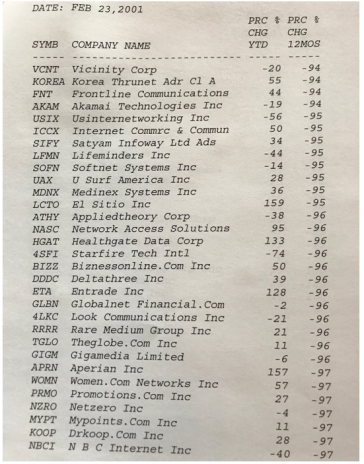

In fact, here’s a copy of just one page from the ISP/Content category from February 2001, showing each stock’s percentage price change over both the previous 12 months and year-to-date.

Take a look at El Sitio a third of the way down the page. The stock was up 159% year-to-date, but still down 95% from the year before!

The one keeper in the group was Akamai (AKAM), which today is the leading company in the Internet?Network Solutions sector, with a market capitalization of $8.1 billion.

Trouble is, Akamai is still 87% below its peak of 2000!

So what do we learn from this sad history?

Lesson one is that the worst time to buy into a sector is when everybody is excited about it, and people are talking about how much money they’ve made. (I remember my lawn guy talking about investing in internet stocks near the top.)

Lesson two is that the best time to invest in a sector is before people get excited about it. That’s when the stocks are still reasonably priced.

And I think we’re near that point today with marijuana stocks.

In fact, I think marijuana stocks have the potential to enjoy the sort of boom that internet stocks enjoyed prior to that 2000 top, and I have three reasons why.

Three Reasons That Marijuana Stocks Are Ready to Boom

- Marijuana is a brand new investing category. Back in 1991, there were no internet stocks; there was no internet category! But 10 years later, there were 521 of them! (Today I’m tracking 105 marijuana stocks—and the number is growing.)

- Marijuana, like the internet, serves the mass market, and when the masses get excited about something, they can drive stocks to ridiculous heights.

- No one expects it today. There are no marijuana companies in the U.S. making big money yet, in part because the drug is still illegal under federal law. But companies in Canada are leading the way quite successfully, and there’s no question that companies in the U.S. will eclipse them when the federal government finally gets out of the way.

However, you shouldn’t buy just any old marijuana company. You need to do the research—and research is difficult, especially in such a young sector.

Luckily for you, I’ve already done the research.

What are the Best Marijuana Stocks to Buy Now?

In August, we published our first issue of Cabot Marijuana Investor, Cabot’s newest investment advisory service, and I already saw my portfolio profits increasing by 169% in just four months!

It’s not too late to profit.

All the trends are in place, and it’s just a matter of time until revenue from legal marijuana business exceeds revenue from legal tobacco businesses (an industry that’s responsible for roughly 480,000 deaths per year in the U.S. according to the CDC).

So all you need to do to make money in the sector is read my profiles of these 10 companies, decide how much money you’re going to put in the sector, and then invest in the right stocks at the right time.

In this report, I cover U.S. companies and Canadian companies.

I cover companies that are growing marijuana, companies that are selling (or developing) pharmaceuticals based on marijuana, companies focusing on plant biotechnology, companies focused on vaping, and companies focused on packaging, distribution, intellectual property and more.

And this report is available to buy right now.

If you’re planning on investing in marijuana stocks, you need this report.

And there’s no better time to start than now—because marijuana stocks are not hot—yet. But they will be!

*This post has been updated from an original version published in August 2017.

[author_ad]