The price of Ether, the world’s hottest new cryptocurrency, suffered its first flash crash in June this year, falling from $350 to 10 cents in a matter of hours.

So-called cryptomillionaires minted in a matter of months lost it all in the blink of an eye.

More on that in a minute.

But first, what are Ether and Ethereum, and how are they different from Bitcoin, the “original” cryptocurrency?

Ethereum vs. Bitcoin

Ether is a digital currency, or cryptocurrency, issued by the creators of Ethereum.

And Ethereum is a distributed application platform or decentralized computing network, which mean pretty much the same thing.

Essentially, the creators of Ethereum hope to connect thousands of computers and then use them together to run software. Each computer will only run a small part of the software, so it can still be used for other things.

A lot of people—techies, futurists and tinfoil hat-types—like the idea because it would mean all our software and data would live in little bits all over the network, instead of on servers owned by big companies. (If this idea sounds familiar, it may be because it’s similar to the plot of the latest season of HBO’s Silicon Valley.)

This all works (in theory) because of the blockchain, which was developed to support the original digital currency, Bitcoin.

The blockchain is a record-keeping system in which the same record is stored on millions of computers in blocks. Each block contains information that refers to all the blocks before it (using math). According to experts, that makes it impossible to hack the blockchain.

Bitcoin’s founder or founders (still anonymous) created the blockchain to track the creation and movement of their new digital currency.

Ethereum’s idea is to use the blockchain to do all sorts of things, like crowdfunding or creating a decentralized Uber (drivers and riders with no Travis Kalanick in the middle).

The network where the blockchain will live and the decentralized applications (so-called dapps) will run is called Ethereum.

To fund the development of the network, Ethereum’s founders launched a new cryptocurrency, Ether. People who want to run applications on Ethereum will need to pay Ether to use the network’s space and computing power.

But until those dapps become reality, Ether is pretty much just a speculative investment—and boy are people speculating with it!

Believers can either buy Ether or create it, which is called mining.

Ether miners put high-tech computers to work doing complicated computations for the Ethereum network, and are rewarded with Ether in exchange.

Now back to that flash crash.

[text_ad use_post='129632']

Ether Flash Crash

Before the crash, the price of Ether had risen over 4,000% year-to-date, from less than $8 on January 1 to $350 earlier this month.

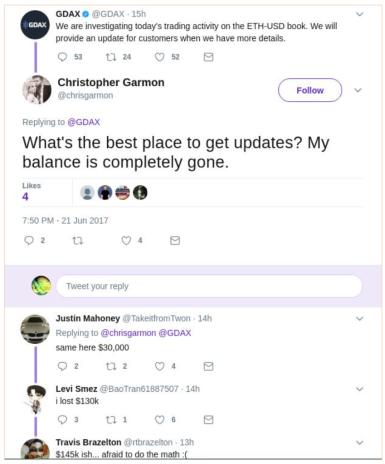

Then last Wednesday, someone—we still don’t know who—sold a huge amount of Ether (millions of dollars’ worth) all at once, driving the price of Ether down from $350 to $224 in a matter of hours.

The digital currency exchange where the sale occurred—GDAX—doesn’t have circuit breakers in place like the major stock exchanges.

However, it does allow trading on margin—and positions that are bought on margin are automatically liquidated once losses hit a certain level.

That meant that Wednesday’s 30% drop triggered a raft of additional sales, at one point pushing the price of ether as low as 10 cents.

The exchange, GDAX, noted in its statement that “trading with advanced features like margin always carries inherent risk.”

And that’s true, to a point. But it’s also true that existing markets—for stocks and bonds, for example—have built-in safeguards that help protect ordinary investors from these risks.

For example, stock markets have circuit breakers that halt trading once losses hit a certain level. Most brokerages require you to apply for permission before trading stocks on margin.

And, if losses start mounting, brokerages can make a “margin call,” essentially asking you for more collateral, rather than immediately selling the position at market prices.

That’s not to mention the differing levels of financial savvy in the two markets: the Ether flash crash seems to have been triggered by—and was certainly exacerbated by—traders using market-price orders and stops to sell large positions.

While that happens in the stock market, it’s mostly among smaller, more inexperienced investors who don’t have market-moving power.

In other words, Ether, Bitcoin and other digital currencies can be very rewarding investments (Bitcoin is up a not-too-shabby 183% year-to-date), but they’re still very young markets without the (relative) stability and safeguards of the stock market.

Luckily, equity investors who want to benefit from the rise of cryptocurrencies without entering this Wild West-like market can find ways to do so in the stock market.

You can’t invest in the digital currencies directly, but you can invest in a few public companies that are benefitting from their rise: a strategy often described as investing in picks and shovels during a gold rush.

The picks and shovels of the cryptocurrency boom are the computers used to mine the currencies. And the most important part of a cryptocurrency “mining rig,” as the specialized computers are called, is the graphical processing unit, or GPU.

So, the two purest plays on the cryptocurrency boom are the two leading makers of GPUs: Nvidia (NVDA) and Advanced Micro Devices (AMD).

Nvidia vs. Advanced Micro Devices

AMD’s graphics cards are the best suited to mine Ether. In fact, AMD’s top-of-the-line models are sold out across the country right now due to the unexpected spike in demand from Ether miners. But Nvidia’s GPUs work well too, and are the second choice of most miners when AMD’s cards are out of stock.

Over the past 18 months, both stocks have risen over 350% (394% for AMD and 367% for NVDA). But outside of the cryptocurrency mining business, their products are quite different. In addition to GPUs, AMD produces a broad range of other computer processors, and competes with Intel (INTC) in the enterprise computing market. Nvidia, by contrast, is focused on GPUs and system on a chip units (SOCs) for mobile devices. Its largest markets are the gaming and auto industries.

The addition of self-driving features—which require advanced visual processing technology—to more and more cars has been great boon to NVDA, helping the stock to advance over 1,000% in the past five years. AMD stock, by contrast, is up only 147% over the past five years.

So AMD is the cheaper stock by most measures. And its graphics cards are the first choice of ether miners. However, both companies are expected to release specialized cryptocurrency mining GPUs soon, which could shake up the current order.

More important to me, Nvidia has a longer history of sales and earnings growth, and the company’s sales growth estimates are still higher: 19% this year and 12% next year.

In other words, AMD may get a larger short-term boost from Ether mania, but I still think NVDA is the better stock long-term. In addition to the cryptocurrency boom, the gaming hardware and self-driving car markets the company also serves are thriving.

[author_ad]

This post was originally published in June 2017 and is periodically updated.