The combination of bullish option activity, a strong stock chart, and a potentially explosive company story has been the perfect set-up for my Cabot Options Trader subscribers in 2018, resulting in profits between 100% and 450% in seven positions already this year. And while options trading may seem difficult, it is my job as the Cabot Options Trader’s chief analyst to give you step-by-step directions on how to make those life-changing profits.

Oftentimes traders new to options get overwhelmed by the various expiration dates and strike prices. And even though they know they like a stock, and want to buy a call option, they don’t know how. At Cabot Options Trader I make those choices for you, giving you exact instructions on how to execute a successful options trade. And if a subscriber has any questions about a trade, they have access to my personal email address for follow-up instructions.

Bullish Option Activity Delivering Big Winners in 2018

For example, so far this year bullish option activity has lined up several times with a stock recommendation from a fellow Cabot analyst. In April, Cabot Growth Investor editor Mike Cintolo and Cabot Stock of the Week editor Tim Lutts both liked the potential of Axon Enterprise (AAXN). And at the same time hedge funds and institutions were aggressively buying calls targeting upside. Because of that, I sent the following instructions to Cabot Options Traders:

[text_ad]

Buy Axon Enterprise (AAXN) September 45 Calls (exp. 9/21/2018) for $4.50 or less.

A couple weeks later I sent the following instructions to sell half of the position for big profits:

Sell HALF of Existing Position: Sell Half your Axon Enterprise (AAXN) September 45 Calls for $10 or more.

And because I know that most subscribers have work, life, etc. and are not watching the market and our stocks all day, it is my job to update readers if a position needs attention. Here is an update I sent recently:

The market is reacting well to a strong Jobs Report this morning, as the S&P 500 is up 1%. If this rally continues to hold, I will likely add another position this afternoon. However, so we can protect our profits, I’m also going to raise three of my stops just in case this is ANOTHER fake-out.

Intel (INTC) January 52.5 Calls worth $7.20 (profit of 127%) – New stop at $5.75

Microsoft (MSFT) July 92.5 Calls worth $8.50 (80%) – New stop at $6.75

Axon Enterprises (AAXN) September 45 Calls worth $20 (387%) – New stop at $17

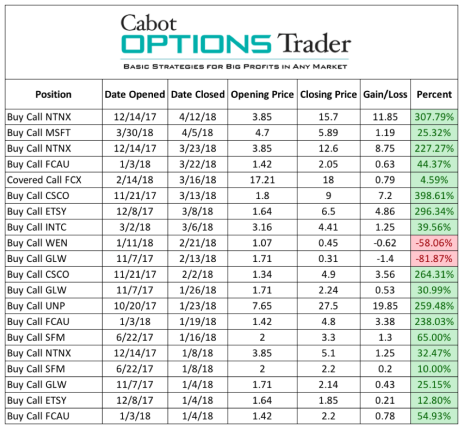

Here are some of our closed positions in 2018:

And in just the last several weeks another stock hit my radar for bullish option activity, lining up with a recommendation from my fellow Cabot analyst (and emerging markets expert) Paul Goodwin. Here is a small sample of my trade alert recommending a call purchase of iQIYI (IQ).

Speculative Trade: Buy iQIYI (IQ) December 25 Calls (exp. 12/21) for $4.70 or less.

iQIYI (IQ) is a recent Chinese IPO that many analysts are referring to as the Netflix (NFLX) of China. While that is an exciting comparison, what intrigues me most about the stock is the steady bullish option activity.

Over the last several days IQ has hit my radar time and time again targeting upside. These aren’t massive trades, but over the course of the day/week the open interest is adding up.

Also, as I’ve watched the stock and option order flow rise, I’ve been waiting for the stock to pull in. Unfortunately it continues higher and higher. It’s been my experience that if a stock isn’t pulling in for me to buy, it’s likely a good buy.

To execute this trade, you need to:

Buy to Open the December 25 Calls

The most you can lose on this trade is the premium paid, or $470 per call purchased.

And just a couple days after sending that trade alert we sold half of our position for a profit of 19%, and the balance is already at a potential profit of 200%.

If you are new to options trading, terms such as calls, puts and iron condors can be intimidating. However, it is my job to simplify options and deliver my subscribers life-changing profits.

And if you want to learn about my newest call recommendation that two Cabot analysts have recently bought for their subscribers, which also saw bullish option activity, click here.

[author_ad]