When a Long Island iced tea company announces that it’s changing its name to Long Blockchain and wants to get into the bitcoin and cryptocurrency business, my alarms go off. The cryptocurrency mania may have gone too far and it may be time to short bitcoin. To do that, you need to know how to short bitcoin.

And when I write mania, I mean MANIA! Take for example, the aforementioned Long Island Iced Tea Corp. (LTEA), which is a maker of iced tea. On December 20, the company changed its name to Long Blockchain and said it wanted to buy into the cryptocurrency business. That day, the stock rose more than 200%.

[text_ad]

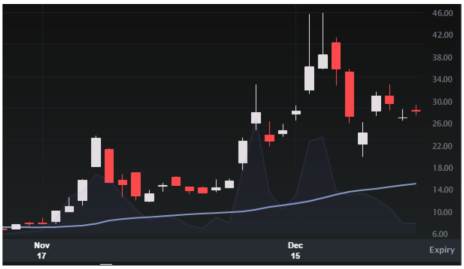

Here is a graph of LTEA before and after the company announced its name change:

Similarly, biotech company Bioptyx changed its name to Riot Blockchain (RIOT) and saw its stock rise significantly.

In all honesty, I have no clue if bitcoin and the various other cryptocurrencies are going to be worthless or significantly higher in 2018. No one does. However, by using put options, there’s a way to short bitcoin with limited risk.

To show you how to short bitcoin, let’s understand what it means to buy a put.

How to Short Bitcoin: Buying Puts

A put option is an option contract that gives the owner the right, but not the obligation, to sell a stock/index at a specified price within a specified time. The buy of a put is a BEARISH position.

When a trader buys a put, the most he can lose on the trade is the premium paid. That’s what makes shorting the bitcoin mania with puts so attractive—the losses on the trade are limited.

Now before we get into the details on how to buy a put on one of these new cryptocurrency-related stocks, I want to point out that buying puts on these stocks is not truly shorting bitcoin. However, if the price of bitcoin crumbles, these stocks will likely fall with it.

I want to be clear, buying these puts is a speculative trade. And I am not the only person looking to buy puts on RIOT. And this demand for RIOT puts makes the option EXTREMELY expensive. However, I don’t think there’s a better alternative to shorting bitcoin.

With that understanding, if I wanted to short bitcoin via a stock related to it, I might buy a put on RIOT.

For example, I could buy RIOT March 25 Puts for $8.

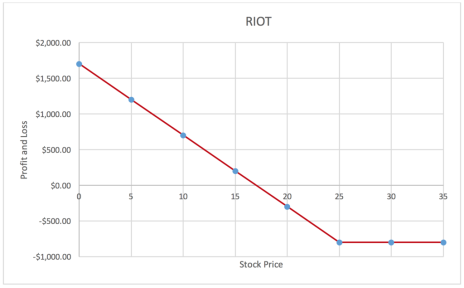

As I noted previously, the most you can lose on this trade is the premium paid, or $800 per put you purchased. This would be the case if RIOT closed at 25 or above on March 16, 2018.

The breakeven on this positon is at 17.

Below 17, each put would increase in value by $100 for every put you purchased.

Here is the profit and loss graph of this RIOT put purchase:

Conversely, if you wanted to play bitcoin via RIOT to the UPSIDE, you could buy call options. That would give you upside exposure with limited risk.

As an example, if you wanted to be bullish RIOT, you could execute the following trade:

Buy to Open RIOT March 33 Calls for $3.

The most you can lose on this trade is the premium paid, or $300 per call purchased if RIOT closed at 33 or below on March 16, 2018.

The breakeven on this position is at 36.

Above 36, each call would increase in value by $100 for every call you purchased.

Clearly, there’s money to be made to both the downside and upside as the volatility in bitcoin has been insane. In just the last three weeks, the price of bitcoin hit a peak at nearly $20,000, before plummeting to a low of $11,159.

Other companies that are now profiting from the cryptocurrency rise are Nvidia (NVDA), Advanced Micro Devices (AMD), International Business Machines (IBM), Accenture (ACN), Square (SQ) and Overstock (OSTK). More speculative stocks include Longfin (LFIN) and Marathon Patent Group (MARA).

[author_ad]