As expected, the Federal Reserve raised the federal funds rate by another quarter point last week, to a range of 0.75% and 1.00%. It was the first time Janet Yellen and company raised short-term interest rates this year, but the third time in the last 15 months. After seven years of near-zero interest rates, investors had feared what Fed rate hikes might do to stocks. It’s becoming increasingly clear that those fears were unwarranted.

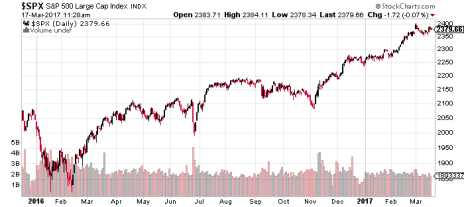

December 16, 2015 was the day the Fed raised interest rates for the first time since before the recession. Here’s what has happened to stocks since then:

After taking a dive following the first rate hike, stocks stabilized last March and, after building a base from April to November as investors held their breath prior to the U.S. election, have since burst to unprecedented heights. All told, the S&P 500 has advanced 14.7% in the 15 months since the first Fed rate hike, and picked up steam after rates were hiked again this past December.

Yet, for some reason, the financial headlines obsess over the Federal Open Market Committee’s (FOMC) every move, parse every word from Janet Yellen’s press conference and Capitol Hill hearings for clues as to what she really meant, and generally paint the picture of angst-riddled investors worrying about the damage the next Fed rate hike might do to their portfolios.

[text_ad]

Maybe there are investors who are still worried about Fed rate hikes. Perhaps you’re one of them. But the next time the Fed considers hiking the rates, take solace in the above chart. It says all you need to know about how much impact Fed rate hikes are having on this bull market.

Granted, there are other factors driving this bull rally: first and foremost, the election of a business-friendly U.S. President, but also a technical breakout after years of stagnation in the stock market, the improving jobs market, the rebound in corporate earnings growth, escalating consumer confidence, the return of investor interest, etc.

But there are just as many potential potholes that threaten to knock stocks from their lofty perch: Brexit, ongoing debt problems in Europe, slower growth in China, decade-high price-to-earnings ratios for large cap stocks, and so on. Just don’t count rising interest rates, which are the Fed’s show of confidence in an improving U.S. economy, among the reasons to sell your stocks.

You may feel like hitting the panic button the next time Janet Yellen hints at more rate hikes. But most investors aren’t.

Going forward, I think the easiest thing to do is to tune out the Fed and all the noise that surrounds it, and continue to buy and hold stocks until the market tells you it’s time to sell a few. Fed rate hikes may not drive the market. But they’re not harming it either.

[author_ad]