The Dow 1 million

The Dow 1 million will happen in 100 years according to Warren Buffett, the most famous investor in the world today with a net worth of roughly $78 billion.

That sounds like a big jump from today’s “lowly” 22,000 level, but in fact Dow 1 Million represents a compound annual growth rate of just 3.9%.

When I was born, 62 years ago, the Dow was at 450! It’s compounded at a 6.5% rate since then.

If the market enjoys better than a 3.9% annual growth rate (a not inconceivable idea), we could see Dow 1 Million in as little as 50 years.

That’s Warren Buffett’s thought; I’m just passing it along.

Long-Term Trend of the Market

So Dow 1 Million is a good idea to keep in mind as you do your investing today. It’s not because you’re actually going to be investing in 100 years (or even 50, unless you’re one of my younger readers), but because it should remind you that despite all the challenges faced by the world, the long-term trend of the markets is up.

If you don’t actually enjoy investing and you just want to take advantage of the trend, you should invest in index funds.

If you like investing, and want to try to beat the market, you’ll find what you need in the wide range of Cabot investment advisories.

[text_ad use_post='129622']

And if you’re very aggressive, you’ll do it on margin! (A competitor of Cabot used to be 200% invested all the time, knowing that after every bear market there was a greater bull market. But he gave it up after the killer bear market of 2000-2003.)

On the other hand, if you fall into the trap of worrying about whatever of the world’s fundamental problems the media is harping on today—there’s always something—you’ll convince yourself that the market is due for a fall and you’ll sell short.

If you’re lucky, you might occasionally make money at it.

But as Warren Buffett pointed out recently, of the 1,500 people who have made the Forbes list of richest people in the world over the decades, none of them have been short-sellers.

Warren Buffett said, “Being short America has been a loser’s game. I predict to you it will continue to be a loser’s game.”

Still, there are always people convinced that they can make money on the short side, especially when they think the market is too high.

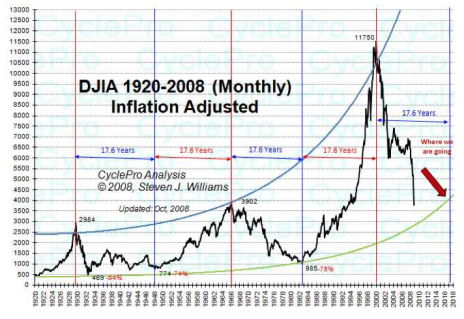

Here’s a chart published online by a very intelligent man back in October 2008, in the depths of the Great Recession. (I know he’s very intelligent because his site has lots of words and lots of charts.) Note the precise delineation of bull and bear market phases, each lasting 17.6 years. It’s impressive—but it’s wrong. He predicted that in August 2017 the Dow would be down at 4,000!

And then there’s the market-timing “expert” who wanted my business last year who modestly wrote, “I specialize in a highly advanced stock market mathematical work that allows me to predict the stock market in both price and time with incredible accuracy. So much so that I believe I publish the most accurate U.S. stock market forecast in the world today.”

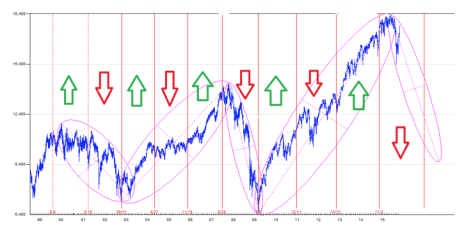

Trouble is, last August he wrote to his followers, “I believe the bull market of 2009-2014/15 is now over … I am now 100% short. I will be maintaining this core short position for the foreseeable future—perhaps for as long as 1 year. I have no intention of covering it anytime soon and I feel very confident in saying that this position will become very profitable going forward. Just a little bit more patience is needed.”

You can see from the chart where the market was supposed to go.

But since his statement, the S&P is up 15%, while the Dow is up 20%—and getting closer to Dow 1 Million every day.

I’m in Warren Buffett’s camp; my long-term forecast is ever upward, interrupted as always by minor and major corrections.

And my major focus, knowing the wind is at my back, is finding revolutionary new companies that have the potential to grow multifold, to be the next Amazon (AMZN), the next Apple (AAPL), the next Google (Alphabet) (GOOG) and the next Tesla (TSLA).

One Revolutionary Stock

The company on my mind today is Weibo (WB), the leading social media company in China. You might call it the Twitter of China, but it also has similarities to Facebook.

Weibo is big, but growing both revenues and earnings rapidly and thus its future is very bright. Also, because few U.S. investors know about the company, there are still way more potential buyers than sellers.

Weibo (WB) was one of the recommended stocks in Cabot Top Ten Trader just a week ago. Here’s what head analyst Mike Cintolo wrote:

“Weibo operates China’s most popular social media platform, a short message service that resembles Twitter in its 240-character limit on posts, but differs because 240 Chinese characters can carry a ton more information than English letters. Weibo continues to reap the benefits of the rise of mobile devices in China as the dominant way for Chinese netizens to access the internet. Weibo’s advertising and marketing programs (which yielded 87% of 2016 revenue) have contributed to some great numbers, including 67% revenue growth in Q1 and 725 in Q2, and earnings that booked an 11th consecutive quarters of triple digit growth in Q2 2017. Analysts are looking for 99% earnings growth in 2017 and 56% growth in 2018. Like Facebook, Weibo is an active partner to its advertisers and marketers, offering a full menu of analytics and promotion assistance.”

As to the stock, it hit a high of 108 in early September and has corrected moderately since, though it hasn’t quite met with its 50-day moving average yet.

You could buy Weibo here, and you might do very well, but a better idea would be to become a regular reader of Cabot Top Ten Trader, so you get the full story, including suggested buying ranges and stops.

But don’t delay. Act today, while the bull market is alive and well!

[author_ad]