The Federal Reserve is all but certain to hike short-term interest rates for just the second time in a decade today. And though the increase in the Federal funds rate is sure to be minimal—probably another quarter of a percent, like last year—investors tend to overreact to “bad news.” And with stocks at all-time highs and trading at decade-high valuations, chances of a volatile market after today’s Fed announcement seem relatively high.

That was the case a year ago.

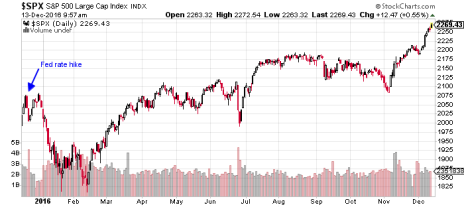

On December 16, Janet Yellen and company hiked rates (from near zero to a range of 0.25% to 0.50%) for the first time since 2006, following seven years of the most accommodative monetary policy in U.S. history. And a volatile market did follow: stocks seesawed back and forth for two weeks before plummeting in January and February. By February 11, the S&P 500 had tumbled nearly 12%, hitting its lowest level in almost two years.

[text_ad]

Weak holiday-quarter earnings and mild GDP growth played a part in the precipitous dropoff. But the Fed’s interest-rate hike was the main catalyst.

A 12% stock market collapse was no way to start the new year, and it seemingly brought every sky-is-falling pundit and market bear out of the woodwork. But remember: the whole thing only lasted about six weeks. All stocks have done since is jump more than 23%, shredding record highs along the way and restoring investor optimism after a sluggish 2015.

Just look at this one-year chart of the S&P 500:

Perhaps investors have matured since the last rate hike. Maybe stocks will scarcely be impacted by today’s (presumed) rate hike. But even if a volatile market does take hold in the wake of slightly higher interest rates, chances are it will only be temporary.

And there’s an easy way to protect your portfolio during temporary market collapses.

If you listened to our advisors when stocks were collapsing last January and February, you probably avoided any big losses. Every one of our experts advised subscribers to sell off any stocks headed in the wrong direction before they became big losers, putting most of their money in cash, and to simply wait out the market downturn.

As stocks stabilized in the ensuing months, our advisors told subscribers to come out of their mid-winter hibernation, start putting their cash back to work, and begin buying stocks at a nice little discount. And that’s exactly what you should do this time if the market turns south again in response to higher interest rates.

And speaking of interest rate hikes, it’s important to remember that they’re the Fed’s response to an improving U.S. economy. It’s a show of confidence that the economy is stable enough to withstand higher borrowing rates. Ultimately, higher interest rates are a good thing—and in the long term, they’re good for stocks too.

So, if a volatile market suddenly emerges after today’s Fed announcement, don’t sweat it. Sell your losers before they fall too far, go mostly to cash, and wait for the clouds to part. Soon enough, they will. When they do, investors will look around and see what the Fed sees: an economy with improving GDP growth, a tumbling unemployment rate, increasing home sales and escalating consumer confidence.

And that will probably be good for stocks.