We’ve enjoyed a stellar stock market in the U.S. for the past year. In fact, for the last five years, U.S. stock markets have averaged a return of 13.91%. And with gains like that, many investors have found no reason for international investing.

However, they may be missing out on some tremendous opportunities to not only boost their returns, but also add some much-need diversification to their holdings.

[text_ad]

The U.S. is Not the Only Stock Market Participating in this Rally

You have probably noticed that stock markets around the world are doing pretty well, but maybe not how well. According to Morningstar, for the past five years, global markets have few reasons to complain, especially with five-year averages like these:

- Japan Nikkei 225: 16.48%

- India S&P BSE Sensex: 12.18%

- Euronext Paris: 10.69%

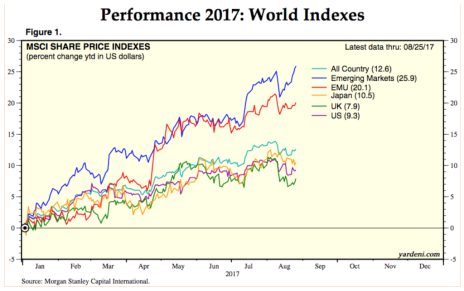

And year-to-date in 2017, as you can see in the graph below, they are performing at an even higher level, with emerging markets leading the way, with 25.9% gains in 2017.

Don’t Be Afraid of International Investing

Many investors shy away from international investing, due to the perceived challenges—real or imaginary. And certainly, there are unique qualities—and risks—to international investing, including:

Different reporting standards can impede transparency. Not every country is as stringent in requiring quarterly and special situation reports from publicly-traded entities.

Currency risk. Translating money from one currency to another can skew financial statements and returns, and sometimes, foreign countries impose currency restrictions that could possibly delay sales of your stocks.

Access to foreign markets. Not every broker has the ability to buy and sell in foreign markets; settlements can take longer than in the U.S., and safekeeping of shares may not have protections that U.S. investors find with the SEC, in cases of fraud or bankruptcy.

Foreign markets can be volatile. Both manipulation and insider trading have caused gigantic market swings in foreign markets, in the past, especially in Latin America.

It is important for investors in these markets to focus on long-term factors. While the markets can be volatile at times, the day-to-day up-and-down swings should not deter eager investors.

But the good news is that there are several ways to reduce these risks and still enjoy the benefits of international investing.

American Depository Receipts

The first American Depository Receipt (ADR) was issued in 1927 for British retailer Selfridges. Since that time, investors have been turning to them for stability and a much safer method of buying foreign stocks. ADRs are foreign stocks that trade on U.S. stock exchanges. These companies must comply with U.S. listing and reporting standards.

Exchange-Traded Funds

Most investors today are familiar with exchange-traded funds (ETFs)—funds that track an underlying index and trade on a U.S. stock exchange. ETFs were first created in the U.S. in 1993. Like stocks, ETFs can be bought and sold all day long. With around 2,000 ETFs currently in existence, investors can choose one for almost any strategy—including sector, broad market and country, or region-focused.

Mutual Funds

Mutual funds have been around since 1924, pooling investors’ dollars to buy stocks, bonds and other issues. Like ETFs, mutual funds have built-in diversification and offer investing in foreign companies, companies outside the U.S. (international), regional and country funds, and international index funds (track international markets).

The Appeal of ADRs

As the first part of this series on international investing, I want to talk about American Depository Receipts. Tomorrow, I will focus on exchange-traded funds and mutual funds.

Charles A. Carlson, editor of DRIP Investor, and a contributor to my newsletters, Wall Street’s Best Investments and Wall Street’s Best Dividend Stocks, recently wrote a comprehensive article on ADRs. He is a proponent of ADR investing, especially in companies with Dividend Reinvestment Plans. Here are some of his thoughts:

While U.S. equity markets have had a nice run so far this year, the big winner has been overseas markets. The benchmark MSCI EAFE (Europe, Australasia, Far East) Index was up 14% in the first half of 2017 versus a 9% return in the S&P 500 Index. And emerging markets did even better, with the MSCI Emerging Markets Index returning nearly 19% in the first half of 2017.

To be sure, the outperformance of foreign stocks comes after an extended period of underperformance versus U.S. equities. You have to go back to 2012 to find both the MSCI EAFE and MSCI Emerging Markets indices beating the S&P 500.

What’s driving the gains in foreign markets?

- Improving global economic conditions. A number of foreign markets are starting to see higher corporate earnings and firming economic conditions. That improvement is drawing investor interest.

- Reduced political uncertainty. The election of Emmanuel Macron in France over the anti-European Union party was an important factor in taking some of Europe’s political uncertainty off the table for investors.

- The China factor. Emerging markets depend to a large extent on China, and investors seem to be growing increasingly comfortable with China’s economic growth outlook.

- Currency impact. Many major European currencies have strengthened against the U.S. dollar this year, which has helped to lift returns in dollar terms.

- Favorable valuations. After four years of underperformance versus U.S. stocks, a strong case can be made that relative value resides in overseas markets.

- Dividend yields are greater than U.S. stocks. The yield on the MSCI EAFE is currently 3% versus a 2% yield on the S&P 500. Yield-hungry investors have taken note and are seeking to capture some of these higher yields.

Of course, the big question for investors is whether this outperformance will continue. If you believe in the idea of reversion to the mean, the answer would be yes. Foreign markets didn’t just lag U.S. markets—they really, really lagged. For the period 2013-2016, the MSCI Emerging Markets posted a cumulative negative return over the period. On the other hand, the S&P 500 posted a gain every year and returned a cumulative 71% over the same period.

Bottom line: Even after their strong first half in 2017, foreign stocks have a lot of ground to make up versus U.S. stocks, so reversion to the mean suggests this rally should have some legs.

If foreign stocks represent an attractive asset class at this time, how much should investors allocate to international stocks? And how should they gain foreign exposure?

Proper portfolio diversification says that all investors should have at least some exposure to foreign investments.

The disparity in performance indicates that U.S. and foreign equities are not perfectly correlated, which means there are diversification benefits to be had by including foreign stocks in a portfolio.

Another reason to include foreign stocks in your stock search is that doing so widens your opportunity set. From an allocation standpoint, I can see foreign exposure representing a minimum of 5% of investment portfolios up to perhaps as much as 20%, depending on your risk level.

ADRs and DRIPs

More than 200 foreign stocks allow any U.S. investor to buy their shares directly, the first share and every share, without ever having to call a broker. ADRs are quoted in U.S. dollars and pay dividends in U.S. dollars. And those dividends, in many cases, receive the current preferential tax treatment afforded qualified dividends paid by U.S. companies. ADRs can be purchased via a stock broker.

Charles mentioned two ADRs that had caught his attention.

Novo Nordisk (NVO), a Danish company and a global leader in the treatment of diabetes. Charles noted “Diabetes is growing at an alarming rate globally. Novo Nordisk is positioned to benefit from the increasing need for treatments. After years of upward performance, these shares took a big hit last year. The company fell victim to some of the pressures that have hurt other pharmaceutical stocks—increased competition and the erosion of pricing power. Despite these headwinds, I think the stock is priced right for new buying, with a current discount of 26%. Granted, patience is required, and my guess is there will probably be another move below $40 in the near term. But 24 months from now I see these shares trading at significantly higher prices. And the dividend yield of 2.05% provides some payoff while waiting for the stock to rebound.

Ireland-based Ryanair (RYAAY) is a European airline. Charles notes, “The firm has more than 1,800 daily flights connecting over 200 destinations in 33 countries. This low-cost carrier is often called “Europe’s Southwest Airlines.” The company’s growth has been impressive, and further economic revival in Europe should drive demand. The stock has done very well this year, but I think there’s plenty of upside remaining. Airline stocks tend to be on the volatile side, which means Ryanair will periodically present buying opportunities. Investors who want a direct play on Europe’s growth fortunes should take advantage of price dips to buy the stock.

Additionally, I ran a search for ADRs, based on earnings growth and current momentum, and found that this ADR had one of the highest ratings:

Royal Dutch Shell plc (RDS-A) has a high dividend yield of 6.75%, and an analyst rating of 1.6 (Strong Buy). Technically, the company looks very interesting, and ready to move forward. RDS beat analysts’ earnings estimates by $0.11 last quarter, and six Wall Streeters have raised their earnings forecasts for the company in the past month. The company holds interests in 22 refineries, 100 distribution terminals and 770 supply points. The shares have crossed above their 50-day and 200-day moving averages.

So far, Hurricane Harvey has driven up energy prices, but they could be in for some short-term hurt. For this one, I would watch it closely for a few days, to see if you can get in at a lower price.

Tomorrow I’ll expand the topic of international investing and will write about international ETFs and mutual funds to buy. So don’t miss your Wall Street’s Best Daily email tomorrow morning.

[author_ad]