U.S. corporations are about to get a windfall—and as a result, so will certain stock market sectors. If the proposed tax legislation passes and is signed by the president, corporations will reap the lion’s share of the bill’s $1.5 billion in tax cuts, in two primary ways:

1. Beginning in 2018, the bill cuts the corporate rate

to 21% from 35%.

2. Multinationals who have been storing their extra cash in overseas tax havens (think Google, Facebook, Apple, Johnson & Johnson and Pfizer) can bring their estimated $3 trillion back to U.S. shores and enjoy a tax rate that experts predict will be 8% to15.5%, much lower than the current 35% that they would suffer under current tax rules.

That explanation certainly simplifies the new tax code, but for investors’ purposes, it could be enough to keep the stock markets on this bull run. Why? Because earnings, traditionally, drive stock prices, and according to UBS, the new bill could increase corporate earnings an extra 6.5% to 9.5%.

[text_ad]

The question, of course, is what will these corporations do with their windfall? The choices are good for investors (and maybe employees and consumers): more dividends and stock buybacks, more M&A and maybe increased wages (although I’ll have to see that to believe it!)

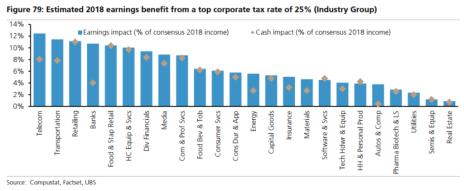

Here’s a chart produced by Factset, which projects the biggest beneficiaries of the tax cut, by sector.

Amundi Pioneer Asset Management in Boston estimates that telecom companies will receive “an aggregate book tax benefit of 12% of net income and a cash tax benefit of 8%. Financials would see a 9.2% boost to earnings but also a lower cash tax benefit, while consumer discretionary and staples would get a 7% to 8% book and cash tax benefit. Real estate and utilities wouldn’t reap much benefit from a lower rate.”

UBS chimes in, noting that “retailing and food-and-staples retailing benefit the most on a cash and book basis, followed by transports and banks. Semiconductors and pharma stocks/biotechs stand to see the least benefit.”

Analysts at Morningstar note that transportation stocks would benefit from the provision of the bill that will allow capital expenditures to be expensed in one year, instead of over a longer term as current rules proscribe.

Right now, according to Wells Fargo, financials lead the way, with one of the highest effective tax rates of 27.5%. Keefe, Bruyette & Woods is forecasting that the tax cuts will add 16% to 2018 bank earnings, and 18% in 2019.

Morningstar says that retailers—with mostly U.S. exposure—will benefit from the lower rate as well as a possible uptick in consumer discretionary spending.

And telecom, a big infrastructure spending sector, and primarily U.S.-based, will surely see a huge benefit from its current average tax rate of 33.4%.

With that in mind, I thought now would be the time to take a look at recent recommendations in each of these four stock market sectors from our contributors to my Wall Street’s Best Investments and Wall Street’s Best Dividend Stocks newsletters:

Four Stock Market Sectors for the Tax Cut

Stock Market Sector #1: Telecom

Deutsche Telekom AG (DTEGY)’s current dividend yield is 3.85%. Peter Staas from Capitalist Times, recently recommended this stock, saying, “Deutsche Telekom AG, which owns a 64% equity interest in T-Mobile US, eventually may receive an offer for America’s No. 3 wireless provider that’s too good to refuse—and has a chance to secure regulatory approval. Ideally, a potential suitor would own broadband assets that would complement T-Mobile U.S.’ wireless network and enable it to compete for IoT business.

“If a viable takeover offer for T-Mobile US emerges, Deutsche Telekom would reap the rewards. We also like the Germany-based company’s high-quality network and improving operations in Europe.”

Stock Market Sector #2: Transportation

Marten Transport (MRTN) pays a small dividend, yielding 0.50%, and the shares recently crossed above their 50-day moving average—a bullish indicator. In his 2 for 1 Stock Split Newsletter, Neil MacNeale, noted, “Small trucking company Marten Transport Ltd. is in the temperature-sensitive trucking business, primarily moving perishable food products all across North America. This niche has provided a very steady business in a field that others are reluctant to enter, probably because it’s just harder than ordinary trucking.

“Not only does Marten do it well, it seems to also run its business differently and better than its competitors. The standout numbers are in the balance sheet—zero long-term debt to equity where the average for the industry is 178%. This could be important over the next few years. Other good numbers include a price-to-book ratio of 1.95 and an enviable free cash flow.

“The strength of this small-cap, family controlled company is in its conservative approach to business, a virtue in short supply, in my opinion. Marten Transport announced a 5 for 3 split in June.”

Stock Market Sector #3: Retailing

Michael Kors Holdings (KORS) shares are still trading at a discounted 17.14 P/E despite walloping analysts’ earnings estimates by $0.50 per share last quarter. Jon Markman, Editor of Pivotal Point Trader, notes: “At one time, Michael Kors Holdings was trumpeted by Wall Street as the next great retail brand. Stores sprung up all over the globe. Then it fell out of favor, hard. And now, Michael Kors is in the midst of a comeback. Its business and share price have reached an important point of pivotal inflection.

“To their credit, Kors managers have been furiously reworking the brand. Earlier this year the company announced the $1.2 billion acquisition of luxury shoemaker Jimmy Choo. And while the company still relies heavily on women’s ready to wear, footwear and men’s accessories, smartwatches are playing a bigger role.

“The stock strength means the longer-term downtrend has been broken. This sets up a bullish reversal. Based on improved share price and business momentum, I’m looking for an important move higher over the next year.”

Stock Market Sector #4: Banks

TD Bank (TD) has a current dividend yield of 3.33%. In Gordon Pape’s Internet Wealth Builder, Gavin Graham writes, “TD Bank is Canada’s second largest bank by market cap and the sixth largest bank in North America. For TD’s full 2016-17 fiscal year, adjusted net income “was $10.6 billion ($5.54 per share), up from $9.4 billion ($4.87 per share) a year ago.

“The bank said this reflected good revenue growth and a continued focus on expense management. The bank also had good results from its U.S. retail operations. Adjusted net income was $812 million (US$650 million), an increase of 16% in U.S. dollars. TD is a Buy for its strong U.S. presence, strength in Canadian retail, and professional management.”

As always, before adding these or any other stocks to your portfolio, please make sure they are a good fit for your long-term risk and diversification strategies.

I hope you have a wonderful holiday and offer my best wishes for a healthy and prosperous New Year!

[author_ad]