A recent poll by Vision Direct (an eyecare company) showed that Americans spent perhaps as much as 19 hours each day looking at screens. It was unclear whether the poll adjusted for respondents’ time spent on more than one screen (say, reading this article on their phones while casually watching a television show), which could help explain why respondents left themselves only five hours of screen-free sleep time.

Regardless, a 2015 Nielsen report, estimated that Americans spent only 11 hours a day in front of screens, which reinforces a simple theme. The world is becoming increasingly digital and automated. As an anecdotal example, I recently installed new wifi in my home which required that I update the wifi password on my oven and washing machine.

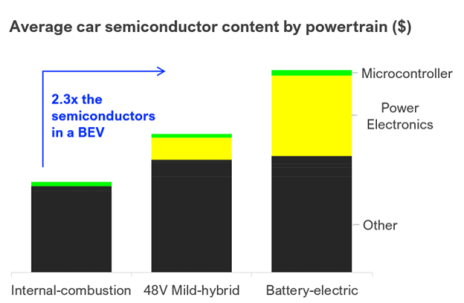

Everything from entertainment, to automated manufacturing, to electric vehicles (EVs) and ovens (apparently) runs on chips. According to recent research by IDTechEx, just shifting to battery-electric vehicles will more than double the semiconductor content of personal vehicles.

And as the pandemic supply shortages have shown us, we may not always be able to source chips internationally. That’s where these chip stocks come in.

Microchip Technologies (MCHP)

Microchip Technologies (MCHP) is an Arizona-based manufacturer of microcontrollers and integrated circuits, among other things, that capitalized on last year’s supply-chain shortages to invest in new equipment and hire on additional personnel in the hopes of meeting increased chip demand domestically.

Over the last 25 years, Microchip Technologies has grown its microcontroller market share from 10th worldwide to third and has been rapidly closing in on the industry leaders. The biggest revenue contributors are Industrial, Data Center/Computing, and Automotive but it believes that two mega-trends—Data Centers and the Internet-of-Things (IoT)—will become significant factors over the next several years.

From a fundamental perspective, the company has been growing free cash flow at a 20% compound annual rate and is aggressively cutting debt. In fact, they’ve paid down $4.41 billion of debt in the last 13 quarters, which came on the heels of the acquisition of Microsemi.

A big part of that debt buyback was convertible debt that was potentially dilutive to shareholders, which is just one of the shareholder-friendly actions in the pipeline.

The company also intends to return that growing free cash flow to shareholders via dividends and buybacks with a goal of increasing dividends and buybacks when key leverage ratios are reached. The company currently returns 23% of free cash flow to shareholders and plans to raise that to 50% when debt ratings further improve, then gradually to 100% as the company deleverages to a 1.5x debt/EBITDA ratio (currently 3x).

Technically, the stock is in an uncertain position, having recently broken down through its 50-day line on average volume. Given the correction in tech stocks and growth, that’s not entirely a surprise. Prospective investors should look for a bounce off the 200-day moving average as a possible buy signal, although a solid break there could bring MCHP back to the mid-60s. While management has been doing and saying all the right things, the recent choppiness and high valuations in tech makes this stock one to watch for either strong signs of a bottom or a high-volume bounce off the 200-day.

Nvidia (NVDA)

Our next stock emphasizes digitization over automation (although they’re working to develop their exposure to the automotive segment) and is looking to a future of growth rather than rebuilding. Nvidia (NVDA) is a pioneer in graphics processing and has been one of the go-to suppliers for gamers for the last two decades.

Nvidia’s graphics processing units (GPUs) are highly sought after for both rendering virtual worlds and mining cryptocurrency. Although the pending shift to Proof of Stake (blockchain validation based on how much of the underlying cryptocurrency someone has) from Proof of Work (blockchain validation based on how quickly a holder can solve a cryptographic equation) will reduce some of the demand for processors, Nvidia will remain one of the biggest players in graphics chips for the foreseeable future.

The company has doubled revenues over the last three years and boasts triple the revenue of the next largest PC GPU supplier. Their Datacenter exposure is also rapidly expanding. They currently provide GPUs to every major cloud provider, including Google, Microsoft, Alibaba, Amazon and IBM, and boast an 82% cumulative annual growth rate for that segment since 2017.

Nvidia is positioning itself for the future, with a strong emphasis on ESG and a focus on using artificial intelligence to optimize its suite of products. If virtual and augmented reality are coming, they’re going to run on Nvidia.

As for the stock, it’s down almost 17% YTD (along with much of tech) but is up 88% over the past year despite blowing through its 50-day line at the start of 2022. The 200-day is at 219 and rising and has been reliable support over the last two years (NVDA returned over 300% in the same period). Like MCHP, this stock is one to watch for signs of support before investing and is a bet on a digital future.

Macro trends suggest that the future will be digital and automated, and these are two of the best chipmaker stocks to cash in on those trends.

Do you own any chipmaker stocks that aren’t on this list?