Get this Investor Briefing now, Earn Big Dividends to Ensure Your Happy Retirement, and you’ll learn how to make the most money from dividends, to ensure your own financial freedom and security. From the basics about understanding dividend investing to specific stock recommendations for growth and safety … from discovering how ex-dividend dates work to key investing sectors for you to consider … and from boring stocks that pay reliable dividends to a once-in-a-decade chance for high-yield dividend stocks. Earn Big Dividends to Ensure Your Happy Retirement is your best guide to ensuring you get big dividends for achieving and maintaining your financial freedom.

2 Stocks to Protect Your Portfolio in Wartime

Russian aggression has led to open conflict in Ukraine, but the threat of conflict elsewhere looms large, too. China’s relationship with Taiwan is, of course, a point of contention between that country and the rest of the world that, thankfully, has remained in something of a status quo that is brought to light only when multinational corporations or groups like the WHO fall silent on whether Taiwan is, in fact, it’s own sovereign entity.

Beyond those simmering tensions, and the omnipresent conflicts in the Middle East, are the civil conflicts arising in response to the ongoing pandemic and measures ostensibly in place to defeat it. Recent protests in Canada over vaccine mandates have thrown a wrench into already brittle supply chains and underscored the war-like temper in a growing number of nations.

Indeed, there has been increasing discussion in mainstream media over the possibility for a “cold” civil war to break out in the U.S. A recent article in The New Yorker titled, “Is a Civil War Ahead?” is a case in point. The article quoted Steven Levitsky, co-author of the book, How Democracies Die, who observed:

“We’re not headed to fascism or Putinism, but I do think we could be headed to recurring constitutional crises, periods of competitive authoritarian and minority rule and episodes of pretty significant violence that could include bombings, assassinations and rallies where people are killed.”

Billionaire hedge fund manager Ray Dalio took it a step further recently, expressing his opinion that a “hot” civil war may even be possible in the U.S. He wrote on Twitter:

“When winning becomes the only thing that matters, unethical fighting becomes progressively more forceful in self-reinforcing ways. When everyone has causes that they are fighting for and no one can agree on anything, the system is on the brink of civil war/revolution.”

Regardless of whether or not the world is headed for more battlefield fighting, there’s no denying that a war-like spirit currently permeates the social fabric of countless nations. It’s also undeniable that in the wake of the 2020-2022 “War Against Covid,” several nations (including the U.S.) have embarked upon wartime levels of public spending.

One major consequence of war is inflation. The elevated spending levels in the wake of the Covid War, along with corresponding supply shortages, have created inflation levels that rival those of past “hot” wars. With that in mind, let’s take a look at some assets that stand to benefit from continued war-related inflation.

It should come as no surprise that food commodities—and inputs related to food production like fuel and fertilizer—are among the resources that are most affected by war or the threat of war. During the last war-time environment in the 2000s, food commodity inflation ran rampant. Prices for key farm commodities like corn and wheat rose 275% and 360%, respectively, while nitrogen fertilizer prices rose by an average of 800% during the height of the Afghanistan and Iraq wars from 2002 to 2008.

Prices for critical fertilizers like nitrogen, phosphate and potash tend to rise vigorously during wartime inflation periods, in part due to war-related sanctions, shipping and production disruptions among key producing countries. Fertilizer prices have indeed already seen substantial run-ups in just the last two years (widely utilized urea, for instance, is up 350% since 2020).

2 Companies Benefiting from Wartime Spending

One company in particular that specializes in producing the inputs that modern farming depends on is Nutrien (NTR). Nutrien makes essential crop nutrients including nitrogen and potash, and is regarded as the world’s largest provider of fertilizers, services and solutions. Because of the turmoil between Russia and Belarus (the world’s third-largest potash producer), analysts expect Nutrien to significantly increase its output of the key nutrient and could restart up to 4 million metric tons of idled annual capacity at its potash facility in Saskatchewan, Canada. Additionally, a recent Bloomberg report speculates that Nutrien may be a takeover target by Australian multi-national mining firm BHP Group (BHP). Sounds like a good wartime stock.

Another natural resource that typically strengthens during war is copper. During the 2002-2008 war-time period, for instance, copper skyrocketed by 570% due to its wide use in a number of military and industrial applications (it’s the second most widely used material by the U.S. Department of Defense).

To that end, Teck Resources (TECK) is another wartime stock that’s poised to benefit if wars escalate around the globe. Aside from being the world’s second-largest seaborne exporter of steelmaking coal (another war-time commodity), Teck is a major producer of copper and zinc and plans to double its copper production in the next two years. A major Wall Street institution agrees and estimates that Teck’s copper production will more than double from its “transformational” QB2 project (one of the world’s largest underdeveloped copper resources) in Chile. Analysts see the firm’s revenue jumping around 80% in both Q4 2021 and Q1 2022, with earnings growth accelerating substantially.

Inflation arising from wartime-like spending is already here, and these commodity plays are some of the best ways to protect your portfolio and spending power.

What commodity plays are you making in your portfolio? Let us know in the comments below.

3 REITs to Buy for the 5G Technology Boom

5G is the latest generation of cellular technology, and it’s currently being rolled out nationwide. This isn’t going to just improve your coverage or marginally increase your data speeds; it’s an exponential improvement over prior generations of cell phone technology.

A new generation rolls around every 10 years or so, from the first one that enabled cell phones in the first place to the third and fourth generations that enabled smartphones and mobile data. Each generation marks an improvement in speed and latency, the amount of time it takes devices to communicate with each other. This generation is projected to add massive speeds, up to 100 times faster, and internet connectivity with far superior speed, scope and scale.

The implications go well beyond phones. It is a crucial tipping point of critical mass. 5G enables virtually instantaneous internet connectivity, providing the technology for a new range of advancements like self-driving cars, robotics, artificial intelligence, smart cities and much more. To this point the digital age was like a dirt road. It’s now about to become a 10-lane highway with speed rails and air traffic. You ain’t seen nothin’ yet.

How important is it? It is such a game changer that it is considered a national security imperative. It is a big part of the struggle for dominance and power with China. The U.S. National Security Council has warned that if China gets 5G first it “will win economically and militarily.” In fact, 5G technology is considered so crucial that the FCC streamlined the rules so that the 5G rollout can continue in haste.

5G is infrastructure. Every new generation requires more and better cell towers and supporting structures. This new generation requires even more because, although it provides great speeds and power, it doesn’t have the cell signal range of previous generations. Therefore, it requires more towers and supporting technologies to increase the range and relieve congestion.

Aside from the major cell phone providers, there are three big players in 5G infrastructure, and they’re all REITs. It’s a business that provides both growth, with the 5G rollout, and defense, as the rollout will continue rain or shine in a good economy or a bad one. Right now, these 5G technology REITs are an incredible opportunity for income investors.

5G REIT #1: American Tower Corp. (AMT)

American Tower is the largest U.S. cellular infrastructure REIT. It owns and operates 187,000 cell towers, 43,000 in the U.S. and over 140,000 abroad, primarily in India and Brazil. And it’s growing. It added 20,000 cell towers in 2018. It leases these towers to cellular service providers under long-term contracts, acting as a mobile technology landlord.

Business is good. The stock has blown away both the returns of the overall market as well as its REIT peers. AMT has provided a better than 26% average annual return over the past three years. It is benefitting in the U.S. from the voracious demand with the 5G rollout as well as in emerging markets as low-cost smartphones proliferate at a torrid pace.

Not only is the business very profitable right now; it’s also defensive. The REIT grew revenues by 6% even in the pandemic-stricken 2020. It looks like it’s back to regular business this year as the REIT has returned over 28% YTD. It is also forecasted to grow earnings at about a 20% per-year clip over the next five years. That’s serious growth for a REIT.

5G REIT #2: SBA Communications Corp. (SBAC)

SBA is the smallest or the cellular infrastructure REITs with more than 32,000 cell towers in North, Central and South America. It has a huge presence in Brazil but generates about three quarters of revenue in the good ole USA.

It has essentially the same business model as AMT in that it leases space on its towers to cellular service providers under long term contracts. The key differentiating point is size, which is both a blessing and a curse. It’s much smaller than the other two REITs. On the downside, all the earnings go back into growth and it only pays a small dividend, currently yielding 0.69%.

On the positive side, the upside is juiced. Smaller companies can grow faster. Performance has been better than AMT. While AMT is forecasted to grow earnings by about 20% over the next five years, SBA is projected to grow at a better than 100% annual clip. It’s really a growth stock disguised as a REIT. But it’s in the right place at the right time.

5G REIT #3: Crown Castle International Corp. (CCI)

Crown Castle International Corp. leases a portfolio of properties that currently includes 40,000 cell towers, 80,000 small cell towers and 80,000 miles of fiber optic cable primarily to the four largest wireless service providers in the U.S.

It has the same basic business model as the other two, but I like this one best for several reasons. For one, it actually pays a decent dividend, currently a 2.64% yield. Another reason is that it operates exclusively in the U.S. The 5G story is so good that I don’t want to risk any crazy emerging market shenanigans messing things up. But perhaps the most important advantage is the small cells.

The current 5G build out plays right into Crown Castle’s hands. Although speed and latency will improve by staggering amounts, this generation lacks something previous ones had – range. A 5G signal only travels about half a mile, compared to several miles for earlier generations. That means that small cell towers will be needed all over the place in order to increase the range and relieve congestion.

Crown Castle is the small tower king. Small towers are about the size of a pizza box, and will soon decorate almost every street corner. AT&T claims that 300,000 new small towers will be needed for 5G. Only 220,000 currently exist. Crown Castle already owns 80,000 (more than any other company in the country) and has signed multibillion dollar contracts with the four largest cell providers (Verizon, AT&T, Sprint and T-Mobile) to provide more.

The proof is in the pudding. CCI has outperformed the other two REITs during the 5G rollout, for the past two-year, one-year and YTD periods. Crown Castle is also projected to grow earnings by an average annual rate of over 20% for the next five years.

Which 5G REITs do you invest in?

These 2 REITs Pay Dividends Every Month

Income investors are in a tough spot right now. The interest rates on CDs and savings accounts are negligible and won’t even keep pace with inflation. At the same time, bonds (while offering slightly higher yields) are staring ahead to a market that will almost certainly bring rising interest rates and lower bond prices.

Meanwhile, the equity market’s choppy trading and rotation can easily give you the feeling that you’re playing musical chairs, and the music has been going on for too long.

Fortunately, there may be a good answer to the current environment: monthly-paying REITs.

While the market is high priced in nose-bleed territory, some of the very best income-paying stocks on the market are still reasonably valued. REITs have vastly underperformed the market in this recovery so far. They have been neglected by investors as technology stocks dominated in the early part of the recovery and cyclical stocks drove the market over the past several months.

But times are changing. Investors are realizing the value in an expensive market. REITs are the best performing sector of the S&P 500 over the past three months, and the second best over the past month. Now, the sector offers momentum as well as value.

Despite the current income investor conundrum, you can actually find a high monthly income from some of the very best income producing securities on the market. Here are two of the best monthly-paying REITs.

The 2 REITs that Pay Dividends Every Month

Realty Income (O)—Yield 4.1%

Realty Income is one of the highest-quality and best-run REITs on the market. Cash flow from a conservative portfolio of 6,500 properties has enabled the company to amass a phenomenal track record of paying dividends—to such an extent that Realty Income actually has the audacity to refer to itself as “The Monthly Dividend Company”.

The large REIT has operated for more than 51 years and its 6,500 properties are rented to 600 different tenants in 49 states, Puerto Rico and the United Kingdom. Since its 1994 IPO, Realty Income has amassed a record of one of the most successful income investments on the market.

Here are a few things to like about it.

- 15% average annual total return since 1994

- 610 consecutive monthly dividends

- 93 consecutive quarters of dividend hikes

- 5% annual dividend growth since 1994

- Sky-high credit ratings

A great business formula delivers such results. Realty buys established properties and leases them back to tenants under long-term leases of 10 to 20 years. Most of these contract are “triple net leases” whereby the tenants pay all the costs associated with the property including maintenance, insurance and taxes. This reduces unpredictable expenses and provides a rock solid cash flow.

I like the timing. As a retail REIT, O took it on the chin during the pandemic—but unjustifiably so. The biggest tenants (Walgeens, 7-Eleven, Dollar General and FedEx) were considered essential services and remained open. Only a small portion of tenants, including restaurants, movie theaters and fitness centers, had trouble.

In the darkest days of the pandemic, Realty still collected about 85% of rents, and that number rebounded to 93.6% by the end of 2020. Earnings and revenues actually increased for the year because of acquisitions. And now, the economy is roaring back.

The stock is still priced well below pre-pandemic levels while earnings are better. And O now has solid upward momentum.

STAG Industrial (STAG)—Yield 4.0%

STAG Industrial, Inc. (STAG) is a REIT that invests in single tenant industrial properties in the eastern and midwestern U.S. The property portfolio includes warehouses, distribution centers, and manufacturing facilities. It’s a diverse portfolio with 457 buildings in 45 different industries located in 38 states.

A couple of big things stand out about this stock. First, 43% of the properties are warehouses and distribution centers related to e-commerce. Those spaces are in huge demand and there isn’t enough supply to keep up. STAG is directly benefitting and will continue to benefit from the rise in e-commerce.

The other thing is that industrial properties are cyclical, which is good ahead of a booming economy, and in high demand. Industrial properties are getting a boost from the surge in manufacturing activity in the country, a trend that may just be beginning. There is also huge growth potential. The U.S. market for industrial properties is estimated to be $1 trillion. As of now, STAG only has about 0.5% of that market.

The stock has been a solid performer, performing on par with the overall market while providing a stellar monthly income. STAG is also in both a long- and a short-term uptrend.

Where are you turning to for income in this market?

Why Mortgage REITs are the Perfect Post-Pandemic Recovery Investment

We’re coming off an epoch year. The calendar year of 2020 is one for the ages. A global pandemic brought the world to its knees. The economy crashed as a result of the lockdowns. But the market loves it. The indexes are at all-time highs and giving every indication of moving still higher.

Say what you will about the current environment. But one thing is clear: It’s good for mortgage REITs.

Now is the Time to Invest in Mortgage REITs

While typical REITs own actual physical real estate properties, charge rent, and pass that income onto shareholders, mortgage REITs are a different animal. They buy mortgages and generate income from monthly mortgage payments. A mortgage REIT borrows money at low short-term rates and uses that money to buy mortgages that pay a higher interest rate, making a profit on the difference in rates, or the net interest spread.

Mortgage REITs are not good investments to buy and forget about. In fact, the long-term returns on these things stink. There are good times and bad times to own mortgage REITs. I believe now is a very good time. Here’s why.

It’s all about the Spread

Sure, there are different kinds of mortgage REITs. Some invest in government-backed mortgages; others invest in riskier ones. Some do a good job of managing the balance sheet; others don’t. There are REITs with good track records and bad ones. All of that stuff is cute. But interest rate spreads are the most important thing by far. The difference between long- and short-term rates is what drives these stocks higher or lower.

Short-term rates are as low as they can be while longer-term rates are rising. The Fed cut the benchmark Fed Funds rate to between 0% and 0.25% when the pandemic emerged. It has pledged to keep these rates there for a long time. The central bank has a lot of control over short-term rates but much less over longer-term rates. And a full recovery in an economy drowning is stimulus is certain to put upward pressure on these longer-term rates.

In fact, it’s already happening. The 10-year treasury rate, a benchmark for longer-term rates including mortgages, is already on the rise. It has more than doubled from the low of 0.50% in the midst of the bear market to 1.1% today. A full recovery and easy money is bound to drive rates higher during this year. There’s plenty of upside: The 10-year treasury rate was over 3% before all this nonsense.

A rising spread is the whole ball game for these securities. When the spread between long and short rates increases, so does the profitability and stock prices of mortgage REITs, and vice versa. It’s really all that matters. But I’ll throw in a couple of other things for good measure.

Low Prices

Prices fell sharply in the pandemic bear market as interest rates crashed and credit concerns in a recession dragged the sector down. The sector crashed more than 50% in a little over a month during the tumult. But the situation has vastly improved since as spreads have risen and the economy has strongly recovered. But these securities are still miles from the pre-pandemic highs while the environment is shaping up to be far better than the pre-pandemic one.

Yields are Obscene

It’s tough to find income in this low interest rate world. But mortgage REITs are yielding 9% and 10% or higher. That may seem too good to be true. And usually it is. But this unique environment creates a situation where you can actually get a yield that high, and a good chance of a rising stock price to boot. It’s a yield opportunity that hasn’t existed in a decade.

High-Yield Mortgage REITs to Buy Now

Which mortgage REITs should you buy? I would stick with the biggest and the best, which include AGNC Investment Corp. (AGNC) and Annaly Capital Management (NLY). These securities yield a whopping 9.3% and 10.7%, respectively.

AGNC has the more conservative portfolio of mortgages, with almost the whole thing in government agency backed securities, as well as the better track record. Annaly has a better balance sheet with less leverage and a higher yield. But either one is a good investment right now and should deliver a phenomenal yield and likely capital appreciation as well in the next year.

2 Dividend Stocks for a Post-Vaccine Era

It looks like the long-awaited coronavirus vaccine has finally arrived. That’s great news all around. It’s also a huge benefit for stocks. A vaccine could mean the end of this pandemic. The end of lockdowns means that the economy can free the other arm that is still tied behind its back and absolutely boom next year.

While the market indexes have already recovered, the bull market has been very uneven so far. Technology stocks are thriving as people rely on technology more than ever during the lockdown. That sector is driving the market higher while many other sectors are still wallowing in bear market oblivion.

Travel and hospitality stocks have been decimated. The energy sector is down 45% YTD and financial stocks are also well entrenched in negative territory for the year. There is great opportunity in the market on the cusp of better days. Despite the high valuation of the market indexes, great bargains and high yields can still be had.

The day of the vaccine announcement, those sectors that depend on a full recovery came alive. Hospitality stocks soared. The energy and financial indexes had one of their best days in history. The mere suggestion that the pandemic might be over soon prompted these sectors to make up for lost time.

Of course, the rally could be a little premature. There could be setbacks ahead. But we got a taste of what lies ahead on the other side of this pandemic. And the pandemic will end. It’s just a matter time. Now, it looks like that time will be sooner rather than later.

It’s time to start investing for the other side of the pandemic. There are two particularly great opportunities for dividend investors right now—one is conservative and the other is more aggressive. Let’s take a look:

Realty Income (O)

Realty Income (O) is perhaps the most popular and successful REIT of all time. While people buy REITs primarily for income, Realty has amassed a track record for reliable income that is second to none. In fact, the company actually refers to itself as “The Monthly Dividend Company”.

Realty generates reliable income from a portfolio of 6,500 properties rented to over 600 tenants in 49 states, Puerto Rico and the U.K. The business model is a “sale-leaseback” arrangement whereby Realty Income buys established properties and rents them back to the tenants under long-term leases of 10 to 20 years. Most are “net leases,” which means the tenant pays all the expenses, removing unpredictability for Realty.

It’s worked. The REITs IPO was in 1994, but it has been operating since 1969. Since then it has paid 604 consecutive monthly dividends and the payout has been raised in 92 consecutive quarters. Since the IPO, it has provided an average annual return of about 15%, compared to less than 10% for the overall market. And that’s after recent lousy performance.

This is a great income stock, but it’s had a rough year, down more than 15%. It’s also down almost 30% from the 52-week high. That means the stock is cheap. That’s good. But why is it cheap?

The entire REIT sector has underperformed this year primarily because it has been dragged down by hospitality, leisure, office and retail properties that have taken it on the chin as people are forced to stay at home. That’s were Realty comes in. About 85% of the portfolio is retail properties. And the retail subsector is down over 35% for the year.

That said, the overwhelming majority of properties are in essential services and discount retailers that are doing fine. The service properties are having a harder time, particularly movie theaters and fitness centers. But in October, Realty still collected 93% of rents under contract. That put the REIT into positive earnings growth for the quarter.

In the first nine months of this year, revenues were actually 20% higher and earnings per share are actually up 3.7% over the same period last year. Even in a severe recession, earnings are still growing.

First of all, the service properties will bounce back when the pandemic ends. Secondly, the stock is down way more than the operational performance justifies because of its association with a group under pressure in the pandemic.

The pandemic will fade. And investors will be attracted to one of the very best income securities ever at a time when the 10-year Treasury is paying just 0.92%.

Valero Energy (VLO)

Valero Energy (VLO) is the largest petroleum refiner in the U.S. The San Antonio-based refiner operates 15 petroleum refineries in the U.S., Canada and the U.K., with a capacity of about 3.1 million barrels per day (MMbpd). It markets products in 43 states, Canada, the U.K., Ireland and Latin America and has over $100 billion in annual revenues.

It also operates 14 ethanol refineries, a rapidly growing renewable diesel business, and midstream piping and storage assets. But the main event is still petroleum products.

This is a cyclical business and this is not a good stock to own in a recession. The refining business has been particularly hard hit during this pandemic-induced recession as demand for gasoline and diesel crashed during the lockdowns.

The lockdown economy has taken a toll on VLO. The stock is down 50% YTD and over 60% from the 2018 high. Of course, demand has bounced back strongly since the strict lockdowns of last spring and demand for gasoline and diesel got back to about 90% of pre-pandemic levels. But there was still a huge excess of inventory to work off and the dark days for the business lasted through the third quarter.

Let’s take a step back. Valero is the most technically advanced and cost efficient refiner in the country. The business is highly cyclical. Oil refining stocks perform badly in recession but typically fly much higher in the part of the economic cycle when the recovery takes hold. And that’s where we are now.

The recovery so far has included technology and consumer staples to the exclusion of the more mainstream economy companies in energy, finance and industrials. But, as I mentioned above, the next phase of the recovery will indeed boost these neglected industries. It has to. There can be no complete or robust economic recovery without gasoline and diesel.

We got a taste of what lies in store for VLO after the vaccine announcement. When the market sensed the other side of this pandemic sooner rather than later, VLO stock soared 32% in one day. Sure, the market may have gotten ahead of itself. It may be a while longer before we reach the Promised Land.

It could still be early for VLO. There may still be some downside volatility ahead. But it’s a great bet that the stock price will be a lot higher six months to a year from now. In the meantime, if pays you a 7.8% yield to wait. And the CFO recently referred to maintaining the dividend payout as “the number one financial priority.”

Buy these 2 Growth and Safety Stocks for the Recession…and Beyond

Many things are uncertain, but one thing we know is that this pandemic will end someday and I believe in a bull market Promised Land on the other side of this pandemic. I think the economy will surprise everyone and boom beyond what most economists expect. We already got the bear market over with. Once we get this recession in the rear view mirror, it will be a new bull market. And it will be glorious.

But first, there are traps and pitfalls that lie ahead. Before we can wallow in the glory, we have to get through at least a few more months of serious funk.

As an investor, you may wonder whether you should play it safe or set yourself up for the coming bull market. Right now, it feels right to play it safe. But you don’t want to miss the likely rewards that lie ahead for more aggressive investors at some point in the next year or so.

Well, you don’t have to choose. You can do both. There are certain safe growth stocks that are not only terrific holdings for the ensuing volatility and uncertainty, but there are even better on the other side. These are rare have-your-cake-and-eat-it-too stocks that are ideal for this moment in time.

B&G Foods, Inc. (BGS) and Brookfield Infrastructure Partners (BIP)

New Jersey-based B&G Foods, Inc. (BGS) is an American food manufacturer that sells familiar shelf-stable and frozen foods in the U.S., Canada and Puerto Rico. In business since 1889, the company sells 50 well-known and popular food brands including Cream of Wheat, Green Giant Vegetables, Ortega, Dash, Accent, Crock-Pot and others.

As a seller of food, the ultimate consumer staple, the company has been able to generate stable earnings from which to pay a generous dividend. But the company has struggled to grow earnings. But the coronavirus changed everything.

Business is booming. During the lockdown, people have been confined to their homes and eating there. Many are stocking up on nonperishable items as they want to limit visits to the store. The new trend is right in B&G’s wheelhouse. How big of an impact is this having?

They’re killing it during the pandemic. What happens when it’s over? There is reason to believe the new habits will last. A recent survey conducted by investment firm Piper Jaffray found that two-thirds of respondents said they intend to eat at home more after the virus.

The survey also predicted a sustainable 15% lift in at-home food consumption. It suggests that, while the numbers we’re seeing during the lockdown will likely come down, a more permanent shift in food consumption is likely underway.

Who knows how long this pandemic will linger. The election could be a mess and roil the market for months. But BGS will be just fine. And when we finally get to the other side of the election and pandemic, B&G will be a much improved company with a high level of sustainable growth.

How is this playing out in the market? BGS has returned 64% YTD and 85% over the past year. You might think you missed the boat. But the stock is still cheap and selling well below its average five-year valuations. Currently 28 per share, this was a 50 stock back in 2016, and with far lower earnings than it has now.

Now let’s talk about Bermuda-based Brookfield Infrastructure Partners (BIP) who owns and operates infrastructure assets all over the world. The master limited partnership (MLP) focuses on high quality, long-life properties that generate stable cash flows, have low maintenance expenses and are virtual monopolies with high barriers to entry.

Brookfield operates a current portfolio of over 1,000 properties in 30 countries on five continents. It is well diversified geographically with roughly 25% in North America, 30% South America, 25% Europe and 20% Asia Pacific. The partnership operates four segments: Utilities, Transport, Energy Services and Data Infrastructure.

Assets include:

- Toll roads in South America

- Telecom towers in France

- Railroads in Australia and North America

- Utilities in Brazil

- Natural gas pipelines in North America

- Ports in Europe, Australia and North America

- Data centers on five continents

These are some of the most reliable revenue generating assets in the world. But it’s even better than it may seem. In addition to dependable revenue, of which over 90% is regulated or contracted, there’s solid growth.

The beauty of this company is that these assets earn reliable income in any economy, even the pandemic economy that has thrust the world into one of the most severe economic downturns ever. The company also forecasts year-over-year earnings growth for the full year.

It’s a great stock to own through the continuing turmoil and uncertainty. But, on the other side of the election and the pandemic, the stock should be even better. It has been able to make great acquisitions on the cheap during the recession that will boost earnings in the quarters and years ahead. And the environment is providing a huge tailwind.

The G-20’s global infrastructure hub estimates that a global investment of $94 trillion will need to be invested in infrastructure improvements over the next several decades. The private sector is an essential part as governments don’t have all those trillions lying around. Limited partnerships, giant sovereign-wealth funds, multilateral and development-finance institutions are raising billion of dollars a year for infrastructure investments. It’s almost becoming a new asset class.

Since its IPO in 2008, BIP has returned over 600% (with dividends reinvested). That’s about three times the return of the overall market during the same period. And there is good reason to believe the future will be even better than the past.

If you’re looking past the recession, these are two stocks with promise.

Two Good Stocks in Two Iffy Sectors

There’s a problem with buying stocks. It’s easy to overlook winning buys in sectors that nobody likes. Of course, the goal with any stock is to buy low and sell high. In order to do that, you need to buy stocks when they are on sale and sell them when they are flying high. In other words, you buy a stock when nobody wants it and sell it when everybody wants it. That’s easier said than done.

Stocks usually go out of favor for good reasons. Business stinks and probably won’t get much better in the foreseeable future. Who wants to own a stock like that? But these out-of-favor stocks and sectors are an ideal place to find companies with great businesses at fire-sale prices. Business will inevitably improve for the very best of these companies. It’s just a matter of when.

The current market offers many such opportunities right now. Sure, the market indexes have staged an epic rally from the March bottoms. But many stocks have been left out of the rally and are still wallowing in bear-market oblivion.

Of the 11 S&P 500 market sectors, the worst performers so far are Energy and Finance. In fact, these two sectors have been the worst performers on the index for the past one-year, three-year and five-year periods as well.

These are cyclical sectors that don’t do well in a recession. Oil prices crashed as demand for energy fell off a cliff during the pandemic lockdown. The industry was already grappling with an unfavorable supply/demand dynamic and the price crash was another kick in the head. It’s been ugly for banks as well. Interest rates again crashed to new all-time lows and loan demand plummeted during the recession.

But the economy will still need oil and gas. It will power the recovery. Banks have a crucial role in the economy and will surely find a way to prosper as the economy recovers. In fact, the market is factoring in a booming economic recovery in the quarters ahead. If that comes to fruition, circumstances should greatly improve in these two sectors in the not-too-distant future.

As well, when the market sours on a sector, it tends to shun all the stocks, even though some companies are far less damaged than others. For patient investors, it might be a good time to look at the very best stocks in these sectors. Here are two that stand out – the best energy stock and the best financial stock right now.

Ignore these out-of-favor stocks at your own risk

Best Out-of-Favor Stock #1: Chevron (CVX)

Chevron is one of the world’s largest integrated oil and gas companies, with operations all over the world. The company is involved in every facet of the energy industry but revenue is heavily skewed toward exploration and production.

Chevron is exposed to oil and gas prices. However, it can compensate for lower prices because it operates with lower costs and higher margins than the other large integrated oil companies.

The tough energy market of years past made this company lean and mean with more upside leverage when things turn around. Chevron’s cost per dollar of business operating expenses produced has fallen from $18 in 2014 to under $10 today. Consider this: The stock produced positive returns amidst the energy sector bloodbath from 2014 to 2016. It should be able to hold up relatively well through this downturn. And think what it could do when things improve.

All large oil companies will benefit if and when the economy and the sector turn around. Chevron is special because it is in better shape to endure the downturn than any other large oil companies. It went into this recession in great shape. The company invested heavily in growth projects in recent years and had cut back on capital expenditures.

It also carries lower debt than its peers, boasting an industry-best 0.25 debt/equity ratio. It also has a strong cash position, a low payout ratio and the ability to preserve cash. For example, the company cut back project expenditures by $4 billion.

The company can turn a profit fast as things improve and it has strong leverage to benefit going forward. It has several projects that recently came online and now has peer leading production growth. Chevron also has a huge and growing presence in the Permian Basin, the largest shale oil producing region in the U.S. and, by far, the fastest-growing oil region in the world.

Best Out-of-Favor Stock #2: Bank of America (BAC)

Bank of America is one of the largest financial institutions in the world. It’s massive, with more than $2.3 trillion in assets. The bank is involved in every facet of the financial industry from business and consumer mortgages, lending, credit cards and deposit gathering to wealth management from its Merrill Lynch subsidiary.

BAC has huge scale and scope, with a massive retail banking network, a major presence in credit card issuance, top commercial operations and a top-notch investment bank. The wide moat gives the bank huge advantages in costs and switching costs for existing customers.

And the stock is cheap. It’s down 29% so far this year and 60% from the pre-financial-crisis high and sells at a price/earnings ratio of just 11, compared to a five-year average of 13.5, and 22 for the overall market.

Obviously this is a bank that will stay in business through the recession and benefit when the economy recovers. But there’s something else. The financial crisis was a banking industry disaster. As a result, banks had a lousy recovery amid the bull market since 2009. The banks are in far stronger shape in this recession and should perform much better in the recovery and bull market this time around.

BAC spent much of the last decade recovering from the hangover from the financial crisis, and its own ill-conceived acquisitions. It has honed its operations and become much leaner and meaner. Prior to the recession it was seeing rapidly increasing profitability.

Bank of America appears poised to benefit greatly when the economy recovers.

These two sectors have certainly seen better days. But the strength of these individual companies puts them in a position to give your portfolio a major boost if you have the patience to wait out the current economy.

A Boring Dividend Stock You Can Count On

Some people say dividend stocks aren’t sexy. You know what is sexy? Artificial intelligence stocks and nanotechnology stocks. Those things give me goosebumps. Dividend stocks, on the other hand, bore the bejesus out of people. People get turned off by a boring dividend stock.

They shouldn’t.

Over time, dividend stocks vastly outperform stocks that don’t pay dividends. And they achieve superior returns with significantly less volatility than the overall market.

If you want excitement that titillates your imagination, read a dirty romance novel. If you want money in the bank, look to dividend stocks.

And there’s nothing less sexy than what I believe is the best dividend-paying industry today – garbage. That’s right, garbage. You can gamble on which company will have the best self-driving car or 3D printing technology. You can try to pick the Kentucky Derby winner. You’ll probably lose. But if you make a bet that our society will continue to produce a lot of garbage, it’s a guaranteed win.

Garbage is a big, smelly business. This country is drowning in garbage. A consumer-oriented society like ours produces colossal amounts of trash. While the U.S. is home to about 5% of the world’s population, we produce about a quarter of the world’s waste.

Every year this country produces enough waste to reach the moon and back – 25 times. Each individual American throws out about 4.4 pounds of trash on an average day. Nationwide, that amounts to about 700,000 tons daily, enough to fill Busch Stadium in St. Louis twice. The average American produces about 1.5 tons of garbage every single year. And it’s getting worse. We throw away twice as much as what we did in 1960.

Clearly society has a great need to deal with all this trash. One company is the king. And all that stuff you throw out everyday just keeps ringing the cash register for this boring dividend stock.

Houston-based Waste Management (WM) is the largest waste services provider in North America.

It isn’t sexy. It’s a dirty business. Few upstarts have the desire to take on such a business or the scale and expertise to thrive in it. But for this industry behemoth garbage is a remarkably consistent and practical business that delivers a torrential downpour of free cash flow.

For such a boring company, returns in WM have been stellar and remarkably consistent. The overwhelming majority of money managers underperform the S&P 500, but this garbage collector has consistently outperformed the major indexes.

A $10,000 investment in WM 10 years ago would now be worth about $55,000, with dividends reinvested.

Bigger isn’t always better. But in this case, it is. The size and scale of the company enables it to process waste efficiently and at a much lower cost than would-be competitors. Its expertise with regulators is unparalleled and the company is loving the easier regulatory environment of the Trump Administration. The company also has deep pockets that enable it to continually gobble up competitors and expand.

The stock is somewhat expensive, selling above five-year average valuations. But why shouldn’t it be? In these increasingly volatile markets a consistent performer in a very recession-resistant business should continue to be in high demand.

Want a Pandemic-Averse Investment? Try Timber

It’s normal to feel uncertain about investing right now. I like to go through a mental checklist in times like these, and one of the big items I suggest you ask yourself is whether or not you have enough diversification in your portfolio.

The big winners over the past several years have been the big tech stocks, but the winds could change, so perhaps you should take some profits off the table and increase your cash position or invest in some other high-quality growth or value stocks.

One idea you may not have thought of, is investing in timber, which has proven over the years to be a terrific investment.

It is sometimes said that “trees don’t read the Wall Street Journal,” and so even in tough times, trees grow, compounding in size and value. This is why big institutional investors such as university endowments and pension funds make timber investment allocations in their giant portfolios.

How Timber Grows in Your Portfolio

Timber has been one of the most consistent investments over time, and a great hedge against inflation. According to value investor Jeremy Grantham, it’s risen 3% more than inflation for more than 90 years.

Timberland has also beaten the stock market over the long run, and with less volatility. According to research produced by Boston-based GMO, where Grantham is co-founder and chief investment strategist, timber has risen steadily in price for 200 years and has returned an average of 6.5% a year during the last century. One reason for timber’s steady growth is that timber prices tend to follow population and economic growth. Emerging market nations such as China and South Korea are key drivers of growing demand for lumber products.

The returns on timber also hold up well in bad economies and bear markets. During the Great Depression, timber gained 233% while the price of stocks fell more than 70%.

A unique characteristic of timberland compared to other agricultural commodities such as soybeans or wheat, is that it functions as both a factory and a warehouse. In other words, timber can be grown and then “stored on the stump.” This gives owners the flexibility of harvesting trees when timber prices are up, and delaying harvests when prices are down.

Here is another reason timber is a great shock absorber for your portfolio: It has a very low correlation with most asset classes, meaning it zigs when other asset classes zag. During one of the worst-ever bear markets in stocks from the late 1960s until about 1980, timber never had a losing year.

Lastly, it is environmentally sustainable since we have certainly come a long way from the cut and burn practices used by the timber barons of the 19th century. Forestry, in America anyway, is now a sophisticated, sustainable and scientific business.

How to Invest in Timber

Today, let’s look at two trades for individual investors looking to diversify into timber.

For a conservative global approach, try S&P Global Timber & Forestry Index Fund (WOOD). This ETF tracks the performance of forestry and timber firms worldwide. Forty-five percent of WOOD is invested in companies based in the United States and its two top two holdings, Weyerhaeuser (WY) and Rayonier (RYN), together account for about 20% of its portfolio. But an even bigger portion is invested in global stocks. Canada accounts for 12% of the ETF, while there are large allocations to Brazil, Finland, and Japan.

For more bang for your buck, I suggest you go with real estate investment trusts (REITs) that directly own and manage timberland. REITs were originally created in the United States in the 1960s as a vehicle to allow investors to buy and sell shares in managed real estate portfolios.

Timber REITs can be listed on a stock exchange, or they can be privately run for clients of Timber Investment Management Organizations (TIMOs). John Hancock is a big player in this area with many institutional and high net worth clients. Timber REITs must pay 90% of funds from operations to shareholders in the form of dividends. This is why they are a favorite of income investors, delivering an average current yield of 4%.

Consider Rayonier (RYN), a leading timberland REIT. The company has assets located in some of the most productive softwood timber growing regions in the United States and New Zealand. Rayonier owns, leases or manages approximately 2.6 million acres of timberlands located in America and 415,000 acres in New Zealand. Institutional investors hold more than 90% of Rayonier’s shares.

A Once-In-A-Decade Chance for High-Yield Dividend Stocks

The coronavirus stock market movement we witnessed will be the thesis project of many young economics students for years to come. Despite the chaos, the market created high-yield opportunities the likes of which have not been out there since the financial crisis of 2008. And you haven’t missed your chance to cash in on the best high-yield dividend stocks in over a decade.

Sure, the market has bounced back from its initial crash. The S&P 500 is creeping back to the all-time high. But the index is skewed with a lopsided allocation in large technology companies, which are doing well. The vast majority of stocks on the index are still down 20% or 30% and more in some cases.

The lower prices have raised the yield in the dividend-paying stocks. In fact, you can find high yields all over the place. But beware: In most cases, those yields are high because the stock price fell because business is way down. Many of these companies will have to cut the dividend to free up cash. Many of these oh-so-juicy yields are a dividend trap. You can wind up with a lot less income and a plummeting price.

However, certain well-chosen companies are uniquely enabled to maintain the dividend through the crisis. Those yields are real. This market has created certain opportunities where you can not only get great stocks at bargain prices, but you can also collect a higher level of income than has existed in over a decade.

I found two such investments.

The 2 Best High-Yield Dividend Stocks in a Decade

Best High-Yield Dividend Stock #1: Altria (MO)

Yield: 8.60%

Altria Group (MO) is the largest U.S. domestic cigarette maker and one of the largest in the world. The company is the domestic part of the old Philip Morris that spun off the international division in the form of Philip Morris International (PM) in 2008. Altria now operates primarily in the United States.

In addition to cigarettes, Altria also sells e-cigarettes, marijuana, beer, wine, and smokeless products. Altria also owns a 10.2% stake in the world’s largest brewer, Anheuser-Busch InBev (BUD). It may seem like a diversified company but it really isn’t. About 85% of net revenues are generated from cigarettes and the overwhelming majority of that is from its flagship Marlboro brand, which commands a stratospheric 40% plus cigarette market share in the U.S.

That’s a problem. In case you haven’t heard, cigarettes are bad for you. The volume of cigarette smoking is declining by about 4% to 6% per year. Of course, it has been declining at about 4% for decades. And over that time Altria has been able to more than compensate for the declines by raising prices and buying back shares. The company still grew annual earnings at a solid rate and had been one of the best-performing large-cap stocks in the index.

But things are changing.

The rate of annual volume declines is increasing because more people are opting for E-cigarettes, especially young smokers. To answer that problem, Altria purchased a 35% stake in dominant e-cigarette brand JUUL in late 2018 for $12.8 billion. It has since been the acquisition from Hell. JUUL has been under relentless assault by regulators primarily for marketing to young people. There is now even a question if e-cigarettes will be allowed to operate at all.

Altria has already written down $8.6 billion of the investment. The market hasn’t liked this and the stock is down about 50% from the 2017 high and near a 5-year low.

But here’s the thing. If e-cigarettes get sued out of business, Altria will sell more cigarettes. If e-cigarettes survive, Altria owns the dominant company in the space. It will ring the register either way. Plus, Altria has other growth opportunities in marijuana (it purchased a 45% stake in Cronos) and a joint venture with Philip Morris International to sell heated tobacco e-cigarette product iQos nationally.

In the meantime, the company continues to grow earnings per share. Management is forecasting high single digit annual growth for the next several years. Earnings grew over 18% in the first quarter of 2020 as people are smoking more during the pandemic.

A Reliable Dividend?

Is that massive 8.9% yield safe? I think it is rock solid. The company has a rather high 80% payout ratio, but that is the historical average. And the company has raised the payout every year for the last 50 years.

The company is growing earnings and has been consistently doing so for decades. Investors are not seeing the value right now. But the stock is dirt cheap, and probably has limited downside in another downturn and a good prognosis for future appreciation. And that yield is phenomenal.

Best High-Yield Dividend Stock #2: Enterprise Product Partners (EPD)

Yield: 8.60%

Enterprise is one of the largest midstream energy companies in the country, with a vast portfolio of service assets connected to the heart of American energy production. It has $36 billion in annual revenues from an unparalleled reach in the industry that is connected to every major U.S. shale basin and 90% of American refiners east of the Rockies, and the company offers export facilities in the Gulf of Mexico.

The energy sector is getting killed by this pandemic, as demand fell off a cliff during the lockdown. Oil prices crashed and energy has been the worst-performing stock sector during this recession. But, as a midstream energy company, Enterprise makes money from the services of piping and storing oil and gas. It isn’t highly exposed to energy prices, but makes its money on the fact that there is a lot of oil and gas sloshing around this country. And the U.S. is now the world’s largest producer of oil and gas.

That said, Enterprise relies on volumes going through its systems to bring in revenue. Those volumes have been diminished during the crisis. But midstream companies are not taking it on the chin like most of the energy sector. And volumes will resume over time.

What About the Distribution?

Because of the financial devastation brought by the pandemic-induced lockdowns, many companies in the energy sector will be forced to cut dividend and distribution payouts to free up cash in order to survive. That will also include many midstream companies.

But Enterprise is highly likely to maintain or even grow its distribution. As a Master Limited Partnership (MLP), EPD pays out the bulk of earnings in the form of distributions. But, unlike most MLPs, EPD has only about a 60% payout ratio of funds from operations. The partnership keeps it low so it can fund growth projects internally. But it has since suspended those investments for the remainder of the crisis.

That frees up that money to pay the distribution. As well, the partnership began this crisis in better financial shape than any of its peers, with low debt and a strong cash position. It has $6.5 billion in cash and cash equivalents from which to pay $4 billion in annual distributions.

Enterprise can easily weather a bad year and maintain the payout. The company also has a track record of raising the distribution every single year since its IPO in 1998 to defend.

With a huge yield that is safe, and an absurdly low price, currently 53% below the all-time high, EPD offers one of the best income opportunities in many years as well as the potential for strong capital appreciation over time.

In my mind, those are the two best high-yield dividend stocks in the last decade.

Prepare to Buy Great Stocks at Bargain Prices

While the stock market has had a huge recovery from the lows of the pandemic market, there is a good chance of another downward move. In the calm of a month-long rally, it’s a great time to target great stocks at bargain prices.

While the economy and market will ultimately recover from this crisis, there could be more trouble ahead. You might get another bite at the apple to buy great stocks at bargain prices ahead of the eventual recovery.

Here’s the situation.

The market has grappled with pandemics in the past but never to anywhere near this degree in the modern era. There have certainly been economic downturns before. In fact, there have been 11 prior recessions in the post-World War II era. But we have never seen such a sudden and comprehensive economic crash like this.

Several reputable firms and analysts are calling for a 30% or 40% economic contraction in the second quarter. Let’s compare that to the contraction during the financial crisis, the worst recession since the Great Depression. In the worst quarter, the fourth quarter of 2008, GDP contracted 8.4%.

Of course, this recession is self imposed to avoid the spread of the virus. The economy didn’t roll over on its own. Government restrictions crashed the economy. The easing of those draconian measures can revive it.

It’s like an athlete that’s injured. Sure, his combine numbers will fall off a cliff while his leg is hurt, but he will be right back in business when the injury heals. It will just take some time.

The market is sensing that the economy will restart sooner rather than later. As a result, the S&P 500 has rallied 30% from the lows in March. The index has recouped about 60% of the losses at the low and is now just 14% off the February 19 high.

I’m a believer in this country and this economy. We will overcome this virus and this recession. The economy will come back strong and so will the market. That said, there is a strong chance that the market has gotten ahead of itself in the near term.

Consider this: If all goes well and the virus continues to recede and the economy continues to restart, it will still take time to overcome the damage already done. Many businesses will not survive the shutdown, and many more will find themselves in more debt and financially damaged in the aftermath.

Think about the consumer, which accounts for 70% of GDP. The pandemic has put 26 million people out of work so far. Many are projecting an unemployment rate not seen since the Great Depression. In order for the economy to recover to near pre-pandemic levels those people will have to trickle back to work, recover the financial damage and regain confidence. That will take some time.

In the meantime, the S&P 500 is currently trading at the same level as this past August, despite the significantly deteriorated fundamental backdrop. Of course, the market is forward looking and it focuses on improved conditions six to nine months from now. But it’s unlikely that the economy will be in August 2019 shape by then, even if the recovery goes very well.

Why has the market come back so strong and so fast?

One reason is that the disaster scenario in which the economy continues to be locked down into the summer and beyond, doing long-term damage to the economy, seems to be unlikely. Fear of that situation drove the market to the lows in late March.

It’s also true that with record-low interest rates money has no place else to go but stocks to earn a decent return. As fear subsides, there’s a lot of money on the sidelines attracted to some of the cheapest stock prices in many years. Investors realize that this economic crash is a temporary situation. And this may be a rare opportunity.

But there are good reasons to believe there could be more trouble for the market ahead. The market is factoring in a “good scenario” that may not happen. The virus could come back as the economy opens up, prompting a retreat. The global economy probably won’t recover as well as America’s, thus dragging our economy down.

The economic damage already done hasn’t been fully realized. Earnings and economic numbers will be horrible. The market won’t like that. There will at least be speculation of long-term economic damage and pain. Gloom and doom prognosticators will come out of the woodwork and forecast the end of prosperity.

Look, the market is unpredictable in the short term. It has a habit of confounding sound reasoning. It could just run away and never look back. That’s certainly possible. But there is a strong enough chance of another downturn that it is worth preparing for.

Instead of fearing another selloff, get ready to exploit it. The market may give you another golden opportunity to pick up great stocks at bargain prices. Good companies purchased at great prices in the bowels of a selloff can turn out to be the best investments of a lifetime.

The Best Stocks to Survive a Post-COVID-19 Market and Economy

It’s been a wild ride in the market. A 34% crash in record time involved a lot of indiscriminate selling—just about everything got crushed. Then, an epic 20%-plus rally from the lows lifted almost every stock. Now, we are entering a different phase.

From here on, stock performance is likely to be a lot more company specific rather than mostly a consequence of the market whirlwind. The coronavirus and adjoining economic shutdown are affecting companies very differently.

Some companies are facing massive disruptions. Airlines and cruise lines as well as many retailers and energy companies are taking a huge financial hit. Some companies won’t survive this and many of the survivors will take a long time to overcome the impact. On the other hand, certain companies are barely affected by the shutdown, and others are actually thriving.

For example, business at Amazon (AMZN) is booming as people stuck at home have to shop online. Companies like AT&T (T) and Verizon (VZ) as well as Netflix (NFLX) are thriving as people use the internet and watch TV more while locked up in their homes. Healthcare companies and Utilities continue to do business as people still take their medicine and heat their homes.

Markets always look forward. The panic and uncertainty surrounding the track of the virus is quickly passing. The next market phase is likely to be all about the economic impact of the shutdown and the recovery. Companies that can endure and thrive through the rest of the crisis and recovery will own the near and intermediate terms. And the relative performance should reflect that fact.

High-yield stocks offer a nice buffer while we weather the rest of this storm. And I’ve found two companies that pay high and secure dividends and whose relative value in the market should soar in the months and quarters ahead.

#1: Verizon Communications (VZ)

Yield 4.34%

Verizon in the largest U.S. wireless carrier. Of the four major U.S. telecom carriers (Verizon, AT&T, Sprint and T-Mobile), Verizon has by far the most wireless revenues with the largest network and coverage.

I like it better than the other large telecom providers because it is a near pure wireless play and competitors are distracted and tied up with mergers (the pending Sprint/T-Mobile merger and AT&T’s absorption of Time Warner). Verizon’s wireless business (which accounts for about 85% of adjusted earnings), along with its ancillary businesses in TV, internet and enterprise service, is booming during this crisis.

Wireless and internet usage is way up while people are stuck at home. It is one business that is absolutely thriving. Verizon should post very stable and probably better-than-expected earnings right through this economic disaster. The dividend should be secure and downside will be limited.

But it is also very well positioned for the post-coronavirus economy and market. Verizon is a leader in 5G and has already rolled it out in 30 cities, putting it ahead of everybody else and first to the party. 5G will be a game-changer that will thrust the country into a new technological age. 5G is also likely to be the biggest story in the market after this crisis abates.

Smartphones with 5G are just hitting the market this year, although things could be delayed. New technologies will need a much higher degree of internet connectivity and they will need Verizon, which will charge for the expanded services.

Verizon is a great stock to own through the crisis and it also has a strong growth catalyst for the post-coronavirus market.

#2: AbbVie Inc. (ABBV)

Yield 5.88%

AbbVie Inc. (ABBV) is a cutting-edge, U.S.-based biopharmaceutical company specializing in drugs and treatments that incorporate biotechnology as a solution to human diseases. Nothing has really changed just because the world around it is collapsing. People won’t stop taking their medicine. And healthcare will likely emerge as the hero of this crisis.

Everything this company had going for it (the pipeline, a big in-the-works merger, better-than-expected earnings, the safe and high dividend) is still intact, only the stock is a lot cheaper now. Few companies have such a defensive business combined with extremely powerful demographic headwinds from the aging of the population.

The company is facing competition for its number one selling blockbuster drug Humira overseas and will face competition in the U.S. starting in 2023. The stock got creamed as investors worried about replacing Humira revenues. But the company has a powerful pipeline and newly launched drugs that I believe are more than capable of replacing lost revenues. As well, the merger with Allergan (AGN), which should close in the next couple months, will further diversify the company.

Investors, as well as insiders, had realized ABBV’s value, and the stock soared over 60% in the months before the virus. ABBV was a good stock before the crisis and will be after the crisis. It is also one of the few stocks you can buy here with the remaining uncertainty.

Dividend Investing

Here I want to address an important strategy that has long been a favorite of investors, especially in their golden years—Dividend Investing.

For many decades, dividends were mostly paid by blue chip, financially-healthy, conservative companies—just the types of stocks that are attractive to retired investors who don’t want to take on excess risk but love the cash flow inherent to dividend-paying stocks.

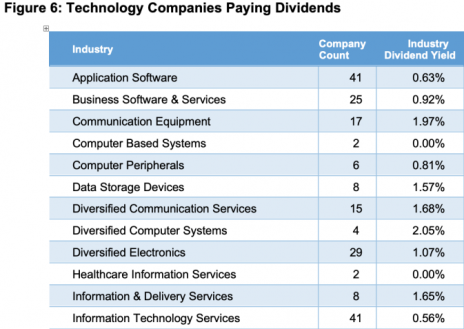

It was rare to see a high-growth company issuing dividends, other than Intel (INTC), who began paying them in 1992. The tech boom and bust of the early 2000s scared a lot of investors away from technology companies, so many of the more established tech companies decided a dividend strategy was one way to lure them back. Microsoft (MSFT) began paying dividends in 2003; Cisco (CSCO) followed in 2011, and now, as you can see by the following chart (Figure 6), many tech companies pay a dividend.

The average dividend yield (annual dividend divided by the current stock price) for companies in these tech sectors is 1.22%, significantly below the 1.91% average for the companies in the S&P 500 index. Currently, some 81.4% of the companies in the index pay a dividend.

Consequently, it’s not unusual for growth as well as value companies to pay some sort of dividend—especially if they’ve been around for a while. But it is rare to find a company in a high-growth stage, such as a start-up technology or cutting-edge biotech firm, that is paying dividends at all.

But many savvy, long-term investors realize dividend investing is a great method to not only build extra appreciation into your portfolio, but also a successful strategy for keeping risk down during uncertain economic and market cycles.

During volatile periods, investors often flock to dividend-paying stocks as a way to create cash flow in their portfolios, as well as to take advantage of their more stable characteristics which may help to mitigate any losses from more speculative stocks that may decline precipitously.

Dividend Reinvesting

Another advantage of buying stocks that pay dividends is their compounding effect if you reinvest the dividends, rather than cashing them out as they are paid.

Here’s one example:

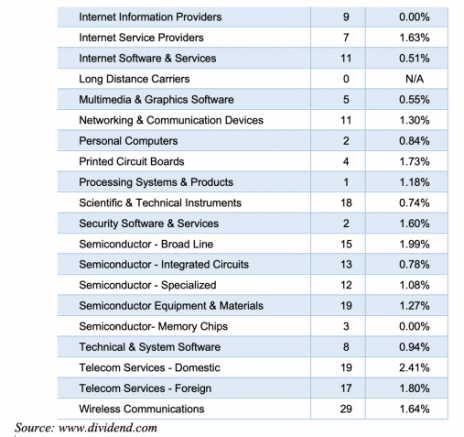

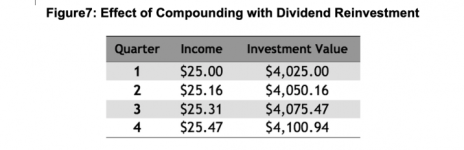

“Let’s say you own 100 shares of a $40 stock with a 2.5% yield. That means the company pays $1.00 per share in dividends each year, or 25 cents per quarter. This table (Figure 7) shows how your dividend income and the size of your investment will change over the first year.

“As you can see, reinvesting that first $25 increases your second dividend payment by 16 cents, because you now own another $25 worth of dividend-paying stock.

“By the end of the year, your quarterly dividends have increased to $25.47, and the value of your investment has increased by $100.94—that $100 is simply the dividend payments, which you would have earned whether or not you chose to reinvest. But the extra 94 cents is “dividends on dividends,” which you earned thanks to reinvesting.”

That’s just a small example of the effects of dividend reinvesting. It’s like free money! And often, companies increase their dividends, which puts even more money in your pocket. In fact, total dividend payouts globally are expected to reach nearly $1.4 trillion this year, just 3% below their pre-pandemic peak.

According to www.DividendInvestor.com, more than 1,100 companies and closed-end funds offer Dividend Reinvestment Plans (DRIPs). A DRIP allows you to automatically reinvest cash dividends by purchasing additional shares or fractional shares on the dividend payment date.

Companies who operate their own DRIPs will often let you buy additional shares of their stock commission-free, and sometimes even at a discount to the current share price. In my Wall Street’s Best newsletters, I follow two investment pros who keep a close eye on dividend reinvestment plans—Charles A. Carlson, editor of DRIP Investor and Vita Nelson, editor of DirectInvesting.com. Each month, they offer great insight into the DRIP industry, as well as a selection of recommended stocks.

DRIPs are often recommended for long-term investors. Buying and selling shares in a DRIP is not as easy as picking up the phone and calling your broker. Most companies buy and sell shares in a DRIP in bulk (to reduce transaction fees), so you are most likely not going to get current market prices. It may take a few days to get in or out, so if you tend to trade stocks, a DRIP would not be your best investing vehicle.

But DRIPs are a great way to invest in well-managed, financially stable companies—for the long term. When my nieces and nephew were born, I set up DRIPs for them, buying stock in McDonald’s (MCD). They didn’t get rich from the DRIP, but when they set off for college, they had a tidy little sum to use for buying some of the extras they needed.

My hope was that discussing their shares with them through the years would turn them on to investing for life. Alas, that didn’t exactly happen. However, I can report that they were thrilled with the McDonald’s coupons that came with the annual company report each year!

DRIP investing is just one type of concentrated dividend investing.

Why Dividend Aristocrats are a Good Place to Find Income

In 2008, at the depths of the worst recession since the Great Depression, the Federal Reserve reduced short-term interest rates to basically zero to help stop the bleeding. The U.S. economy recovered nicely since that tourniquet was applied. But seven years later, short-term interest rates remain near zero.

That means the traditional avenues for earning interest on the money you save— certificates of deposit, Treasury bonds and money-market accounts—have been all but cut off. Income seekers hoping to save for retirement have had to turn elsewhere. The most logical place is dividend stocks.

As investors have gone hunting for dividend-paying stocks in recent years, more and more companies have initiated a dividend. Currently 421 of the companies that comprise the S&P 500 pay a dividend, the highest number since the turn of the century. But don’t let the high participation rate fool you. Not all dividend stocks are created equal.

Though 84% of all large-cap stocks now pay a dividend, the payouts aren’t particularly generous. The average yield among S&P 500 stocks is a mere 1.9%, roughly in line with the 10-year median. Meanwhile, the payout ratio among S&P 500 companies is 32%, only a few percentage points higher than the 10-year average (29%).

Some companies want to dangle the carrot of a dividend to attract more investors without really rewarding those shareholders in a meaningful way. A 0.8% yield technically makes a company a dividend payer, but it’s not an amount that should entice you to buy the stock. Other companies may offer eye-popping yields—6%! 7%!— that aren’t sustainable because the company simply isn’t making enough money.

Those are dividend stocks you should avoid.

Rather, you should consider companies that have not only been paying dividends for decades, but have also annually increased those payouts. These are called “Dividend Aristocrats.”

Dividend Aristocrats are companies that have increased their dividends at least once per year, every year, for at least 25 straight years. That kind of dividend growth demonstrates two things: stable cash flow and a commitment to rewarding shareholders. Better yet, most Dividend Aristocrats offer generous yields, typically in the 3% to 4% range—much higher than the 1.9% yield you’d receive from the “average” dividend stock.

When you invest in a Dividend Aristocrat, you not only count on receiving a quarterly dividend payment, but you can also rely on those payouts increasing every year.

Say you buy shares of Procter & Gamble (PG), a company that has upped its dividend payout for 58 consecutive years. Through the dot-com bubble bursting at the turn of the century, the Great Recession of 2008–2009, the European debt crisis volatility that plagued U.S. markets in 2011, P&G has increased its dividend every year.

The 3% dividend yield P&G offers today isn’t much different from what it was five years ago, 10 years ago or 25 years ago. The certainty of a 3% yield is a nice buffer against market volatility and sudden crashes like we saw during the recession. It’s even better knowing that your quarterly payouts will increase every year.

Dividend Aristocrats aren’t a super-exclusive group. After all, roughly a quarter of the 421 dividend payers in the S&P 500 qualify as Dividend Aristocrats.

Most Dividend Aristocrats you already know. They are blue-chip companies known for being reliable and shareholder friendly. Those include:

- McDonald’s (MCD): 44 straight years of dividend growth

- Johnson & Johnson (JNJ): 58 years

- Coca-Cola (KO): 58 years

- Wal-Mart (WMT): 46 years

- Exxon Mobil (XOM): 38 years

Others are less obvious. For example, the longest-tenured Dividend Aristocrat is

Deibold (DBD), with 67 straight years of dividend growth.

Regardless, most Dividend Aristocrats are large, relatively stable blue-chip companies with healthy balance sheets. They can afford to not only reward shareholders, but to increase those rewards every year.

Not all Dividend Aristocrats have staying power. After the financial crisis, a number of brand-name companies ordinarily associated with dividend stability suddenly cut their payouts or dropped them altogether. Bank of America (BAC) was one example.

But those types of catastrophic situations are rare. And besides, when a company stops increasing its dividend annually, it is simply cut from the Dividend Aristocrats list.

You can find the full list of Dividend Aristocrats online by visiting the Standard & Poor’s Dividend Aristocrats page. Just note that the list does fluctuate a bit from year to year, as companies either hit the 25-year dividend growth mark or (in those rare cases) elect to stop increasing their dividend.

Knowing where to find Dividend Aristocrats, and how to invest in them, is easy. Understanding why you should invest in them is even easier.

In an age when storing your money in a high-interest-bearing CD or money market account has become essentially worthless, Dividend Aristocrats are reliable alternatives.

The yields are better than your average dividend stock; the share prices are fairly predictable, appreciating slower than the market but rarely falling too far during corrections; and best of all, the dividend payments you receive are likely to grow every year.