After a long, painful 2021, there are a lot of affordable cannabis stocks in the marketplace. In fact, the entire sector is trading at a roughly 60% discount to where it was trading just one year ago.

Coincidentally, I happened to hold a webinar on February 18, 2021, in which I highlighted both the strength of the leading stocks and the levels to which they had become overvalued.

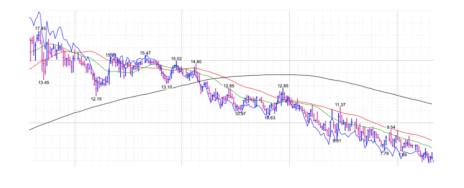

Here’s a typical one-year chart from that time, showing the stock of the industry’s biggest company in 2021, Curaleaf (CURLF).

From the low of March 2020 to the peak of February 2021, CURLF stock shot up an incredible 624%. Of course, not all cannabis stocks were this hot, but even the Cannabis Stock Index, which includes lesser companies, was up 405% over the same period.

As a result, stocks in the cannabis sector were wildly overvalued.

Now, overvalued is not necessarily a bad thing. Stocks can stay overvalued a long time, and as long as they keep going up, I’m happy to hold on to overvalued stocks.

But the more overvalued they get, the greater the potential downside—and the past year has proven that quite clearly, as Curaleaf’s stock has returned to earth and given up 72% of that upside gain.

Yet business at the company is still very good!

In fact, revenues in the last reported quarter were up 74% from the year before.

And what that means is the stock may well be considered undervalued now.

Look at it this way. In the S&P 500, where the average company is growing revenue at a modest rate of 14%, the average price/sales ratio of the stocks is 1.5. But at Curaleaf, where revenue growth is more than five times as fast, the price/sales ratio is just 4.5, or only three times as much.

Now, there are other factors to consider, of course, like earnings. Curaleaf has no earnings yet, as it’s plowing all its cash into expansion. But there’s no question that earnings will come soon, and that Curaleaf, like all the leading companies in the cannabis industry, will be a very profitable company.

Yet Curaleaf is not one of my recommended buys today, because it’s not one of the cheapest! It’s not unusual for the biggest company in a sector to be relatively overvalued.

The three undervalued cannabis stocks that I’m looking at today are Cresco Labs (CRLBF), Green Thumb (GTBIF) and Trulieve (TCNNF).

3 Bargain Cannabis Stocks

Cresco Labs (CRLBF), based in Chicago, is one of the five leading marijuana companies in the U.S., with 47 operational dispensaries, 47 retail licenses and 20 production facilities in 10 operational states. It’s the market share leader in Illinois and is very strong in Pennsylvania, where it announced the opening of its 10th store in the state just this month. So, Cresco is growing, but with revenues up 41% in the third quarter, to $216 million, it’s growing more slowly than the leaders. Reflecting that, it’s the cheapest of these three, selling at just 2.1 times revenues—down from 9.9 times a year ago. Still, Cresco has turned the corner and is now posting real earnings, $0.23 per share in the third quarter. On the technical side, CRLBF established 6 as a base in December and early January, and while it dipped briefly below that level at the end of January, it’s back above it now, and trading above its 25-day moving average, which is a good sign.

Green Thumb (GTBIF), also based in Chicago, is just a little bigger than Cresco. The company has 16 manufacturing facilities and 73 operating retail locations in 15 states (California, Colorado, Connecticut, Florida, Illinois, Maryland, Massachusetts, Minnesota, Nevada, New Jersey, New York, Ohio, Pennsylvania and Virginia). Third-quarter revenues were $234 million, up 49% from the year before. And Green Thumb now has three quarters of positive earnings under its belt, recording $0.52 per share in the third quarter. Yet the stock is now selling for just 4.1 times revenues, down from 13.3 times a year ago. As for the stock, it bottomed at 18.40 back on November 3, and held above that level fairly well until last month, when it fell through support, however the stock bounced back quickly and is now trading north of 21. Fourth-quarter results will be released before the market open on Tuesday, March 1.

Trulieve (TCNNF) has long been the biggest seller of marijuana in its home state of Florida, where it has a 46% market share, because that’s where it chose to concentrate all its efforts in the early years. And because of that, it turned profitable more quickly, and now has posted seven consecutive quarters of positive earnings, with the third quarter bringing in $1.11 per share while revenues grew 64% to $224 million. But since its October acquisition of Harvest Health & Recreation, which added great strength in the western U.S. and resulted in Trulieve operating in 11 states, with leading market positions in Arizona, Florida, and (maybe) Pennsylvania, Trulieve has become a national powerhouse. Yet that hasn’t prevented the stock from falling like the rest of the sector this year; and just last month the stock failed to hold up above its December lows. Still, a year ago, Trulieve was selling at 13.4 times revenues, and today it’s relatively cheap, selling at just 3.0 times revenues.

Conclusion: These three cannabis stocks are not only industry leaders, but also shockingly cheap compared to their values just 12 months ago, and that’s why they should be near the top of any cannabis investor’s watch list as we wait for this sector to turn up.

Do you own cannabis stocks in your portfolio? Which have performed well? Tell us about them in the comments below.