Have you dreamed of turning your jewelry-making hobby into profits? Do your friends and family tell you that you are so good at baking that you should have your own Food Network show? Are your photographs professional quality? Does everyone you know ask you to plan their birthday, wedding, anniversary parties?

Or have you just fantasized—for years—about chucking your boring job and starting your own business?

Well, now may be the perfect time to do that! And you wouldn’t be alone. According to a survey from Prudential, since the beginning of the pandemic, 20% of workers have changed careers. And Microsoft recently reported that 46% of employees are considering a career change.

Last August, 4.3 million Americans (about 3% of the workforce) quit their jobs.

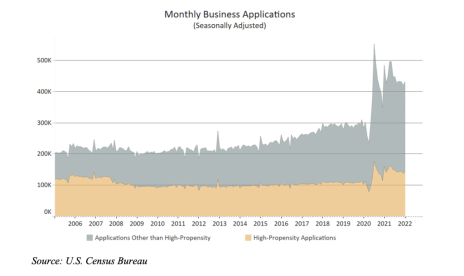

Many of these career changers and job terminators are trying something new—starting their own businesses. In 2021, according to the U.S. Census Bureau, 5.4 million new business applications were filed, easily beating the previous record of 4.4 million applications in 2020, and handily surpassing the 3.5 million filed in 2019.

What is causing this frenzy of entrepreneurship? Actually, a couple of things:

COVID-19 was responsible for 9.37 million jobs lost, according to the Wall Street Journal. Many of those were in low-wage jobs. That initial shock turned into a bonus for some of those workers, who sought training to qualify for new careers. Others elected to “go it on their own,” starting their own businesses.

The stock market bull run has padded the retirement savings of many workers. The American Society of Pension Professionals and Actuaries reports that folks, aged 55-64 (with more than 20 years tenure on their jobs) saw a rise of 20.5% in their 401(k) balances last year, while the younger set (25-34, with 1-4 years on the job) enjoyed gains of 33.3%! And that extra capital in their pockets has funded new businesses in a variety of industries.

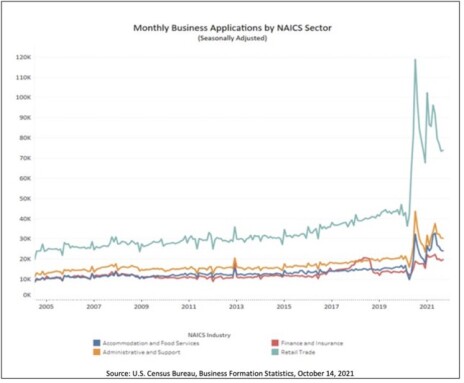

As you can see in the graph below, the majority of these new businesses were in the Retail/Trade sector, followed by Administrative & Support, Accommodation & Food Services, and Finance & Insurance.

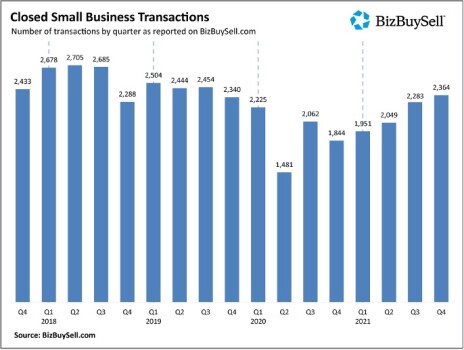

But starting a business from scratch is not the only way to own a business. Last year, according to BizBuySell, there were 8,647 sales of small businesses.

Bottom line, this is a great time for budding entrepreneurs to step out on their own. Are you ready? If so, read on …

10 Steps to Buying a Business

Let’s start our journey with looking at existing businesses that might strike your fancy. And then, we’ll investigate the ins and outs of starting your business from scratch. Buying a business will probably cost you more money upfront than a start-up. But if you can buy a business that is already making money, you’ll be ahead of the game, as creating a new business is going to take longer to return a profit, and it also comes with lots of paperwork, legal costs, and development and marketing expenses—just to name a few of the challenges. And it will probably be more difficult to get a loan or investors for a start-up. Of course, it can also be incredibly lucrative. So, let’s explore both possibilities.

Step 1. What Can You Afford?

It’s important that you not “work backwards” when computing this number. I helped found a business incubator a few years ago, and right after the state of Tennessee began licensing moonshine producers, I had my first client. And when I first examined his financial projections, I saw that he began with the goal of netting $80,000 per year—his salary in his previous job. Can I tell you, that doesn’t make any sense! He should have started with the moonshine business projections: how much it would cost to manufacture certain volumes, the amount he would need to invest in marketing and development fees, what would he have to pay his sales reps, etc. It was obvious; I had my work cut out for me!

Alternatively, the right way to go about determining the affordability of buying (or starting a business) is to first look at your personal financial situation.

What down payment can you afford? Even with a Small Business Administration loan, you’ll probably need a down payment of at least 20% of the value of the business, although I understand some of their new programs may only require 10%.

How’s your credit? Your FICO score is probably going to need to be at least 700 to attract financing from a bank or credit union.

Are you willing to use the equity in your home as collateral? In my banking years, many would-be entrepreneurs approached my bank for a loan to help them buy/start a business, but erroneously thought they could do that without any skin in the game. Nope!

Do you have any other sources of income (parents, friends, etc.?)

Step 2: What Skills and Strengths Do You Have?

You can certainly buy/start a business if you have no experience in a particular arena, but I wouldn’t advise it, as it may take too long to get up to speed. And, even if the existing business is lucky enough to have long-time employees with plenty of expertise, you need to know something about their skill levels to ensure that you can grow the business as you desire, with their assistance, and also, so that you are not so naïve that they are taking advantage of you.

Do you have experience in selling? In my real estate business, I get lots of calls from people who want to become Realtors but have no background in selling or customer relations. That’s not a dealbreaker, but they need to make sure they have the mindset of a salesperson and be a good communicator to be successful in that field.

Are you good at keeping books? No matter whether you buy or build a business, you need to have this skillset. Most folks can’t afford to hire someone to do this for them until they’ve been in business for a while. And even if you do hire a bookkeeper or accountant, you are still in charge of your finances, and you should have a working knowledge of accounting so that you can make sure your employees are trustworthy and as knowledgeable as they claim.

I have personally known several small and large business owners who have been seriously hurt or even bankrupted due to trusting the wrong people with keeping their books. Just the other day, a friend shared a story of a real estate maven whose assistant stole more than $100,000 over a very short period of time. The agent had half-heartedly checked the employee’s references, and no one gave her a bad rep—although she had previously been caught—several times—with her hand in the cookie jar. Her previous jobs elected not to prosecute her—a very big mistake!

In what fields have you worked? Do you know how to run a manufacturing line? Are you skilled at getting a product from design to manufacturing? Maybe you are really good at interviewing and hiring people or counseling your friends as to their career choices. Those are all marketable skills.

What kind of professional licenses do you have or may need when acquiring a business?

Do you have experience or like managing people, or would you prefer to be a sole proprietor with no employees?

Step 3: How Much Disruption to Your Lifestyle/Family Can You Tolerate?

I know you’ve heard this before, but it’s absolutely true. Owning your own business is not a 9-to-5 job, especially in the beginning stages. You can expect to spend long hours learning the business, as well as operating it. Ask yourself these questions:

- How many hours are you willing to work?

- Are your spouse or other family members available—and willing—to help?

- Do you need and are you and your family willing to relocate for a business opportunity?

- Is your spouse on board with possibly using the equity in your homes as collateral for buying a business?

Step 4: Researching Businesses to Buy

As I mentioned, it’s probably better to look for a business in an industry that you understand—one that will be enhanced by your skills and expertise.

Next, consider the size of the business (which may be determined by how much money and time you have to invest). Here, you need to think about how many employees and locations you want to manage. Several of my friends own or manage real estate brokerages with 150 or more agents. But I know that’s not for me. I like a hands-on approach, and that just isn’t possible with that many salespeople.

Where do you want your business to be located? You’ll need to look at the labor pool, as well as employment and training costs. And if you plan to relocate, there will be other expenses, such as moving, housing costs, and the various licenses required by city, county, and state governments.

Start scouring local newspapers for businesses for sale. Next, find a good commercial real estate broker. Most multiple-listing services will have a commercial division, which spotlights commercial real estate property as well as businesses for sale.

Employ your networking skills and ask around to see if your local business associates or organizations, such as the Chamber of Commerce, know of any businesses for sale.

You can also use a business broker to search for businesses that might fit your requirements. A business broker can be very helpful, offering services including prescreening businesses, helping you narrow down the type of business you want to own, negotiation, and handling whatever legal paperwork is required.

For these services, a business broker will usually charge 5%-10% of the purchase price. But you may also just use a broker for one or a couple of these services, which will reduce your fees.

And then, there are many business sale websites that are available for your review, including Loopnet.com (around 10,000 listings) and Bizbuysell.com (about 45,000 business listings).

Step 5: The Questions You Will Need to Ask

Once you have identified a business that you are interested in, you’ll want to meet with the seller and arrange a thorough tour of the business. Be aware that the business seller probably has not yet shared with his employees his desire to sell his business, so you will probably have to meet him after normal business hours or on the weekend.

Here are a few questions you’ll want to address with the seller:

- Why are you selling?

- Would you be willing to finance the business?

- Is the company incorporated? Make sure to check its legal status with the state in which it is located.

- Is the building owned or leased? Is it in good condition, or does it need updating/repairs? Who is responsible for those?

- If the business has inventory, is it adequate and in good shape?

- How has the business fared in good and bad economic cycles?

- Does the business have more than one product or service? What percentage of revenues and profits does each business segment contribute?

- How long have the employees been with the business? What salaries do they command? What do they contribute? Who is your most trusted employee, and would he want to buy the business? If not, will he want to stay—at least for a while?

- Is there customer concentration, or does the business enjoy a widely diversified customer base? Are there existing contracts with customers? If so, ask for copies.

- If the business has suppliers, are there enough sources so that it is not dependent on one or just a few? Request any contracts related to suppliers.

- Do any vehicles come with the purchase? Are they leased, owned outright, or do they have outstanding liens against them?

- Who is your competition, and how would you rank your business, as to market share?

- How do you market your products/services? Do you use a multi-channel strategy?

- If the business has not been growing every year, why not?

- Would you be willing to be a consultant to the business for a time period after the sale?

- Is the business cyclical or seasonal?

- If subject to OSHA requirements, what is your safety history?

- What type of insurance is required in your business? And what is the claims history?

- Is there a history of product liability? Lawsuits, legal proceedings?

- What intellectual property, such as patents, do you own, and will they be transferable?

- What banking relationships do you have?

- Will you sign a non-compete agreement?

- How much money do you take out of the business each year?

- Do you take a vacation, and how much?

- Is owning this business fun?

Step 6: Financial Due Diligence

After your meeting with the seller, they will have shared with you how much they want for the business. You’ll need to find out the methods they have used to determine the value for the business. Often, the selling price will be a multiplier of either the monthly gross sales, monthly gross sales plus inventory, or after-tax profits. This is considered a Market-Based Model.

However, there are other methods often used to come up with a reasonable selling price for a business, including:

Book Values, or Asset-Based Model. Here, you will need to calculate the net worth of the business, or the difference between the assets and liabilities of the company. Businesses are often valued at one- or two-times book value. But coming up with book value isn’t as easy as it sounds. You’ll need your accountant’s help to decide which assets should be included and at what price. They may need to be marked to market, instead of at cost, as they are currently stated on a company’s balance sheet, or not valued at all if they have been fully depreciated. Also, the company may have additional liabilities that are not reported on its balance sheet, such as unpaid taxes, outstanding lawsuits, etc.

Return on Investment (ROI), or Income-Based Model. This is perhaps the most-used valuation tool. ROI is calculated by dividing an investment’s net profit (or loss) by its initial cost or outlay. It is simply the amount of money the buyer will realize from the business in profit after debt service and taxes. Entrepreneur.com says you should expect the ROI from a small business to be 15%-30%.

Capitalized Earnings, also an Income-Based Model. In this method, you would use profits to estimate future earnings, and then divide those by a standard capitalization rate. The standard capitalization rate is determined by learning what the risk of investment in the business would be in comparison to other investments such as government bonds or stock in other companies. Here’s the formula: Projected Earnings x Capitalization Rate = Price.

Let’s say you’ve analyzed the company you want to buy and think the projected earnings could grow to $35,000 per year. If your capitalization rate is 25%, the value of the business would be: $35,000/.25 = $140,000.

Once you understand the seller’s valuation method, you’ll need to undertake a deep dive into the business’ finances. Be aware that this can get tricky. You, obviously, need to see the financial statements of a company—how much money do they earn and spend, as well as how much cash has the owner invested. You’ll need not only the statements, but also the tax returns of the business for at least five years, a complete list of liabilities and accounts receivables, and a history of product returns/refunds.

However, those facts and figures are proprietary, and most business owners are not going to turn them over to a stranger. If your business seller decides that you are a serious buyer (and that means you’re going to have to show them that you have the financial resources to buy the company), they will most likely require that you sign a non-disclosure agreement before sharing the business financials.

Step 7: Inquire About the Company’s Reputation

If the financials hold up, next you’ll need to seek out the company’s top vendors and customers and interview them. Does the business have a solid reputation for product quality, meeting deadlines, and paying on time? And if permitted, talking with the employees would also be a great move.

Check for complaints against the company with the Better Business Bureau and industry associations.

Step 8: Form Your Acquisition Team

This team should be comprised of your banker, accountant, and attorney. They can help you with determining the price to pay for the business, obtaining financing, due diligence, and the legal end of purchasing a company.

Step 9: Secure Financing

There are many options for financing a business, including:

Loans/investments from family and/or friends.

A loan from your local bank. The bank will require:

- Your personal credit score

- The business’ credit score, financial statements, pro forma statements, history of the company

- A down payment of 20%-25%

- Collateral

Seller financing, if they agree. This can be a short-term—one to three years—until you can prove your capability to your bank, at which time you would obtain a longer-term loan from your bank. Or it could be a long-term (10-20 years) if the seller agrees.

The Small Business Administration (SBA.gov) has several financing options. Some of its new loan programs require only a 10% down payment, with just half from the buyer’s own cash.

Step 10: Negotiate a Purchase Price and Sign a Sales Contract

You’ll need to include the terms of the sale (what is included) and timeline. Your attorney should review and approve this document.

Your attorney will also help you with the other legal documents and licenses you will need to obtain, including:

- Business licenses and permits

- Organizational paperwork and certificate of good standing

- Zoning laws/requirements

- Environmental regulations

- Review of existing contracts and leases

- Business insurance coverage

How to Start a Business from Scratch

As I mentioned, buying an existing business will probably cost you more upfront. Whereas, if you build a company from the ground up, your costs may be spread out over a longer time period.

Many of the steps for buying a business will also apply to starting a business. For instance, it’s easier to start a business in an area in which you have experience and expertise. And the same questions regarding affordability and lifestyle considerations are equally important. But let’s break them down, one by one.

Step 1: Explore Business Ideas

Let’s start with the type of business you might like to own. You may already have a concept of the type of business you would like to operate. Perhaps you are turning a hobby into a business, as I discussed earlier. Or maybe you’ve always wanted to own a bookstore. Some people are good at fixing things, and they own handyman businesses.

But if you only know that you want to build a business, but don’t yet have one in mind, start with this:

Make a list of your strengths and your interests. List a handful of things you are good at, such as bookkeeping, sales, marketing/creative ideas, interacting with people, etc.

Next, make a list of the things you aren’t good at. Maybe you are not a public speaker, or you don’t like to travel.

Make a list of a few products or services that you think would enhance your (and other people’s) personal and business lives.

My niece has cosmetology and esthetician licenses. She loves to make people feel and look better. My friend Pete invented a better storage compartment for his boat, which he has patented. And of course, all of us Cabot analysts like to share our investment knowledge with our subscribers!

I think of all the products and services that have been created in my lifetime that save me money and time—Amazon.com (on second thought, that probably doesn’t save me any money!), the internet, streaming services, and cell phones. How many times have you said, if only this product…? At least once a week, I say, why don’t the car manufacturers create a space for women drivers’ purses? Or why don’t women’s clothes have more pockets? And one of my biggest life questions: Why do I have to repeat my account number three times to a disembodied voice every time I call my bank, credit card company, and insurance company? I don’t know how to fix any of those problems, but maybe you do!

What ideas can you dream up to change people’s lives?

Step 2: Get Your Market Research Hat On

Once you’ve settled on a concept for a new business, you’ll need to analyze all facets of your idea to see if there’s a market for it. You’ll need to examine:

Demand: Is there a desire for your product or service?

Market size: How many people would be interested in your product or service? What are their age groups and spending power? How many can you sell?

Economic indicators: Is your product or service cyclical, seasonal, a staple or discretionary?

Location: Can you sell your product to customers in a specific local area, or will it appeal to a broad, maybe global, audience?

Market saturation: What’s the competition for your product? Determine:

- Market share—who has the most

- Your competition’s strengths and weaknesses

- Barriers to entry

Pricing: What do potential customers pay for these alternatives? What kind of profit margin might you make?

Your market research can be obtained directly from consumers and industry experts, via surveys, questionnaires, focus groups, in-depth interviews and taste-testing (if it’s a food or beverage item).

Alternatively, there are many sources of reliable customer and market information that are free, such as the following federal business statistics:

| Focus | Goal | Reference |

| General business statistics | Find statistics on industries, business conditions. | NAICS, USA.gov Statistics, Statistical Abstract of the United States, |

| Consumer statistics | Gain info on potential customers, consumer markets. | Consumer Credit Data, Consumer Product Safety |

| Demographics | Segment the population for targeting customers. | U.S. Census Bureau, Bureau of Labor Statistics |

| Economic indicators | Know unemployment rates, loans granted and more. | Consumer Price Index, Bureau of Economic Analysis |

| Employment statistics | Dig deeper into employment trends for your market. | Employment and Unemployment Statistics |

| Income statistics | Pay your employees fair rates based on earnings data. | Earnings by Occupation and Education, Income Statistics |

| Money and interest rates | Keep money by mastering exchange and interest rates. | Daily Interest Rates, Money Statistics via Federal Reserve |

| Production and sales statistics | Understand demand, costs and consumer spending. | Consumer Spending, Gross Domestic Product (GDP) |

| Trade statistics | Track indicators of sales and market performance. | Balance of Payments, USA Trade Online |

| Statistics of specific industries | Use a wealth of federal agency data on industries. | Statistics of U.S. Businesses |

Step 3: Decide How to Legally Organize Your Business

There are many ways to legally structure your business:

Sole proprietorship. Sole proprietorships do not produce a separate business entity. This means your business assets and liabilities are not separate from your personal assets and liabilities. You can be held personally liable for the debts and obligations of the business. Sole proprietorships are often used for low-risk businesses. However, you should know that banks are hesitant to lend to sole proprietorships.

Partnerships consist of two or more people owning a business together. They come in two forms: limited partnerships (LP) and limited liability partnerships (LLP). Limited partnerships have only one general partner with unlimited liability, and all other partners have limited liability (and usually limited control). You report profits on your personal tax returns, and the general partner—the partner without limited liability — must also pay self-employment taxes.

Limited liability partnerships bestow limited liability to every owner. An LLP protects each partner from debts against the partnership. You often see partnerships with professional groups like doctors and lawyers.

Limited liability company (LLC). With an LLC, you get the benefits of both the corporation and partnership business structures. This structure protects you from personal liability in most instances, in the event your LLC faces bankruptcy or lawsuits. Profits and losses are also passed through to your personal income without facing corporate taxes. However, members of an LLC are considered self-employed and must pay self-employment tax contributions towards Medicare and Social Security.

If you are a medium- or higher-risk businesses, have significant personal assets that you want to protect, and want to pay less taxes than you would with a corporation structure, an LLC might be right for you.

Corporations come in several flavors:

C corps are legal entities, separate from their owners. Corporations can make a profit, be taxed, and can be held legally liable. They offer the strongest protection to their owners from personal liability. However, it’s more expensive to form a corporation and they also require more extensive record-keeping, operational processes, and reporting.

An S corp is designed to avoid the double taxation drawback of regular C corps. S corps allow profits, and some losses, to be passed through directly to owners’ personal income without ever being subject to corporate tax rates.

Online Assistance in Forming Your Business Structure

If you choose to bypass an attorney to help your form your business structure, here is a list of the Top 5 online services for forming LLCs, courtesy of Top10incorporate.com:ZenBusiness - Exceptional service for fast & easy business formation with expert support and 100% accuracy guarantee.

- LLC filing starts at $49 (+state fees)

- Registered agent & worry-free service

- Lifetime expert business support

- 100% accuracy guarantee

IncFile - Affordable LLC formation services for all business types.

- LLC filing starts at $0 (+state fees)

- Free 1st year registered agent service

- Launched +500,000 businesses since 2004

Northwest Registered Agent - LLC formation starter packages with registered agent services included.

LLC filing starts at $39 (+state fees)

Free 1st year registered agent service

Exceptional multi-state Registered Agent service

SwyftFilings - LLC and corporation filings services with fast turnaround times.

- LLC filing starts at $49 (+state fees)

- Personal business specialist & free tax consultation

- 100% money back guarantee

IncAuthority - More than 20 years of experience as an LLC & corporation formation specialist.

- As low as $0 + state fees

- Free 1st year registered agent service

- Dedicated support from expert business coaches

Step 4: Build Your Professional Assistance Team

Just like with buying a business, you will need the professional help of an attorney and accountant. They can help you figure out a name for your company, obtain a Tax ID number, and secure all the licenses and permits you will need to start and run your business.

Step 5: Calculate Your Costs to Start and Maintain Your Business

Make a spreadsheet of every expense you can think of, including:

- Leasing/buying office space

- Equipment and supplies

- Communications: telephone, internet

- Utilities

- Licenses and permits

- Automobile expenses

- Insurance

- Lawyer and accountant

- Inventory

- Employee salaries

- Software

- Subscriptions

- Memberships

- Advertising and marketing

- Market research

- Printed marketing materials

- Logo creation

- Creating a website

- Taxes

Some of your expenses will be fixed, maybe payable annually, such as subscriptions and memberships. Others may be one-time, and expenses like utilities will vary, month-to-month. It’s best to add up all of your expected expenses for a year, then divide them by 12 to get a monthly estimate.

Step 6: Calculate Your Estimated Revenues

This number is going to be the result of your market research. You’ll be estimating how many items you will sell and to how many customers. In my experience, it’s best to overestimate your expenses and underestimate your revenues.

Step 7: Calculate your Estimated Profits

This will simply be your revenues minus your expenses on a monthly basis.

Step 8: Calculate a Break-Even Analysis

You’ll need to know at what point your revenues will begin exceeding your expenses. And so will your lender or investor.

Step 9: Write a Business Plan

All of the above steps will ultimately be included in your Business Plan. And you will need to have this completed before you seek financing of your startup business. The Business Plan consists of several sections:

Executive summary. This will include a mission statement, outlining the focus of your business, a description of the products or services, ownership structure, and a summary of your plans.

Company description. This is a snapshot of your business. It includes its registered name, address of any physical location, names of key people in the business, history of the company, nature of the business and more details about your products or services.

Objective statement or business goals. This should clearly define your company’s goals—short- and long-term—and the strategy you will use to achieve them. If you are seeking financing, you will explain why you need funds, how the money will be used to expand your business, and how you will meet your growth goals.

Business and management structure. Here, you will define how your business is legally structured—such as a sole proprietorship, partnership or corporation — and list your key employees, managers or other owners of the business, as well as their ownership percentage.

Products and services. This section will include more detail on your products and services, such as, how your product or service works, your pricing model, the demographics of your customers, your strategy for selling and distributing, your competitive strengths and current and pending trademarks and patents.

Marketing and sales plan. Explain your marketing strategy and how you will execute it—for initial and repeat sales.

Business financial analysis. Here is where you’ll show all of your previous calculations—costs, revenues, profits. You’ll also need to include a balance sheet describing your assets and liabilities—personal and business—as well as a cash flow statement.

Financial projections. You’ll need to show how much money you expect to earn over the next few years, especially if you are seeking funding. Your creditors will need to know how and when they will be repaid.

Appendix. This is the place for any additional documents or information, such as resumes of key employees, licenses, equipment leases, permits, patents, receipts, bank statements, contracts, and personal and business credit history.

Step 10: Seek Financing

It’s great if you have the cash (or perhaps can borrow from your 401(k)) to self-fund your start-up. But many people don’t or can’t. Fortunately, there is funding assistance. And once you’ve completed the above calculations, deducting the capital you can provide, you’ll have come up with the amount of financing you will need to begin your entrepreneurial adventure. And your Business Plan will show potential lenders how you intend your business to operate, and to repay their funds.

Here are some financing options:

Venture capital from investors. In 2021, venture capitalists funded more than $621 billion in investments worldwide, reports cbinsights.com. But obtaining VC money is highly competitive.

Venture capitalists typically:

- Focus on high-growth companies

- Invest capital in return for equity, rather than debt (it’s not a loan)

- Take higher risks in exchange for potentially higher returns

- Have a longer investment horizon than traditional financing

So, if you do obtain VC financing, you’ll have to give up equity in your company, and they’ll most likely also require a seat on your Board of Directors.

These are the Top 100 VC firms according to Eqvista.

Crowdfunding. Crowdfunders aren’t what you would technically call investors. They don’t have ownership in your company. Instead, they expect to receive a gift, such as free products or services, in exchange for the money they give you. Crowdfunding is a popular financing option for creative purposes, such as a new high-tech product or a film.

These are the 6 Best Crowdfunding platforms, according to Investopedia.

A small business loan from your bank or credit union. Be aware that these are very difficult to obtain for start-ups, unless you have significant collateral.

An SBA-guaranteed loan. The SBA’s Lender Match program will match you with lenders who are willing to lend to small business startups: https://www.sba.gov/funding-programs/loans/lender-match

An SBA investment program. There are several:

Small Business Investment Company (SBIC). These are privately owned and managed investment funds licensed and regulated by SBA.

Small Business Innovation Research (SBIR) program. For businesses that are involved in federal research and development with commercial potential.

Small Business Technology Transfer (STTR) program. Also, for businesses that are involved in federal research and development with nonprofit research institutions.

Best Business Loans for February 2022 (According to bussinessheroes.com)

Buying a Franchise

There’s one more option to consider if you’re in the market to buy or start a business. And that’s purchasing a franchise. Franchise prices can range from $5,000 to more than a million dollars.

With a franchise, you’ll buy the rights to a company’s business logo, name, and model. Franchises are popping up in many industries, but are most common in the restaurant, hotel, and service-oriented businesses (like real estate and insurance companies).

There are two types of franchises:

Product/trade name franchising: You buy the right to use the franchisor’s name and trademark. In this case, the franchisor usually manufactures or supplies the product to the franchisee, who then sells it.

Business format franchising: This is a long-term arrangement between the franchisor and franchisee and involves adhering to the franchisor’s business management model, which may include, site selection, training, product supply, marketing plans, and sometimes, financing assistance.

There are pros and cons to buying a franchise.

Advantages

- Low failure rate. Statistics show that franchises have a much better chance of success than independent start-up businesses.

- Business assistance. When you buy a franchise, you receive all of the equipment, supplies, and instruction needed to start your business. In many cases, you receive ongoing training and help with management and marketing.

- Buying power. Your franchise will benefit from the collective buying power of the parent company.

- Star power. Many well-known franchises have national brand-name recognition.

- Profits. A franchise business can be immensely profitable.

Disadvantages

- Rules and guidelines. The main disadvantage of buying a franchise is that you must conform to the rules and guidelines of the franchisor.

- Ongoing costs. Besides the original franchise fee, a percentage of royalties from your franchise’s business revenue will need to be paid to the franchisor each month.

- Cost. Buying into a well-known franchise is costly. You can expect to pay over a million dollars for a McDonald’s franchise in some locations.

- Risk. Buying a little-known, perhaps inexpensive franchise can come with risks. Just because a business is offering franchises is no guarantee that the franchise will be successful.

In the end, it is up to you to decide which is right for you—buying or building a business. As you can see, there’s a lot of groundwork that needs to be completed before making your decision.

I’ve done both. I bought an existing franchise, which I eventually sold, and instead formed an independent company. I’ve had sole proprietorships, partnerships, S corps, and now my business is structured as an LLC. There’s no right or wrong way—it’s whatever works for you and your family. But I can attest that having your own business can be very rewarding—emotionally and financially.

I hope this will help you in making your decision. And I wish you much success!