Over the last three years, as measured by the S&P 500, equities have returned 20% annually, even factoring in the covid crash two years ago. Given those vaunted numbers, and Ukraine/Russia, inflation, and the ever-present fear of Fed rate hikes, there’s been a lot of volatility lately.

High returns and increased worry can turn investor sentiment south and makes a correction less of a possibility and more of an inevitability. I am not a prognosticator, my crystal ball is in the shop, but it does make sense to take steps to protect profits in these situations.

One popular strategy for adding inexpensive insurance to protect your profits is the protective collar; I’ll give you an example shortly.

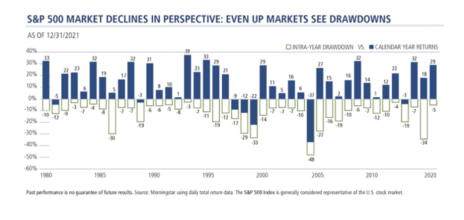

According to Calamos Investments, the chart below “shows the maximum intra-year equity market drawdowns since 1980.” From this, we can see how frequently at least one double-digit decline occurs within any given calendar year. In 21 of the last 41 calendar years—more than half of the time—the S&P 500 saw a double-digit pullback within the year.

Basically, drawdowns are a part of investing. They should be expected and the best time to prepare for them is before they occur, not afterwards.

Why?

Because options premium is significantly cheaper, which means portfolio protection, using a variety of different options strategies, is far more affordable.

Protecting Your Portfolio in a Volatile Market

Unfortunately, most investors don’t view hedging strategies as a way to manage all of the risk in their portfolios. Investors focus more on the cost of the insurance and how much it takes away from their potential return. But what we all need to understand is that unrealized profits aren’t really profits until they are, well, realized. Until then your portfolio balance exists as a risk to be managed, and not an earned reward. Again, as seen in the chart above, markets don’t move continually higher. Pullbacks occur. Manage accordingly.

I mean, come on, we buy insurance on our homes, cars, life and a host of other uncertainties, yet very few of us “buy” insurance on our hard-earned investments. It makes no sense.

Thankfully, as investors, we have the potential to use options to hedge our investments.

And there are numerous strategies we can use.

Almost every day, I’m asked, “How do I protect my profits using options?”

The question has been rolling in far more frequently of late, so I’m going to go over one of my favorite strategies, step-by-step, for protecting profits without giving up too much in the way of potential future returns.

I mean, it’s no surprise to me that protecting profits is a major concern for intelligent investors right now.

Most investors simply buy puts to protect returns. Unfortunately, that’s one of the worst choices right now due to the inflated levels of volatility. So, I want to discuss an options strategy that helps to mitigate volatility while protecting profits and still allowing for some potential upside.

Implementing a Protective Collar

The options strategy most professionals prefer is known as a collar.

The strategy’s goal is to preserve capital while simultaneously allowing a position to continue making profits, albeit limited.

Unfortunately, greed and oftentimes hope deter investors from using collars. Hedge funds and even large institutional managers frequently use collars, so why aren’t most individual investors?

A collar is an options strategy that requires an investor who already owns at least 100 shares of a stock to purchase an out-of-the-money put option and sell an out-of-the-money call option.

Think of it as a covered call coupled with a long put.

- Long Stock (at least 100 shares)

- Sell call option to finance the purchase of the protective put

- Buy put option to hedge downside risk

*Collar Option Strategy: long stock + out-of-the-money long put + out-of-the-money short call

I’m going to use Chevron (CVX) for my example. The energy stalwart has seen incredible gains over the past month and is one of the few major stocks to see a pop this year.

Let’s say we own 100 shares of CVX and would like to protect our return going forward. We still want to hold the stock and participate in further upside. But we also realize that the stock has had an incredible run and want some downside protection, specifically over the short to intermediate term.

At the time of writing, the stock is trading for 166.72.

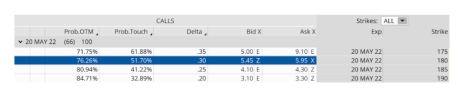

- With CVX currently trading for 166.72, we want to sell an out-of-the-money call as our first step in using a collar option strategy.

I typically look for a call that has roughly 30-90 days left until expiration. So, to keep things simple, I am going with the May options that are due to expire in 66 days.

I don’t want to sell calls that are too far out-of-the-money because I want to bring in a decent amount of premium to cover most, if not all, of the protective put I’m going to buy.

As a result, I try to sell a call with a delta somewhere around 0.30. The CVX May 180 call option with a delta of 0.30 fits the bill. We can sell the 180 call option in May for $5.60, or $560 per call. We can now use the $560 from the call sold to help finance the put contract needed to achieve our goal of protecting returns.

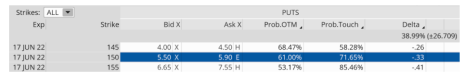

- The second and final step is to find an appropriate protective put to purchase. There are many different ways to approach this step, mostly centered around which expiration cycle to use. Should we go out 30 days in expiration? 60 days? 90 days? It really is up to you.

I’m going to go out to the June expiration cycle with 94 days left until expiration. I plan on buying the 150 puts for roughly $5.80, or $580 per put contract.

This means that almost the entire cost of the 150 puts will be covered by selling the May 180 calls.

Total Cost: June 150 puts ($580) – May 180 calls ($560) = $20 debit

And we can actually add to our return by selling more calls in June, while still maintaining protection.

So as it stands, our upside return is limited to 180 over the next 66 days. If CVX pushes above 180 per share at May expiration, our stock would be called away. Basically, you would lock in any capital gains up to the price of 180. With CVX currently trading for roughly 167, you would tack on an additional $13, or 7.8%, to your overall return.

But the key reason to use the strategy is not about making additional returns, it’s about protecting profits. And through using a collar option strategy, in this instance you are protected if CVX falls below 150 (where we purchased our put option). Essentially, you would only give up 10.2% of your overall returns and insure your position against a sharp pullback.

Not bad considering CVX has gained roughly 67% over the past six months with approximately 28% of the gains coming in the last 15 days.

Collars limit your risk at an incredibly low cost and allow you to participate in further, albeit limited, upside profit potential. I’m certain you won’t regret adding this easy yet effective options strategy to your investment tool belt.

Have you ever executed a protective collar options strategy before? If so, how did it go? Tell us about it in the comments below.