Today, we are profiling a micro-cap bank that is focused on serving an attractive niche, the litigation industry. It looks highly compelling:

- High insider ownership (insiders own ~12.5% of shares outstanding).

- Strong momentum (stock is near 52 week high).

- ~20%+ earnings growth for the foreseeable future.

- Low valuation: P/E ratio of 12x.

- ~60% upside to fair value.

All the details are inside this month’s Issue. Enjoy!

New Recommendation

Choose the Game Carefully

This weekend, my friend was over with his kid for a playdate with my 3-year-old, and we were shooting the breeze.

We laughed about Elon Musk’s Twitter poll.

In case you missed it, Musk posted the following poll:

My friend said, “Tesla (TSLA) has to be a short right? Its market cap is bigger than all the other auto manufacturers combined.”

My response, “You could have made a similar argument at any point over the past three years, and you would have lost a lot of money.”

I was raised as a value investor so Tesla’s valuation does appear a little crazy to me, but just because I don’t understand it doesn’t mean it’s wrong or unjustified.

The other recent news FinTwit (Finance Twitter) has been talking about is Peloton (PTON) and Zillow (Z), which have both tanked recently.

Cynically, value investors took the opportunity to dunk on both companies.

The debate raged as to whether both these companies were good shorts or due to bounce back.

While it’s tempting to wade in and trade these stocks, I usually have no problem resisting the urge.

Realistically, I have no edge with large-cap growth stocks like Tesla, Peloton and Zillow.

For me, trying to trade them would just be gambling.

I try to stick to the game in which I have an edge: micro-caps.

Historically, micro-caps have generated 17.5% compound annual returns, crushing their larger-cap competition.

Better yet, the cheapest micro-caps have generated even better annual returns: 28.2%.

In the U.S. alone there are over 5,000 different micro-cap stocks. There is virtually no analyst coverage. So, competition is not something you have to worry about.

The only downside is the stocks are small and illiquid so you have to be patient when you buy them or sell them.

But the “downside” is actually a structural advantage. Most micro-cap professional investors who are good will attract more assets and “graduate” out of the micro-cap arena, leaving less competition for us.

Without further ado, let’s discuss this month’s micro-cap idea: Esquire Financial Holdings (ESQ).

New Recommendation

Esquire Financial Holdings (ESQ): Niche Bank with Fast Growth and Cheap Valuation

Company: Esquire Financial Holdings

Ticker: ESQ

Price: 33.64

Market Cap: $257 million

Price Target: 52.50

Upside: 56%

Recommendation: Buy under 35

Recommendation Type: Rocket

Executive Summary

Esquire Financial Holdings (ESQ) is a niche bank focused on lawyers and the litigation industry. Due to its specialty and expertise, it has been able to grow very well. Lawyers are low credit risk, and consequently losses have been low. Despite strong growth, the stock trades at a very cheap valuation. Looking out a couple of years, Esquire should be trading significantly higher.

Company Overview

Background

Esquire is a small commercial bank dedicated to serving the financial needs of the legal and small business communities on a national basis. Esquire’s primary market is New York, but its innovative model will enable it to grow nationwide.

The company is headquartered in Jericho, New York (Long Island).

The bank was founded in 2006 to serve the legal community and their clients.

The company IPO’d in 2017 and has performed very well, outperforming both the S&P 500 Financials sector and the broader S&P 500 index.

Current Business

As noted above, Esquire’s focus is on serving the legal community.

What is the benefit of this?

First of all, I think niche banks (or any companies) will always do better than banks that try to be all be all things to all people.

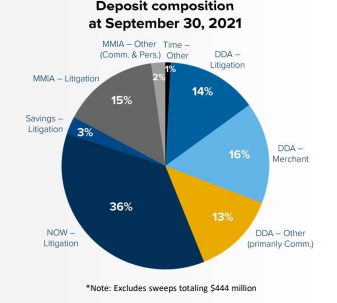

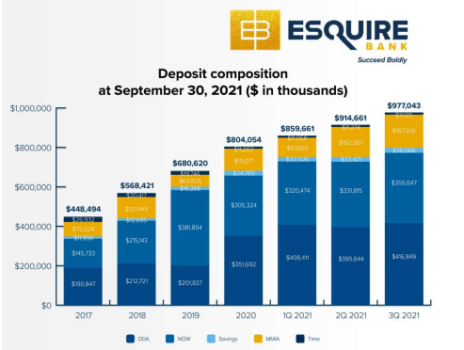

The second major benefit of banking the legal industry is it attracts low-cost deposits. The litigation community represented more than 68% of its deposit base.

Esquire gets deposits from 1) law firm-operating checking accounts when they extend credit and 2) capturing escrow deposits from law firms for funds and settlements that firms’ attorneys control.

These deposits are not rate-sensitive, as the attorneys place ease of use above the rate paid in choosing their banking relationships.

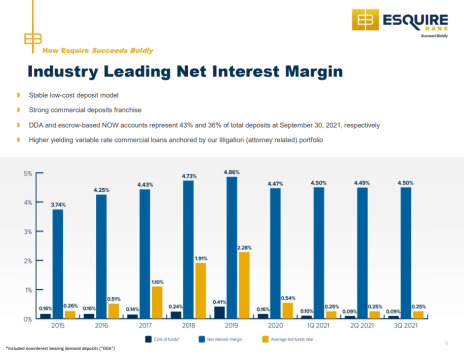

As a result of its low-cost deposit base, the bank can generate a high net interest margin (interest rate it receives minus interest rate it pays out) than most other banks.

Even better, the litigation market deposits tend to be sticky.

Since the company was founded relatively recently (2006), it has an innovative model as a primarily branchless model. It only has one brand, but serves customers with technology.

For example, in October 2020, Esquire launched a new suite of best digital tools including its customer-centric Customer Relationship Management application coupled with its digital marketing resources, newly designed and highly functional website, and new brand image to support future growth.

These digital technologies support seamless communication to Esquire’s customers, significantly enhance its digital marketing capabilities and streamline its online functionality and associated application processes.

I used to work at Citi Private Bank, and we had a successful Law Firm Group within the bank. I remember the Law Firm Group was an important and valuable niche for the bank, but I remember bankers and customers were always complaining about Citi’s antiquated technology solutions.

It seems to me that a recently built bank would have a huge advantage versus a legacy bank.

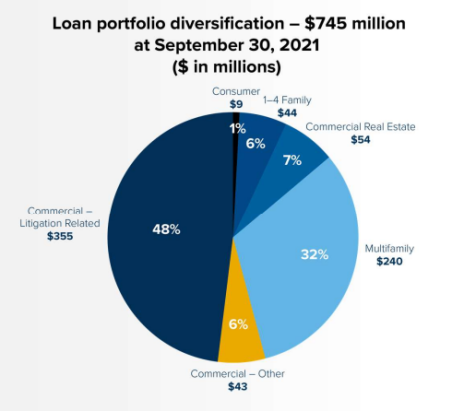

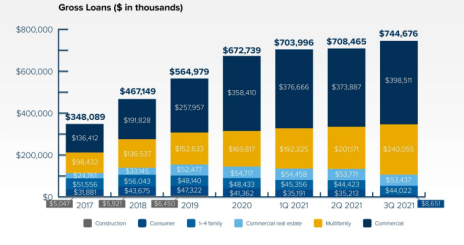

Forty-eight perfect of Esquire’s loan portfolio is in the litigation industry while the remaining balance is spread among commercial real estate, 1-4 family buildings, and multi-family buildings.

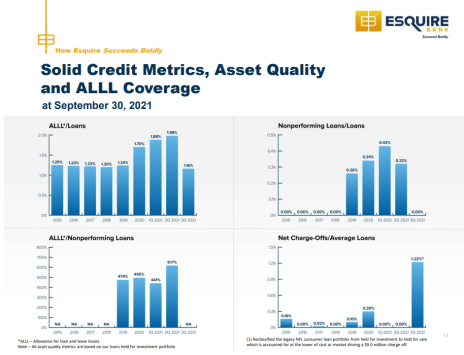

Esquire’s credit metrics are solid.

In addition to its lending activities, Esquire has grown its merchant services platform nicely over the years, which generates fee income (27% of total in 2020).

Business Outlook

Esquire has done a nice job growing deposits and loans since it went public.

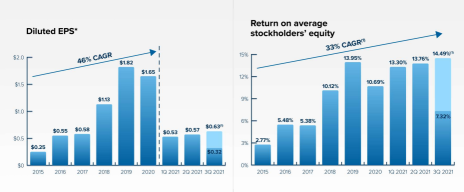

As a result, earnings have grown sharply over the years.

Historically the company has grown at ~20% per year. While the company is focused on the litigation niche, it happens to be a rather large niche with a total addressable market of $429BN.

I think that strong growth is poised to continue.

Insider Ownership

As Cabot Micro-Cap Insiders know, insider alignment is high on my check list.

Esquire checks the box as management and the board of directors own 12.5% of shares outstanding.

Valuation and Price Target

Esquire reminds me in many ways of SVB Financial Group (SVP), formerly known as Silicon Valley Bank. It services the venture capital and private equity industry and has grown rapidly and profitably by focusing on that niche.

As a result, the stock has performed extremely well and is currently trading at 23x forward earnings.

I expect Esquire to continue with its historical 20% growth rate and generate ~$3.50 of EPS in 2023. A 15x P/E multiple seems very reasonable given Esquire’s attractive strategy.

This works out to a 52.50 price target, implying significant upside over the next year.

My official rating is Buy under 35.00.

As is always the case with micro-caps, use limits as volume is quite low.

Risks

- Primarily focused on the New York area, which is losing its population to low tax jurisdictions like Florida.

- While this is certainly a headwind, New York is likely to remain a financial and litigation hot spot for the foreseeable future.

- Credit losses. As is the case with any bank, the biggest risk is bad loans.

- Historically, losses have been very low although the portfolio is relatively unseasoned. Nonetheless, I believe the litigation market is an attractive market which should be an attractive credit profile.

Updates, Watch List and Ratings

Recommendation Updates

Changes This Week

Downgrade Performant (PFMT) to Sell

Updates

Aptevo (APVO) has started to perk up. Aptevo’s poison pill expired recently, but unfortunately the company extended it for another year. This will prevent Tang Capital from buying any more shares. Tang has three options: 1) do nothing and wait, 2) sell his stock, 3) re-engage with management about a potential buyout. It will be interesting to see what he does. From a fundamental perspective, Aptevo remains undervalued. The market is currently valuing the stock as if its pipeline is worth negative value (currently -$15MM). This doesn’t make sense as Aptevo’s main drug, APVO436, has shown promising data and the company has a pipeline of other assets. This is a high-risk/reward trade because the upside could be substantial, but downside could also be substantial if it continues to burn cash with little to show for it. We will see preliminary phase II data later this year, which could be a nice catalyst. Original Write-up. Buy under 25.00

Atento S.A. (ATTO) recently disclosed that it suffered a brief cyberattack although it appears to be a minor incident which should not meaningfully impact revenue generation. I expect a strong quarter to be announced shortly. Atento last reported earnings in August. In the quarter, revenue increased 22% to $382MM, beating consensus by 4%. EBITDA increased 123% y/y to $50.7MM. EBITDA margin increased to 13.3%, up from 7.1% a year ago. Despite the strong performance, ATTO is still only trading at 3.9x my estimate for 2022 EBITDA. Peers such as Concentrix (CNXC) trade at 10x or higher. Original Write-up. Buy under 30.00

BBX Capital (BBXIA) disclosed in September in an 8-K that it is increasing its share buyback authorization from $10MM to $20MM. The first $10MM authorization was used to buy back $8.3MM worth of shares, while the additional $10MM authorization will enable the company to continue these buybacks. Further, the company announced that it recognized a $7.7MM cash distribution from a property that it had held at a $2.1MM valuation. This is good news and implies that book value per share ($17.53) may be understated. I recently moved up my price target to $12. Here’s how I’m thinking about my new valuation: The company has $7.44 per share of net cash/notes receivable on its balance sheet and I’m giving it 100% credit for that (given recent shareholder-friendly actions). I’m assuming the remaining business is worth 5x this year’s free cash flow. Note, a $12 target is still at a significant discount to book value per share ($17.53). Given strong performance, I’m increasing my buy under limit to 9.50. I would recommend trying to buy the stock around its 50-day moving average as that has historically been a timely entry point. Original Write-up. Buy under 9.50

Cipher Pharma (CPHRF) is a cheap, Canadian specialty pharma company that has a promising pipeline. Despite strong potential, the stock trades at a draconian valuation. Insider ownership is high, and insiders have been buying the stock in the open market. Further, the company is buying back its own shares in the open market. Downside protection is high given net cash on its balance sheet and strong free cash flow generation. My price target of 2.50 implies good upside over the next 12 months. Original Write-up. Buy under 2.00

Dorchester Minerals LP (DMLP) moved slightly lower this week as it passed its ex-date for its next distribution. The distribution of $0.50 will be paid out this Thursday, November 11. If we annualize the distribution, the stock is trading at a 10.3% dividend yield. I think the dividend will be increasing next quarter as energy prices continue to rise. Given higher energy prices, I recently increased my price target on DMLP to 25.00. The stock has run sharply, but I would recommend buying it around its 50-day moving average (currently ~17.50). Over time, I will increase my buy limit. Original Write-up. Buy under 17.50

Drive Shack (DS) recently pre-announced revenue of $75MM, which was slightly below consensus. We will get more details when the company reports earnings in November. Drive Shack also mentioned in its press release that it has successfully opened Puttery in The Colony, Texas, and initial reviews look pretty good. I continue to like the stock. At its current valuation, Drive Shack’s share price gives minimal value to the strong upside potential from new Puttery venues. Finally, alignment is high as management and directors own 16.3% of shares outstanding and have recently bought in the open market. My price target is 6.00. Original Write-up. Buy under 4.00

Epsilon Energy (EPSN) has will report earnings within the next couple of weeks, and I expect a strong quarter as natural gas prices have rallied. I recently spoke to the CEO of the company and learned more about Epsilon’s natural gas hedges. The company has two-thirds of its product hedged in the $3/Mcf range, but one-third has exposure to the spot market. From November ’21 to March ’22, 30% of production is hedged at ~$3.34/Mcf, but 70% of production is exposed to the soaring spot market. I see significant upside over the next 12 months as the company benefits from high natural gas prices. Original Write-up. Buy under 5.50

FlexShopper (FPAY) had no news this week. The stock saw strong insider buying in August in the 2.50 to 2.90 range following a strong earnings release. In the quarter, revenue grew 25% y/y to $30.7MM. Looking out to the rest of the year, strong growth should continue as the company is expanding its pilot program with an undisclosed national retailer and has added a second national retailer to its pilot program. My 12-month price target for FlexShopper is 4.70. Original Write-up. Buy under 2.50

IDT Corporation (IDT) recently reported a great quarter with strong growth across the board. Mobile Top-up revenue increased 41% y/y; this is the sixth consecutive quarter of 20%+ revenue growth. National Retail Solutions (NRS) revenue increased 76% y/y, with performance being driven by an increase in average revenue per user (ARPU) and terminal growth. Management expects continued upside in ARPU, driven by merchant services, advertising, and data. Net2phone subscription revenue increased 46% y/y, with 80%+ gross margin. Lastly, Traditional communications reported its third consecutive quarter of revenue growth and generated $29mm of EBITDA. Original Write-up. Buy under 45.00

Leatt (LEAT) Corporation was my recommendation last month and it has traded slightly up. There was no news this week. It is a South African company that designs and manufactures protective equipment for motor bike riders. Despite a revenue compound annual growth rate (CAGR) of 24% from 2017 to 2020, and an EPS CAGR of 165%, the stock trades at a forward P/E multiple of just 13.2x. Insiders own 45% of shares outstanding, and I expect strong growth ahead. My price target of 36 implies significant upside. Original Write-up. Buy under 27.00

Liberated Syndication (LSYN) recently announced that it hired a new full-time CEO to add to its recently hired CFO. This is a positive as the company had been operating without a CFO or CEO. However, I do have strong confidence in President Laurie Sims, who has been leading the business. I’m hopeful that financials will be re-stated by the end of the year or, at worst case, in January. At that point, I think the financials will reveal a fast-growing podcast company trading at a cheap valuation. Original Write-up. Buy under 5.00

Medexus Pharma (MEDXF) had positive news this week as the company announced that it has scheduled a Type A meeting with the FDA to review its plans to address the FDA’s concerns regarding Treosulfan. Recently management has also reiterated that it has enough liquidity to get to the Treosulfan approval date (targeting middle to end of next year). The way that I’m thinking about it is Medexus should be a $10+ stock if Treosulfan is approved. I think there is at least a 50% chance it is approved next year. In the case that it is not approved, I don’t think there is much downside to the stock as the base business (as long as IXINITY reverts to growth) easily supports the current valuation. As such, I’m upgrading the stock to Buy under 3.50. Original Write-up. Buy under 3.50

P10 Holdings (PX) recently priced its IPO/up-listing. The stock was priced at 12, below the original 14 to 16 range. Existing shareholders saw their PIOE shares exchanged for PX shares (the new symbol). As part of the IPO (which really should be viewed as a secondary offering), the company raised ~$240MM to de-lever and strengthen its balance sheet for additional acquisition opportunities. In addition, certain shareholders are selling ~10MM shares. The pricing of the IPO was disappointing, but I think the stock looks very attractive at its current valuation (14.3x EBITDA). The shares in my account are still not tradable (not that I have any intention of selling), but Schwab has assured me that the shares will appear in my account under the new symbol (PX) soon. Hamilton Lane (HLNE), a close peer, trades at 28.1x. As such, I think P10 has substantial upside ahead. Original Write-up. Buy under 15.00

Performant Financial (PFMT) reported a disappointing quarter with ~14% revenue growth in its health care business, a deceleration from last quarter. Management took down guidance again for healthcare revenue to $77.5MM for the year. Management cited lower healthcare utilization which is negatively impacting Performant’s business. This explanation doesn’t totally make sense because the company was able to grow healthcare revenue significantly during the depths of COVID last year. On top of that, the stock has dropped below its 200 day moving average and has lost momentum. As such, I’m going to move the stock to SELL and wait for the business to re-accelerate before recommending it again. It will remain on my watch list. Original Write-up. SELL

Watch List

American Outdoor Brands (AOUT) remains on my watch list. It is a recent spin-off that sells outdoor apparel and hunting paraphernalia. The stock looks cheap trading at 9.8x forward earnings yet growing revenue 20% in the previous quarter. The low valuation is due to investor concern that the company benefitted from pandemic tailwinds which mute this year’s growth outlook. Nonetheless, I think the stock looks interesting and there has been recent insider buying. I’m going to continue to closely follow this stock.

BNCCORP (BNCC) is a small bank that is headquartered in North Dakota. It just announced that it is paying out a $6 per share special dividend, its second special dividend of 2021. Even better, the company says that it will continue to return excess cash to shareholders going forward. Adjusting for the dividend, the stock is trading at a P/E of ~7x. It looks pretty attractive, especially in a rising interest rate environment.

Nanophase Technologies (NANX) is a fast-growing (~50%) skin care company that is trading at a reasonable valuation (30x 2022 EPS).

Recommendation RATINGS

| Stock | Price Bought | Date Bought | Price 11/9/21 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 14.10 | -56% | Buy under 25.00 |

| Atento SA (ATTO) | 21.57 | 8/24/21 | 28.00 | 30% | Buy under 30.00 |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 9.90 | 212% | Buy under 9.00 |

| Cipher Pharma (CPHRF) | 1.80 | 9/8/21 | 2.15 | 19% | Buy under 2.50 |

| Dorchester Minerals LP (DMLP)* | 10.45 | 10/14/20 | 19.52 | 100% | Buy under 17.50 |

| Drive Shack (DS) | 2.61 | 5/12/21 | 2.54 | -3% | Buy under 4.00 |

| Epsilon Energy (EPSN) | 5.00 | 8/11/21 | 5.74 | 15% | Buy under 5.50 |

| Esquire Financial Holdings (ESQ) | New | — | 33.50 | — | Buy under 35 |

| FlexShopper (FPAY) | 2.13 | 12/9/20 | 2.72 | 28% | Buy under 2.50 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 59.24 | 206% | Buy under 45.00 |

| Leatt Corporation (LEAT) | 24.00 | 10/13/21 | 23.84 | -1% | Buy under 27.00 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 2.02 | -34% | Buy under 5.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 2.64 | 48% | Buy under 3.50 |

| P10 Holdings (PX)** | 1.98 | 4/28/20 | 12.57 | 535% | Buy under 10.00 |

| Performant Financial (PFMT) | 4.66 | 7/14/21 | 3.28 | -30% | Sell |

| Stabilis Solutions (SLNG) | — | — | — | — | Sold |

* Return calculation includes dividends

**Original Price adjusted for reverse split.

Glossary

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, HPTO, PIOE, MEDXF, LSYN, IDT, FPAY, DMLP, PFMT, DS, and SLNG. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on December 8, 2021.