Today, we are making a “jockey bet”. In other words, we are betting primarily on the management team. The management team that we are betting on is responsible for some incredibly value creation in public markets (hint: it’s the same management team as P10 Holdings (PX), a stock that is up over 300% since or original recommendation in 2020).

Other key points:

- Trades at a cheap valuation.

- Paid a special dividend worth over twice its current stock price last year.

- High insider ownership.

All the details are inside this month’s Issue. Enjoy!

New Recommendation

Circle of Competence

As you know, my primary areas of focus are micro-caps and special situations (stock spin-offs are the most common special situation). Predictably, my favorite situation/set-up is micro-cap spin-offs (think BBX Capital!).

I believe it’s best to focus on a niche in order to generate attractive returns.

When you focus on the same niche for many years you begin to recognize certain patterns and trading set-ups that you can profitably exploit.

Once in a while, I’m tempted to weigh in on a stock that everyone is talking about, whether it’s Tesla (TSLA), Amazon (AMZN) or Peloton (PTON).

Generally, if everyone is talking about a stock, it’s going to be a large-cap stock.

Recently, it’s been Meta Platforms (FB), formerly known as Facebook. About a month ago, I was tempted to buy the stock. I use Instagram a ton and buy many of the products that are advertised to me. I find tremendous value in it (the Peter Lynch approach!).

Meanwhile the company was growing revenue ~30% per year yet trading at a P/E of 23x. Seemed pretty compelling and I was tempted to make it a sizeable position.

We all know what happened. Facebook reported earnings and cited growth deceleration due to Apple’s IDFA changes and a step up in spending to fund Facebook’s metaverse bet.

And the stock got crushed.

Even now, I’m tempted to buy it as I believe the sell-off is an overreaction. But I’m going to pass on the stock and stick to my niche.

There are many investors who can beat the market with large-cap stocks, but that it is not me.

I’m content to stay within my circle of competence and wait for a fat pitch.

Speaking of which, let’s discuss my latest idea Crossroad Systems (CRSS).

New Recommendation

Crossroad Systems: A Jockey Bet with Significant Long-Term Upside

Company: Crossroad Systems

Ticker: CRSS

Price: 13.66

Market Cap: $82 million

Price Target: 21.00

Upside: 54%

Recommendation: Buy under 16.00

Recommendation Type: Rocket

Executive Summary

Crossroad Systems (CRSS) is a “jockey bet.” In other words, we are betting on the management team and board of directors to create significant value going forward. The investors that control Crossroad Systems are the same investors that control P10 Holdings (PX), a Cabot Micro-Cap Insider recommendation that is up 323% since I originally recommended it. I think a similar situation could play out with Crossroad Systems as the stock is cheap, trading slightly above book value, yet has significant option value that is being heavily discounted by the market.

Company Overview

Background

Robert Alpert and Clark Webb at 210 Capital are successful financiers who have created a ton of value in the public markets.

Their specialty is acquiring shell companies with NOLs and then creating value through acquisitions and other business opportunities.

Cabot Micro-Cap Insider’s biggest winner (so far!) is P10 Holdings (PX), another entity that was controlled by Robert Alpert and Clark Webb.

Alpert and Webb took control of Crossroad Systems in 2017, when it was essentially a cash/NOL shell ($132MM of NOLs). It had previously been an intellectual property licensed company based in Austin, Texas.

Soon after reincorporation, Crossroads acquired Capital Plus Financial, LLC in December 2017 (CPF). CPF is a Texas-based community development financial organization (CDFI) originally formed in 1992 to provide mortgage financing in Texas. Crossroads paid $30.8mm and 2,955,028 of newly issued stock for the acquisition. CPF’s stated goal is to provide homeownership for the Hispanic community.

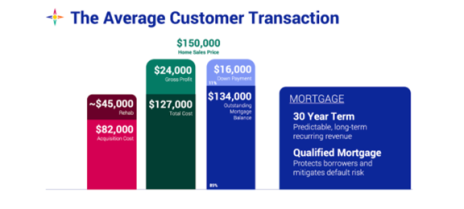

CPF purchases outdated and unkempt homes, rehabs them, and sells them to the Hispanic community. CPF targets homes in the $100,000 - $175,000 post-rehab range. The chart below further illustrates this. CPF also provides mortgage services to this community.

Source: Crossroads Investor Presentation

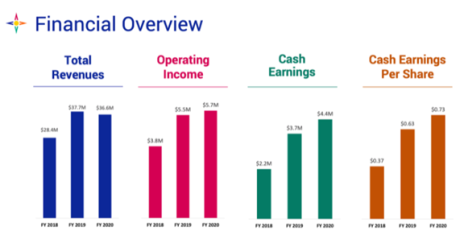

The business performed well and was growing nicely even during the pandemic.

Source: Crossroads Investor Presentation

Until 2021, this was Crossroads’ entire business. The stock traded at $9 around its adjusted book value.

But everything changed in 2021.

Crossroads partnered with a technology firm (Blueacorn) to distribute PPP funds.

Critics of the initial PPP round claimed many of the loans were going to businesses and wealthy owners that did not need them. Therefore, the government turned to trusted CDFIs like CPF to get money in the hands of those who truly needed it.

Eric Donnelly is the CEO of Crossroads and has served as the CEO of CPF since 2014. Under his tutelage, CPF has grown into one of the largest CDFIs in the country. Donnelly is a member of the Hispanic community which helps him promote the company’s stated mission of advancing Hispanic homeownership.

The company was the second largest PPP lender in 2021 and placed $7 billion of loans in just a few months.

In FY2020, Crossroads generated $3mm in net income. In FY 2021, it earned $194mm in net income due to the PPP program.

What a windfall.

As the company quickly became significantly overcapitalized, it paid out a $40 per share dividend to shareholders and retained $20 per share of “liquidity” to help grow its business.

Crossroads issued a $40 special dividend to shareholders because of this windfall.

Business Outlook

Before 2021, Crossroads was a pure CDFI play as CPF was its only asset. However, the outlook of the company is certainly changing with recent developments.

Crossroads made one recent acquisition (Rise Line Business Credit in September ‘21) and they have another lending acquisition pending approval (Fountainhead). As a flexible holdco, these and other future acquisitions can be considered “call options’’ for shareholders. Management’s flexibility can allow them to quickly take advantage of opportunities such as the issuance of PPP loans during the pandemic.

Crossroads’ stated goal of the Rise Line Business Credit (RLBC) acquisition is to provide better accessibility to banking for small businesses. RLBC is a nationwide asset-based lending firm based in NYC. Crossroads paid $10mm to acquire RLBC. Per RLBC’s website, the company makes loans in the $2mm - $15mm range.

Though the terms are unknown, the proposed acquisition of Fountainhead could be beneficial to the company. Fountainhead is a founder-led, national lender specializing in lending to small and mid-size businesses.

Fountainhead’s team has been involved in financing over $24 billion in total projects across all 50 states. Like CPF, Fountainhead was actively funding PPP loans to the tune of more than $4.7bn over the last two years.

Additionally, Crossroads has entered into an advisory agreement with Enhanced Capital Group. Crossroads expects this agreement to expand CPF’s credit assets and to inject over $250mm in emerging communities over the next 12 to 18 months.

With the recent and future acquisitions Crossroads appears to be building a portfolio of lending companies. Crossroads’ shareholders will benefit from the operational synergies and improvements of the acquired companies.

Insider Ownership

As seasoned Cabot Micro-Cap Insider subscribers know, insider ownership is high on my check list and is critical when investing in micro-caps.

In this case, insiders own ~53% of shares outstanding. Even better, we know that Robert Alpert and Clark Webb, who essentially control the company, are excellent capital allocators and operators.

Valuation and Price Target

I don’t know exactly what Crossroads is worth, but I think it’s worth a lot more than where it’s currently trading.

Prior to its massive PPP windfall, Crossroads traded at $9 (at the time adjusted book value was $9.04).

Currently, Crossroads’ adjusted book value is $12.70. The stock trades a few dollars above this level, but I view adjusted book value as a good downside scenario.

It’s important to note that adjusted book value has grown over time.

It was $8.54 per share in 2019 and currently stands at $12.70 (despite the company paying out a $40 per share dividend in 2021!).

This is clearly a company and management team/board of directors that creates value.

So $12.70 (adjusted book value) is our downside case.

What’s the upside scenario?

Well, in 2021 the company pivoted to serving the PPP market and generated $36.19 of cash EPS! It then paid out a $40 special dividend.

Is another massive opportunity around the corner? While it probably won’t materialize tomorrow, we do know that this management team is always on the lookout for creative ways to generate shareholder value.

As such, I’m confident that shareholder returns will look attractive going forward. I could see this as a stock that generates ~25%+ annual returns going forward for a very long time.

The timing of the next catalyst is unclear, but I think this is a stock that you could “tuck away” for years and do quite well.

My official rating is Buy under 16.00.

As is always the case with micro-caps, use limits as volume is quite low.

Risks

- Illiquidity. While all my recommendations are illiquid, this stock is particularly so because 1) its market cap is under $100MM and 2) insiders own over 50% of shares outstanding so the float is very low.

- Texas Market. Crossroads Systems is focused on the Texas market. While Texas is a great area of the country given favorable climate, low regulation and a booming energy industry, it does present a geographic concentration risk.

Updates, Watch List and Ratings

Recommendation Updates

Changes This Week

Sell FlexShopper (FPAY)

Updates

Aptevo (APVO) recently revealed that its chairman of the board announced he is retiring. He was the founder of the company Emergent BioSolutions (parent company of Aptevo). I don’t think his retirement announcement signals anything about Aptevo’s valuation and fundamentals. Aptevo is suffering along with the rest of biotech as we are in a biotech bear market. Nonetheless, I continue to believe the stock looks compelling given positive recent APVO436 data. Where do we go from here? I don’t know, but I know there are many positive catalysts on the horizon. Aptevo will report additional data from its ongoing trials and any positive news will move the stock upwards. Buy under 15.00

Atento S.A. (ATTO) had no news this week. The company will report earnings at the end of March. The most important news of late is that Kyma Capital now owns 5% of the company and is engaging with the management team to unlock value. This is a strong positive, given healthy fundamentals and an incredibly cheap valuation. 2022 could be the year that Atento gets sold. Buy under 30.00

BBX Capital (BBXIA) recently announced yet another share repurchase authorization, this time for an additional $15MM. I’m looking forward to BBX reporting its annual results so that I can add up all the shares that have been repurchased since the initial spin-off. Well over 20% of shares outstanding have been retired. While BBX has performed very well since our initial recommendation, it remains a high-conviction idea, given 1) positive fundamentals (real estate in Florida is hot) and 2) a very cheap valuation (the stock is still trading at a 50% discount to book value). Buy under 11.00

Cipher Pharma (CPHRF) has stabilized after selling off in November and December. The stock is currently dirt cheap, has no debt, and significant optionality. Finally, insiders own a significant portfolio of shares outstanding and are incentivized to maximize value. The company is buying back shares aggressively. Buy under 2.00

Dorchester Minerals LP (DMLP) announced that it will pay out a distribution of $0.639 per unit on February 10, 2022. On an annualized basis, Dorchester is yielding 10.6%. The stock continues to look attractive. I’m optimistic that the current COVID wave caused by the Omicron variant will be the last and we will see strong economic activity in 2022 that drives energy prices higher. Buy under 24.00

Epsilon Energy (EPSN) had no news but is benefitting from surging natural gas prices. The company reported a strong quarter in November, generating $3.3MM of free cash flow. Given no debt and a large and growing cash balance, I expect the management team to announce a large special dividend or accelerated share repurchase within the next few quarters. Buy under 5.50

Esquire Financial Holdings (ESQ) reported a great quarter in January. The company generated $2.26 of EPS, up 37% from last year. Asset quality remains high as the company’s allowance for bad loans is just 1.7% of total loans. Esquire dominates its niche, the liquidation industry. Due to its specialty and expertise, it has been able to grow very well, and I expect that growth to continue. Importantly, the company’s investment in digital marketing and sales is paying off as digital accounted for half of commercial loan originations in 2021. This expertise will enable Esquire to growth beyond its current New York and New Jersey focus. Despite strong historical growth (~20% per year), the stock trades at ~12x forward earnings. Looking out a couple of years, Esquire should be trading significantly higher. Buy under 35.00

FlexShopper (FPAY) stock continues to perform poorly. The business is performing well, and management continues to gobble up shares. However, the stock is not working and is now below its 200-day moving average. I still like the stock, but am going to recommend selling it to make room for my new idea (Crossroad Systems). SELL

IDT Corporation (IDT) started to stabilize this week although it is down considerably from its all-time high. What drove the sell-off? It’s hard to say with certainty, but I think it’s been a combination of three factors: 1) the sell-off in high-growth companies that are valuation comps to NRS and net2phone, 2) a sell-off in the small- and micro-cap markets and, 3) investors thinking that a spin-off may be delayed given the rocky environment for growth stocks. Nonetheless, I’m maintaining my position in the stock. I updated my sum-of-the-parts with lower multiples (to reflect lower multiples for growth stocks) and got an updated fair value of $55 per share. Buy under 45.00

Leatt Corporation (LEAT) has also sold off sharply. Why the sell-off? There is really nothing that I can think of. The stock has done incredibly well over the past couple of years, but it’s been driven by strong fundamentals. For example, the stock grew revenue 94% in the most recent quarter despite headwinds from supply chain bottlenecks. Yes, Covid has benefitted Leatt and other providers of motocross gear, but even before Covid, Leatt revenue was growing at a high-teens clip. At its current price, the stock is trading at price to annualized earnings multiple of 7.9. This is just too cheap. Buy under 40.00

Liberated Syndication (LSYN) had no news this week. It filed an 8-K in early January announcing that it had canceled 7.5MM shares (22% of shares outstanding!) that had been fraudulently issued to Zhang Parties prior to LSYN’s spin-off. This is a major positive. Zhang Parties have 90 days to challenge the cancellation. Given that Zhang Parties didn’t respond to the initial lawsuit that resulted in the cancellation of shares, it’s possible that there will be no challenge. While I do have some questions regarding LSYN’s business trajectory, I think it remains quite attractive at its current valuation. I estimate that it’s trading at 3.0x (EV/revenue) with high-teens revenue growth. Buy under 5.00

Medexus Pharma (MEDXF) continues to look completely washed out. Given a recent positive meeting with the FDA, it looks like Treo will be up for approval in the second half of this year. If approval is gained (I estimate 50% probability), I believe the stock is worth $10+. As such, I think the risk/reward looks very favorable at current levels. Buy under 3.50

NexPoint Diversified REIT (NXDT) has performed well over the past month. It is a closed end fund that is transitioning into a real estate investment trust (REIT). It trades at a 40% discount to NAV and is significantly below where it traded pre-pandemic. Once the transition to a REIT is complete, it will be eligible for many more investors to own including funds and ETFs. This will likely drive indiscriminate buying pressure. The CEO owns 14% of the company and has been buying the stock in the open market relentlessly. A near-term re-rate to NAV could drive 50%+ upside, but longer term, a bigger opportunity could materialize as the REIT is repositioned to capture value. Buy under 15.00

P10 Holdings (PX) had no news this week. It reported a great quarter in November. Adjusted EBITDA increased 147% to $21.8MM. Adjusted EPS increased 66% to $0.15. Meanwhile, three brokers (JPMorgan, KBW, and UBS) all initiated coverage with Buy ratings. The investment case remains on track as fundamentals are strong, yet the stock remains cheap on a relative and absolute basis. Buy under 15.00

Truxton (TRUX) reported a great quarter in January. It announced a $1 per share special dividend and $5MM share repurchase authorization. For the full year, EPS increased 29% to $5.02. Meanwhile, the stock trades at just 14.3x earnings. Loan quality remains excellent as the company wrote off just $2k in loan losses. Allowance for loan losses remains very low (0.9% of all loans). I expect strong performance to continue in the future and anticipate significant upside in the years ahead. Buy under 75.00

Watch List

BNCCORP (BNCC) is a cheap bank that is returning all excess cash to shareholders via special dividends. Last year, it paid out $14/share in special dividends (32% of the current share price). It looks like an attractive low-risk idea. The stock has faded a bit. In 2022, it should generate EPS of $5 and will likely dividend it all out to shareholders.

Currency Exchange International Corp (CURN) is a new name on my watch list. It is a Canadian company with a legacy business and a hidden high growth software business. Downside appears limited given cash on its balance sheet but upside is considerable given impressive software growth.

Orbit International Corp (ORBT) is a micro-cap that designs hardware and software for government procurement agencies. It has high insider ownership and is controlled by a Warren Buffett disciple. It just announced an accretive acquisition that should create significant value.

Recommendation RATINGS

| Stock | Price Bought | Date Bought | Price on 2/8/22 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 6.05 | -81% | Buy under 15.00 |

| Atento SA (ATTO) | 21.57 | 8/24/21 | 23.75 | 30% | Buy under 30.00 |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 12.00 | 279% | Buy under 11.00 |

| Cipher Pharma (CPHRF) | 1.80 | 9/8/21 | 1.50 | -17% | Buy under 2.00 |

| Dorchester Minerals LP (DMLP)* | 10.45 | 10/14/20 | 22.98 | 144% | Buy under 24.00 |

| Epsilon Energy (EPSN) | 5.00 | 8/11/21 | 5.56 | 11% | Buy under 5.50 |

| Esquire Financial Holdings (ESQ) | 34.10 | 11/10/21 | 36.61 | 7% | Buy under 35.00 |

| FlexShopper (FPAY) | 2.13 | 12/9/20 | 1.60 | -25% | SELL |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 40.94 | 111% | Buy under 45.00 |

| Leatt Corporation (LEAT) | 24.00 | 10/13/21 | 26.00 | 8% | Buy under 40.00 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.60 | 18% | Buy under 5.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 2.54 | 43% | Buy under 3.50 |

| NexPoint Diversified Real Estate Trust (NXDT) | 14.15 | 1/12/22 | 15.00 | 6% | Buy under 15.00 |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 12.55 | 321% | Buy under 15.00 |

| Truxton Corp (TRUX) | 69.50 | 12/8/21 | 72.25 | 4% | Buy under 75.00 |

Buy means accumulate shares at or around the current price.*Adjusted for reverse split

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, PX, MEDXF, LSYN, IDT, FPAY, DMLP, LEAT, and NXDT. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on March 9, 2022.