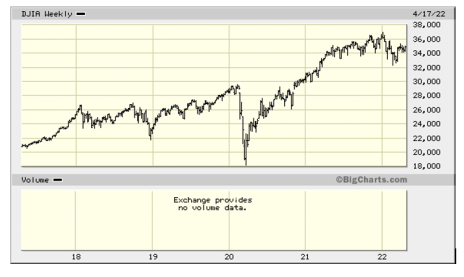

Since the market bottom on March 6, 2009—when the Dow Jones Industrial Average sunk to 6,469.95—investors have lined their pockets with lots of coin. Sure, COVID sent the markets reeling—down to 19,173.98 on the Dow in March 2020—but since then, boy, have we recovered! Despite recent volatility—due to rising interest rates and inflation, as well as the war in Ukraine—the Dow is getting close to breaking records again, closing at 35,116.35, as I write this.

And while I love a bull market, I’m really excited that retail investors—that’s you and me—are coming back to investing in force. From 2010-2020, BNY Mellon reports that retail investors owned just 10-15% of the overall stock market cap. That rose to 20% in 2020, then fell, and now, is close to 25%. As you can surmise, the other three quarters of the market is held by institutional investors—mutual funds, hedge funds, ETFs, pension funds, insurance companies and banks.

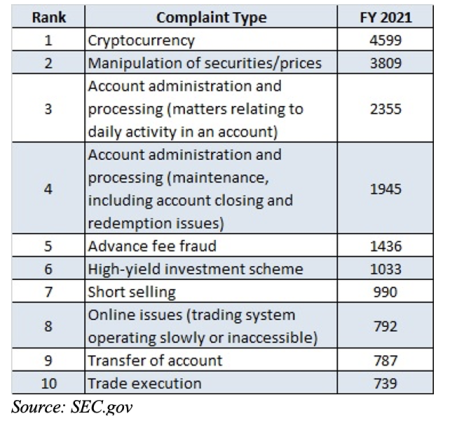

But what’s even more amazing to me is that with 3,435 investment firms, 617,549 registered representatives, and around 395 million shares traded daily in the United States, the Securities and Exchange Commission (SEC) only filed 697 new enforcement actions in 2021—up 7% from the year before. But as you can see in the chart of the Top 10 complaints below, there were a whole lot more complaints received than actions filed.

Top 10 Complaints to the SEC in 2021

So, what happened to all those complaints? Some are immediately dismissed, some are withdrawn by the plaintiff and others make their way through the system at a snail’s pace.

You should know that you can also file a complaint with the Financial Industry Regulatory Authority (FINRA). For 2021, FINRA opened 484 new cases, closed 631, and has 4,998 outstanding. But you should also be aware that according to FINRA, only 32% of cases so far this year have resulted in an award to the customer.

While the stock market helps millions of investors live a more prosperous life, it is also, unfortunately, peppered with unscrupulous brokers and investment advisors who do not have their customers’ best interests at heart. In the old days, most complaints centered around churning, front-running, and hyping securities, but the much-lauded technology advances we enjoy today have also created many new avenues for fraud and scams.

Javelin Strategy & Research reports that in 2016, $16 billion was lost worldwide to various types of fraud, scams and identity theft, a 16% increase over 2015. Fast forward to 2020, when almost $20 billion was lost to phone scams in the U.S only, double the previous year.

Scams are not new. The first recorded one was the Dutch tulip bulb mania of the 1600s, when tulip prices were hyped to 100,000 florins for 40 bulbs—at a time when 2,050 pounds of butter was selling for 100 florins! The late 90s was a frenzied marketplace of legitimate and fraudulent tech startups. And today, cryptocurrency has its own set of scammers.

Today, I’d like to dig a bit deeper and give you a bird’s eye view of the most popular fraud vehicles and scams, so that you can be armed and ready to avoid them!

Churning

Churning is when your broker generates commissions by illegally and unethically trading your assets. In other words, he’s just buying and selling for the purpose of raking in the dough—with no thought as to whether or not he’s actually making money for you.

I’ve heard lots of horror stories about churning. When we hear churning, we think about individual stocks, but you should know that it can also happen with funds and ETFs.

In 2020, FINRA filed 190 arbitration actions against brokers accused of churning. Many of these complaints are for minimal amounts, but some are huge. Last January, FINRA filed one complaint to return $1.6 million in commissions from one broker—William Nicholas Athas—who allegedly churned and excessively traded nine accounts belonging to seven customers at two New York firms, K.C. Ward Financial and Worden Capital Management. And this past November, FINRA sanctioned Aegis Capital for a sum of $2.8M for the excessive and unsuitable trading in dozens of customers’ accounts.

Consequently, it’s imperative that you review your brokerage statements, and watch for unusual increases in transactions, especially if your portfolio is not gaining commensurately.

And, of course, you can always look for a broker/advisor who works for a flat fee instead of commissions.

Unsuitable Investments

Like churning, sometimes brokers and investment managers buy “unsuitable investments” for their clients. These are investments “made in a manner that is not consistent with the client’s circumstances or investment objectives.”

Your broker has a fiduciary duty to know your financial needs (and constraints) and to make suitable investment recommendations accordingly. It is up to your advisor to ascertain your:

- Financial state

- Reasons for investing

- Investment goals

- Risk tolerance

- Investment experience

- Tax considerations

- Age and investment horizon

A reputable advisor will discuss all of these considerations with you.

But, just like churning, it is ultimately up to you to keep a close watch on how your advisor is handling your account, to make sure that he or she is not committing unethical practices. Taking actions like buying tax-free bonds with IRA money (which is already protected from income tax), putting clients with low risk tolerances into high-risk investments, such as option or margin trading, buying an inappropriate amount of a stock or security (overconcentrating), or making illiquid investments that don’t allow easy access to funds (such as private or closely held investments) are all red flags. That type of activity is good evidence that your advisor is inappropriately managing your account, whether intentionally (ethics) or not (competence).

Hidden Referral Fees

In the business world, we all love referrals. In my real estate business, we often receive referrals from out-of-area agents looking for someone to assist their clients in real estate transaction in our region. The use of referrals is regulated by the real estate commission, and a fee—agreed upon between both parties—is paid.

It’s very similar in the investment industry. Many investment advisors receive client referrals, for a fee. They are heavily regulated by the SEC Rule 206(4)-3, which “places relatively stringent regulatory requirements on solicitor relationships, from the disclosures that must be provided to potential clients, and the fact that solicitors themselves often must become ‘registered persons’ as well.”

However, investment advisors may also receive paid referrals from in-house employees. Take, for example, your local bank. Many years ago, when I was a banker, banks transformed from strictly service to selling institutions. That meant—even at the local branch level—your customer service rep earns commissions based on how many customers and accounts she refers to the bank’s trust and investment departments.

There’s nothing inherently wrong with that. It’s the way the business world operates. But know that you are paying for those referral fees, unintentionally, in your fees to your investment manager. And, even more importantly, it’s crucial to make sure you are being referred to an ethical and experienced investment pro—and not just someone who is willing to pay the person who referred you a hefty fee.

Hidden Expense Fees

Many investors are enthralled with “no-fee” mutual funds or so-called “commission-less” trading. And most times, they are great. But you must look under the hood because there are many expenses, such as extra money, gifts, and incentives that funds pay to promote their investments—money that doesn’t show up as a “load” or “commission,” but is included in your management fees or expense ratios. Those expenses may be hidden up front, but ultimately will reduce any gains that your investments have made.

Promoting/Hyping Investment Firm Underwriting Clients

One of the outcomes from the 1929 stock market crash was the Glass-Steagall Act of 1933, which created the Chinese Wall—the “supposed” separation between a brokerage company’s research and its investment banking divisions.

Until then, brokerage firms were in their heyday, underwriting and issuing stock for companies, and their research departments hyped it to their retail customers, always with glowing recommendations—whether or not they merited it. You see, the goal was to sell the stock and make their investment clients and themselves—not their retail customers—rich.

The Glass-Steagall Act and the Chinese Wall were supposed to end that wholesale bias of research “ratings,” preventing the investment bankers from interacting with the research analysts. But in reality, that never really happened.

In most brokerage firms, the majority of the research reports are still written on behalf of the firm’s investment banking clients. And even in the boutique brokerage firm for which I plied my trade in the 90s, it was routine for a research analyst to be “not-so-gently persuaded” to write up a positive report on one of the firm’s investment banking clients.

Because the system makes it difficult for complete objectivity, investors need to be ultra-vigilant when it comes to digesting analyst reports.

Pump and Dump

“Pump and dump” is another form of manipulation—plied by folks who own stock but want to make a killing by hyping (pumping) it to unwitting investors, and then selling it at inflated prices (dumping).

The hype is comprised of false, misleading, or greatly exaggerated statements. Most such scams are for little-known companies and are often perpetrated by company outsiders, like boiler-room-type brokerage firms. This basic room devoted to high-pressure telephone sales was depicted very well in two films: The Wolf of Wall Street and Boiler Room. These are the folks that call you at dinner time with an “act now or you’ll lose out” high-flying investment. Best to ignore those calls.

Over my career, I’ve been approached several times—as an analyst—to make some quick money by hyping up a company in one of my newsletters. No dice. I’ve always been independent, and so are all the folks at Cabot. We earn our money from our subscriptions—period.

But there are plenty of newsletters and so-called experts who are glad to take the dirty money. So, buyer beware when it comes to investment information—especially all that free stuff going around the internet.

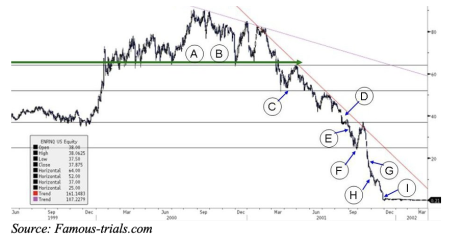

But pump and dump by insiders can also take place. You will, no doubt, recall the Enron scandal in 2001. That was probably the most elaborate pump and dump scheme in history.

Pump and dump was just one of Enron’s problems, but the scheme was conducted in full agreement between the company’s senior management. While Enron was busy wining and dining Wall Street, the company was issuing fraudulent financial statements—which were gobbled up and spit out by some of the country’s most famous energy analysts. The inflated profits boosted Enron’s stock price, and twenty-nine Enron executives sold overvalued stock for more than a billion dollars before the company went bankrupt.

And who was left holding stock that went from $90+ to just $0.26? Right, millions of investors and thousands of Enron employees who witnessed their company going from a high-flyer to bankruptcy court.

Selling Dividends

Beware if your broker tries to persuade you to buy a stock or fund because “it’s upcoming dividend will boost the share price.” This is called dividend selling, and it’s just another method for a fast commission for the broker.

It works like this: Let’s say your shares are trading at $25, and the upcoming dividend is $2. The broker says you can buy the stock before the dividend payment and gain 8% (25/2=8%). But in reality, that doesn’t happen, and if you are buying just to get the dividend, and then sell quickly, you’re going to be taxed at your ordinary rate, as you won’t have held the stock long enough to take advantage of capital gains taxes.

Now, there are certain instances when a company pays a “special dividend,” when this might be worthwhile. Back in May 2006, I noticed an announcement of a $4 special dividend by Sak’s Incorporated (no longer a public company). I didn’t own the shares at the time, but as I recall, they were trading in the teens, so an additional $4 would be a pretty hefty return. I immediately bought the stock and sold it after I got the special dividend. However, a friend of mine decided to hold onto his shares for a while and was again rewarded with a $4 per share special dividend in October 2006. That was a very nice gain!

Withholding Recommendation to Invest at Breakpoint

Some funds incur legitimate sales charges. And some brokerages and investment firms tier those charges according to how much you invest. Let’s say there’s a “breakpoint” at $30,000. If you invest less, you might be hit with a 5% fee; over $30,000, the fee may be 4%. But an unscrupulous broker may encourage you to invest less than $30,000, so his fee will be 1% higher. It’s essential that you check all the numbers before investing.

Ponzi Schemes

If you hadn’t heard of a Ponzi scheme before Bernie Madoff, you certainly knew all about them later. Think of the Ponzi scheme as a pyramid structure. The name was coined from the shenanigans of Charles Ponzi, an Italian swindler who used it to rake in over $20 million in the U.S. in a 1920s stamp-swapping scheme. Amazingly, it was said that more than 75% of Boston police officers were invested in the scheme.

A Ponzi scheme is a little different than the typical pyramid, which uses individuals downstream to recruit investors. In the case of a Ponzi, the original scammer does his own recruiting, like in Madoff’s case. The scheme works like this: The scammer recruits investors, spends their money, then recruits more investors to pay off the first investors, and on it goes.

Madoff was the former chairman of the NASDAQ stock exchange, incredibly trusted. And over 17 years, he managed a $65 billion Ponzi scheme that ripped off some of his closest friends and allies. According to Madoff’s records, he lured investors in, claiming that his worst month out of his 215 months of trading showed a -0.64% return, with an average annual return of more than 11%.

And lest you think that Madoff scared off any would-be Ponzi entrepreneurs, think again. A Tucson con man Herbert Ivan Kay was sentenced to five years in prison in 2015, for taking clients for more than $8 million in an investment scheme involving commercial and residential developments. This occurred over a 13-year period, in which Kay paid for his debts and failed venture capital projects with his investors’ monies.

The Ponzi scheme is the embodiment of “too good to be true.” So, investor beware. Here are some Ponzi prevention techniques:

Be skeptical. Beware promises of high and fast returns, or investments that seem too complicated to understand.

Be suspicious of unsolicited offers. I get at least one unsolicited invitation every week to some investment, retirement, solar energy, etc., seminar. Now, I’m not saying they are all fraudulent, but if you are tempted by someone calling or inviting you into an investment—whom you’ve never heard of—check them out. And if you are of retirement age, be extra cautious. Plenty of these scams and schemes target the older generation.

Investigate the seller. You can easily research a broker, financial advisor, brokerage company and investment advisor firm using the Financial Industry Regulatory Authority’s (FINRA) BrokerCheck. Just for fun, I typed in Madoff’s name and 18 pages of information popped up!

Make sure the investment is registered. The SEC says that scams like Ponzi schemes often involve unregistered investments. If you’re told the investment is registered, check it out at https://www.investor.gov/. If the provider says it is unregistered, ask why. Not all investments must be registered, but note that there is much more risk inherent in an unregistered investment, especially liquidity risk, or the ability to sell it when you are ready.

Understand the investment. I remember Warren Buffett—during the tech boom and bust of the late ‘90s—saying, “Never invest in a business you cannot understand.” Information is readily available on almost any product or service. Make sure you understand the investment, as well as the risks that go along with it. If the investment provider is hesitant to answer your questions, my advice: Run for the hills!

Report potential scams. If you think you’ve been a victim or a scam, file a complaint at FINRA, with the SEC or with your state securities regulatory body.

Forex Scams

Millions of traders make their fortune in the foreign exchange market (Forex). It is a global decentralized or over-the-counter market for trading currencies, which determines foreign exchange rates for every currency.

Forex is the largest financial market in the world, with daily volume of $6.6 trillion. As of January 2022, the worldwide forex market was worth $2.409 quadrillion (1 quadrillion is equal to 1,000,000 billion). The market is made up of buyers and sellers who exchange currencies at current or determined prices.

And it’s a haven for scammers promising high returns or once-in-a-lifetime gains on their investment with little to no risk. They use social media advertisements and fake websites to lure in investors, and then disappear after they’ve gotten your money.

One of the most egregious examples of Forex scams was in 2017, when FXCM, the largest Forex trading broker in the U.S. at that time, was permanently banned from being a member of the National Futures Association for a variety of bad practices. A couple of years before that, In IB Capital FX LLC was required to pay $35 million to clients it defrauded.

Here are six of the most common scams:

Signal seller scams promise that their data will pinpoint the best time to buy and sell currencies, guaranteeing successful trades and high profits. Investors pay a fee for this information.

Forex robot scams utilize software programs to automatically buy and sell currency, using an algorithm. Legitimate firms use similar “forex robots,” but also offer their customers the ability to back-test and review. Alternatively, scammers sell untested or fake software that performs random trades that will most likely result in big losses for investors.

Forex broker scams. Just like scammers will use an email or website address that is close to a legitimate firm to “phish” you, fraudsters will adopt a name similar to a reputable and legitimate forex broker or investment platform (and sometimes, the exact same name) to trick people into investing in non-existent forex funds. To combat this, you can check with the Financial Conduct Authority (FCA) register. The United Kingdom-based FCA regulates financial organizations and advisors and is considered to be one of the most reputable regulatory organizations in the world for regulating Forex brokers and other financial entities.

Forex pyramid schemes sell subscriptions to investment groups that supposedly offer advice and data to help investors make profitable forex trades. The original members then recruit other members (and get a commission), and then it works just like other pyramid schemes. You only make money from recruiting commissions.

Managed forex account are offered by legitimate investment companies where an expert forex trader invests currency on your behalf—for a fee or commission. Scammers, however, just take your money and don’t give you anything in return. Again, check out the company with the FCA.

Forex Ponzi schemes advertise non-existent forex funds that guarantee quick and high profits. They generally begin with a small investment on which they pay a high return, and then pay future gains from the next set of investors they recruit. And like pyramids, they invite you to ask your friends and associates to join them. Once they’ve accumulated enough of your money to get rich, they disappear.

Phrases like “risk-free investing” and “must act now,” and practices such as unsolicited offers, ridiculously high promised gains, and social media advertisements are best avoided so that you don’t get taken by a Forex scammer.

Forex trading can be incredibly profitable, but it’s best left to experienced, sophisticated traders.

There are plenty more unsavory broker practices, including:

- Charging egregious trading commissions, fees, or spreads.

- Freezing trading platforms or suspending trading during busy market hours, which keeps you from being able to cancel an order and allows an unscrupulous broker to fill the order at prices outside of the market.

- Onerous and unnecessary requirements to withdraw your funds. Your broker may ask for excessive forms of identification, levy ridiculously high withdrawal fees, and make you wait an unnecessarily long time to get your money (This is not to be confused with “Know Your Client” verification which brokers are required to undertake).

- Automated trading systems to make “guaranteed” profits.

- “Free” bonuses or sign-up funds.

Precious Metals Scams

Many investors have been caught up in precious metals pyramid schemes and other scams. When times are uncertain, we often flock to hard, tangible assets such as gold, silver and other metals.

Scammers in this area usually have slick sales pitches, offer guarantees, and some even charge sales commissions of 50%! Be especially aware of these metal scams internationally, as metal dealers around the world are not often as regulated as they are in the U.S.

FINRA offers suggestions before you invest with a metals broker. First off, say “no” to pushy salespeople. Saying “no” at first won’t prevent you from working with a legitimate broker and it removes you from the high-pressure sales pitch that’s typical from scammers.

Next, check out the salesperson’s background before you invest. There is no centralized, regulator-approved list of gold dealers. However, you can still check out the business at the Better Business Bureau. And the U.S. Mint, meanwhile, maintains a searchable database of coin sellers. The National Futures Association’s (NFA) Background Affiliation Status Information Center (BASIC) will tell you whether a firm or individual is registered and whether they have been the subject of any disciplinary actions. And don’t forget about FINRA’s BrokerCheck.

If the salesperson says, “low risk,” run.

Also, pay attention to leverage risk, or margin. That means you are borrowing, and in the precious metals business, the margined portion may be up to 80% of your purchase price. You have two things to worry about here: interest and a possible margin call if the value of the investment declines.

If you are already working with a metals broker, get a full accounting of fees.

Cryptocurrency Scams

Any new investment provides a breeding ground for scammers. And that’s certainly the case with cryptocurrency. Some of the most popular crypto scams include:

Fake websites with similar domain names to legitimate sites that set up what look like authorized trading sites. You got it; you put your money in, and they take it out.

Phishing scams, often related to online wallets, and targeting crypto wallet private keys, which are required to access funds within the wallet. Investors receive emails inviting them to websites where they enter their private key information. And then the scammers steal the cryptocurrency from your wallet. The only time you should enter your private key in a computer is if you’re recovering your wallet.

Pump and dump schemes for particular coins that are hyped through an email blast or social media. Unwary investors buy in, the price goes up, and the scammers sell, causing the price of the coin to plummet.

Fake apps available for download through Google Play and the Apple App Store.

Fake celebrity endorsements.

Giveaway scams which supposedly match or multiply the cryptocurrency sent to them. These are the “once-in-a-lifetime” deals.

Blackmail and extortion scams, claiming to have a record of adult websites visited by the user and threatening to expose them unless they share private keys or send cryptocurrency to the scammer.

Cloud mining scams use companies that allow you to rent mining hardware they operate in exchange for a fixed fee and a share of the revenue you will supposedly make. This promises users that they can mine remotely without buying expensive mining hardware.

Fraudulent initial coin offerings (ICOs) raise money from future users. Customers are promised a discount on the new crypto coins in exchange for sending active cryptocurrencies like bitcoin or another popular cryptocurrency.

Kapersky.com offers these tips on spotting cryptocurrency scams:

- Promises of guaranteed returns.

- A poor or non-existent whitepaper. Crypto investors know that whitepapers explaining how the cryptocurrency has been designed and how it will work are critical components of every cryptocurrency.

- Excessive marketing.

- Unnamed team members: you need to find out who the key people are and be able to easily access their biographies.

- Free money.

Many people have made a fortune in cryptocurrency, but caution is imperative to fend off the hucksters.

Other Alternative Investment Scams

If you can invest in it, there’s probably a scammer on the hunt for you. It’s not just the typical investments we know, like stocks, bonds, currencies, and funds. Think of all the fine wine, art, classic cars, rare documents and stamp collections. They are all ripe for fraudsters.

More Tips for Avoiding the Fraudsters

So, what’s a wary investor supposed to do to circumvent these greedy and unscrupulous investment advisors (thankfully, they really are a small portion of the business)?

- Find out how long the broker and brokerage have been in business.

- Execute the 3 R’s: 1) Check that the broker and firm are registered with a legitimate financial regulator; 2) Read broker reviews from clients; and look for 3) Recent industry recognition .

- Review the firm’s website for: margin requirements, trading platforms, costs and fees, a physical address, hours and phone numbers for customer service.

Questions to Ask your Broker

Lastly, if you are moving your money to a new firm or new broker, these questions will help you judge the type of assistance you may expect:

What investment training have you had? Do you have a degree in finance or accounting? It’s unfortunate, but many brokers are never formally trained. A few years ago, the SEC, the National Association of Securities Dealers (NASD), the New York Stock Exchange and the National Organization of State Regulators issued a report that said one-third of problem brokers switched firms as many as six times during their careers, only 24% of brokerage firms conducted even a cursory review before hiring brokers and 26% of supervisors (managing as many as 30 brokers or more) don’t take the time to conduct even a cursory review of client trades.

Do you receive extra commissions for selling “house products”? Your broker should be forthright about where their incentives come from and you should be able to trust that recommendations are in your best interest, not your broker’s.

Are there any hidden costs in your “commission-free trading”? Most retail brokerage houses are now offering commission-free online trading, but the associated costs have to be covered by revenue from somewhere.

Is your firm underwriting this issue (that you are trying to sell me)? If it’s a hot IPO, working with a large firm with an underwriting department can be an opportunity to participate. If it’s not, the underwriter may be incentivized to find buyers to backstop the issue.

Do you currently hold this stock in your principal trading account? If so, run; the firm is probably trying to unload it.

Are you selling this stock on behalf of one of your major clients? If so, why is he or she selling and how many shares?

And lastly, I think this graphic from Commodity.com is worth cutting out and sticking in your investment notebook.

Bottom line, it’s buyer beware when it comes to creating a long-term successful investment strategy. Fortunately, most purveyors of investments are perfectly legitimate, but I hope you will find these tips helpful in taking steps to protect yourself before buying any investment.