Get this Investor Briefing now, How to Get and Stay Rich, and you’ll learn about how to gain and maintain financial independence—so that you have all the resources to make any decision you want. From advice about the best places to retire to how the long-term housing forecast may affect you … from the latest on interest rates to how to invest in BDCs … and from how your conservative investments make sense in a crisis to preparing yourself for the post-coronavirus era. How to Get and Stay Rich is your best guide to financial wellness, now and for the rest of your life.

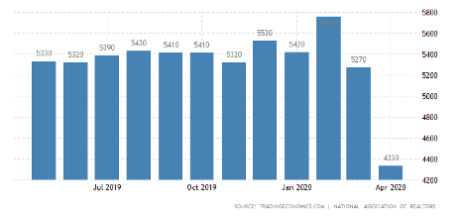

How Long Can the Housing Market Stay This Hot?

I’ve recently written about receiving two unsolicited offers to buy properties I own which may have seemed incredibly strange just a few years ago but is becoming increasingly common. The housing market is white hot and industry insiders aren’t anticipating significant near-term changes in demand due to the ongoing low inventory. The catch with the offer for one property (which was never meant to hold a family of four) is that the aforementioned low inventory means there aren’t many next-size-up properties in the areas we’d prefer.

I’m not sure what to make of this situation. On the one hand, from our vantage point, it’s certainly nice to already own residential real estate and not be first-time homebuyers right now. I feel for those who have been priced out and/or cannot find something suitable within their budget.

On the other hand, it seems the housing market is undergoing a structural change that could put what were once reasonable homes (a relative scale, for sure) out of reach. This is due to the confluence of both demographic and pandemic-induced changes.

The rising generations, that for so long did not seem interested in buying, now are. And the throngs of people who previously needed to work in and around major urban areas are suddenly free to go wherever they wish without any geographic-related salary reduction (at least for now).

My examples of offers for homes in Vermont and Rhode Island aren’t outliers. The same trend in the housing market appears to be happening around the country. We are currently visiting my in-laws in North Carolina. Their development typically sees 12 new homes built every year. There are 38 under construction this very moment.

Stepping back, this scenario is reminiscent of the dramatic structural shifts in work-from-home stocks that began roughly a year ago. That trend caught fire quickly, burned intensely for several months, then began to cool. But it is far from being snuffed out – work from home and the wider group of Internet, e-commerce, cloud, digital, etc. stocks, while well off their highs, are still up significantly from where they were pre-pandemic.

Will the housing market follow a similar curve?

Real estate is far less liquid than equities. Whereas stocks offer little to no utility (maybe dividend payments, in some cases), real estate offers it in spades. In many ways homeownership represents a form of consumption with a (usually) appreciating asset.

The strength in the housing market helps illustrate just how dramatic and widespread the trend shifts are as a result of the Covid-19 pandemic.

As we move forward the simple and often repeated narrative of “everything will go back to normal once enough people have been vaccinated” will likely prove to be far from accurate. More likely is that a new normal will emerge, and it will be different from what was expected.

As investors we need to keep our eyes open and ears to the ground as we seek out opportunities to participate in what that new normal could be.

Reader Response

Here are some of the comments I have received since first writing about the surging real estate market. I’ve edited for clarity and brevity, and removed certain personal details.

“Hi Tyler, my husband and I live in Michigan. We built a home on 45 acres and moved in December 2019. Even when we built, Trump’s policies made lumber from Canada and door handles from China soar in price. We have friends building now and prices of new home building have shot up. This makes existing homes seem like a bargain, even at much higher than usual prices. Even if President Biden can repair some of these relationships, it seems prices never retreat as quickly or to the level from which they started. Our friends said a sheet of plywood has tripled in cost. This pressure on the existing home market will probably last some time.”

“Santa Fe is a bit of a boutique real estate market with a somewhat fixed amount of inventory. A small uptick in demand quickly sends prices higher. The CofC did a study finding that the city was 8,000 housing units short of what was needed due to employer needs. In the most desirable areas people are buying homes online without ever seeing them in person and prices are exceeding $500/sf., which previously was considered top of the market. Marry the above with the fact that Santa Fe is likely a great climate change pick due to its 7,000′ elevation and the fact that there are no natural disasters, and you have a city in great demand.”

“Tyler, the Nashville market has been an anomaly for 12+ years but now it fairly represents the recipient cities who are benefiting from the flight to the red zones, as I call them. As a developer, builder, glazing subcontractor to the construction industry and owner of a large commercial property portfolio, I think I have a pretty good handle on the real estate side of life, the answer is … flip a coin. Just like the stock market, there is simply more money in the world than there are safe/reasonable places to put it. This is causing prices to rise for no good other reason other than supply and demand. With the flight from crowded cities and blue cities and a realization that there is more to life than 60 hour work weeks, really nice areas and red areas are going to win out. As for you, if someone offers you stupid money for your primary residence and you can find something to rent for three years, it is probably worth doing. Once things calm down and you have a chance to re-evaluate your life [to fit] the ‘new norm’ (which will not be known for at least two to three years) you will be able to put your money back into a replacement home that fits your new life circumstances.”

“We live in a gated community in Palm Beach County, 1,622 homes. Normally there are 90-120 for sale. Today … 15, and all lower priced. Last home in our village went for about $150,000 more than I thought it was worth. Friend in Concord, Mass., just had a bidding war on his home which went for some $120,000 over ask. Bottom line: People are leaving the cities, working at home, enjoying a quieter life.”

This is Tyler again. I’m interested to hear what you all think of the residential housing market right now, and the underlying trends behind the strength and re-distribution from cities to more suburban areas.

If you have thoughts to share and/or observations of your own, along with some indication of where you live, please share below.

Planning for Your Financial Freedom

Happy New Year! I know you’re as pleased as I am to put 2020 to rest. But with the new year—drumroll please—it’s time to make our Resolutions for 2021!

Yes, it’s true, resolutions are made to be broken. And I’m just like the 94% of people who don’t keep theirs (according to uabmedicine.org). Every year, I make the same ones—lose 10 pounds and save and invest more money. Although, I have to say, I have stuck (mostly) to my exercise program (didn’t lose any weight!) and I did make some progress on the saving and investing angle.

How did you do?

The Top 10 New Year’s Resolutions

According to goskills.com, here are the Top 10 New Year’s Resolutions:

- Exercise more

- Lose weight

- Get organized

- Learn a new skill or hobby

- Live life to the fullest

- Save more money / spend less money

- Quit smoking

- Spend more time with family and friends

- Travel more

- Read more

Those resolutions vary greatly by state.

As you can see in the following map, zippia.com reports that therapy is the most popular resolution in 12 states (including my state of Tennessee). I guess that makes sense, with the increase in the focus on mental health during this COVID-19 crisis. Eight states cite weight loss as their number one goal. Seven wish to quarantine and chill. Four just want a good night’s sleep. And only Iowa, Mississippi and North Dakota want to save money!

Why our Resolutions Fail

So, why do only 8% of our population keep their New Year’s Resolutions? It turns out that the answers are the same as for those who fail in their financial goals—or really any other ‘wish list.’

According to BusinessInsider.com, they are:

Your resolution isn’t specific enough. You see, just saying you will “lose weight,” “save more,” or “learn a new skill or hobby” sets you up for failure, as you have not set up a system to mark your progress. As a business owner, if I say to myself, “I want to hire some good Realtors this year,” it probably won’t happen. But if I say, “I want to hire 5 new agents who each produce at least $2 million in annual sales,” I can make that happen, by outlining a plan to find and hire those agents, and then train them to succeed. Without planning, creating and following the steps needed to attain that goal, and acknowledging my small wins along the way, I probably won’t stay motivated and I won’t reach my goal.

Solution: Make your goal specific and achievable: I’m going to exercise 30 minutes, three times a week. I will go to Starbucks twice a week instead of every day and I will save and invest that $100 extra per month. I will sign up for a virtual French class in January.

You are not looking at your goals positively. We may want to “stop eating junk food” or “wasting money,” but those words are negative, and they dwell on what you’re trying to stop, which often makes them more attractive. Just thinking about junk food makes me want to find the chips!

Solution: Focus on the positive things that will come to you when you stop those behaviors, such as weight loss, feeling healthier, and saving more money.

Your resolution isn’t about you. Sometimes, our New Year’s resolutions are not what we really want. Oftentimes, we are influenced by what our husbands, mothers, and friends want us to do—like lose weight, dress better, or stop watching so much television.

Solution: You must want and set your own goals if you are to be successful, otherwise, you will fail. If you love to watch five hours of TV every day, and your wife wants you to reduce that viewing time, it probably won’t work. But if you decide three of those hours could be used for something more productive—that you like to do—you are more likely to buy into the plan and be successful.

The point is, you can make and achieve your resolutions—you just have to go about it the right way. I’m going to give you some great tips on just how to do that—as well as the tools you’ll need to steer your course.

New Year, New Beginning

But first, let’s talk about new beginnings.

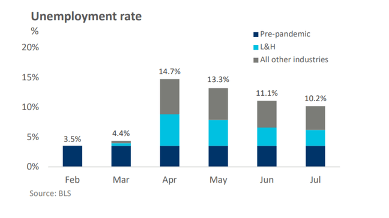

2020 dealt a devastating financial blow to many of us. The unemployment rate peaked in April, at 14.7%. As of December 13, there have been 610 corporate bankruptcies in America.

But one bright spot that COVID brought us is this: people in the U.S. are saving more now than they have in decades. Also, in April, our national savings rate peaked at 33.7%, according to Statista.com. It has since dropped to 12.9% in November, but that is the highest savings rate in more than 60 years, and well above our average, which has generally hovered in the 7% range.

Now, we’ve arrived at 2021. The year ahead shines brightly, as a beacon of hope—hope that we will toll the death knells on the coronavirus, boost employment, and nurse our travel, restaurant, retail, and small businesses back to health.

After the financial interruption of the coronavirus, saving and investing more should be right at the top of everyone’s New Year’s resolutions. Think of it this way—cash gives you a lot of flexibility. It can make your life a whole lot easier if you suddenly find yourself without a job or with a medical emergency. Saving/investing can buy you some really nice vacations, pay for your children’s or grandchildren’s education, purchase your dream house, or help you start a business. And most of all, it will provide you greater mental health, as you will have a cash cushion that stops the worrying that comes with financial instability.

So, number 1, define your savings/investing goal, and as my dad used to say, “pay yourself first.” That means—even if you don’t think you can afford it—save something, and then build on that. Here are some ways to make your savings grow.

5 Easy Steps to Creating a Budget

Create a budget. There are five steps to developing a budget.

- Calculate your net income. Most of us know how much money is coming in. Of course, if you are self-employed, or commission-based, that varies month-to-month. So, you can start with what your minimum monthly intake will be.

- List monthly expenses. What are you buying? The best way to figure this out is to keep a record of all your expenses for a minimum of one month. You’ll be surprised and amazed at where your money is going. Write it all down: $5 at Starbucks, $10 at the grocery store for impulse buys (that’s why you need to make a grocery list before you go shopping!), $17.99 for Netflix, $80 for your hair cut and style, $40 for that scarf you didn’t need, utilities, auto and health insurance, gas, auto repair, HVAC tune-up, childcare, gym memberships, dining out, entertainment, and loan and mortgage payments—yes, write it all down—no matter how small!

- Label which expenses are fixed, and which are variable. Fixed expenses are just like they sound; you have to pay them. These are bills like rent/mortgage, utilities, transportation, insurance, food, and repaying loans. Variable expenses are items that you may not need, like your daily Starbucks run, eating out three times a week (like we used to, pre-COVID!), or the gym membership that you don’t use, or those regular shopping sprees to make you feel better. In other words, these are the expenses that you have the opportunity to reduce or eliminate completely which can be the source of your new savings/investing initiative.

- Determine average monthly costs for each expense. Your fixed expenses should be about the same each month, but things like groceries and utilities may vary. So, if you have the patience, look at your checking account and see how much you’ve spent on these items in the last year, and average them out. Then put that number into your budget. Some months you’ll be ahead and some you won’t.

- Make adjustments and start saving. If you’re outspending your net income, you’ll need to find some expenses that you can reduce or cut completely. And this is also where you will allocate your monthly savings. If you are spending less than you make, drop the overage into savings. You can set up one or more savings vehicles—for vacations, education, and retirement. But first…

Making Saving and Investing a Priority

Create an emergency fund. According to a November survey from listwithclever.com, three in five Americans (61%) say their emergency savings won’t last through the end of the year or that they have already run out of savings. Historically, experts have advised that you have three to six months’ worth of living expenses in your rainy-day fund. COVID-19 has shown us that our emergency funds should probably cover at least one year’s expenses.

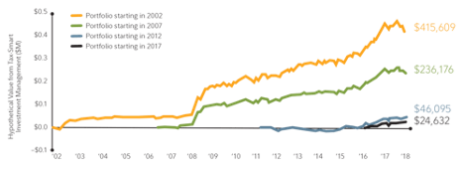

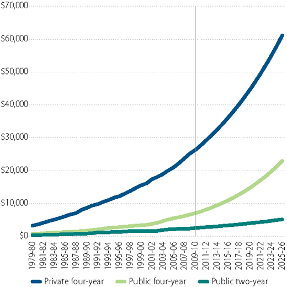

Automate your savings contributions. If your paycheck goes automatically into your checking account, ask your employer to divide it, so that some of your income is allocated to your savings account. And every time you get a raise, add at least a portion of that to your savings. If you are self-employed, sign up for an automatic monthly debit from your checking to your savings/investing accounts. If you do that, your money will grow exponentially. The sooner, the better, as when it comes to savings, time is your friend, as you can see from the following chart.

If you’d like to play around with different savings and interest/investment rates, try this calculator: helpfulcalculators.com/compound-interest-calculator

Boost your retirement savings. This is the most important part of your financial plan. Depending on Social Security is not a great (or livable) goal. The average Social Security benefit is $1,503 per month. That will barely cover rent or mortgage expenses for most people.

If you have a 401(k), maximize your contribution—especially if your employer matches some or all of your contributions. Do that now! Do not leave any “free” money on the table. In 2020, you can contribute up to $19,500 into a 401(k). And if you are 50 or older, that contribution goes up to $26,000.

Consider contributing to or maximizing your IRA. The maximum contribution for 2020 is $6,000, or $7,000, if you are over 50 years of age.

Invest more. Don’t just stop at retirement savings, although many of those are tax advantaged. After you’ve maxed out your retirement accounts, create another investment account at a brokerage house, in which you make regular deposits. There’s no limit to what you can save! Commissions are almost non-existent today, and these accounts can be as liquid as you desire. And if you are new to investing, start with mutual funds and ETFs.

Ways to Reduce your Spending

Ok, that takes care of the saving/investing portion of your New Year’s resolutions. Now, let’s talk about expense reduction resolutions.

Refinance your mortgage and/or your student loans. According to Bankrate.com, the average 30-year mortgage rate is now 2.87%. If you plan to stay in your home for more than a couple of years, and your rate is at least 1% higher than that, you should definitely refinance. Let’s look at a couple of examples.

Mortgage balance: $200,000

Payment at 2.87%: $829

Payment at 4.50%: $1,013

Mortgage balance: $400,000

Payment at 2.87%: $1,659

Payment at 4.50%: $2,027

Just ask yourself, “What could I do with an extra $184-$368 (or more) per month?”

Pay down credit card debt. As I mentioned earlier, saving is on the rise in America, and credit card debt is dropping. As you can see in the following chart—this is the first decline in eight years!

And that’s a great thing! The average interest rate on credit cards is 17.98%, according to wallethub.com. Imagine how much money you would have if you had zero credit card debt—and how much faster you could bring up your savings/investing accounts.

If you feel snowed under with credit card debt, there are two popular strategies to gain control of it:

- The debt avalanche method—paying off your highest debt first

- The snowball method—paying off your smallest amount of debt first

I know many financial advisors who advocate the first strategy, and that’s fine. But often, baby steps work best when getting your financial house in order. That’s because after each step, you’ll feel that you’ve accomplished something. And for that reason, #2 is my favorite strategy. Each time you pay off one of those lower balances, you’ll feel rewarded, and ready to tackle the next step.

Use the Island Approach to separate your credit charges. This means you will have different credit card accounts for different financial needs—a chain of islands, so to speak. For example, everyday purchases can be paid for with a rewards credit card that gives you airline miles, cash back, gift cards, etc. Alternatively, if you sometimes carry a balance, you will benefit from a 0% APR card. Comparecredit.com gives you a list of the best 0% cards (at least until 2022). The top five are:

- Citi Diamond Preferred (18 months interest-free on balance transfers)

- Citi Double Cash (18 months interest-free on balance transfers + double the cash back)

- Blue Cash Everyday from American Express (15 months interest-free on balance transfers)

- Bank of America Cash Rewards (12 months interest-free on balance transfers + rewards)

- Discover It Cash Back (14 months interest-free on balance transfers + 5% cash back)

Improve your credit score. Most credit scoring companies rank credit scores from 300-850. According to FICO, the average credit score in the U.S. is 695. If you want to apply for a mortgage, FHA considers the minimum score to be 580. Your credit score is critical when you need to borrow money. Generally, the higher your score, the lower your home mortgage (or consumer debt) interest rate will be. And that means a lower payment and more money in your pocket, instead of your bank’s.

Before you apply for any credit, it’s imperative that you find out your credit score. You can go to AnnualCreditReport.com to get a free copy of your credit report and score. I recommend that you do this at least once a year—whether or not you’re seeking credit—just so you can check your report for any errors. (It won’t count against your credit score).

The good news is, if you don’t like what you see, it’s possible to increase your credit score.

| Seven Key Strategies to Increase your Credit Score Here are seven key strategies:

|

Cook more meals at home. I know, COVID-19 has sort of forced this on us. But not only is eating at home better for your pocketbook, it’s also healthier. According to the USDA, from 1978 to 2012, the share of daily calorie intake from food away from home (FAFH) rose from 17% to 34%. You can blame our addiction to fast food for most of that. And, honestly, most restaurant food has more butter, salt, and fattening ingredients than most home chefs use. And don’t forget the temptations, including all those fatty foods and desserts (which I rarely eat at home, but love to gobble up at a restaurant!).

If you don’t believe me, just look at this chart from Infoplease.com:

| Food | Calories | Fat |

| McDonald’s Big Mac | 563 | 33 grams |

| Medium-sized McDonald’s French fries | 384 | 20 |

| Medium-sized McDonald’s vanilla shake | 733 | 21 |

| Total for one meal | 1,680 calories | 74 grams |

| Burger King Whopper with cheese | 790 | 48 |

| Medium-sized Burger King French fries | 387 | 20 |

| Medium-sized Burger King vanilla shake | 667 | 35 |

| Total for one meal | 1,844 calories | 103 grams |

| Compare that to a meal prepared at home: | ||

| One-half of a roasted chicken breast | 142 | 3 grams |

| Medium-sized baked white potato | 130 | 0 |

| Half a cup of green peas | 67 | 0 |

| 8-ounce glass of 1% milk | 102 | 3 |

| 1 cup of unsweetened applesauce | 105 | 0 |

| Total for one meal | 546 | 5 grams |

Source: Infoplease.com

So, if you’ve cut down on eating out in 2020, stick with it in 2021. Your bank account and your waist will love you for it!

This may be something you’ve already begun to do with many restaurants around the U.S. being limited to takeout only. Keep it going into 2021.

Pare your expenditures. Once you see your budget in black and white (and all that stuff you are spending money on!), I have no doubt that you can eliminate a few categories. Be brutal—wouldn’t it be a lot more fun to see an extra $1,000 or two in your savings/investing account at the end of the year than those magazines you don’t read, those 40 pairs of black shoes, or 365 empty coffee cups?

If you’ve Cut Spending as much as Possible, Consider…

Look for ways to boost your income. In my November issue of Financial Freedom, I talked about different methods to increase your income, including second careers and side hustles.

Last year taught us some hard lessons, and one is that financial uncertainty can happen in the blink of an eye, and even when you think you have a steady income, that can quickly disappear. So, leaning on your entrepreneurial side can be beneficial—long and short term. You can do any number of side jobs—freelance work, dog walking, cleaning homes and/or offices, and even investing in rental properties.

Some Last Financial Resolutions

Review your insurance policies. Lots of things changed this past year, so make sure you have enough coverage—on your automobile, health, and property. And don’t forget to update your beneficiaries.

Update your will and medical directives. Family dynamics often change, so review these documents so that they are in line with your current relationships.

Check your withholdings. In 2019, the IRS created a new W-4 form to help you calculate your withholdings. You don’t want to let Uncle Sam use your money interest-free, so make sure you review your deductions.

Use Technology to Keep your Financial Life on Track

Fortunately, we no longer operate in an Ebenezer Scrooge environment, where bookkeepers toiled by kerosene lamps over their green ledger books!

Today, it’s pretty easy to let technology do most of the work. Sure, you can set up a spreadsheet in Google Sheets or Excel. That works just fine for a lot of people. But the downside of that is those spreadsheets don’t come with a lot of data tools to help you figure out exactly where you stand, financially.

However, there are plenty of technology solutions that will help you create and stick to a budget, tell you when an expense is getting out of line, and give you ideas on reallocating your income for maximum results. Most are pretty inexpensive, too.

| Financial Software Programs and Apps Balance.com cites the following websites as the best for personal financial planning:

|

I can recommend Quicken.com. It works great for personal financial planning and execution, and you can interface it with your bank accounts. You just create the accounts and direct your income and expenses to the right one. Once you have those initially set up, most of your data will be automatically updated from your bank accounts.

I graduated about a decade ago to Quickbooks.com, which I use for business. I’ve used it for about 10 years, and it contains really good tools to decipher where your money is going to help you get control of your budget.

Most of these programs also offer apps for your phone (yes, there’s an app for that!). I’m still old-school and don’t do a lot with phone apps, but the younger generation prefers to do almost everything on their phones, and they have plenty of apps to choose from, including these from nerdwallet.com:

For budgeting:

- PocketGuard, for a simplified budgeting snapshot

- Mint, for budgeting and credit monitoring

- YNAB and EveryDollar, for zero-based budgeting

- Goodbudget, for shared envelope-budgeting

- Honeydue, for budgeting with your partner

- Personal Capital, for tracking wealth and spending

For personal finance:

- Mint: Best Overall

- You Need a Budget: Best for Debt Payoff

- Personal Capital: Best for Wealth Management

- Clarity Money: Best for Managing Subscriptions

- Prism: Best for Bill Payment

- Spendee: Best for Shared Expenses

- Mobills: Best Visuals

We’ve discussed our 2021 Financial Resolutions: creating a budget, scrutinizing your expenses, boosting your income, and tracking all the above, so that you are 100% on top of your finances. But we still need to talk about how to make those resolutions come true. Don’t worry; it really isn’t that difficult. You just need to create some new habits.

I think these tips from uabmedicine.org on keeping your resolutions are excellent:

Start with specific micro-goals: Baby steps! Think of it as a marathon, not a sprint. Set small, measurable interim goals that will keep you driving toward your ultimate resolutions.

As I said earlier, set resolutions for goals that you—not anyone else—desire: That way, they will be far easier to keep.

Document your progress: It’s like making a list and checking it twice. Don’t you feel good when you can scratch something off your list? You will build confidence in your end goal by seeing—in black and white—your progress. Some folks find a journal is a great way to do this.

Practice patience and forgiveness: Just like with a weight loss program, you’re going to have “bad” days. So, forgive yourself and move on.

Schedule time to achieve goals: You schedule your business meetings, family birthdays, lunches with friends. Schedule your time to get on track with your resolutions, too!

Embrace the buddy system: Sometimes, it takes a village to achieve great things. And having a buddy to discuss your progress (and once in a while, to hold your feet to the fire!) can help you accomplish your goals.

Reward yourself for achievements: Big or small, cut yourself a break and build in a reward system for meeting your goals.

I feel sure that 2021 is going to be a much better year, and by taking these steps to create, monitor, and achieve your financial resolutions will result in our ultimate goal—Financial Freedom!

6 Tips for Becoming a Successful Investor…and Golfer

This year has been turned upside down in many ways. That includes the sport of golf. In recent years, golf has seen its active player numbers steadily decline as baby boomers age and youngsters eschew this traditional country club sport.

So who would have thought that its popularity would surge during a pandemic? In 2020 golf rounds played were up almost 9% as golf is the rare sport that can be played while maintaining social distancing.

How to Invest in Golf Stocks

Golf stocks such as Callaway Golf (ELY) bounced backed from the COVID-19 pandemic and are posting strong sales and profits well ahead of 2019 as golfers with cabin fever escaped to golf courses across the globe.

One area of growth are golf club and ball sales, said Callaway Chief Executive Chip Brewer, while the company’s apparel brands remained “resilient” in the wake of the economic downturn.

“The golf business is experiencing unprecedented growth and is in a position of strength, and our brands are very strong,” said Brewer in a conference call with Wall Street analysts. For its third quarter, Callaway reported a sales increase of nearly 12%, to $476 million, with profits soaring 69% from last year.

Acushnet Holdings (GOLF), which owns Titleist and FootJoy, is another golf stock that indicated a big turnaround, and CEO David Maher recently told analysts that “the game and business of golf have been incredibly resilient over the past few months.” The company said that demand for golf balls had been particularly strong, indicating a pickup in rounds played.

6 Tips for Being a Successful Investor and Golfer

- Get organized with a smart, conservative strategy and realistic goals

This is very important. To get ahead, you must get organized. Great golfers always have a strategy in mind for every hole before they begin. They carefully chart a course and set specific targets that can be adjusted for different weather conditions. Unfortunately, amateurs (dare I say hackers) give little thought to strategy and usually have no plan at all.

- Keep your head when things get rough

The roguish, stylish and flamboyant Walter Hagen usually arrived on the first tee in black tie and always expected to hit three or four poor shots a round. This relaxed attitude led to him staying calm when the inevitable shot went astray. Remember, golf and investing are not games of perfection. When stock picks go south, cut your losses and get back into the game.

- Be deliberate, patient, and play the probabilities

In golf and investing, patience and consistency is the magic formula. Having one great round or a few good stock picks in a row will not lead to success. The greatest golfer of all time, Jack Nicklaus, always played the percentages to keep his ball in play.

- Proper preparation prevents poor performance

Professionals – in golf and investing – prepare carefully and follow a set and steady routine. Investors would do well to carefully emulate the pros. Don’t jump at every stock pick that comes your way. Do your research, find and stick with a proven investment strategy that suits your personality, time frame and financial goals.

- Build a talented team

If you go to the Masters or any other professional tournament, you will notice that a pro does not go it alone. Most have swing coaches, sports psychologists, sports agents, financial consultants and of course professional caddies to help them play at their peak potential. The same goes for investors. Get a good CPA and lawyer, plus some talented investment help from trusted and independent sources like us.

- Look overseas for value and growth opportunities

Golf has always been an international game, and no tournament is more international than the Masters. Are you equally open to scouring the globe to find companies trading at value prices all over the world?

Remember, investing, like golf, is not a game of perfection. Having the right mindset, strategy and preparation simply increases the probabilities of success.

Tax Planning Time

It’s not yet time to pay your 2020 taxes, but it is the perfect time to get started on your year-end tax planning. By paying attention to the details of tax law changes and taking advantage of strategies to defer income, you can significantly reduce or defer your income tax bill.

If you practice tax-smart investing, this graph from Fidelity.com shows you how long-term tax smarts pay off by utilizing 4 simple strategies, and the sooner you get started, the bigger the difference it will make:

- Tax-loss harvesting

- Managing capital gains

- Managing distributions

- Tax-smart withdrawals

2020 Tax Law Changes

We’re going to talk about each of those strategies, plus many more! But let’s get started by reviewing a few of the recent changes to tax laws that you need to know before you file your 2020 returns:

Tax brackets were adjusted to keep up with inflation.

The 2020 income brackets for single filing status, according to the IRS, are:

- 37% tax rate: Applies to taxable income of more than $518,400

- 35%: More than $207,350 but not more than $518,400

- 32%: More than $163,300 but not more than $207,350

- 24%: More than $85,525 but not more than $163,300

- 22%: More than $40,125 but not more than $85,525

- 12%: More than $9,875 but not more than $40,125

- 10%: Income of $9,875 or less

For married filing jointly:

- 37% tax rate: Applies to taxable income of more than $622,050

- 35%: More than $414,700 but not more than $622,050

- 32%: More than $326,600 but not more than $414,700

- 24%: More than $171,050 but not more than $326,600

- 22%: More than $80,250– but not more than$171,050

- 12%: More than $19,750– but not more than $80,250

- 10%: Income of $19.750 or less

Standard Deduction Amounts have increased as follows:

- Married filing jointly: $24,800—up $400

- Married filing separately: $12,400—up $200

- Head of household: $18,650—up $300

- Single: $12,400 up $200

At the end of 2019, Congress passed the Setting Every Community Up for Retirement Enhancement Act of 2019, better known as the SECURE Act. One of its features was to increase contribution limits for limited workplace retirement accounts. For 2020. the base contribution limit for 401(k) plans is $19,500, up $500 from the previous tax year. The limit for catch-up contributions (for anyone 50 and over), is $6,500, up $500.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act waived required minimum distributions (RMDs) for 2020 tax returns. Normally, the distributions are taxed. For retirees, that’s a bonus and may decrease your federal income taxes owed.

Even if you file using a standard deduction, this year, you can deduct as much as $300 in cash contributions made to charities during 2020 (also part of the CARES Act). Usually, you can only do this if you itemize deductions. And, if you do itemize, you can deduct cash contributions made in 2020 of up to 100% (increased from 60%) of your adjusted gross income (AGI).

You can increase your contribution limits to your Health Savings Account (HSA):

Self-only coverage: $3,550—($50 increase from the previous years’ return)

Family coverage: $7,100—($100 increase from the previous years’ return)

If you adopted a child in 2020, your maximum allowable credit for adoption expenses goes up by $220, to $14,300.

The Saver’s Credit is a tax credit for eligible contributions to your IRA or employer-sponsored retirement plan. This year, the income limits have been raised.

You’re eligible for the Saver’s Credit if your income is no more than:

Married filing jointly: $65,000—up $1,000 from the previous tax year

Head of household: $48,750—up $750

All other tax-filing statuses: $32,500—up $500

Here’s a chart of how much you can deduct:

2020 Saver’s Credit

| Credit Rate | Married Filing Jointly | Head of Household | All Other Filers* |

| 50% of your contribution | AGI not more than $39,000 | AGI not more than $29,250 | AGI not more than $19,500 |

| 20% of your contribution | $39,001 - $42,500 | $29,250 - $31,875 | $19,501 - $21,250 |

| 10% of your contribution | $42,501 - $65,000 | $31,876 - $48,750 | $21,251 - $32,500 |

| 0% of your contribution | more than $65,000 | more than $48,750 | more than $32,500 |

Source: irs.gov

Income limits and maximum credit amount for the Earned Income Tax Credit (EITC) are higher.

You might be eligible for the EITC in 2020 if your AGI is not more than:

- Married filing jointly: $56,844—up from $55,952 for 2019

- All other tax-filing statuses: $50,594—up from $50,162

- The maximum amount that the EITC is worth in 2020 is $6,660—up from $6,557.

The Social Security income cap rose. The maximum amount of income subject to Social Security payroll taxes increased to $137,700 for 2020—up from $132,900 last year.

6 Tips to Make the Tax Process (almost) Painless!

|

21 Tips for Reducing your Taxes

Now that you know how tax law changes will affect your deductions and brackets, let’s look at ways that you can defer or reduce your tax bite.

Tip #1: Accounting rules require that we pay taxes on our income in the year that it is received. But, sometimes, you can defer your income—such as year-end bonuses—into the next year, especially if you think your income will be lower then. For those who are self-employed, you can ask your customers to defer payment to you until the following year.

You can also use several strategies to defer capital gains.

Tip #2: Wait at least one year before selling an asset or a property. That way, you’ll be taxed at long-term capital gains tax rates, which are 0%, 15% or 20%, depending on your taxable income and filing status. In contrast, if you sell it within one year, your gains will be taxed at short-term capital gain rates, which generally correspond to ordinary income tax brackets (10%, 12%, 22%, 24%, 32%, 35% or 37%).

Tip #3: Take advantage of the IRS’ Primary Residence Exclusion. If you’ve owned and used your property as your primary residence for two out of the five years immediately preceding the date of the sale, individuals can exclude up to $250,000 of capital gains while a married couple can exclude up to $500,000. However, you’re only eligible if you haven’t taken a capital gains exclusion for any other property sold at least two years before this current sale.

Tip #4: If you are subject to the capital gains tax for selling your property, and you know your income will be lower next year (due to retirement, changing jobs, etc.), you may want to hold off on the sale until then. And if you will need to pay capital gains, make sure you keep track of home renovation and selling expenses (like real estate commissions) you’ve made over the years. If they increase the value of your home, they can also add to your basis in the property, which means lower capital gains when you sell. See: irs.gov/taxtopics/tc701

Tip #5: Use a 1031 Exchange when you buy and sell a rental or investment property. With the exchange, you can defer paying capital gains tax by reinvesting funds from property sales back into your next real estate purchase. The rules can be quite complex, so please consult a tax advisor. You can find details at: irs.gov/businesses/small-businesses-self-employed/like-kind-exchanges-real-estate-tax-tips

Tip #6: If you have investment property, there are extensive rules and regulations about deductions. The IRS says that “you can deduct the ordinary and necessary expenses for managing, conserving, and maintaining your rental property. Ordinary expenses are those that are common and generally accepted in the business. Necessary expenses are those that are deemed appropriate, such as interest, taxes, advertising, maintenance, utilities, and insurance.

“You can deduct the costs of certain materials, supplies, repairs, and maintenance that you make to your rental property to keep your property in good operating condition.

“You can deduct the expenses paid by the tenant if they are deductible rental expenses. When you include the fair market value of the property or services in your rental income, you can deduct that same amount as a rental expense.

“You may not deduct the cost of improvements. A rental property is improved only if the amounts paid are for a betterment or restoration or adaptation to a new or different use.”

Tip #7: Accelerate deductions. You can lower your tax bill by increasing your charitable deductions: donating appreciated stock or property, instead of cash. And if you’ve owned the donated asset for more than a year, you can deduct the property’s market value on the date of the gift and you avoid paying capital gains tax on the built-up appreciation—sort of a 2-for-1 tactic! Just make sure you have a receipt. The old rule that you only needed receipts for a $250 or more charitable contribution is no longer valid.

Additionally, you can accelerate these expenses:

- Estimated state income tax bills due January 15

- Property taxes due early next year

- Medical bills

Tip #8: Don’t automatically assume that you don’t have enough deductions to itemize. The IRS says 75% of taxpayers take the standard deduction, but many could reduce their taxes by itemizing.

One valuable hint: if you’re close to the standard deduction limit, you might consider a ‘bunching’ year-end tactic. This means timing expenses to produce lean and fat years. One year, you take as many deductible expenses as possible, using the above strategies. And then, the next year, you’ll have a ‘lean’ deduction year, and will take the standard deduction.

Tip #9: Contribute the maximum to retirement accounts. And, if you have an employer who matches some or all of your contributions, do it now! Do not leave any ‘free’ money on the table. As I said earlier, in 2020, you can contribute up to $19,500 into a 401(k). And if you are 50 or older, that contribution goes up to $26,000.

Tip #10: Consider contributing to or maximizing your IRA. The deadline for IRA contributions is April 15, but why wait? The way the stock market has been performing of late, if you wait, you’re likely to miss out on some appreciation. The maximum contribution for 2020 is $6,000, or $7,000, if you are over 50 years of age.

Tip #11: If you are self-employed, consider a Keogh plan or a Simplified Employee Pension Plan (SEP-IRA). A Keogh plan is a tax-deferred pension plan. For 2020, you can contribute up to 100% of compensation, or $57,000. A SEP-IRA allows you to contribute 5% of your net earnings from self-employment to your employees (not including contributions for yourself), up to $57,000 for this year. The rules are a little more complicated for your own contributions. See here: irs.gov/publications/p560

Tip #12: Do a Roth IRA Conversion if you expect your future income to be taxed at a higher rate. And unlike Roth Contributions, there is no income limit to convert a Roth, nor is there a cap on the conversion amount.

Tip #13: Sell investments that have declined in value to offset gains from your winners. This is called tax loss-harvesting. You realize losses on the losers and then offset them dollar for dollar against the gains on your winners. And this goes even further than offsetting gains. If your losses are more than your gains, you can use up to $3,000 of excess loss to offset other, ordinary, income. Further, if you have more than $3,000 in excess loss, you can carry it over to the next year. You can carry over losses year after year for as long as you live.

Tip #14: Exercise Stock-Options if you expect your 2021 income to rise. You can recognize the taxable income that is generated by the difference in the current price of your stock and what you paid for it.

Tip #15: Avoid the kiddie tax. In the past, parents would often try to shift the tax bill on their investment income from their high tax bracket to a child’s low bracket. Not anymore! For 2020, the kiddie tax taxes a child’s investment income above $2,200 at the same rates as trusts and estates, which are typically higher than rates for individuals. If the child is a full-time student who provides less than half of his or her support, the tax usually applies until the year the child turns age 24. One caveat: gifting stock to pay college expenses can backfire. If the appreciation sends the child’s unearned income above $2,200, your tax bill might be a lot higher than you bargained for.

So be careful if you plan to give a child stock to sell to pay college expenses. If the gain is too large and the child’s unearned income exceeds $2,200, you could end up paying taxes at the same rates as trusts and estates.

Tip #16: Make sure you’ve spent your money in your flexible spending accounts. The money you deposited escapes both income and Social Security taxes. But if you don’t use it, you lose it. You may need to make some last-minute purchases to ensure the account is cleaned out.

Tip #17: Gifting. You can give $15,000 to each of your heirs without it counting toward the estate tax calculation. The lifetime exclusion for 2020 is $11.58 million per recipient. If you’re married, you can each give that much. Medical gifts and tuition gifts do not count against your lifetime exemption or the annual exclusion. And you can also pay the provider directly for medical and education bills for your family.

Tip #18: Home office deductions. With more than 42% of the workforce currently working at home, according to the Stanford Institute for Economic Policy Research, this question, naturally has come up. Under current law, you’re not allowed to deduct these expenses—unless you’re self-employed. However, things could change if Congress grants additional COVID-19-related tax relief.

Here’s the rule: A home office qualifies as your principal place of business if most of your income-earning activities occur there. It can also be your principal place of business if you use it to conduct administrative or management functions, such as bookkeeping and processing invoices, and you don’t conduct those functions at any other fixed location.

Self-employed expenses that are directly allocable to the home office space, such as repair and maintenance costs, are fully deductible as long as you don’t run afoul of the business income limitation. That rule limits your allowable home office deductions to the gross income from your business activity reduced by:

Other expenses for which deductions are allowed in the absence of business use (such as home mortgage interest and real estate taxes), and business deductions that aren’t allocable to the use of the home (such as advertising and supplies).

You can also deduct indirect home office expenses, including:

- Utilities

- Property taxes

- Casualty insurance premiums

- Homeowner association fees

- Security monitoring

- Depreciation for a residence that you own

- Rent for a rented residence

A percentage of these expenses can be allocated to the home office space based on square footage or the number of rooms in the residence (assuming all the rooms are of similar size). Indirect expenses are also subject to the business income limitation.

Please see irs.gov/credits-deductions/individuals/home-office-deduction-at-a-glance for more information.

Tip #19: Invest in Opportunity Zone Funds. Opportunity zones were designated by the U.S. government in 2017. They are distressed areas that the government wanted to revitalize by inducing investment in housing, small businesses, and infrastructure. They encourage investors with capital gains to invest in low-income and undercapitalized communities.

According to the Tax Policy Center, they offer these three primary benefits:

- Temporary deferral of taxes on previously earned capital gains. Investors can place existing assets with accumulated capital gains into Opportunity Funds. Those existing capital gains are not taxed until the end of 2026 or when the asset is disposed of.

- Basis step-up of previously earned capital gains invested. For capital gains placed in Opportunity Funds for at least 5 years, investors’ basis on the original investment increases by 10 percent. If invested for at least 7 years, investors’ basis on the original investment increases by 15 percent.

- Permanent exclusion of taxable income on new gains. For investments held for at least 10 years, investors pay no taxes on any capital gains produced through their investment in Opportunity Funds (the investment vehicle that invests in Opportunity Zones).

Rules and regulations have changed since 2017. So, please consult your tax advisor for the most recent information. Here is a link to the IRS site: irs.gov/credits-deductions/businesses/opportunity-zones

And this link will help you locate opportunity zones: irs.gov/pub/irs-drop/n-18-48.pdf

If you don’t want to be an individual owner, you can invest in Opportunity Zone Funds that buy older buildings in Opportunity Zones, renovate them at a reinvestment cost, then manage them as rental properties. This link offers information on 218 Opportunity Zone Funds: ncsha.org/resource/opportunity-zone-fund-directory/

Investing in Opportunity Zones can be advantageous for active real estate investors who buy and sell multiple properties that generate revenues, accompanied by higher tax high tax brackets.

What not to Do

Tip #20: Beware the Alternative Minimum Tax (AMT). This tax can turn your ‘hoping for a refund’ into a tax nightmare. So, you have to make sure you don’t trigger it by accelerating your tax deductions too much. The AMT is figured separately from your regular tax liability and with different rules. It was created in the 1960s to prevent high-income taxpayers from avoiding the individual income tax. Folks with high incomes have to calculate their taxes twice: once, under the regular income tax system, and once under AMT rules. They then have to pay whichever tax bill is higher. For 2020, the AMT exemption amount is $72,900 for singles and $113,400 for married couples filing jointly.

Some accelerated deductions, such as state and local income taxes, and property taxes are not deductible under the AMT. Please check with your tax advisor.

Tips #21: Avoid Purchasing Mutual Funds in late November or December. This will help you avoid ‘phantom’ costs. These are two-fold: Capital gains (for the full year) on investments in funds must be paid out prior to the end of the year. So, if the funds you are buying are in the black, you will get a capital gain, which will be taxed—even if you just bought the fund at the end of the year. You will have to report that gain to the IRS, even though you still own the fund. Secondly, when the year-end distribution is paid, the share price of the fund drops on the distribution date by the amount of the payout. So, if a fund pays a $1-per-share capital gains distribution and the share price is $10, the price will drop to $9 on the day after the distribution. The $1 difference is the payout, or taxable amount. You get a double whammy; your share price has dropped by $1 and you are being taxed on that $1.

7 IRS Tips for Avoiding COVID-19 Tax Scams

Do This so you aren’t a Victim

|

And, finally, some special considerations for 2020 and beyond.

Are Stimulus Checks Taxable?

You’ll be relieved to know that you won’t have to pay taxes if you received that $1,200 check from Uncle Sam. And it won’t reduce any future tax refunds you are owed.

What about Taxation on Paycheck Protection Program Funds (PPP)?

That’s an excellent question that is way beyond the scope of this article. It seems the rules are changing daily, so please consult your tax advisor.

What to Expect after the Election?

Well, we’ve covered the tax rule changes for 2020, as well as how to take advantage of all the legal deductions and deferments to which you are entitled. Now, let’s move onto next year and try to decipher how the rules may change as a result of the presidential election.

Let’s first look at the proposals from the candidates.

A Trump Win. During his term, Trump did manage to lower top individual tax rates, from 39.6% to 37%. The standard deduction was also increased, so a lot of folks no longer had to go through their shoe boxes, counting up all their expenses. The child tax credit was increased to $2,000, and the estate tax exemption rose to $11,580,000 for 2020.

After 2025, all of these changes are scheduled to revert back to their previous levels.

If reelected, Trump says he will do this:

- Make the changes permanent,

- Reduce the capital gains rate

- Enact a capital gains tax “holiday”

- Enact a 10% middle-class tax cut, reducing the 22% marginal tax rate to 15%.

A Biden Win. Biden says he will revert all of these changes back to the old tax rate levels. He also would like to:

- Raise the childcare credit for daycare expenses to $8,000 for one child and $16,000 for two or more, with a phase-out of the credit for couples making more than $125,000

- Enact a $5,000 credit for caregivers

- Enact a refundable, $15,000 tax credit for first-time home buyers

- Exclude forgiven student debt from taxable income

- Enact a renter’s tax credit

- Raise the top tax rate back to 39.6% for income over $400,000

- Expand the 12.4% social security tax on earnings over $400,000

- Raise the tax rate on capital gains and qualifying dividends to 39.6% for those with income over $1 million

- Limit the tax benefit from itemized deductions for those with income over $400,000

- Eliminate the stepped-up basis on transfers of appreciated property at death. Currently, instead of paying taxes on the difference between what you paid for an asset and the current value when you transfer it to an heir, the cost basis of the asset is considered the price when you transfer it, thus reducing taxes on any gains.

- Reduce the estate tax exemption to $3.5 million. It is currently $11.18 million for singles and $22.36 million for married couples.

- Eliminate the ability to exchange real estate using the tax deferred section 1031 exchange

- Increase the tax on corporate income from the flat 21% to a flat 28%

Of course, any proposals will have to be approved by the House and the Senate. If the House stays under Democratic control, and the Senate under Republican control, many of these proposals will be nixed. If, however, the Democrats manage to snag control of both Houses, we can expect more tax changes.

Whoever wins, you can count on it—there will be tax reform. And government spending will almost certainly increase. Our infrastructure needs are huge. The American Society of Civil Engineers says we would need to invest $3.6 trillion into U.S. infrastructure by 2020 just to bring our 1.6 million miles of aging water and sewer pipes to acceptable levels. And not much has been done to tackle this issue. As well, healthcare is always on the agenda, and costs are rapidly escalating as our population ages (not counting the drastic needs relating to COVID-19). Renewable energy is likely to require additional government funds, and Social Security reform is on almost every President’s wish list.

Bottom line: someone (you and me) is going to have to pay for it. That will mean certain tax reform. Stay tuned!

Second Careers and Side Hustles

More than 22 million jobs were lost due to the coronavirus. Experts say some 22% of those jobs are gone forever.

As you can see from the following graph, the hardest hit industry is the service economy—especially Leisure & Hospitality. The service sector accounts for 40% of the permanent job losses the country has suffered. According to Yelp, nearly 16,000 restaurants and almost 5,500 bars and nightclubs have closed permanently. That leaves millions of people unemployed, and in industries that will take years to recover.

The government stimulus programs have provided temporary relief. And Congress is working on another stimulus pact but that, too, will be temporary. As those funds run out, unemployed and underemployed citizens need to figure out, “what’s next?”

Fortunately, there are lots of options. None are overnight solutions, but with thought and investigation, it is possible for a new—and even better—beginning.

I have some experience with this—a devastating loss that turned into an entire new career.

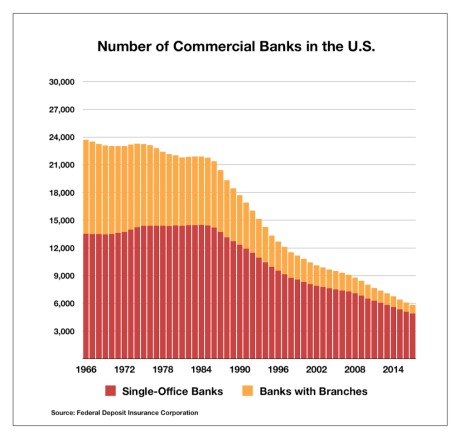

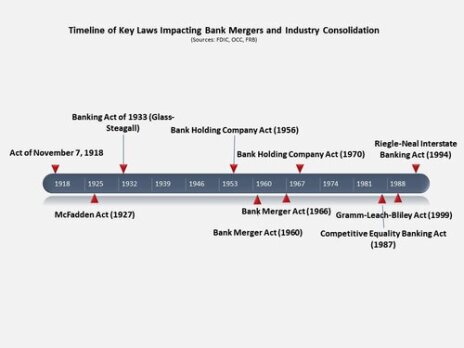

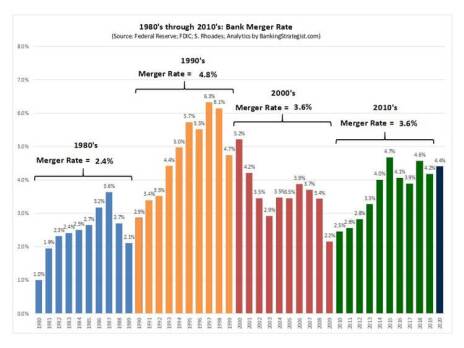

In the early 90s, I was in the banking industry. I was a Vice President of a Florida bank, managing a branch, developing business, and making loans. During that period, mergers and acquisitions were rampant in many industries. That was mostly predicated by the 1990-1991 recession the country was undergoing, as well as a move to deregulate banking, trucking, long distance telecommunications, airlines, and energy, that started in the 1970s.

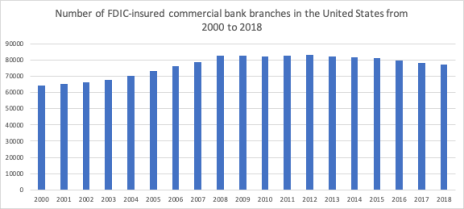

Banking was particularly hard hit, by both the recession and the merger frenzy. In fact, from 1989 to 1994, there were 169 bank mergers. The recession and the mergers led to massive layoffs in the banking industry. And after eight years in the industry, my job was axed when a larger, regional bank bought out my bank. In fact, all of our branch managers lost our jobs as the new owner merged branches which were ultimately run by its own managers.

But the carnage didn’t stop there. In the late 1990s, there were 370 bank mergers. Those mergers led to lots more job losses—accounting for about 11% of the total job losses in 1998 alone. That year, Merrill Lynch & Co. Inc. fired 5% of its workers—about 3,400 people, and Citigroup laid off 10,400 folks, or 6% of its workforce, according to outplacement firm Challenger Gray & Christmas.

So, I had lots of company. Just like the folks who are now without jobs.

However, once I got over my initial shock, I was actually relieved. You see, I hated my job. The industry had changed so much since I began my banking career, and—in my opinion—not for the better. And yet, inertia just kept me working there. So, when the layoffs arrived, I was ready for something new—I just didn’t know what that would be.

Outplacement to the Rescue

I was truly fortunate that the new bank owner provided outplacement resources for those of us who were laid off. That consisted of 3 days, one-on-one, with an outplacement counselor, who tested my skills, and asked me lots of questions about the kinds of tasks that I liked and didn’t like about my all of my previous jobs. He then helped me redesign my resume to pursue those jobs that included most of the tasks I liked to do. The result—a brand new, tailored resume and a list of careers that intrigued me. That experience led to my entry into the investing world.

I haven’t heard much about companies that are offering outplacement services to their laid-off workers today. And since many of the lost jobs are in the service industry—in small mom-and-pop businesses, there probably are not going to be many such benefits.

Fortunately, there are still outplacement companies you can use, although you may have to pay something for their services. And for folks who aren’t sure what their next career step should be, I think a good outplacement service can be invaluable.

Here’s what you can expect from using outplacement resources:

- Self-assessment tests to help you explore new careers and create a new strategy

- Develop marketing materials, including a resume and LinkedIn profile

- Enhance and grow your personal brand so that you and future employers can understand the value you offer to their organizations

- Identify your ideal job and duties

- Develop a networking strategy to expand your job search

- Hone your interviewing skills

- Learn how to negotiate and evaluate job offers

Source: thejub.com

Outplacement Services

And these are some of the top-ranked businesses offering outplacement services, according to thejub.com:

VelvetJobs

Offerings:

- Career Coaching

- Curated Job Matching

- 1:1 Resume Writing and Job Interview Preparation

- Proven Global Solution with Millions of Users

- Job Placement Guarantee

- Affordable, Starting at $500 Per Person

RiseSmart

Offerings:

- Career Coaching

- Resume Writing and Branding

- Professional Branding

- Customized Job Leads

- Dedicated Team of Three Career Professionals

Right Management

Offerings:

- Career Coaching

- Dedicated Account Team From Start to Finish

- Targeted Job Leads

- Access to Local Job Resources

- Resume Writing Assistance

Lee Hecht Harrison (LHH)

Offerings:

- Active Placement

- Career Transition for Senior Executives

- Redeploying Talent Internally

- Advanced Technology

- Talent Sourcing

- Virtual Career Fairs

Mercer

Offerings:

- Career Coaching

- 24/7 Access to Award-winning Platform

- Designed for Adult Learners

- Social Network Integration

- Subscription-Based Model

Finally, the book, What Color Is Your Parachute, by Richard Nelson Bolles—whether or not you use an outplacement service—is a wonderful resource. The book was first published in 1970 and is still in print. I think it is a tremendous resource. You can probably find it in your library, but you can also buy it at any major bookstore or online.

The book—like an outplacement service—focuses on defining who you are, not what you do as the starting point to a new career. It preaches networking as the best way to find a new position, rather than sending out resumes in bulk

Side Hustles

And speaking of who you are, if you are currently facing a layoff—or still have a job but looking to change careers—why not look into a side job (side hustle), one that is custom-made for your talents and interests?

Again, if you’ll indulge me for a moment, I’d like to share how I turned my real estate interests into a second career.

You see, I’ve always loved real estate—I’ve bought and sold numerous properties. And since I was a young woman, I have spent many weekends visiting open houses—to get design/decorating ideas, as well as to learn of new building and technology innovations that I might want in my next home.

When I was in the process of interviewing Realtors to sell my mother’s house after she passed away, the agent asked me if I had considered a real estate career. I thought that was funny, as I had long had many friends in the real estate business, but never really considered it for myself. I was a securities analyst and an investment newsletter writer! What did I want with a real estate career?

But I couldn’t get the idea out of my head. And after careful consideration, I thought, “well, if nothing else, I can save myself some money on commissions when I’m buying and selling my own properties.” And it was an opportunity to learn something new, which I’m always ready to do.

So, I went to real estate school and got my license. That was in 2005; the market was great, and I thought “boy, this is an easy way to make money.” Of course, you can guess what happened when the real estate market crashed in 2007 and we entered a two-year recession. However, that, too, was a great learning experience. I survived, went on to get my broker’s license, managed a real estate company, and then opened my own. Today, real estate is still my second career.

Now, I pretty much fell into that job. But millions of people are making money from their hobbies and special interests. I know several real estate photographers who started out snapping photos with a Polaroid instant camera and who now own cameras, lenses, tripods, and fancy screens that cost in the tens of thousands of dollars—the tools of the trade for a very lucrative career.

A good friend began collecting antiques back in the early 70s. Once he retired from his day job as a graphics artist, he opened an antique store. That led to estate sales, and now, he and his wife own one of the busiest—and most profitable—eBay sites for reselling antiques.

A work colleague who is a successful Home Warranty salesperson is now also driving for Uber and pulls in a couple of thousand dollars per month.

A neighbor’s daughter was a pet groomer for years. Then, she invented a ‘hoodie’ for animals that made the grooming process less terrifying to animals. She now sells that product to companies around the world.

The point is, your hobbies or interests can help lead you into—at the very least—a sideline that is fun and earns money—and maybe offers a new career direction.

Here are some other ideas for side hustles:

Deliver food for someone like Grubhub, DoorDash, or Uber Eats.

Are you a savvy social media user? Lots of companies need help with that. Websites like Fiverr can help you market those skills.

Clean houses. Busy people appreciate a good house cleaner and will pay handsomely for one.

Design logos for someone like 99designs.com. In this world, new small businesses will be popping up, and most people don’t have a clue how to design a logo.

Develop a dog walking service or a mobile pet grooming service.

Become a Mystery Shopper. Some of the highest-ranked companies that you might want to investigate are: BestMark, Second to None, and Market Force.

If you like to cook and have an awesome specialty, why not start a food truck?

Wash and detail cars. This is a much-wanted service, and pretty lucrative. Just about every web site is looking for content, so if you can write, you can probably find someone who needs your services.

Do you have organizational skills? Consider becoming a virtual assistant. Lots of small businesses need help with administrative tasks but can’t afford a full-time employee. Fiverr.com or upwork.com are just two of the companies that market virtual assistants.

Transitioning to a New Career

If you do decide to transition into a whole new career, that may require some additional training. You may need to take some classes at a college or vocational school. If you have a degree, check with your Alumni organization to see what they may offer. Lastly, you can ask a mentor in your chosen field to allow you to shadow him to see if his position/industry may be right for you.

And here are some additional resources:

CareerOneStop: sponsored by the U.S. Department of Labor where you can explore careers and find training opportunities.

ApprenticeshipUSA: also sponsored by the Department of Labor. It has 65,000 available apprenticeships and on-the-job training opportunities.

Microsot Virtual Academy: for free, on-demand technology courses.

Lastly, some state unemployment offices offer free training for career transitions.

Remote Jobs

Some side hustles can be done while sitting at your computer. But as the coronavirus pandemic has shown us, there are many full-time jobs that are also being done remotely.

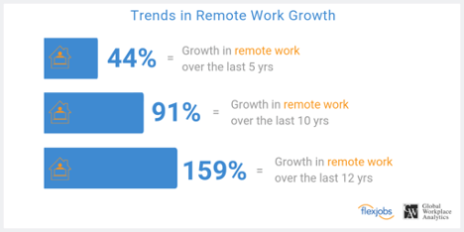

The National Association for Business Economists (NABE) surveyed 12,000 professionals in the U.S., Germany, and India, and found that 40% of them are now working remotely. I’ve talked to countless friends and associates—almost all of whom are working remotely—and many of them tell me that—even after coronavirus—their companies plan to make their remote option available on a permanent basis.

Research firm Gartner found that 74% of the 317 CFOs and business finance leaders it surveyed said they are transitioning their previously on-site workforces to permanently remote positions after the pandemic. And in a recent study, Harvard Business School noted that companies who moved some of their employees to remote workers since the pandemic believe that at least 16% of them will continue to work at home post COVID-19.

The biggest reason: the cost-saving benefits of working from home—for both employee and employer. FlexJobs has reported that remote employees are saving an average $4,000 per year on commuting expenses, office meals, and other miscellaneous costs. And even before COVID-19, Sun Microsystems said remote working was saving it $68 million annually in real estate costs, and both Dow Chemical and Nortel have reported savings of more than 30% on non-real estate costs.

All sizes and types of companies are embracing the remote work trend. Here are just a few of the businesses that have switched to long-term remote work—all names you will recognize:

- Adobe

- Aetna

- Amazon

- Capital One

- Mastercard

- Microsoft

- Nationwide Insurance

- PayPal

- Salesforce

- Shopify

- Square

- Zillow

So, if you think that remote working might be a good option for you, know that from the second to third quarter of this year, there was a 53% rise in companies recruiting remote workers.

And just from July to August, there was a 12% increase in remote job listings.

Some of the top companies that have greatly increased their available remote jobs are: Amazon, Shopify, and UnitedHealth Group. And these 10 companies posted the highest number of remote job listings between March 1, 2020 and September 15, 2020:

- Robert Half International

- Randstad

- Kelly Services

- VocoVision

- Aerotek

- Kforce

- UnitedHealth Group

- Amazon

- Keywords Studios

- Atlassian

And here are the fields in which remote jobs are rapidly growing:

- Computer/IT

- Customer Service

- Accounting & Finance

- Project Management

- Marketing

- Sales

- Mortgage & Real Estate

Some of the job titles include accountant, bookkeeper, customer service representative, developer, teacher, writer, virtual assistant, business development manager, copywriter, marketing manager, and product manager.

Is Now the Time to Start your own Business?

Perhaps you’ve always dreamed of having your own business. I can tell you that starting a business from scratch is not easy. There’s the legal costs and more paperwork than you may want to deal with, to register your business with your state, county, and city; logo and branding development costs; website development; 5-year business plan; start-up and ongoing marketing costs; location and demographic research; various licenses; and lots more.

Is Franchising an Option?

That’s why some folks start their entrepreneurial careers with a franchise. Franchising actually dates back to the Middle Ages (from the 5th to the 15th century), when high church officials were granted a license to maintain order, assess taxes, hold markets, and perform business-related activities. This continued into the Colonial Period (1607-1776 in America). But today’s more modern franchises date back to the beer brewers who licensed their brews to taverns in Germany in the 1840s.

Franchising is simply when a company bestows a license to an individual or group to market its goods or services in a particular territory.

In 2019, there were 773,603 franchises in the United States. And if you can think of a product or service, there is probably a franchise for it. Think about all the franchises that you may frequent: Starbucks, Sally’s Beauty Supply, Midas Muffler, your local UPS store, Molly Maid, and Papa John’s.

They are just a few of the most popular franchises. Jobmonkey.com lists these categories as the franchises with the highest demand today:

- Automotive Franchises: General shops; specialty shops—transmissions, muffler, tires, detailing, rentals, etc.

- Beauty Franchises: Tanning, nail salons, hair salons, weight loss, cosmetics, etc.

- Business Opportunities: franchise opportunities

- Business Services: Medical billing, paralegal services, payroll, taxes, business management, consulting, pre-employment screening, and much more.

- Children Related: Tutoring, fitness, photography, games, and more.

- Cleaning and Maintenance: Commercial and home cleaning, carpet, rental, air duct and HVAC systems, etc.

- Computer and Internet: Technical services, computer games

- Education Franchises: Business coaching, tutoring for children, science programs, and more.

- Financial Services: Credit repair, financing, tax preparation, and more.

- Food & Drink Franchises: Pizza shops, juice bars, coffee shops, restaurants, fast food, and more.

- Health & Fitness: Nutrition, diet centers, fitness classes, senior fitness, drug testing, tanning centers, and more.

- Home Related: Handyman, furniture repair, lawn care, security, remodeling, insulation, roofing, painting, pest control, etc.

- Miscellaneous: Vending, laundry and dry cleaning, transportation, wedding, and event planning, etc.

- Pet Services: Pet food, pet supplies, pet care, and more.

- Photo and Video: Children’s photography, team photography, trophies, DVD rental kiosks, video stores, etc.

- Printing and Packing: Shipping, imprinting, and copies.

- Retail Franchises: Party stores, apparel, convenience stores, electronics stores, hardware, eye care stores, pharmacies, sports stores, telecommunications, and much more.

- Senior Services: Assisted living, senior care, walk-in medical clinics, and more.

- Sports and Recreation: Sportswear, nutrition, fitness centers, children’s fitness, massage and spas, campgrounds, etc.

- Travel Franchises: Cruise planning, hotel reservations, transportation, etc.

They left out the one category that I am most familiar with, and that’s Real Estate. The National Association of Realtor’s website lists 29 real estate franchises.

Here are the top 10 food franchises:

| COMPANY | CATEGORY | 2019 US SYSTEM-WIDE SALES MILLIONS | 2019 AVERAGE SALES PER UNIT THOUSANDS | 2019 FRANCHISED UNITS | 2019 COMPANY UNITS | 2019 TOTAL UNITS |

| MCDONALD’S | BURGER | 40,413 | 2,912 | 13,154 | 692 | 13,846 |

| STARBUCKS* | SNACK | 21,550 | 1,454 | 6,768 | 8,273 | 15,041 |

| CHICK-FIL-A | CHICKEN | 11,000 | 4,517 | 2,500 | 0 | 2,500 |

| TACO BELL | GLOBAL | 11,000 | 1,502 | 6,622 | 467 | 7,089 |

| BURGER KING | BURGER | 10,300 | 1,399 | 7,294 | 52 | 7,346 |

| SUBWAY | SANDWICH | 10,000 | 410 | 23,802 | 0 | 23,802 |

| WENDY’S | BURGER | 9,865 | 1,666 | 5,495 | 357 | 5,852 |

| DUNKIN’ | SNACK | 9,220 | 968 | 9,630 | 0 | 9,630 |

| DOMINO’S | PIZZA | 7,100 | 1,178 | 5,815 | 342 | 6,157 |

| PANERA BREAD* | SANDWICH | 5,925 | 2,751 | 1,202 | 1,023 | 2,225 |

Source: qsrmagazine.com

The costs to open a franchise generally range from $10,000-$50,000. Some are cheaper; some are considerably more expensive.

Here’s a small list of the most popular franchises and how much it costs to buy in:

McDonald’s: $45,000, but you will need a minimum of $955,000 in nonborrowed, personal resources to be considered

Subway: $15,000, but you will need a total investment of $116,600 and $263,150.

Wendy’s: $40,000, and you must have $2 million in liquid assets with $5 million net worth.

Domino’s: $25,000.

Pizza Hut: $25,000, and a budget of $1.3 million to $3 million and a net worth of $1 million with $360,000 in liquid assets.

Dunkin Donuts: $40,000 to $90,000 start-up fee, initial investment of $228,621 to $1,692,314, and $250,000 liquidity and net worth of $500,000 per unit.

Source: thebalancesmb.com

But you don’t need that much money for the following franchises, according to franchise.com:

- PostalAnnex: $70,000

- Allstate Insurance; $100,000

- Claim Tek Systems (medical billing): $20,000

- ServiceMaster Clean: $36,300

- Glass Doctor: $35,000

- Huntington Learning Centers: $65,000

- AmeriSpec Home Inspection Services: $22,000

- Furniture Medic: $25,000

- Century 21 Real Estate: $25,000

- Crye-Leike Realtors: $9,500-$25,000

- Re/Max: $10,000-30,000

- United Country: $10,500

If I haven’t scared you away yet, keep reading for the advantages and disadvantages of owning a franchise, according to thebalancesmb.com:

Advantages

- Low failure rate. Statistics show that franchises have a much better chance of success than independent start-up businesses.

- Business assistance. When you buy a franchise, you receive all of the equipment, supplies, and instruction needed to start your business. In many cases, you receive ongoing training and help with management and marketing.

- Buying power. Your franchise will benefit from the collective buying power of the parent company.

- Star power. Many well-known franchises have national brand-name recognition.

- Profits. A franchise business can be immensely profitable.

Disadvantages

- Rules and guidelines. The main disadvantage of buying a franchise is that you must conform to the rules and guidelines of the franchisor.

- Ongoing costs. Besides the original franchise fee, a percentage of royalties from your franchise’s business revenue will need to be paid to the franchisor each month.

- Ongoing support.

- Buying into a well-known franchise is costly.

- Buying a little-known, perhaps inexpensive franchise can come with risks. Just because a business is offering franchises is no guarantee that the franchise will be successful.