Year to date, the S&P 500 is off roughly 5% while the growth-heavy Nasdaq is off closer to 8%. If you’re invested in some of the 2021 pandemic-recovery darlings you may have individual positions that are down (and hopefully sold) 30%, 50% or even more (Peloton (PTON) is down a staggering 80% in the last year).

If you’re holding stocks with huge double-digit losses, cutting bait is usually our recommended strategy for addressing the position. But what if you’re interested in managing broader market risk?

Or what if you’re overall bullish on a portfolio for the long term but are worried about short-term gyrations?

In those instances, using options to protect your portfolio (particularly relevant now, given how the year has started) can be an important strategy. And to get there, let me first tell you about something that happened to my brother a few years ago.

“Everything I’ve Owned Is Gone…”

One night, my younger brother was awoken in the middle of the night by police cars honking their horns and instructing residents over loudspeakers to evacuate the neighborhood. My brother grabbed his dog, jumped in his car and raced to safety.

Days later, when the California wildfires had died down, he returned to his house in Santa Rosa to find his home was now ash, and his other cars were destroyed.

Here are photos of what was left of his former home and car:

My brother had lost everything, but he did have home and auto insurance, which financially protected him from this life-shattering event (he’s totally fine today).

Home and auto insurance allows us to sleep at night, knowing that if a disaster hits, we’ll be able to withstand the financial loss.

And there’s a way to get similar insurance and peace of mind on your investment portfolio—through put options.

Buying a put option is a bearish options position, and can be used to hedge a portfolio. For example, here is an article I found years ago on the Chicago Board of Options Exchange website that helps calculate how to Hedge a Portfolio.

(Please note that this article is using the SPX. When we trade the S&P 500 at Cabot Options Trader, we trade the SPY, which is worth 1/10th of the SPX. For example, today the SPX is trading at 4,662, while the SPY is trading at 466.2. Also note, because this article is years old the SPX prices are quite outdated.)

Calculating Index Contracts to Hedge a Portfolio

Stock prices tend to move in tandem with the overall stock market as measured by the S&P 500 ETF Trust (SPX). The 500 stocks that comprise the S&P 500 Index represent almost 85% of the stock market value in the United States. Therefore, the index is an excellent reflection of the overall stock market. If an investor owns a portfolio of stocks and is concerned about a near-term downward move in the overall market, purchasing the appropriate SPX put options could be a desirable alternative to hedging each stock individually.

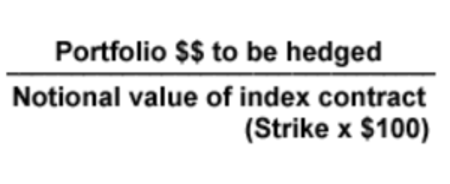

Determining the number of contracts to use to hedge a portfolio is a fairly simple process using the following formula:

Each SPX option represents $100 times the strike price. For instance, if an SPX put with a strike price of 1250 is utilized, it would represent $125,000 of market value (1250 x $100). So, an investor with a stock portfolio valued at $500,000 would purchase 4 SPX 1250 puts ($500,000 / $125,000) to hedge the portfolio.

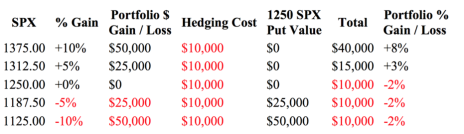

For example, consider an investor who has a diversified stock portfolio valued at $500,000 and is concerned about a market correction of 10% over the next 30 days. With the S&P 500 Index quoted at 1250, a correction of 10% would result in the S&P 500 trading at 1125.00. The investor could choose to purchase four 30-day SPX 1250 puts quoted at 25.00 ($2500 per contract) that would have a total cost of $10,000 or 2% of the value of the portfolio.

The previous table shows the dollar and percent results of this strategy based on the S&P 500 index at a few levels upon option expiration. Because at-the-money SPX option contracts are used for hedging, the maximum potential loss is equal to the 2% cost of hedging. Two percent of performance is sacrificed on the upside if an unanticipated market rally occurs. A payout comparison between a hedged and un-hedged portfolio appears in the payout diagram below.

Here is another example from the CBOE website that may be a bit easier to understand:

An investor has a portfolio of mixed stocks worth $2 million that closely matches the composition of index XYZ. With the current level of index XYZ at 100, this investor wants to buy XYZ puts to protect the portfolio from a market decline of 4% over the next 60 days.

The investor might determine the number of puts to purchase by dividing the amount to be hedged (the $2,000,000 portfolio) by the current aggregate value of index XYZ (100 x 100 multiplier = 10,000). $2,000,000 / 10,000 = 200, so the investor purchases 200 XYZ puts.

To establish the protective put position with the downside protection needed the investor chooses an XYZ put strike price 4% below the current XYZ level of 100, or the 60-day XYZ 96 put. The XYZ 96 puts are purchased for a quoted price of $0.75, or $75 per option. 200 puts are therefore bought for a total of $75 x 200 contracts = $15,000.

XYZ Index at 100

Buy 200 XYZ 96 Puts at $0.75

Why You Need Put Options

I hate paying for home insurance and put options on my stock holdings as much as anyone. However, given the potential for a wildfire or a significant market decline (like the one happening right now), I understand that paying for insurance is often the best way to protect both your home and portfolio.

Do you use put options as part of your investment strategy? Tell us about some put option trades that have worked particularly well for you.