You’ve probably heard the phrase that “time in the market is better than timing the market.” Mathematically it’s true, but the cherry-picking behind that math does a lot of heavy lifting.

In a recent memo, Howard Marks, of Oaktree Capital, highlighted data from JP Morgan Asset Management’s 2019 Retirement Guide showing that, had you missed the 10 best days in each trading year between 1999 and 2018, your return would have been only 2% annually vs. a 5.6% return for the S&P 500.

If you missed the best 20 days, you would have generated no return at all.

This implies that you cannot time the market. Buy-and-hold investing is the only way to go, it suggests.

After all, if you missed the 10 best days in the market, you would have generated only 2% per year on average. If you had simply bought and held, you would have generated 5.6% on average. That is a massive difference, especially with the benefit of compounding returns.

This advice is “common knowledge” among “experienced” investors.

But the “if you missed the best 10 days in the market” advice is, at best, misleading, and at worst, just wrong.

Let me explain.

Typically, the best days in the market and the worst days in the market are clustered together.

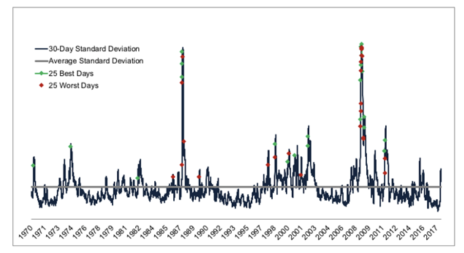

A Wealth of Common Sense created a great chart displaying this pattern.

The market’s biggest up and down days are clustered around highly volatile, down-trending markets.

Therefore, it is intellectually dishonest to assume an investor would have somehow missed the 10 best days in the market without also missing some of the 10 worst days in the market.

Let’s look at a more realistic analysis.

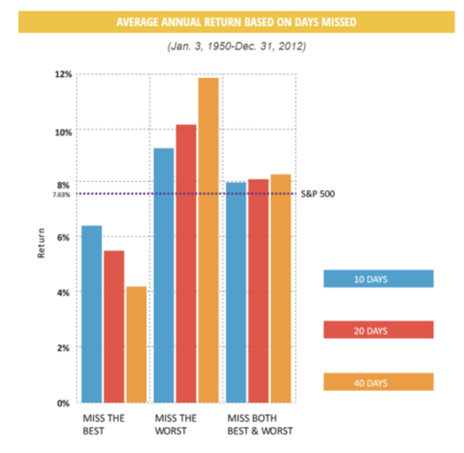

Hepburn Capital Management found that you would have generally outperformed the market if you had missed BOTH the best days and the worst days in the market as shown below.

Bank of America and CNBC reached the same conclusion:

The chart above is titled, “The difficulties of trying to time the market,” but I think it should be titled, “The benefit of trying to time the market.”

Why?

If you had bought and held the index, you would have generated a 17,715% total return. But if you had missed the best days and the worst days, you would have generated a 27,213% return.

The point of this article is not that you should or shouldn’t try to time the market, but to point out that the conventional wisdom pushed by the asset management industry is wrong.

The most important takeaway for investors is that it’s important to have a strategy and stick to it.

I personally focus on micro-cap stocks in my advisory, as they tend to significantly outperform larger stocks. But they are less liquid and more volatile. That’s a trade-off that I’m willing to make.

But there are many ways to make money in the market. You can be a growth investor, a value investor, a momentum investor, a market timer, a proponent of buy-and-hold investing, or something entirely different. Odds are you will be successful if you stick to your strategy through good times and bad.

Have you had more success with buy-and-hold investing or market timing? Tell us about your wins and losses with either approach in the comments below.