The (Cash) Balancing Act: Winning Investing Strategies for Times of Inflation and Volatile Markets

The Dow Jones Industrial Average closed May 18 down 1,164.52 points. Rates are rising, and inflation is cutting into our discretionary funds. It’s disheartening, for sure, but don’t give up! There are ways to maximize your portfolio and minimize your risk during these uncertain times. Just read on for some ideas that will help you navigate these uncertain times.

Should We or Shouldn’t We … Bail Out of the Markets?

I wouldn’t blame you if you looked at the markets since February and thought, “why am I still hanging in there?” The following chart of the Dow Jones Industrial Average since the first of the year would surely weigh on any investor’s mind.

Add to that the specter of rising rates. As you can see in the following graph, the Fed Funds rate has increased from 0.08%in January to 1% today, pushing up mortgage rates to over 5%. And that won’t be the end of it. The Fed is expected to boost rates five more times before the end of the year: two half-point hikes and three quarter-point increases, bringing the federal funds interest rate to 2.5% by next January.

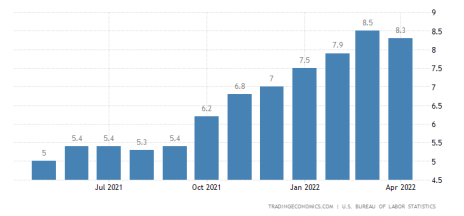

And then, we have inflation. Now more than 8%, inflation gurus expect the rate to decline to 6.3% by the end of this year, and fall to 3.0% by the close of 2023.

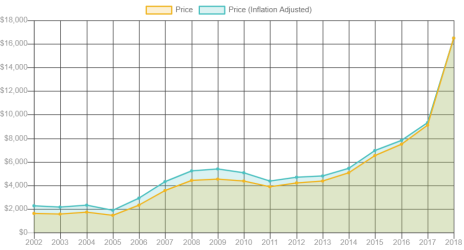

But in the meantime, as stocks have retreated from their highs at the beginning of the year, investors are feeling the squeeze of falling portfolios. At the same time, rising rates and inflationary pressures are making the price of everyday items soar, as denoted in the chart below.

The result: a two-pronged sword with less money input from investing and more money output from rising expenses.

Avoid These 2 Strategies: Cash Only and Market Timing

So, back to my question, is now the time to get out of the market and conserve your cash? My answer is a resounding no!!!

There are two major problems with holding cash: 1) Your cash doesn’t make you any extra money. The only way to make your cash grow is to invest it in something: stocks, bonds, gold, artwork, even a lousy money market fund (which still pays less than 1% annually); and 2) No one has ever proven that they can properly time the market so that you get in at just the right time (the bottom) and exit at the peak of the bull run (the top). So, if that’s your shtick, you can plan on a lot of anxiety and extra trading costs, which will just result in lower returns.

If you don’t believe me, I can cite numerous financial studies that prove it. But one of the best examples is a recent study done by Charles Schwab Corporation. Here, I’ve paraphrased the company’s findings:

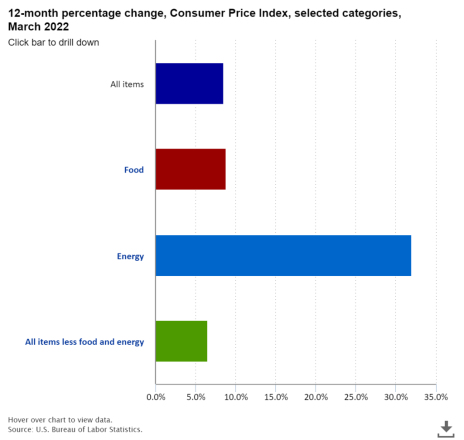

Schwab offered an example of five investors, who invested $2,000 each year, and plied their differing strategies over a period of 20 years (2001-2020). Here they are:

Investor #1 was a perfect market-timer (impossible, but fun to think about!). He got in and out at just the perfect times, cashing in at the highest points, and reentering at the lowest points. His results: $2,000 turned into $151,391.

Investor #2 didn’t dilly-dally; she put her money to work as soon as she got it. She accumulated $135,471—only $15,920 less than the perfect market timer.

Investor #3 decided that dollar-cost-averaging was going to be his strategy. That means he decided to divide his money up and buy in smaller amounts at regular intervals, regardless of price. He turned his investments into $134,856 at the end of 20 years.

Investor #4 was like most investors—a very bad market timer, getting into and out of the markets at just the wrong times. Yet, she still managed to end up with $121,171 with bad timing.

Investor #5 elected to stick his head in the sand, and just put his money in the bank. I hate to tell you this, but his annual $2,000 contributions amounted to a measly $44,438—after 20 years!

The moral of this story, as you can see in this graph, is that market timing isn’t the best strategy, but it is almost three times better than hoarding your cash. There’s a big opportunity cost in holding cash: the cost that could be realized if your money was utilized in a better investment. Now, just think if you were investing more than $2,000 per year—the gains would be incredible!

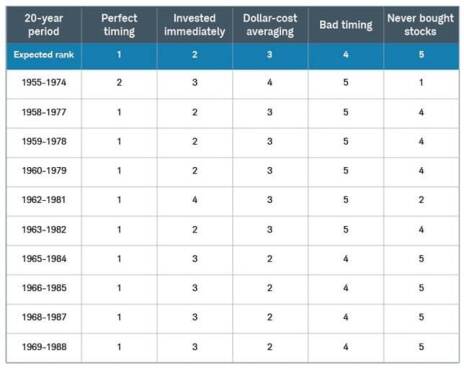

This is just a piece of Schwab’s total analysis in which the company reviewed a total of 76 separate 20-year periods. The results were essentially the same as these five scenarios.

As you can see, only 10 of 76 periods had unexpected rankings. That’s a pretty good reason for staying invested, in my opinion.

Alternatives to Individual Stocks

Now, I’m still a lover of equities, but I don’t think we’ve seen the bottom in the market yet, and although I think there are hundreds of stocks that have been unfairly beaten down this year, I’m just not ready to start throwing my money at them. But I do want you to stay in the market, so here are some ideas of the areas in the market where you may want to park some of your money until this rabid market volatility abates. I want to maybe “expand” your investment thinking to some alternative investments that may be right for your portfolio. These are all available via investing in ETFs, so if you’re a little skittish on individual equities, one or more of these ETFs might just work for you.

Commodities. Normally, when investors worry, the price of gold rises. However, this is a weird market. As Clif Droke, Chief Analyst of Cabot SX Gold & Metals Advisor recently told his subscribers, gold is faltering due to the dollar’s strength. But fortunately, there are other metals and commodities that have shown attractive strength since the first of the year.

Take for example, lithium, in high demand for electric vehicles.

The lithium ETFs are not faring as well in this latest market selloff, but they’ve held up pretty well, compared to some sectors of the economy. However, diversified commodity ETFs such as the iShares S&P GSCI Commodity-Indexed Trust (GSG), have excelled. This ETF is up 42.96% since the beginning of the year.

Wheat—mostly due to the Russia-Ukraine war and inflation—is also trending significantly higher. The Teucrium Wheat Fund (WEAT) is up 67.25% for the year. And, of course, energy continues to be the number one investment gainer. The United States Natural Gas Fund, LP (UNG) is up 127.7%, year to date.

Jeffrey Hirsch, editor of The Stock Trader’s Almanac, recently recommended that investors should consider Consumer Staples and Utilities. The Utilities Select Sector SPDR Fund (XLU) is up 1.13% so far in 2022 and the Consumer Staples Select Sector SPDR Fund (XLP) is down 0.44% (compared to a loss of 22% for the S&P 500.

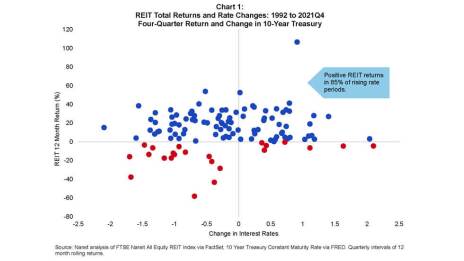

Additionally, you may consider investing in the commodity of Real Estate, via Real Estate Investment Trusts (REITs). I know; you’ve probably heard to “stay away from REITs when interest rates are rising.” But that’s an old wives’ tale. The following chart illustrates that, in reality, REITs have, collectively, shown a positive return in 85% of periods of rising rates.

A recent study by NAREIT noted that “historically, REITs have performed well during periods of rising long-term interest rates with average four-quarter return in periods with rising rates of 16.55% compared to 10.68% in non-rising rate periods from the first quarter of 1992 to the fourth quarter of 2021.” And that’s not all; the same study showed that “REITs outperformed the S&P 500 in half of the periods when Treasury yields were rising.”

But you do need to distinguish between the types of REITs that do well when rates are on the upswing. And that would not be residential mortgage REITs. Tied to mortgage rates, they tend to be short of cash during these phases. However, commercial mortgage REITs are another story. That’s because they tend to borrow at fixed interest rates and lend at variable rates, so their borrowing costs remain fixed, but the lending income rises as rates go up. One caveat, however, is that investors should be aware that rising rates can increase default rates which can lead to dividend cuts. And even more importantly, COVID has negatively impacted the commercial real estate business, with so many folks now working remotely. The jury is still out as to whether we will soon see a glut of commercial real estate for sale. Consequently, I wouldn’t be looking to dive into those REITs.

Hotel REITs are the most volatile as compared to the S&P 500, which makes sense, as they are also very economically dependent, but the least volatile when it comes to yield, and that’s because their cash flow is short-term. As long as the economy improves, hotel REITs should as well, as consumer discretionary buying rises. Of course, the “recession” term is being bandied about right now, and if that were to happen, the hospitality sector will suffer. But right now, most experts aren’t betting on a recession, and that makes REITs such as Hersha Hospitality Trust (HT) stand out.

Net Lease REITs show the most volatility to yields, as their long-term contracts—while inflation-adjusted—may not keep up with quick rate increases, but they are the least volatile, compared to the S&P, because they have long-term, steady cash flow. But these REITs have been known for dividend safety, good steady income, with decent rates, so gradual rate increases shouldn’t bother them too much. A good example is W. P. Carey Inc. (WPC), which has held up very well in this market turmoil.

Stocks That Pay Dividends Are Great During Economic and Market Uncertainty

The average dividend yield in the S&P 500 Index is 1.37%. I love dividend stocks! Now, I wouldn’t go out and buy stocks right now just because they pay dividends, but if you already own some dividend payers, and you have several years before you need to cash in for retirement, just hold onto them (if they are good stocks!) You’ll be glad you did, as the cash flow in your portfolio will help mitigate any losses in your growth stocks.

Companies across the globe, in the past two years, have been raising their dividends, as you can see from this map. And that’s great for investors in uncertain times!

The one issue you will need to be aware of during this volatile time, is that earnings will probably not be growing at the very attractive rates that we’ve seen the last couple of years, and that could affect your dividend-paying stocks—especially the ones that provide high dividend yields. So, it’s imperative to keep an eye on the fundamentals of the companies in your portfolio so that you don’t get surprised by dividend cuts or eliminations.

Don’t Cash in Your IRAs or 401(k)s!

And speaking of long-term investments, don’t do like some of my friends who cashed in their entire retirement accounts in 2008 and 2009. Certainly, you need to review your holdings and perhaps move them into some more conservative investments, if need be. But the market always snaps back, and you will lose an inordinate amount of your retirement monies if you panic.

Allocate for Risk and Time

Of course, you need to allocate your portfolio—at all times—based on your personal investment risk and time to retirement. The older we get, most of us need to be more conservative with our funds, but most advisers would never tell you today to hold only fixed income investments (like they did our parents). If you do that, you will quickly fall behind your ultimate retirement funding goals.

It’s certainly possible not to hold a single equity in your portfolio as you head toward retirement. You can accomplish your goals with mutual funds and ETFs, if that’s more to your liking.

You could just buy ETFs that track the broad indexes, but, honestly, what fun is that? You’ll come close to market returns, but you won’t ever beat the market. You can do better!

To make it even easier for you, the financial industry offers Target Date Funds in which you put your money in a fund that targets your retirement date. There are all kinds of these funds. And according to Morningstar, 80% of 401(k) plan participants are invested in these “set it and forget it” funds. But it’s never a good idea to “set it and forget it.” Even if you elect to buy such a fund, you still need to monitor it and make sure it’s investing in ideas that work with your ultimate strategy.

And while we’re on this subject, let’s look at investment allocation by age. I love the name of this chart “Proper Allocation…”. What the heck does that mean? It’s actually a suggested allocation, but that is totally dependent upon your personal financial situation. You’ll need to think about the following questions to determine that:

What’s your risk aversion factor? Can you sleep at night when your stocks take a 10%, 30% or 50% dive? The less sleep you get, the more risk averse you probably are.

How much money do you have right now and how much do you think you’ll need at retirement? In the old days, advisors told folks to plan a 10-20 year retirement, spending about 4% per year of your retirement funds. That 4% per year needed to last as long as you do. Today, clearer and smarter minds have found that you really need more than 4% per year. Your expenses in retirement don’t actually decline that much. Sure, you may not have a mortgage or car payment, but your medical expenses will most likely rise—quite a bit too. And most of us aren’t planning to sit around and twiddle our thumbs in our golden years. Heck, no! We want to travel, which means more money, too. And then, many folks want to help their children and grandchildren pay for college, cars, and even homes. So, you see what I’m getting at.

The following chart is just a guideline.

Bottom line, it just means for most of us, that we need to get a bit more risk averse as we age.

Most advisors look at three primary stages:

Risk-Loving up to Age 35

You have plenty of time until retirement. You’re starting to make some decent money, so why not be a bit speculative? If you don’t take a flyer once in a while, your portfolio will probably not be maximized by retirement age. At this age phase, individual stocks will generally help you do that.

Risk-Neutral from Ages 36-60

Yep, now you have the mortgage, and most likely, children and then grandchildren. You’ve probably accumulated a few bucks, too, and you want to make sure that your wealth continues to grow, but also maybe take fewer risks with your money.

In this age phase, you might consider tipping your portfolio a bit more toward some indexes and broad funds and ETFs.

Risk-Averse from Ages 61-Death

Your nest egg should be substantial by now, so you can become even more risk averse. This is the time to begin enjoying the rewards of a life well-lived. That doesn’t mean you can’t “take a flyer” every now and then, but those should be rare instances.

How to Protect Your Portfolio During Market Volatility and Downturns

Now that I’ve given you some ideas on stocking up your portfolio to help withstand market volatility, and to plan for later stages in your live, let’s talk about how to protect your portfolio along the way.

Listen, I was front and center when the market dived to its lowest point of the 2007-2009 recession—the Dow hit 6,433.27 in 2009. And I exulted in the subsequent (mostly up) ride from then until COVID. But that blip in the markets really didn’t last that long, and we soon soared to almost 37,000 points on the Dow Jones Industrial Average.

Here at Cabot, we are not fortune tellers. But I pay close attention to both Mike Cintolo and Tim Lutts who are experts at interpreting market signals. They are telling their subscribers to remain defensive right now, and I think they are right.

One thing I know is that investors love to buy stocks and hate to sell them. When the market is in an upward trend, we often become so excited that we begin to buy stocks, willy-nilly, with no thought to a balanced portfolio. And when the market drops, we become frozen, not knowing whether we should continue to buy more, to take advantage of the lower prices, or just bail out and sell everything. The result: When under pressure, investors will generally make exactly the wrong decision!

So, it just makes sense to realize that what goes up must come down, and while our newsletters are all about finding fabulous—and profitable—recommendations for our readers, we would be remiss if we didn’t also offer ideas to protect your portfolios, in times of pullbacks or excessive volatility.

Bottom line: You don’t have to make the same mistakes. Instead, with a little thought and planning, you can create an all-weather portfolio.

Planning is no guarantee that you won’t ever lose money because there are no guarantees in the stock market. But there are steps you can take to minimize your losses and also maximize your profits.

Step 1: Set Price Targets

Set a price target the day you purchase your stocks. Your target should be based on the P/E of your stock, multiplied out by expected future earnings. I recommend that you at least think about what price your stock can achieve within 18-24 months. And that should at least be a 30-50% gain. If it doesn’t have that potential, keep looking.

Going forward, when the stock hits your target, reevaluate it and determine if it has the ability to continue double-digit price gains or if you would gain more by cashing in now and using those funds to purchase a different stock with more potential.

When I speak at Money Shows across the country, I am frequently asked about how I set my target prices. If it’s not the most common question I get, it’s certainly up there in the top five.

First of all, I can’t emphasize too strongly that it is essential to set a target at the time you buy a stock. If you don’t, then how the heck do you know when your stock has appreciated enough to sell it?

Let’s make it simple. Here’s an example of how to set a price target:

Price of XYZ company = $20

Expected earnings per share = $2

P/E = 20/2, or 10

Let’s say the company’s earnings have been increasing at a 20% annual growth rate for the past five years. So, its earnings would look like this over the next 3 years:

Year 1: 2.00 x a 20% increase = $2.40 per share

Year 2: 2.40 x a 20% increase = $2.88 per share

Year 3: 2.88 x a 20% increase = $3.46 per share

So, at year 3, your company is earning $3.46 per share. Now, if its P/E ratio remains the same (10), the projected price of the shares can be found by mere substitution into the P/E equation, and solving for P:

P divided by E (3.46) = 10. So, a little algebra later, P = $34.60. Wow—that’s a 73% gain! Most investors would be tickled pink by that.

However, should you believe that the company’s earnings may grow even faster than 20% annually, due to some event such as a tremendous new product, gains in market share, new markets, etc., or that one of those occurrences might drive the company’s price greater than $34.60 (even without the requisite earnings growth), you would be even happier.

Step 2: Set Stop-Losses

Set a stop-loss limit the day you purchase your stocks. A stop-loss is simply an order—either formally placed with your broker—or a “mental” reminder—to sell your stock when it reaches a certain price threshold.

The actual percentage you set is up to you and should be based on your personal risk tolerance. Very conservative investors may want to place their stops at a level that is 10%-15% below their purchase prices. Moderate risk takers would probably feel most comfortable setting stop losses at 15%-25% below their buy prices and aggressive investors who have a longer time frame and the ability not to panic at short-term losses, may choose to set stop-losses at 25%-35% of their purchase prices.

I’m a big believer in stop-losses for one simple reason: If your stock doesn’t go the way you think it will (up in most cases!)—for whatever reason—this little tool will limit your potential losses.

In a bull market, you may want to use trailing stops—stop-losses that continue to move up as your stock rises—rather than stops based on the absolute value of your purchase price. A trailing stop is more flexible than an absolute stop, as it allows you to protect your portfolio in case the price of your stock declines. But as the price rises, the trailing stop is based on the new price, helping you to lock in your gains and reduce your overall risk.

I want you to know that there are plenty of advisors who don’t believe in stops. But I believe that wise investors should use all the valuable tools at their disposal. And I have found that stop-losses have worked very well for my subscribers and are great tools for stemming potential losses.

Step 3: Diversify

Diversify your portfolio to reduce your overall portfolio risk, as well as volatility. That means creating a portfolio with non-correlated assets, which, theoretically, results in assets that react differently to market catalysts. When market action causes some of your assets to decline in value, others should rise, effectively providing protection against your entire portfolio declining at the same time.

Consequently, you should own small-, mid- and large-cap stocks; companies in different sectors; and value and growth stocks.

And while you may think you are properly diversified because you may have 10 different technology stocks that operate in totally different segments, remember that they are all still technology stocks—companies that tend to do very well when the economy is steaming ahead and folks have plenty of money to upgrade, but don’t fare as well in a stumbling economy.

And don’t forget about fixed income investments. In rising rate cycles (like the one we are now in), bonds can be attractive.

Step 4: Rebalance and Reposition Your Portfolio

This is a step that so many investors ignore—to their peril. During the tech boom of the early 2000s, technology companies were chased to the stratosphere by investors who had no idea what they were buying; they just saw triple-digit overnight gains and jumped right in. But the signs of the bust were everywhere. I saw price-equity ratios as high as 1,500.

And pay attention to the sectors in your portfolio, too, and load up on steadier stocks in more mundane industries during periods of volatility, while trimming your positions in riskier assets. Taking a flyer on speculative stocks is often a lot of fun, but it’s best to keep those to a small portion of your holdings—especially during erratic markets.

Step 5: Consider Put Options

Consider buying put options as insurance that any unrealized gains you have don’t turn into losses. These options provide protection by betting that the underlying stock will decline. They give you the right (not the obligation) to sell the stock at a certain price at a specific future time. Most investors don’t use options because they can be expensive and complex and have a reputation as risky. Also, employing options requires a pretty active style of portfolio management that many investors do not want to undertake. But simple options can help protect your portfolio on the downside and also improve your returns in a bull market.

If you would like more information/education about options trading, here at Cabot, Jacob Mintz has been offering some excellent options advice for a number of years—to both beginning and expert options investors. His newsletters are Cabot Options Trader, Cabot Options Trader Pro, and Cabot Profit Booster.

For most investors, following these five steps will help you create a portfolio that will thrive through normal up and down market cycles. Certainly, an undiversified portfolio can give you tremendous gains—if you are lucky enough to choose only “homerun” stocks. But realistically, no one picks winners all the time. And creating a portfolio with just one type of company or sector—no matter how promising—is a recipe for failure in the long term.

The old “buy and hold” days are gone forever. And even if you pay for expert advice, it’s ultimately up to you to monitor and rebalance your portfolio for the seasons of market ups and downs. You can do it!