Remember when COVID fees like disinfection charges, personal protection equipment fees, and other miscellaneous charges were added on to restaurant tabs? One of the steepest charges was the “temporary COVID-19 Recovery Charge” of up to 10% of total bills in New York City, approved by the New York City Council. During the pandemic, these fees were life-saving tactics for many businesses—restaurants in particular—that saw their sales drastically erode.

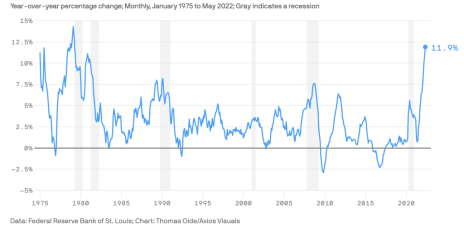

Those excess fees mostly disappeared as restaurants reopened and customers returned. Now with 40-year-high inflation causing both supply and labor costs to soar, menu prices are creeping up.

And lately, on top of those inflated food prices, we have the return of “special fees” at restaurants. But food establishments aren’t the only merchants or service providers that are levying these “taxes.” Honestly, although I realize that inflation is taking a big chunk out of our pocketbooks right now, I was even taken by surprise by the new—and sometimes, hefty—extra fees I’m seeing that directly affect both consumers and businesses.

Changes in prices for select goods and services, April 2021-April 2022

| SELECT GOODS AND SERVICES | PRICE CHANGE |

| Source: U.S. Bureau of Labor Statistics | |

| Gas | 43.6% |

| New cars | 13.2% |

| Groceries | 10.8% |

| Clothing | 5.4% |

| Housing | 5.1% |

| Health care | 3.5% |

Source: U.S. Bureau of Labor Statistics

Consumers Are Taking Direct Hits to Their Pocketbooks

Restaurants: According to the Food and Agriculture Organization of the United Nations (FAO), April’s world food commodity prices rose 29.8% from a year ago, primarily due to the Russia-Ukraine war’s impact on staple grains and vegetable oils.

The National Restaurant Association reports that wholesale food prices have gone up nearly 18% in the past year—the biggest rise in almost 50 years! At the same time, restaurants have increased their menu prices. Bloomin’ Brands, owner of Outback Steakhouse, Carrabba’s and Bonefish Grill recently announced across-the-board food price increases of 5%. Shake Shack, which normally increases its menu prices by about 2% per year, has—so far this year—pushed up prices by 6-7%. The average increase for the industry now stands at 7.2%.

The great job market has also put pressure on restaurants, with labor costs increasing by 13.2% last year. Then, add in the heftier merchant transaction fees levied by Mastercard and Visa, and it’s a certainty that we have to expect these costs to be passed on to consumers.

And, indeed, they are. According to point-of-sale software developer Lightspeed, “the number of restaurants adding service fees rose by 36.4% from April 2021 to April 2022.” And the fees aren’t lightweight. For example, Romano’s Macaroni Grill recently added a $2 “temporary fee” to its restaurant tickets. Sometimes, this surcharge shows up as a higher delivery fee, can be called a “kitchen appreciation” fee, or may be directly tied to certain menu items that have higher costs.

What you can do:

I don’t know how much leverage you may have with these fees. You can ask the restaurant to remove them (especially if you are a regular diner). But even if that’s not likely, just make sure you review your receipt carefully to ascertain exactly what you are being charge.

Groceries:

Grocery costs are up 10% year over year (as of March 2022), according to Bureau of Labor Statistics data. All food categories increased in cost, but some foods have been hit harder by inflation: Meat costs were up 14.8%, fruits and vegetables 8.5%, and pasta and rice 9.3%.

Unfortunately, food prices aren’t likely to stop rising anytime soon. The U.S. Department of Agriculture (USDA) March 2022 Price Outlook predicts grocery prices will increase more before the end of the year.

What you can do:

Create a food budget, and then compare it to the USDA’s food spending plans. The website lists a variety of plans—thrifty, low, moderate, and liberal. For example, the thrifty plan will feed a family of four for about $900 a month, and in the liberal plan, that family would spend about $1,200 per month. That sounds like a lot to me, but I’m a family of one, and I spend about $150-$200 per month on groceries. Of course, I do eat out at least once or twice a week, so my total food costs are higher.

Develop a meal plan. You don’t have to be totally rigid, but if you plan your meals out for a week, you’ll know exactly what you need to buy at the grocery store. I love to entertain, and my big party for the year is my annual cookie exchange at Christmas. I usually invite about 30-40 women who each bring two dozen cookies. And I make around 15 dishes—finger foods and seasonal desserts. Believe me, that’s a lot of ingredients! And the only way to make it work is to write down all the ingredients I need and buy them all at once. But you can certainly do this on a smaller scale—using weekly menu plans.

Shop with a list, and stick to it; otherwise, you’ll be tempted to load up your basket with a bunch of impulse buys that will quickly cause you to overspend. And, it goes without saying, don’t shop on an empty stomach!

Buy store brands instead of popular labels. Look, during the first few years I spent as a brokerage analyst, I traveled the country and had the opportunity to visit several food manufacturing plants. And in several cases, I witnessed the same food product travel down an assembly line, with half going to the private label packaging line, and the other half designated for brand-name packaging. It’s not the case with every item, but if you are buying canned vegetables to put into a casserole, go with the cheaper brand. No one will notice!

And with the cost of gas rising daily, it may not be smart to drive 25 miles to shop the sales at the various grocery stores in your area. But if they are congregated in a condensed travel area, I say, shop the sales! And be aware, all of the sales may not be advertised. In my neighborhood, I just happened upon a great meat sale at my local Kroger store; since then, I’ve found that the store offers unadvertised meat sales every Sunday (and I’m talking about great sales; for example, two filet mignon steaks for $12.99!).

Use coupons. Many are digital now, so instead of clipping coupons in your Sunday newspaper, you just need to download your favorite stores’ apps.

Buy in bulk at a warehouse store, such as Costco or Sam’s Club, but only if you have the storage space.

Shop at off-price stores. Listen; I used to be a grocery snob, and I also never shopped at dollar stores. But my mother taught me a great lesson about both: there are great deals to be had, on brand-name merchandise, as well as produce.

Shop for cost-effective foods. If you don’t have to have meat at every meal, try using meals centered around beans, pasta, potatoes, rice, and eggs. And usually, frozen veggies and fruits cost less than fresh, and if you are using them in a casserole, pie, or cobbler, they work just as well.

Gas: As if gas wasn’t already at ridiculous prices ($5.16 a gallon for regular, as of yesterday, according to AAA), now we are being hit with surcharges! I was actually planning to take a couple of long-desired driving trips this summer—one around Lake Superior and the other down the Natchez Trace. But the rise in oil prices—and now surcharges—have led me to pursue some staycations or shorter trips.

The fees are generally listed as “fuel surcharges,” but may also show up as “temporary fees” or “noncash adjustments” for using a credit card instead of cash.

In addition to the rising costs when you fill up your own vehicle, the ridesharing companies and on-demand delivery apps have also begun to levy fuel surcharges to help their drivers. In mid-March, Uber added a fuel surcharge of $0.45 or $0.55 to each trip and Lyft added a $0.55 surcharge to each ride.

And now, Amazon has also joined the list. Last week, the company said, “for the first time,” it will charge sellers a 5% fuel and inflation surcharge. Amazon says these extra fees will only apply to sellers who use Amazon’s fulfillment services. However, according to the company, that amounts to 73% of their sellers, as of January 2022. And you know, if won’t be long before those added fees become higher costs for anything you order from Amazon.

What you can do:

Become a loyalty member cardholder. In my neighborhood, two grocery stores— Kroger and Food City—offer 10-15 cents off each gallon of gas after you buy $100 and $150 worth of groceries, respectively. And the Weigel’s convenience store offers 10 cents a gallon discounts with its membership card.

Get a gas credit card. Both Shell and Exxon Mobil offer 10-15 cents per gallon discounts to cardholders. But know that you might do better by purchasing your gasoline with a rewards credit card, which pays you in cash back (such as Discover) or gift cards (such as Capital One).

Carpool, where possible, ride your bike, or take public transportation, if available.

Stack your errands, so you are hitting as many places as possible in one trip.

Work remotely, if possible. Although many companies are now requiring their employees to return to the office, there are still plenty of jobs that will allow at least part-time remote work.

Airlines: You might as well forget those cheap airfares of the pandemic. They are gone. Blame the rising price of oil, accompanied by new fuel surcharges. The Bureau of Labor Statistics reports that the consumer price index for airline tickets has shot up by 25% in the last year—the biggest leap since the Federal Reserve of St. Louis began tracking the index in 1989. And just in April, airfares soared 18.6%.

It’s important to note that the fuel surcharges are sometimes disguised as “carrier-imposed surcharges.” However, when named that, airlines can charge them at their leisure. But if they are called “fuel surcharges,” they are regulated by the U.S. Department of Transportation, so they must be approved.

Forbes recently published an article called, “Which Airlines Have High Fuel Surcharges.”

Here’s the list of the airlines with the highest fuel surcharges:

- Lufthansa: $750 in taxes/fees for business class one-way from New York to Frankfurt

- SWISS Air Lines: $750 in taxes/fees for business class one-way from New York to Zurich

- Austrian Airlines: $750 in taxes/fees for business class one-way from New York to Vienna

- Brussels Airlines: $750 in taxes/fees for business class one-way from New York to Brussels

- Virgin Atlantic: $750 in taxes/fees for business class one-way from New York to London

- British Airways: $729 in taxes/fees for business class one-way from New York to London

And those with the lowest fuel surcharges are:

- Air France: $219 in taxes/fees for business class one-way from New York to Paris

- Asiana Airlines: $206 in taxes/fees for business class one-way from Los Angeles to Seoul

- Emirates: $181 in taxes/fees for first class one-way from Los Angeles to Dubai

- Japan Airlines: $133 in taxes/fees for business class one-way from Los Angeles to Tokyo

- All Nippon Airways: $123 in taxes/fees for business class one-way from Los Angeles to Tokyo

- Iberia: $122 in taxes/fees for business class one-way from Boston to Madrid

- Cathay Pacific: $100 in taxes/fees for business class one-way from Los Angeles to Hong Kong

What you can do:

Become a frequent flyer. Although these rewards are not nearly as good as they were when I was flying around the country a few years ago, they still might be worthwhile. USnews.com recently ranked the following airlines as having the best rewards programs:

Best Airline Rewards Programs

- Alaska Airlines Mileage Plan

- Delta SkyMiles

- American Airlines AAdvantage

- JetBlue TrueBlue

- Southwest Rapid Rewards

- United MileagePlus

- Free Spirit

- FRONTIER Miles

Get an airline credit card. Nerdwallet.com recently listed the top airline credit cards:

- Capital One Venture Rewards Credit Card; annual fee, $95

- Chase Sapphire Preferred® Card; annual fee, $95

- United℠ Explorer Card; intro annual fee, $0

- Discover it® Miles; annual fee, $0

Research different airline and travel websites to find the best deals. I recently did a search for roundtrip flights to Seattle. I compared several websites, using different departure cities, dates, and times, and found a large range of prices—$500-$1,100. It definitely pays to spend a little time and effort to do this, especially if you can be flexible as to dates and can fly from any of several airports. Here are the best booking sites, according to upgradedpoints.com:

- Book Direct Through the Airline’s Website.

- Momondo.com

- Kayak.com

- Expedia.com

- Priceline.com

- Orbitz.com

- Agoda.com

- Hotwire.com

Sign up for emails that deliver specials right to your inbox. I know it’s annoying to sort through all that mail, but it can be very worthwhile.

Just recently, I’ve been looking at European river cruises for 2023. I’m still a little antsy about traveling internationally this year but am hopeful that next year will finally sound the death knell to COVID. However, if you are looking for a deal, Viking has been sending me some fabulous prices on 8-12-day river cruises, starting at $1,999—if you can book last minute. Oh, and also, the company is offering free international airfare (from lots of airports), free Wi-fi, and beverage packages!

Plan ahead, which becomes critical if you are using free miles.

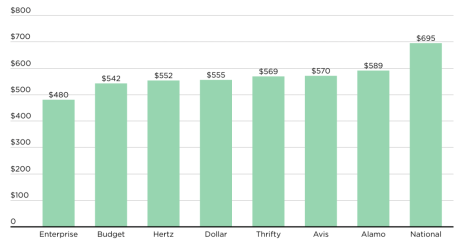

Rental Cars: According to Kelley Blue Book, the average new car in April would have set you back $46,526—$5,354 more than April 2021. And since rental car companies buy new fleets of cars every year, their costs have precipitously risen, and therefore, so have yours. The chart below depicts the average cost for a seven-day rental at some of the largest rental agencies.

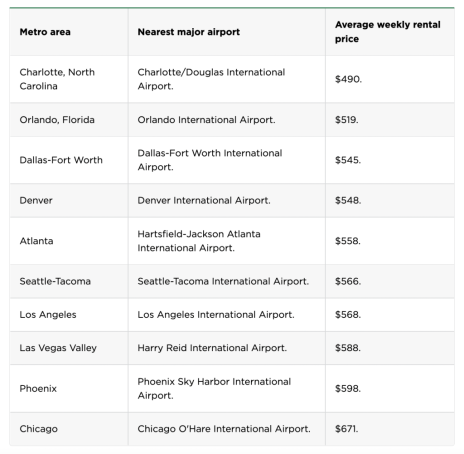

Nerdwallet.com recently compiled a report showing the cheapest places to rent cars, which are shown in the chart below:

What you can do:

Join your favorite rental car membership programs. You’ll receive special offers, featuring discounted prices and automobile upgrades.

Lodging: The Bureau of Labor Statistics reports that hotel prices are up 29% from a year ago.

As you can surmise, taking a flying/hotel/rental car vacation just became a lot more expensive!

What you can do:

Plan ahead. By doing this, you can often get better prices or amenities, especially if you are taking advantage of membership awards.

This is another instance when signing up for emails from the hotels in which you are a member or frequent visitor can pay off. Last year, I spent four nights in Myrtle Beach, South Carolina, for $199. And because I’m a Marriott frequent visitor, I received 50,000 bonus points on my rewards! Sure, I had to listen to a 90-minute time share presentation, but it was well worth it!

Check the travel websites for packages that include hotel, flight, and maybe car rental inclusive deals.

Join a group. I have a friend who puts together trips for her yoga studio, and she gets some pretty sweetheart deals for her groups. Best of all, if she can book a certain number of travelers, she and her husband often get free travel!

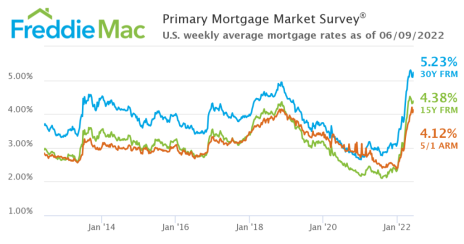

Mortgage Loan Rates: As you can see in the graph below, as soon as the Federal Reserve began raising the short-term Federal Funds rate in March, mortgage lenders didn’t waste any time boosting mortgage interest rates. As of the end of last week, the average nationwide 30-year fixed rate hit 5.23%.

Now, if you have a fixed-rate mortgage loan, you don’t have to worry about it. But, if your loan is adjustable, you may be in for a nasty surprise when your rate adjusts. And, unfortunately, if you are moving into a different residence, you will probably find that your monthly payment is more than you expected, which can mean that you may have to temper your expectations as to your home size, price, etc.

What you can do:

Shop around. Rates are not the only comparison point. Make sure you also review origination points, buydown points (to lower the rate), private mortgage insurance requirements, down payment, and rate-lock periods. And read the fine print so that you can question any abnormal charges.

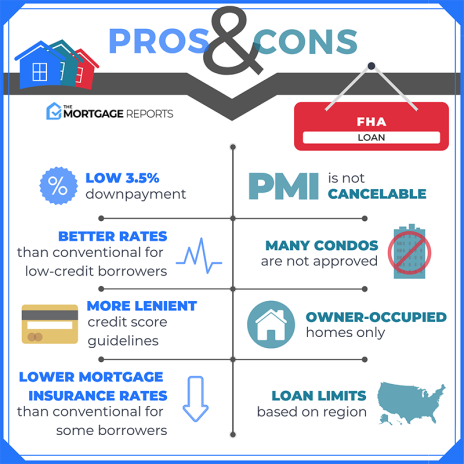

Go FHA. FHA loans are subject to regional/local maximum home prices, as well as the condition of the home. But, if the home qualifies, you can see from the following chart that down payments and interest rates are generally less than conventional loans.

Source: themortgagereports.com

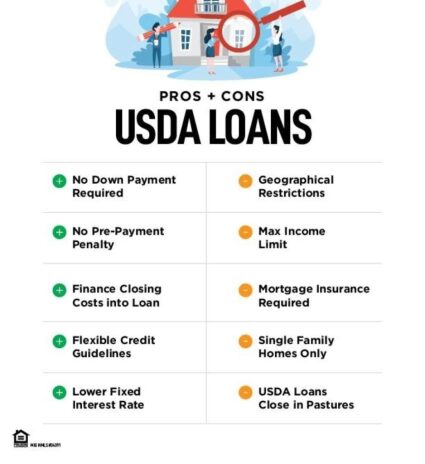

Go USDA. Also subject to maximum housing prices and income limits; if you qualify, you may not need a down payment at all!

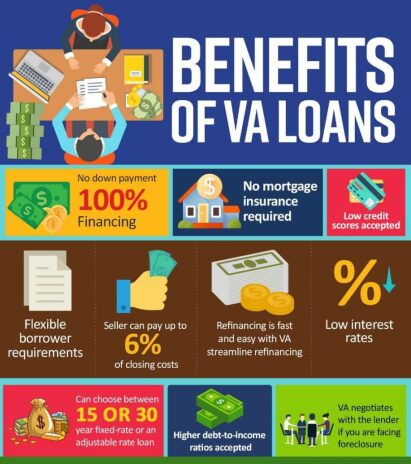

Go VA. A great program for our veterans, using a VA loan requires no down payment, offers low interest rates, and sellers sometimes help pay your closing costs.

Get a first-time homebuyer loan. These are generally subject to maximum income limits but may include better-than-market interest rates and low or no down payments. Check with your local mortgage lenders to see if any of these types of loan programs are currently being offered in your area.

Credit Card Interest Rates:

If you think that mortgage rates rose pretty quickly, you’re going to be downright amazed at how fast your credit card interest rates are increasing.

Below is a chart of average credit card rates, depending on your credit score.

| Credit Score Rating | Approximate FICO® Score Range | Credit Card APR Range (2020) |

| Superprime | 740 and Above | 16%-18% |

| Prime | 670-739 | 20%-22% |

| Subprime | 580-669 | 22%–24% |

| Deep Subprime | 579 and Below | 24% and Above |

| Source: The Consumer Credit Card Market Report, September 2021, Bureau of Consumer Financial Protection | ||

According to Creditcard.com, the average credit card interest rate is 16.77%—and rising. The company reported that among the 100 cards it tracks weekly, only eight cards offer rates below 12%, compared to 14 a few months ago. These rate hikes will matter more to you if you habitually keep balances on your cards. Here’s a hypothetical example of just what a detriment keeping balances as rates are rising will be to your long-term financial health:

| Credit Card Interest Cost Comparison | ||||

| Credit Card Balance | Monthly Payment | Interest Rate (APR) | Months to Pay Off Debt | Total Interest Paid |

| $7,500 | $150 | 15% | 78 | $4,145 |

| $7,500 | $150 | 20% | 106 | $8,254 |

Source: Forbes.com

As you can see, that chart paints a frightening picture—an added two years and four months to get totally out of credit card debt! And that’s if you don’t charge any more to that account and assumes rates stay below that 20% cited in the example. All bets are off on that; if the Fed keeps raising rates, the credit card rates will rise a lot faster than mortgage or shorter-term loan rates.

What you can do:

Pay down credit card debt. Americans are carrying credit card balances of some $841 billion, as of May 2022, according to lendingtree.com. And wallethub.com reports that the average household credit card debt in April was $8,425—up from $8,169 a year ago. As rates continue to rise, that debt will become more onerous. So, if you can, I recommend that you begin whittling it down.

Apply for a new credit card with lower interest rates. The following chart depicts recent research from Bankrate.com, showing some of the best low-interest credit cards currently available.

Bankrate’s top low-interest credit cards

| Card name | Variable APR | Best for | Bankrate review score |

| Discover it Cash Back | 12.74%– 23.74% | First-year rewards | 4.0 / 5 (Read full card review) |

| Chase Freedom Unlimited | 15.74%–24.49% | High earning potential | 5 / 5 (Read full card review) |

| Wells Fargo Reflect Card | 13.74%–25.74% | Long intro APR offers | 4.2 / 5 (Read full card review) |

| Citi Diamond Preferred Card | 14.49%–24.49% | Balance transfers | 3.5 / 5 (Read full card review) |

| Capital One Quicksilver Cash Rewards Credit Card | 15.24%–25.24% | 15-month intro APR offers | 3.8 / 5 (Read full card review) |

| Chase Freedom Flex | 15.74%–24.49% | Cash back in multiple categories | 4.3 / 5 (Read full card review) |

| Blue Cash Everyday Card from American Express | 14.74%–24.74% | Cash back for families | 3.0 / 5 (Read full card review) |

| Petal 2 “Cash Back, No Fees” Visa Credit Card | 13.74%–27.74% | Best for credit-building with cash back | 4.5 / 5 (Read full card review) |

| Citi Rewards+ Card | 15.74%–24.49% | Points on everyday purchases | 3.4 / 5 (Read full card review) |

Source: Bankrate.com

Transfer credit card balances to cards that offer low or 0% rates. You do have to be careful here, and make sure you read the fine print. There will be a transfer fee, based on the amount of the balances you move to the new card. And you’ll want to make sure you know what the interest rate will revert to once the 0% balance transfer period is over.

Get a reward card—one that provides airline miles, points, gift cards, or cash back. Again, you’ll need to make sure you are aware of all the fees that may come with these cards, as well as interest rates on balances. And try to avoid those cards with annual fees, unless you’re sure the rewards you’ll receive are worth the fees you’ll pay.

Nerdwallet.com lists some of the best rewards cards as follows:

| Card | Annual Fee | Rewards Rate | NerdWallet Rating |

| Capital One Venture Rewards Credit Card | $95 | 2x-5x Miles | 4.7 |

| Chase Freedom Unlimited | $0 | 1.5%-6.5% Cashback | 5.0 |

| Wells Fargo Active Cash® Card | $0 | 2% Cashback | 5.0 |

| Blue Cash Preferred® Card from American Express | $95 | 1%-6% Cashback | 5.0 |

| Chase Sapphire Preferred® Card | $95 | 1x-5x Points | 5.0 |

| Capital One SavorOne Cash Rewards Credit Card | $0 | 1%-8% Cashback | 5.0 |

| Discover it® Cash Back | $0 | 1%-5% Cashback | 4.9 |

| Citi Custom Cash℠ Card | $0 | 1%-5% Cashback | 4.7 |

| Chase Freedom Flex℠ | $0 | 1%-5% Cashback | 5.0 |

| Citi® Double Cash Card – 18 month BT offer | $0 | 1%-2% Cashback | 4.6 |

Source: Nerdwallet.com

5 More Tips to Combat Inflation

The above discussion should help you tame specific inflationary spikes, but here are several more ideas you may want to consider:

Ask for a raise—or switch jobs. As of April, there were just about two available jobs for every unemployed person, with 11.4 million available jobs, says the Labor Department. That won’t last forever, but now is still a potentially prosperous time for employees looking to earn more or find a new position.

On that same note, now is a great time to pick up a second job or side hustle.

Negotiate work-related costs such as expense accounts, car allowances, and mileage reimbursements.

Review all of your expenses. If you do not operate on a budget, now is the time to do so. Check your memberships and subscriptions and eliminate or renegotiate where you can. Renegotiation works pretty well for cable, streaming, satellite radio, and internet bills.

Limit your wants. This is advice from Charlie Munger, Warren Buffett’s business partner and vice chairman of Berkshire Hathaway. Charlie is known as a “tell it like it is” guy, and he told Berkshire Hathaway investors this in 2004—advice which still makes sense today: “One of the great defenses to being worried about inflation is not having a lot of silly needs in your life. In other words, if you haven’t created a lot of artificial demand to drown in consumer goods, why, you have a considerable defense against the vicissitudes of life.”

Save and Invest

Certainly, the stock market doesn’t look very attractive right now. The Dow Jones Industrial Average is down about 16.6% since the beginning of the year.

The best sector so far in 2022 (and the only positive one) is Energy, up 51.50%. The worst sector is Consumer Discretionary, which has lost an average of 32.6%.

Having said that, I don’t have a crystal ball that tells me when this bear market will end, but there are sure a lot of stocks that look like bargains at this level. And, as a long-term investor, I don’t rush in and out of the market; I typically buy fundamentally strong companies and hope to keep them for the long term. Of course, I reevaluate all of my holdings, on at least a quarterly basis, to determine if they are still worth holding, or whether I should sell them and invest in a better opportunity.

And for my entire career, I’ve been a big fan of Warren Buffett, chairman of Berkshire Hathaway, due to his common-sense take on investing. He’s not always right; and sometimes, he’s late to the trend, such as his very slow entrée into tech stocks a few years ago. But, over the years, he’s been mostly right, and his gains are proof of his investing acumen. According to Barron’s, “from 1965 through 2021, Berkshire shares generated a compound annual return of 20.1% against 10.5% for the S&P 500.” Not bad, huh?

Buffet’s major investing tenets include:

Invest in good businesses with low capital needs. That just means there will be more profits that fall to the bottom line, especially during rising inflation, as these companies don’t have to buy heavy equipment or invest in costly infrastructure when prices are escalating.

Buy companies that have elastic prices. In other words, if their costs are rising, they have the flexibility to pass the higher prices on to their customers, keeping margins stable.

Buy Treasury Inflation-Protected Securities (TIPS). The principal amount is adjusted for inflation, pegged to the Consumer Price Index, and investors receive a fixed interest payment twice a year.

Stay away from traditional bonds. In an almost omniscient prediction, Buffett told his shareholders two years ago to avoid bonds, as they are losers during inflationary periods (as rates rise, prices of bonds decline).

Avoid both gold and cryptocurrencies. Buffett has not ever really been a gold bug, as he prefers productive assets. And as for cryptocurrencies, in 2019, he remarked to CNBC that “Bitcoin has no unique value at all. It doesn’t produce anything. You can stare at it all day, and no little Bitcoins come out or anything like that. It’s a delusion, basically.”

Bitcoin and crypto are not for the faint-hearted, as you can see the erosion of value of Bitcoin since the beginning of the year:

Source: coinmarketcap.com

Here are some of Buffett’s recent buys, along with current analyst ratings:

- Chevron (CVX), Buy

- Occidental Petroleum (OXY), Buy

- Citigroup (C), Strong Sell

- Ally Financial (ALLY), Strong Sell

- Markel (MKL), Weak Sell

- Activision Blizzard (ATVI), Weak Sell

- Apple (AAPL), Strong Sell

- HP Inc. (HPQ), Weak Sell

- Paramount Global (PARA), Strong Sell

- Celanese Corp. (CE), Sell

- McKesson Corp. (MCK), Buy

Note that the analyst rankings I’m quoting are for technical, or short-term signals. I’ll remind you that Buffett is a long-term investor, and that’s the perspective from which he views his purchases.

And here’s what he’s been selling:

- Verizon Communications (VZ)

- AbbVie (ABBV)

- Bristol-Myers Squibb (BMY)

- Royalty Pharma (RPRX)

- STORE Capital Corp. (STOR)

- Wells Fargo (WFC)

Bottom line, I wouldn’t bet against Warren Buffett. So, if you feel like shoring up your investment portfolio with some long-term ideas, you might consider a few of the above companies.

I hope that these inflation tips will be helpful to you. Looking longer term, the experts are forecasting a decline in inflation later this year and into next year. Fannie Mae is predicting that the inflation rate in 4Q22 will average 5.5%, and the Fed expects it will drop to 4.5% by the end of this year and to 2.5% by year-end 2023. That’s down considerably from the current 8.6% rate.

Nevertheless, whether or not the rate falls as expected, it never hurts to reevaluate just where your money is going. If you do that, in the long run, you’ll be in a much stronger financial position.