There are many different methods for finding relative strength (an important metric for tracking the “smart money”) in the equity market, but one of the simplest and most effective ways is to monitor the daily number of stocks making new 52-week highs and lows. Both major U.S. exchanges publish these figures each day and they can be found on any number of websites for free (my favorite is The Wall Street Journal’s list, which you can find here).

Whenever major averages like the S&P 500 are in an extended upward trend, many traders use the new 52-week highs for the NYSE and Nasdaq exchanges to quickly locate the stocks which stand the best chance of continuing to trend even higher. This is a momentum strategy, and although it’s not without pitfalls, it can be quite effective as long as bull market conditions prevail. That’s because stocks which consistently make new 52-week highs typically don’t face as much overhead supply or “chart resistance” (i.e. previous price peaks, which often serve as reversal areas for stocks). After all, it’s much easier for institutions to push stocks higher when there are no previous obstacles in the way.

CNBC’s Jim Cramer has observed, “As a voting machine, you cannot [beat] the new 52-week highs, and they do not get there for no reason.”

New 52-week highs have also been likened to baseball players who boast stellar batting averages (the players you want to bet on). Just as ballplayers on a hitting streak tend to continue outperforming, so, too, do the stocks which consistently make new highs—that is, as long as bullish broad market conditions prevail. And a bullish environment is usually characterized by new 52-week highs outnumbering new 52-week lows by at least a 3-to-1 ratio (the higher the better) on a daily basis.

Which leads us to the other important aspect of the new highs and lows, namely how they can be used to quickly isolate areas of weakness. Whenever a general market uptrend shows signs of losing steam, one of the first places you should consult to see where most of the weakness is concentrated is the list of NYSE and Nasdaq stocks making new 52-week lows.

The total number of listed stocks making new 52-week lows, while easy to gauge, contains a wealth of information in and of itself. The new lows tell us: 1.) if there’s an unusual degree of selling pressure within the market; and 2.) where exactly that selling pressure is located. Years ago, a study was made here at Cabot covering all stock market environments going back to 1962. That study found that:

“As long as the number of daily new lows did not exceed 40, the market was sound and in no danger of falling significantly. And remarkably, this specific threshold of 40 new lows remained the same over the entire 50 years we studied.”

This observation forms the basis of the Cabot Two Second Indicator, which is a daily determination of whether there are fewer than 40 stocks making new 52-week lows on the NYSE and the Nasdaq. If there are more than 40 new lows each day covering a period of several consecutive days, you can be reasonably certain that there’s an abnormal degree of selling pressure somewhere in the market. And to isolate where exactly that selling pressure is coming from, all you have to do is pay attention to the stocks touching new lows; specifically, what sector or industry those stocks trade in.

(As an aside, this especially holds true during times in which the major averages are still in an uptrend yet the new 52-week lows are increasing. It can almost always be assumed in such cases that the “smart money” is using the market’s surface strength to disguise their distribution, or selling, activities.)

To illustrate the Two Second Indicator in action, let’s briefly examine the stock market’s latest internal profile.

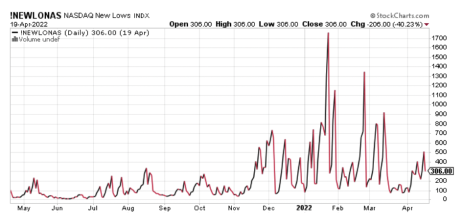

In recent days, there has been a gradual increase in the number of stocks making new 52-week lows on both major exchanges. There are currently 285 NYSE stocks trading at 52-week lows, and 306 Nasdaq stocks. Those are still high numbers, mind you, but WAY down from this year’s highs of 672 for the NYSE and 1,501 for the Nasdaq, which both of them hit on January 24.

Here’s what the NYSE and Nasdaq 52-weeks lows look like on a chart:

Additionally, the highs (173 on the NYSE, 116 on the Nasdaq) do not outnumber the lows right now, and it’s nowhere near the ideal 3-to-1 ratio that signals a bull market.

Once the new lows shrink to below 40 for several consecutive days, while new highs steadily increase (preferably to a 3-to-1 or greater ratio versus new lows), you can reasonably infer that sellers have been cleared out of the market and that the bulls are back in control of the dominant intermediate-term trend. But as long as there are 40 or more stocks making new 52-week lows each day, it’s generally a good idea to play it safe and avoid diving back in.

As our growth investing expert Mike Cintolo has pointed out, “One of the big secrets to investing is to avoid making huge mistakes, and if you stay in gear with the trends and the action of the leaders, you’re guaranteed never to miss out on a major upmove or to stay bullish during a prolonged drop—and that fact alone puts you ahead of 80% of investors.”

Using the 52-week highs and lows to zero in on strength and avoid weakness will help you do just that.

Do you monitor 52-week highs and lows? What other market indicators do you use? Tell us about them in the comments below.