There is seemingly no end to the myriad risks that could potentially weigh on the U.S. economy. Inflation is currently at 40-year highs. War in Ukraine and the resulting sanctions against Russia are crimping global supplies of fossil fuels, metals, and agricultural commodities like wheat, which further exacerbates cost pressures.

Simultaneously, the Federal Reserve is walking a tightrope to unwind years of abundant fiscal stimulus. It’s leading investors to wonder how we can possibly avoid a significant economic slowdown.

It’s a reasonable concern, especially when you consider that the most recent commensurate move in oil prices (from $50/barrel to over $100 between 2005 and 2008) brought a recession in its wake.

Are We Approaching a Recession?

The difference between 2008 and now is that consumer price inflation wasn’t running nearly as hot. And the tripling of oil prices from $50 to almost $150 in 2008 took around three years to accomplish. This time around, by contrast, WTI crude prices have risen more than five-fold from the low of 2020 and have more than doubled from the pre-pandemic low of about $50.

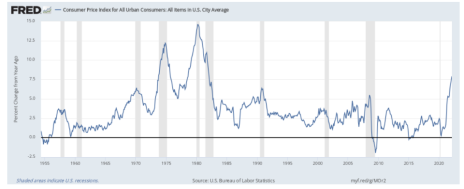

An important consideration for the prospects of a recession is the Consumer Price Index (CPI), one of the most commonly used inflation gauges. According to the latest release from the U.S. Labor Department, the CPI for February rose nearly 8% from a year ago—the highest level since 1982—mainly due to surging energy prices. Since 1955, whenever the CPI has spiked more than 3% it has always been followed by a recession—usually within a year or so.

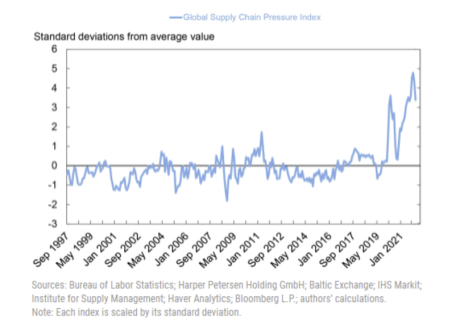

It’s also worth noting that, during the 2008-09 recession, supply chain problems weren’t a major factor. In early 2022, however, supplies of several key raw materials and finished goods are more difficult to obtain in a timely fashion.

Consider the New York Fed’s Global Supply Chain Pressure Index (GSCPI), which hovers near a record high as of March. You’ll recall that the classic definition of inflation is “too much money chasing too few goods.” With many goods experiencing shortages (or sanctions), it’s only exacerbating rising costs.

Inflation-related problems are also extending to critical industrial metal markets. Last week, the London Metals Exchange halted nickel trading as Chinese nickel giant Tsingshan Holding Group, the world’s largest producer of the metal, purchased huge amounts of nickel to reduce its short positions and exposure to margin calls, “turbocharging a rally fueled by the conflict in Ukraine,” in the words of a Reuters report. Consequently, as ZeroHedge observed:

“…futures investors who wanted physical metal delivered to them cannot get it. Instead during this time of crisis when physical metal matters most, the LME says all trades will settle in [cash] only, not nickel metal.”

Similar shortages are now being experienced in other key metals including titanium (used in the aerospace, automobile and electronics industries), copper (building construction, automobile and power generation industries) and aluminum (auto, aerospace and home appliances). With prices dramatically rising and supplies decreasing for each of these important metals, global economic growth rates are expected to slow this year.

Another indication that U.S. investors are starting to think about recession is the collapse of the Treasury yield curve. The 10-year minus 2-year spread is getting perilously closing to inverting (when the 2-year Treasury has a higher rate than the 10-year bond). Historically, an inverted yield curve has always preceded a major economic slowdown—including the most recent one that occurred in 2020.

I’m not here to argue that a recession is imminent. My point instead is that investors should be thinking about ways to hedge their portfolios against what will likely be a slowing global economy as we head further into the year. Inflation pressures don’t look to diminish anytime soon, so a good place to start looking for opportunities is in inflation-sensitive assets like precious metals, which are also in high demand right now.

One of the best inflation hedges is gold, which tends to be somewhat recession proof. In the Great Recession that raged from December 2007 until June 2009, for example, the price of gold soared 25% while the S&P 500 Index (SPX) was down 36% in that same period. In the most recent mini-recession of February-April 2020, gold rose 12% while the SPX shed 24%. Thus, the yellow metal showed itself to be a worthy protection from the ravages of both inflation and recession.

4 ETFs to Increase Your Metals Exposure

To that end, investors should consider owning some gold either in physical form (bullion bars or coins) or via an ETF. My favorite gold-backed ETF is the GraniteShares Gold Trust (BAR), which is also one of the lowest-cost exchange-traded funds on the market. I recommend that participants have some long-term exposure to BAR or another actively traded gold fund like the iShares Gold Trust (IAU) or the SPDR Gold Shares (GLD). Owning some gold and other precious metals during troubled times will provide peace of mind, as it should serve as a buffer against both extreme equity market volatility and economic recession.

Yet another way to hedge against inflation is to allocate a small percentage of your portfolio to the SPDR S&P Metals & Mining ETF (XME). This ETF provides exposure not only to gold, silver and other precious metals, but also to aluminum, coal & consumable fuels, copper and steel. It therefore serves as a worthwhile vehicle for having exposure to a wide array of inflation-sensitive commodities.

Do you own any precious metals ETFs or stocks not on this list? Tell us about them in the comments below.