After nearly two years of non-stop coverage, it appears that we’re in the end stages of the Covid pandemic. Omicron carries its own unique risks and remains incredibly prevalent globally, but, upon initial impression, seems to be a far less dangerous variant than initially feared. That’s potentially good news for global health, healthcare systems and economic activity as well.

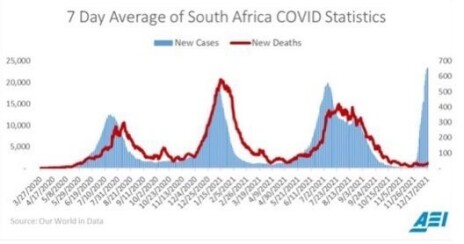

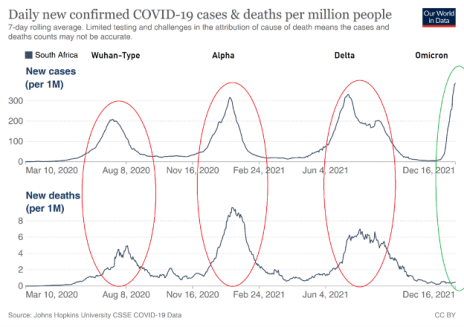

South Africa was the first to identify and track Omicron and saw a peak that eclipsed prior surges but, more importantly, has not seen a corresponding increase in mortality.

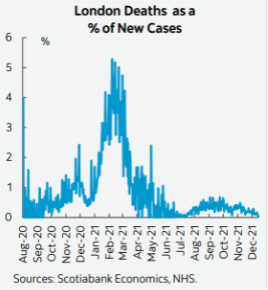

The same trend is materializing in London…

….and also in the U.S….

To summarize, a lot more people are getting Covid but a much smaller percentage of them are getting hospitalized and/or dying.

In some ways, Omicron is kind of like a global vaccine as many people will get it, have minimal negative symptoms, and will gain immunity to Covid.

Whatever your thoughts on Covid vaccinations, you may get the “Omicron” vaccine!

If I’m right that the pandemic will be over shortly, how should we position out portfolios?

I think we should plan on strong global growth in 2022 and higher energy prices.

Despite continued “surges” and bottlenecked supply chains, WTI Oil is over $85/bbl and natural gas is $4/Mcf, prices that enable energy companies to gush profits.

If economic activity accelerates, prices will likely surge even higher in 2022 and beyond, and you will want to own these two energy micro-caps:

2 Energy Stocks Saying Goodbye to the Pandemic

Energy Stock #1: Dorchester Minerals (DMLP)

Dorchester Minerals LP is an oil and gas royalty firm. It owns land and offers oil and gas companies the ability to drill on its land in exchange for a royalty or a profit share. It is the rare oil and gas company with a good business model. As a result of its business model, it has very low operating costs and generates very high margins (operating profit margin of 70% over the past 12 months).

The company has no debt and pays out all its income to unit holders. Despite the recovery in the energy markets, Dorchester’s stock price is below pre-pandemic levels.

In December, Dorchester paid out its most recent distribution of $0.50. If we annualize the distribution, the stock is trading at a 10.3% dividend yield. Better yet, the company has no debt so risk is low and insiders have been buying in the open market.

Energy Stock #2: Epsilon Energy (EPSN)

Epsilon is a cheap, debt-free company that is generating gobs of cash and buying back stock.

It is a North American oil and natural gas development and midstream company with a focus on the dry gas area of the Marcellus Shale of northeast Pennsylvania.

Insiders own 25% of shares outstanding. The company has downside protection with a net cash balance sheet and a valuable midstream business.

The company is benefitting from soaring natural gas prices and is gushing free cash flow.

In its last press release, the company wrote: “Once our 2022 development capital needs are defined, we will evaluate the appropriate amount of capital to retain in the business.”

This seems to hint that management is likely to announce a special dividend or large accelerated share repurchase authorization. As a result, Epsilon is well positioned to outperform in 2022.

Do you own any micro-cap stocks? Or energy stocks? Tell us about them in the comments below.