From pit experience as the designated primary market maker to setting up a proprietary trading desk, professional options trader and Chief Analyst of Cabot Option Trader Jacob Mintz shares his years of Wall Street and market experience in this StockTwits Q&A session.

17+ Year Pro Options Trading Veteran and Former CBOE Market Maker Shares His Knowledge

From pit experience as the designated primary market maker to setting up a proprietary trading desk, this professional options trader shares his years of Wall Street and market experience.

Jacob Mintz has been a professional options trader for 17 years. He is chief analyst of Cabot Options Trader and founder of OptionsAce.com. Jacob began his trading career as a market maker on the floor of the CBOE, where he traded for nearly 10 years. In 2008, Jacob was tasked with leading the merger of three trading crowds on the CBOE. As the Designated Primary Market Maker, he provided the largest and tightest option spreads for any option order that came into his pit. While in this role, Jacob helped develop a sector trading system and managed the group’s risk. In late 2009 he set up a proprietary trading desk. In this role, he was in charge of strategy, risk mgmt and trading. Jacob has a passion for sharing his knowledge and experience from “Wall Street” and he travels the country educating beginner and intermediate-level options traders in a one-on-one mentoring environment. Below is a re-cap of a live Q&A we had with the entire StockTwits community.

What’s your YTD return sir?

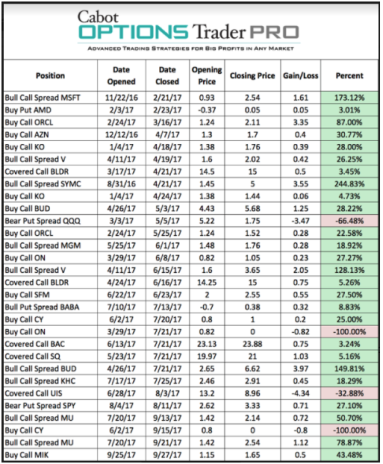

I’ve had a great year. Though I suppose a bull market makes everyone look smart. Here are my last several months’ worth of trades.

What is a good starting point to learn or even practice options trading?

Learning about options is similar to learning a foreign language for many people. So what I recommend is that you start slowly. First, really learn what a Call is. Next make a fake trade. Say to yourself, “I think stock XYZ is going higher, so I’m going to buy the XYZ January Call” And then track the trades success or failure. Then learn what a put is. Make a fake/paper trade and track it. Next learn what a covered call/buy-write is. Then when you have those three strategies down, then you should actually buy a call or a put. Put some money on the line. But only buy ONE contract. Learning how to execute a trade is also new to many people. So if you make a mistake, or lose on the trade, it won’t hurt too badly. What I do NOT recommend is spending thousands of dollars on a video course teaching options. The amount of people I know who have spent thousands of dollars on video courses who are unhappy with the results is overwhelming. I teach options students in a one on one environment. That way I can see if you are really understanding a concept.

I’ll go right for the big one. How do you manage your positions? How do you use options to reduce your risk once in a trade?

Every trader is different, and every trader has their own strengths and weaknesses. The mistake I made too often in the early part of my career is taking off a winning trade too soon. We all love to lock in profits, but often times that is the worst trade. So with that in mind, this is how I trade a winning position. Once I’m up 20–30% on an options trade I sell half. Those profits will let me go for the home run on the balance. Then I set a mental stop on the balance, and raise that mental stop along the way higher. For example, last year I hit a home run in $NVDA. Originally I bought the June 33 Call for $2.18. A couple weeks later I sold HALF of these calls for $2.96, or a profit of 35%. Then I went for the home run! As the stock ran higher, I kept raising my mental stop. This allowed me let the trade run, while protecting myself should NVDA fall. So when the option was worth $7, I had a stop at $6. When the stock ran higher and the call was worth $9, I moved my stop to $7.5. Finally my mental stop was hit, and I sold for $13.25, or a profit of 507%

Should we assume that robots extend to all portions of options trading?

Yes unfortunately there aren’t many humans/floor traders left. The computers are making 99% of the options markets that you see. They are just too fast to compete with. That said, I’m still buying and selling. And so are many of you. And at the end of the day, it’s not such a bad thing that the computers have taken over. Why? Because they can make $BAC options markets a penny wide. I couldn’t do that on the floor. So you and I pay less when we are buying and selling options. That said, man I wish I was still on the trading floor! But the world has changed, so we have to change with it.

Which valuation model do you prefer for the current market environment? BSM, Binomial or a custom one?

That is above my pay grade. I’m just a dumb options trader ?

If you were to teach every person one thing from your experiences on Wall Street, what would that be?

Wow that is a tough question! I guess never stop reading, and learning about the market! I studied under two trading floor legends at the CBOE, and they taught me a ton. But even today, I talk to my fellow analysts at Cabotwealth.com and continue to be amazed at new ideas and strategies.

What’s the stupidest options trade you gladly filled (e.g. someone buying a bunch of extremely OTM calls/puts)?

Usually someone buying calls extremely far out-of- the-money was a winning trade for me, and a losing trade for them. That said, as we all know, unfortunately insider trading does happen. So when a trader is buying calls with a couple days till their expiration, far from the current stock price, alarm bells go off in my head. Like “Why would someone be throwing away hundreds of thousands of dollars buying these calls?!!” And next thing you know, the stock is taken over.

On monthlys, how far out is a good rule of thumb like 1–3 month? Given time decay and expense with longer exp dates.

Everyone has a different take on this type of question. Personally, I’m allergic to time decay. I hate buying calls/puts and watch them lose value. So I tend to buy calls with 3 plus months until expiration. While these calls cost more, they don’t decay at nearly the rate of options expiring in a month. The cost vs. decay debate is not easy.

Are most traders selling puts & calls rather buying? Why is collecting premium better than speculative buying?

I guess I don’t know what “most” traders are doing these days. And I don’t think selling vs. buying is “better” or vice versa. My style is that I don’t have a style. Why would I want to only trade one way? If it’s a bull market, then by all means buy Calls. If it’s a choppy/sideways market, then sell volatility via Buy-writes, Put-writes and Iron Condors. If you pigeonhole yourself to one

style, you will miss out on plenty of money making trades.

How to get started in the industry? What type of education would you need and how to go about landing an internship?

You don’t have to be a rocket scientist to be a successful trader! There were plenty of traders who flamed out on the CBOE who graduated from Harvard/MIT. And there were other guys who had amazing careers, who never went to college. And then I suppose it’s all about networking. I don’t know the actual numbers, but the amount of people who get jobs via

personal connections has to grossly overwhelm the amount of people who get jobs via sending blind resumes. I got my interview with my future boss because my uncle knew the guy from his neighborhood. Then it was my job to impress him via math questions and answers etc.

If you were investing in $SHOP for long term. What option strategy would you use? Plain LEAPS or Bull Call Spread?

I guess the answer to that is how high do you/I think SHOP can go. If I think the upside is limited to 120 for example, then I would buy the 100/120 Bull Call Spread. If I believe SHOP is the next great stock, and could go to 200 and beyond, then buy straight calls, and go for the big home run.

How do you set your profit targets? If it hits your target do you sell 100% or do you try and scale out?

I never set price targets. I’m a home run hitter. And if I set a price target, I’m limiting my upside. That said, as I mentioned above, I sell HALF at a profit of 20–30% and then raise mental stops as the stock and my option go higher. That protects me from a big fall, and protects me from making the mistake of selling a big winner too early.

How do you establish your stop loss? Is it a percentage move in the underlying stock or certain dollar amount?

First off, I NEVER double down on a losing trade. As the famous Paul Tudor Jones sticky note above his computer in his office said “Losers average Losers”.

That said, sometimes I get stopped on trades. Other times, I give trades time to work. For example in the last couple months I bought $MU calls after tons of unusual call buying. And then, a couple days later, $MU and all of the semiconductors fell hard. The trade was a loser! Yet the call buying never stopped, and even became more frenzied. So I held the position, and the stock

roared back to life. I closed that trade for a profit of over 225% this week!

What’s your favorite sell signal?

I have a couple sell signals. The first is watching option order flow. If there is steady call buying in the market leaders such as $FB $GS $BAC $BABA then I read this as the big traders have faith in the market. However, when that call buying flips to put buying in those stocks and the indexes, I become wary. And when its 2–4 days of that activity, I unload some of my positions. Also, while I don’t like trading the $VIX, I absolutely keep an eye on it. My very simple rule is that if the $VIX is at 9–13, the hedge funds and institutions are ok with the market. 14–17 in the VIX I’m paying attention. 18 and above, it’s time to sell first, and ask questions later. Remember, just because you sell, doesn’t mean you can’t get right back in.

Which kinds of unusual option activity are the most useful to trade off of, and how do you trade it?

The size of the trade vs. typical trade volume. By this I mean, someone buying 5,000 calls in a liquid stock like BAC means very little. However, if there is a buy in a random stock, that hardly trades options, my alarm bells go off.

And when there is repeated buys, day after day, it means the trader has high conviction in the trade. And when the trader pays higher and higher prices, it means they want in badly. And last, it’s a feel. By this I mean, when a trader is making a super suspicious trade, like buying calls far out-of-the-money with three days till expiration, I wonder why the heck would they be doing this? And that is when I want to take a shot that this trader may know news is coming.

What do you believe helped you the most throughout your career? Whether it be a strategy or advice someone told you.

I guess at the end of the day I’ve tried to make trading as simple as possible. While you or I can create some crazy algorithm, I find it easier to use my own brain/reasoning. I evaluate trades in terms of odds. If I like $FB, and the stock is trading at 175, I ask myself how high do I think it can go. If the answer is 185, then I buy the 175 or 180 call depending on the price. However, if

those calls cost $10, and I feel they are grossly too expensive, and hurt the odds of success, then I move on. To me, trading is all about odds. I execute only the trades I like best. And some will work, and some won’t. But if I’m selective, and put on trades with a great chance of succeeding, over time I know I will be profitable.

What do you think about $TRXC both short term and long term?

I’m not a chartist. @MikeCintolo is the chartist I turn to, especially when it comes to growth stocks.

What % of portfolio should be allocated to options for adequate diversification ? e.g: Let’s say $100k in equity

Unfortunately, I can’t answer that. All traders/investors have different goals/timelines.

When you have a winning options trade, do you sell the position and roll out to a more distant strike?

As I mentioned previously, I tend to hold my winning calls/puts as long as possible, using a mental stop, that I raise higher and higher.

Can a decent trader win in the long run by being long spreads, or do you need to sell premium to have a prayer?

Absolutely you can win be long options. It only takes a couple home runs being long options to make a career. That said, I think being able to trade both long and short options has the best chance of success.

How much impact can MM’s and OI have on a 5B-20B mkt cap names like say an $AMD or a $SNAP?

The power of those “evil” market makers is grossly exaggerated. Trust me, back in the day my firepower on the trading floor wasn’t going to move a stock for an extended period of time.

I write opts at low volume and have tried to learn some MM’s style. Some of them won’t budge. What’s my best tactic?

First off realize that today those market makers are computers. And they don’t care about you or me. They are there to make money. If you are having trouble getting filled, offer small amounts at a time. Size orders can scare off a fill.

Do MM’s ever stay stubborn or cagey as a revenge move when they think they spot a particular retail customer?

Those days are long gone. Again, the MM’s are now computers. And they don’t hold grudges like I used to. ?

I always battle to select the right Strike Price and period to expiration for Options. Guidance on this somewhere?

Make this as easy as possible. Ask yourself, “at what price am I willing to sell the stock?” Once you have that number in mind, sell that strike call. Keep it simple. Conversely, if you want to sell a put, ask yourself, at what price am I willing to buy the stock. Then sell that strike put.

What is your analytical framework for managing and hedging option strategy risk?

For most traders, I would say this … Determine where your exposure is. Tech or Financials or Pharmaceuticals? Then determine at what point you want to get out should the stock/sector fall, and on what time frame. Then buy as many puts that allow you to sleep at night.

How can options be used as a tool for more effective and profitable trading? Can beginners use these tools?

Buy-Writes should be in every investors arsenal in my opinion to create yield. Calls should be used to take speculative shots, and puts should are a great tool for hedging/shorting. Anyone can use these strategies!

Do you feel letting in the money calls expire and taking delivery of the shares a viable strategy?

Absolutely, if you want to own the stock, take delivery. At Cabot Options Trader we sell out our calls/puts before expiration.

Where should I apply to as an undergraduate for a trading career? Prop firms? Most firms need capital to join.

Unfortunately trading firms have changed a great deal over the years, and most require capital and charge ridiculous commissions and fees. Be careful on those fees if you find a prop firm.

Buy ITM options? When and why?

If you have high conviction in a trade absolutely buy ITM calls/puts. If more speculative, go OTM.

If an MM has a large amt of calls bought from them, does the MM immediately purchase equivalent shares to stay flat?

Depends on the firms “style”. Some are trying to stay flat via buying stock against a sale. Others will buy calls in another stock in the sector. Or others will balance vs. exposure to overall market.

What was your most successful stock you invested in, and why did you choose to invest in it?

Trading Google made my career. Mostly I churned out profits as a market maker every day. But the greatest trade of my career was made trading the stock, and it was PURE luck. But that is a long story for another day.

I’ve been paying car ins. PREMIUMs 35 years w/o a claim, is that Theta, time decay or rube?

Just like puts held against a portfolio, or your home insurance, that is the price of sleeping well at night.

Probably already asked but do you have a favorite strategy?

I don’t limit myself to a favorite strategy. Every market/stock situation requires a different tactic/trade.

Any memorable large options trades you can recall in your career? How did they work out for the parties involved?

Plenty I can think of. Always seem to be trader buying calls before takeovers. White Wave, Nymex, XMSR etc.

In terms of trade strategy & risk mgmt, what are the differences between a prop trading desk and market maker?

Makers are there to provide liquidity and make money on the spread. Prop desks are there to make money

How do you size your position?

I put 2–5% of my options trading capital to work in each trade. If I love the trade 5%. If I just like it, 2%.

Thanks for all the GREAT questions! You can find me at cabotwealth.com.