To help you get in the holiday spirit, today I will tell you what I think is the best dividend stock to take advantage of the ongoing holiday shopping. But first, let’s talk about the improving U.S. economy.

Is It 2007 All Over Again?

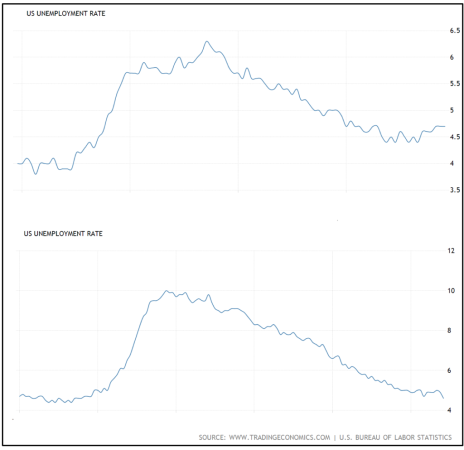

Here are two charts of the U.S. unemployment rate. One is a chart of the last 10 years. Can you guess which one?

If you guessed the lower chart, you’re right. It shows the unemployment rate from December 2006 to today. The big hump in the middle is the 2007-2008 financial crisis, when the jobless rate rose as high as 10%.

In addition to their similar curves, these two charts have something else in common—both end with the jobless rate around 4.6%.

That’s the level the jobless rate hit last Friday, its lowest level in nine years.

The top chart is a similar period from the last time the jobless rate was this low. Here it is again, this time with dates at the bottom:

In this chart, the run-up in the unemployment rate follows the 2000 tech crash (although it doesn’t get nearly as high, peaking just above 6%). The chart ends shortly before the financial crisis begins, with the jobless rate at 4.6%.

And that’s not the only thing that happened last week for the first time since 2007.

On Tuesday, the Conference Board reported that consumer confidence hit its highest level since before the financial crisis. Consumer confidence had been improving ahead of the election, and has continued to strengthen in the weeks since.

[text_ad]

In addition, the percentage of consumers saying business conditions are good rose to 29%, from 27% in October, while those saying business conditions are bad fell to 15%, from 17%. Consumers are also getting more positive about the labor market, with 27% saying jobs are plentiful, up from 25% last month.

This is a great backdrop for the holiday season, when consumer spending and retailer results become unusually important economic indicators.

The Best Dividend Stock to Profit from Holiday Shopping

Investors wondering how to position themselves to take advantage of this situation should look for stocks that will benefit from this holiday shopping spree.

My top pick isn’t a retailer though. In fact, it’s one of the major beneficiaries of the recent decline in traditional, in-store shopping.

It’s United Parcel Service (UPS), a high quality dividend-paying stock that’s hitting new highs going into the holiday season. In recent years, the growing popularity of online shopping has contributed to record package volumes every Christmas, and record revenues for UPS. Analysts expect EPS to grow 7.2% this quarter and 7.0% this year (both ending December).

However, UPS’ stock hadn’t made much progress until the last month, trading between 90 and 110 since the start of 2014. One of the major headwinds facing the company was weak demand for its freight and supply chain services, which are closely tied to industrial activity and business investment. But with the U.S. economy seemingly on the verge of firing on all cylinders, these businesses may soon join package shipping as profit centers for UPS. And in the meantime, the stock pays a reliable dividend that yields a solid 2.6%.

For those reasons, UPS is the best dividend stock for the holiday season.

Right now, I have UPS rated Buy in our Cabot Dividend Investor portfolio, but I recommend members try to start new positions on pullbacks. You could do the same, but if you want my continuing guidance on UPS—and other top-quality, dividend stocks, you should click here now to find out more about Cabot Dividend Investor.

[author_ad]