Dividend stocks underperformed in the first half of 2018. Whether you bet on the best dividend growers, the most undervalued dividend stocks, the highest yielders or the safest payers, almost any broad-based basket of dividend stocks you picked underperformed the S&P 500 over the past six months.

The good news for dividend investors is that a lot can change in the second half of the year. Stocks, sectors and styles that lagged in the first half can use the next six months to make up for lost time, as big mangers try to gain an edge by switching to new horses. And dividend stocks’ underperformance means there are lots of great undervalued dividend stocks for them to choose from.

To find the undervalued dividend stocks most likely to see a second-half surge, I looked to see which dividend stocks lagged the worst in the first half.

The Worst Sectors of the First Half

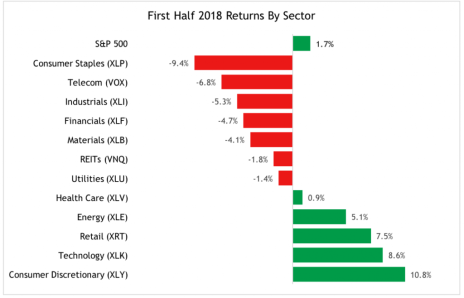

Between the start of the year and the end of June, the S&P 500 rose 1.7%. But some sectors did much better, while others did much worse. The best-performing sectors were consumer discretionary stocks, technology stocks and (surprisingly to many investors) retail stocks.

[text_ad]

The worst-performing sectors were consumer staples, telecoms and industrials, followed by financials and materials. REITs and utilities, which are typically counter-cyclical, performed very poorly in the first few months of the year but did better in the second quarter, and each ended the first half down less than 2%.

There are great undervalued dividend stocks in all seven of these lagging sectors, especially consumer staples, industrials, financials, materials, REITs and utilities. (Telecoms pay great dividends but there aren’t any telecom stocks I like right now.)

Large Stocks Lagged Over the Past Six Months

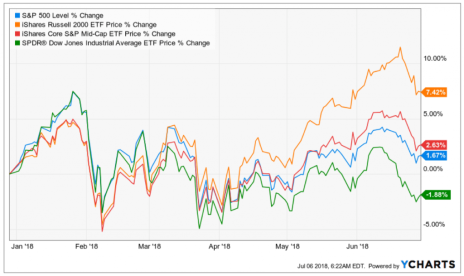

In the first half, smaller stocks did better. Small-cap stocks outperformed mid-cap stocks, mid-cap stocks outperformed large-cap stocks, and large-cap stocks outperformed mega-cap stocks.

In the chart below, you can see that small- and mid-cap stocks, represented by the Russell 2000 ETF (orange line) and iShares Mid-Cap ETF (red), outperformed both the large stocks of the S&P 500 (blue line) and the even larger stocks in the Dow (green).

Dividend payers tend to be larger companies, so it’s no surprise that both large stocks and dividend payers did poorly in the first half.

What Investment Strategies Did Best and Worst In The First Half?

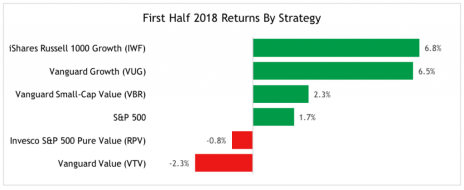

Finally, before I pick the 10 undervalued dividend stocks I think will be the best second-half bets, I think it’s worth noting that even with the large-cap space, growth-oriented strategies have outperformed value strategies by a wide margin so far this year. For example, two of the largest “growth” ETFs, the iShares Russell 1000 Growth ETF (IWF) and the Vanguard Growth ETF (VUG), outperformed the S&P 500 by a large margin.

The Invesco S&P 500 Pure Value ETF (RPV) and Vanguard Value ETF (VTV), on the other hand, which invest in large caps with low valuation ratios (like P/E) and other value characteristics, have underperformed the S&P 500.

And it wasn’t just large-cap value that underperformed: The Vanguard Small Cap Value ETF (VBR) did a little better than the S&P, but much worse than either of the growth funds.

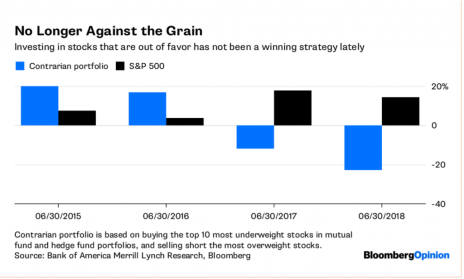

This chart from Bloomberg takes a different approach, comparing the first half performance of a “contrarian portfolio” of stocks unpopular with institutional investors to that of the S&P 500. Selecting out-of-favor stocks this way didn’t work in the first half of this year either (it also flopped in the first half of 2017, but outperformed in 2015 and 2016).

Undervalued Dividend Stocks List Coming Tomorrow!

So, to sum things up, there are plenty of undervalued dividend stocks that are good candidates for a second-half bump today, especially large caps in the consumer staples, industrial, financial, materials, REIT and utilities sectors.

In part two of this post, to be published tomorrow, I’ll pick 10 undervalued dividend stocks that fit those criteria and could see a big boost over the next six months. Stay tuned!

[author_ad]