General Motors (GM) stock recently pulled back to its 200-day moving average around 34 after March auto sales disappointed. Is this a good time to buy GM stock, or is the latest sales data a red flag?

GM Stock at a Glance

General Motors is a household name in the U.S., and mostly people probably think of the stock as a blue chip. But because the stock was de-listed during the 2008 auto industry bailout, and didn’t IPO again until 2010, the stock actually has less than seven years of history as a public company.

And while the old GM stock was a reliable dividend payer, the new GM has a scant three years of dividend history. The old GM paid a $1 per year dividend, but suspended payments in 2008 before filing for bankruptcy. The new, post-bailout company declared its first dividend in January 2014, and has raised the dividend twice since then. At current levels, GM is a high yielding stock, with a current dividend yield of 4.6%.

[text_ad]

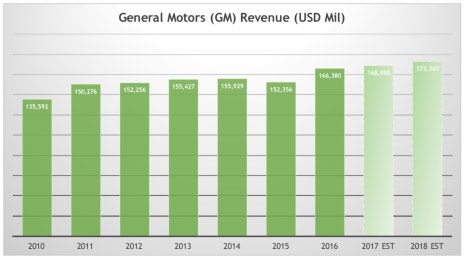

Since the bailout, GM’s revenues have grown mostly steadily, with a slight pullback in 2015. However, while analysts expect revenues to continue growing, their estimates are low: 1.6% growth this year and 2.6% in 2018.

That reflects fears that auto sales’ post-crisis high in 2016 was a peak for the industry, and the pace of U.S. car consumption will slow down from here. March auto sales data provided these Chicken Littles with one more weapon. Auto sales fell 1.2%, mostly because car companies started offering aggressive discounts, so average selling prices fell. They’re competing with each other, but they’re also competing against more competitively priced used cars. The cost of used vehicles dropped 0.9% in March, the biggest drop since December 2014, and was down 4.7% from a year ago. Industry analysts blame a glut of relatively new cars coming off lease.

Even with these challenges, GM’s March sales were much stronger than competitors’. GM’s revenues rose 1.6% year-over-year, and the company gained market share. It was less than expected, but not as bad as Ford’s (F) 7.2% sales decline, or Fiat Chrysler’s (FCAU) 4.6% slump.

It’s also worth noting that there’s been a near-constant stream of worrying news stories about GM ever since the company become public again. A few years ago, it was the company’s ignition switch debacle, then analysts worried that China’s economic slowdown would impact GM’s sales. Now it’s “peak auto.”

GM Undervalued

Whether because of these factors, or simply a lack of love from investors, General Motors stock is deeply undervalued today. The stock’s current P/E ratio is under 6, while its forward P/E is in the basement at 5.5. And the company’s price-to-book ratio is very reasonable at only 1.1. By comparison, Ford (F) trades at a P/E of 9.7 and a price to book ratio of 1.5. Tesla (TSLA), which was recently in the news for becoming “more valuable” than GM, trades at a price-to-book ratio of 10.4. (And doesn’t even have a P/E because earnings are still negative!)

As for GM’s earnings, they’ve increased every year since 2014, but analysts expect a slight decline this year, from $6.12 per share to $6.04 per share. Analysts expect 3% growth the following year, to $6.23 per share.

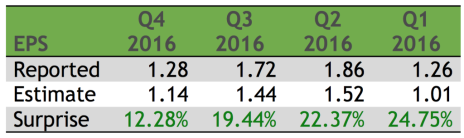

If the analysts are right, 2017 could be a lackluster year for GM stock. However, GM has beaten earnings estimates by double digits in each of the last four quarters. On average, GM’s earnings have come in 19.7% higher than analysts expected.

If we see more surprises like that this year, 2017 could be the year GM stock finally breaks out of its trading range.

The stock has been stuck roughly between 25 and 40 for the past three years. It built a higher trading range between 34 and 38 over the past four months, and looked ready to break through overhead resistance several times early this year. But March’s market troubles and lousy auto sales report have brought the stock back down to its 200-day moving average.

At this level, GM stock is certainly a bargain, but most investors will want to wait until it begins rebounding to start new positions. To get alerted when that is, consider signing up for my premium advisory, Cabot Dividend Investor. Members get alerts on GM and other dividend-paying stocks every week, plus the name of my favorite new buy every month.

[author_ad]