In normal times (pre-COVID), there were always companies who cut their dividends, usually for one of these two reasons:

- Sagging earnings

- Escalating debt

Although, once in a while, you may see companies reduce or eliminate their dividends because they have an upcoming big acquisition or a stock buyback.

But when COVID invaded the world, investors who relied on their steady dividends got a huge shock, as the pandemic spurred dividend cuts of $1.26 trillion in 2020—a 12.2% decline.

[text_ad]

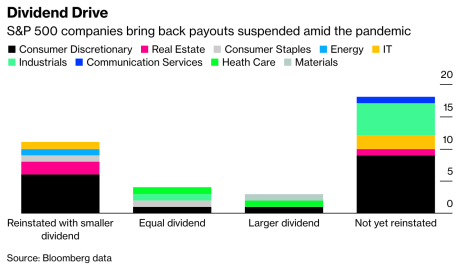

The good news, according to Bloomberg, is that half of the 36 members of the S&P 500 Index that suspended payouts in 2020 have now restored them, as you can see in the following graph.

However, Bloomberg—earlier this year—published the following chart of large U.S. companies whose dividends remain suspended in 2022.

Zero Yielders

| Company / Ticker | Month/Year of Dividend Suspension |

| Alaska Air Group /ALK | March/2020 |

| American Airlines Group / AAL | April/2020 |

| Boeing / BA | March/2020 |

| Delta Air Lines / DAL | March 2020 |

| Expedia Group / EXPE | April/2020 |

| General Motors / GM | April/2020 |

| Hilton Worldwide Holdings / HLT | March/2020 |

| Las Vegas Sands / LVS | April/2020 |

| Marriott International / MAR | March/2020 |

| Nordstrom / JWN | March/2020 |

| Royal Caribbean Group / RCL | May/2020 |

| Southwest Airlines / LUV | April/2020 |

| Walt Disney / DIS | May/2020 |

Sources: FactSet; Bloomberg

You’ll notice that one company—Nordstrom (JWN)—is in bold type in the chart. That’s because the department store reinstated its dividend last month, paying $0.19 per share on March 25. The rest of the companies have not yet done so.

2022 Dividends are on the Rise

The other good news is that dividends—on the whole—are on the rise. According to S&P Dow Jones Indices, during the first quarter of 2022, 963 companies boosted their dividends, a 6.3% rise over last year. Total dividends increases were $27.7 billion for the period, up from $20.3 billion for Q1 2021.

You’ve probably heard of the Dividend Aristocrats—those companies in the S&P 500 Index that have boosted their dividends for the past 25 years. But do you know there are also 39 companies in that index that have increased their dividends for the past 50 (or more) years? They’re called dividend kings. Here’s the list:

2022 Dividend Kings

| Company | Sector | Consecutive Years of Dividend Increases |

| American States Water (AWR) | Utilities | 67 |

| Dover Corporation (DOV) | Industrials | 66 |

| Northwest Natural Holding (NWN) | Utilities | 66 |

| Genuine Parts (GPC) | Consumer cyclical | 66 |

| Emerson Electric (EMR) | Industrials | 65 |

| Procter & Gamble (PG) | Consumer defensive | 65 |

| Parker Hannifin (PH) | Industrials | 65 |

| 3M (MMM) | Industrials | 64 |

| Cincinnati Financial (CINF) | Financial services | 62 |

| Coca-Cola (KO) | Consumer defensive | 60 |

| Colgate-Palmolive (CL) | Consumer defensive | 60 |

| Johnson & Johnson (JNJ) | Healthcare | 59 |

| Lowe’s (LOW) | Consumer cyclical | 59 |

| Lancaster Colony (LANC) | Consumer defensive | 59 |

| Nordson (NDSN) | Industrials | 58 |

| Farmers & Merchants Bancorp (FMCB) | Financial services | 58 |

| Hormel Foods (HRL) | Consumer defensive | 56 |

| California Water Service Group (CWT) | Utilities | 55 |

| Stepan (SCL) | Basic materials | 55 |

| Stanley Black & Decker (SWK) | Industrials | 54 |

| Federal Realty Investment Trust (FRT) | Real estate | 54 |

| SJW Group (SJW) | Utilities | 54 |

| Commerce Bancshares (CBSH) | Financial services | 54 |

| ABM Industries (ABM) | Industrials | 54 |

| Sysco (SYY) | Consumer defensive | 52 |

| H.B. Fuller (FUL) | Basic materials | 52 |

| Altria Group (MO) | Consumer defensive | 52 |

| Black Hills Corp. (BKH) | Utilities | 51 |

| National Fuel Gas (NFG) | Energy | 51 |

| Universal Corporation (UVV) | Consumer defensive | 51 |

| W.W. Grainger (GWW) | Industrials | 50 |

| PPG Industries (PPG) | Materials | 50 |

| Target (TGT) | Consumer defensive | 50 |

| Abbott Labs (ABT) | Healthcare | 50 |

| AbbVie (ABBV) | Healthcare | 50 |

| Becton, Dickinson & Co. (BDX) | Healthcare | 50 |

| Kimberly-Clark (KMB) | Consumer staples | 50 |

| MSA Safety (MSA) | Industrials | 50 |

| Tennant (TNC) | Industrials | 50 |

DATA SOURCES: COMPANY PRESS RELEASES, YAHOO! FINANCE.

For investors who depend on their dividends for cash flow, that is indeed promising! As you can see, most of these companies are fairly conservative, steadily grow their earnings, and share the wealth with their stockholders.

I ran each of these dividend kings through my analysis, and found three of them that look very promising.

| Company | Symbol | Industry | P/E | Dividend Yield (%) | Analyst Rank | Price ($) |

| Black Hills Corp. | BKH | Utilities | 21.1 | 3.12 | 1.7 | 77.17 |

| National Fuel Gas | NFG | Energy | 15.81 | 2.59 | 2.5 | 71.07 |

| AbbVie | ABBV | Healthcare | 24.03 | 3.61 | 2.1 | 158.43 |

Two of these companies operate in the Energy and Utilities sectors, which are two of the three sectors that have shown gains so far this year, up 33% and 2%, respectively.

As always, these are just ideas, to get you started on your own research. But if you are looking for some steady and growing cash flow, these stocks may just help you reach your goals.

Do you own any dividend kings? Any Dividend Aristocrats? Tell us about how they’ve performed in the comments below.

[author_ad]

*This post has been updated from an original version.