We hear from a lot of retired investors seeking income investing tips in today’s market. They know they should be moving more of their assets to fixed-income investments as they get older, and now they’re feeling the pressure to move more quickly with the Fed once again cutting rates.

Even with the prospect of lower rates ahead, it’s still possible to live on the income from your investment portfolio after you retire without sacrificing safety or your standard of living. You just need a sound strategy.

[text_ad]

Below are our top five income investing tips for investors in retirement.

Our Top Five Income Investing Tips

Tip #1: Fixed Income Isn’t the Best Source of Income

Fixed-income investments—bonds, preferred stocks, CEFs and more—are called that for a reason. These investments are securitized debt, and the interest payments on the debt create a nice steady income stream for whoever owns them.

Rates have risen over the course of the last few years, making yields on all types of fixed-income investments—from muni bonds to corporate loans—more attractive to most investors.

But, instead of reaching for yield in higher-risk fixed-income assets—like junk bonds—today’s retirees would be wise to turn to the stock market, where dividends are having a renaissance. Also, with inflation still high, you’ll need asset appreciation to avoid losing your purchasing power.

Tip #2: Don’t Overvalue “Low Risk”

Retired investors often think they should use a low-risk investment strategy because they don’t have as long to rebuild their nest egg if they suffer a catastrophic loss.

The problem that a lot of retirees run into is that they don’t just want to preserve their portfolio until they die—which is the aim of the lowest-risk investment strategies. They also want to grow their investment portfolio, while living on the dividends or other income from it.

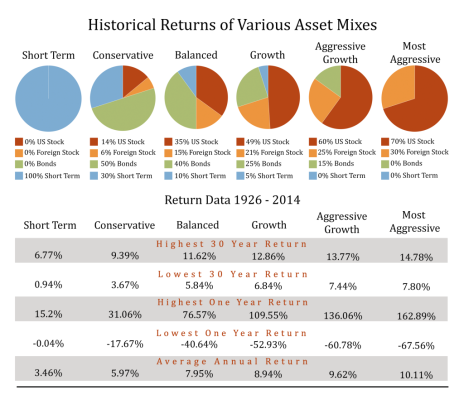

These investors are more likely to meet their goals by taking on a moderate amount of risk, at least in part of their portfolio. As the table below reveals, based on data from Fidelity, higher-risk strategies not only return more every year on average, they also beat low-risk strategies over the long term (30-year period).

If you’re happy with average annual returns under 6%, which is still barely outpacing inflation, you can opt for a conservative strategy. But if you’re hoping for more growth from your portfolio, a conservative strategy that’s billed as “low risk” may actually disappoint.

Tip #3: Don’t Underestimate the Power of Dividend Growth

Many investors turn to the stock market for income, then ignore 1% or 2% yielding stocks because their yields are “too low.” But stocks in these brackets are often the best long-term income investments because they have greater ability to grow their dividends over time.

Years ago, Equifax (EFX), one of our Cabot Dividend Investor recommendations, was yielding just about 2%. The stock traded around 32 and paid a 16-cent quarterly dividend. (To figure out the yield of any stock, just divide the annual dividend payout, in this case, 0.16 x 4, by the stock price. So EFX’s yield fifteen years ago was 0.64 / 32.00 = 0.02 or 2%.)

Over the past decade-plus, EFX has done very well, rising from 32 to 221, and its yield has fallen from 2% to 0.9%. But EFX has also increased its dividend every year over this time period, from 64 cents per year in 2011 to $2.00 today. Even though the stock’s yield is now 0.9%, investors who bought fifteen years ago are now collecting $2.00 per year on a stock they originally bought for $32, for a yield on cost of 6.25%.

Over longer time periods, this effect becomes even more powerful. It’s estimated that Warren Buffett’s Berkshire Hathaway now earns more in dividends from Coca-Cola (KO) every year than it originally paid for the stock ... that’s a yield of more than 100%.

Tip #4: Take Advantage of Gifts from Uncle Sam

Another benefit of depending on dividend stocks for income is the special tax status they’ve been granted by the U.S. government. For investors in the 10% to 12% tax bracket on ordinary income, qualified dividends are tax-free. And investors whose ordinary tax rate is between that and the upper levels of the 35% bracket pay only 15% tax on dividends, while investors in the top of that bracket and the 37% tax bracket still only pay 20% tax on qualified dividend income.

(You do need to have held the stock for over 60 days, including the ex-dividend date, in order to qualify for the lower dividend tax rate. Also, make sure to talk to a tax professional if you’re wondering how dividend stocks will impact your tax outlook.)

Most U.S. corporations pay qualified dividends, and some Canadian and foreign stocks listed on U.S. exchanges do too.

Tip #5: Yields That Seem Too Good To Be True Probably Are

While dividend stocks are a great source of tax-advantaged regular income—often with potential for growth—you have to be selective about which ones you buy. And looking for dividend stocks with the highest yields is a surefire way to get yourself in trouble.

At the beginning of November 2015, Seadrill (SDRL), an offshore drilling contractor, yielded a whopping 18%. The company had long been a great dividend payer, often yielding as much as 7% or 8%. But after a dramatic drop in oil prices and offshore drilling activity, the dividend—and the company’s very survival—was suddenly in jeopardy. Between the beginning of September and mid-November, SDRL slid from 37 to 20, sending the normally high but sustainable yield to nearly 20%.

For most of the fall, Seadrill’s management assured investors that the dividend was safe through 2015, but ultimately they suspended the dividend on the day before Thanksgiving 2015.

That 16% yield was suddenly 0%, and the worst wasn’t over yet. SDRL fell from 20 to 10 within a week. Two years later, SDRL traded around three dollars. Now, the company has emerged from a bankruptcy that saw original investors in the stock receive as little as 0.25% of their original holdings.

Tip #6: Use Covered Calls to Generate Extra Income from Stocks You Already Own

Here’s one more bonus investing tip, because I couldn’t resist.

If you’re already investing in dividend stocks for income, writing covered calls on your stocks is a great way to generate extra yield from stocks you already own.

Covered calls are the least risky way to trade options, and you can control exactly how much capital you put at risk in each trade. It’s a strategy we employ in both Cabot Profit Booster and Cabot Income Advisor.

[author_ad]

*This post is periodically updated to reflect market conditions.