I know a lot of investors who love high yielding stocks with dividends over 5 percent. And I agree that getting 5% of your investment back as income every year sure is nice. But too often, the highest yielding stocks are high yielding for the wrong reasons.

For example, many of the highest paying dividend stocks in the Dow are old-school companies whose earnings have gone into decline in recent years. As a result, their stock prices have fallen, which has made their yields unusually high. Likewise, the list of the highest yield stocks in the S&P 500 is full of landline phone companies, paper suppliers, department stores and other relics of the pre-internet age.

While these companies’ current yields are high, their not-so-bright futures will make it hard to maintain their dividend payments, and eventually those yields are likely to disappear.

[text_ad]

Investors interested in sustainable yields over 5% will have better luck in traditionally high yield sectors, like REITs, and with turnaround stocks, which are often some of the highest paying dividend stocks. You may need to take on some extra risk, in the case of turnaround stocks, or tax obligations, in the case of yield vehicles. But for dedicated high yield hunters, these tradeoffs are worth it. If that sounds like you, read on for my top five stocks with dividends over 5%, ranked by dividend yield.

Apollo Global Management LLC (APO) – Dividend Yield 8.0%

Apollo is an alternative asset manager. The company manages publicly traded debt funds and real estate investment trusts, runs several private equity funds, and also invests directly in middle-market companies. Apollo’s assets under management have grown by 23% per year (on average) since 2006.

APO currently offers a whopping 8% dividend yield. However, it comes with a few caveats. First, APO’s distribution varies from quarter to quarter, based on after-tax earnings. So that 8% yield won’t last. However, APO’s yield has averaged 5.4% over the past five years, so investors can expect their income stream to stay pretty beefy, if slightly unpredictable.

However, investors who like to keep their taxes simple may not want to trouble with APO. APO’s distribution is made up of income from a variety of sources, including interest payments on bonds it owns and capital appreciation of securities in its funds. That means only a portion of each distribution qualifies for the lower dividend tax rate, while the rest is taxed as return of capital, capital gains or some other type of income.

GameStop (GME) – Dividend Yield 6.0%

GameStop Corp. is a video game retailer. The company’s eponymous stores buy and sell new and used video games, consoles and accessories.

In 2010, 90% of GameStop’s earnings came from selling physical copies of video games, both new and used. Unfortunately for GameStop, those revenues are drying up quickly as publishers make digital versions of their games available directly to the consumer. Gamers can now browse for, buy and download (and most recently, even stream) new games right on their Xbox, PlayStation or Wii, all without leaving the comfort of their couch. In 2009, downloads accounted for only 20% of computer and video game sales. In 2015, they accounted for 56%.

GameStop has compensated by diversifying and seeking new sources of revenue, primarily through acquisitions. The company’s new businesses include mobile game publishing, a collectibles site called ThinkGeek.com and three “technology brands” store chains: Spring Mobile, Cricket Wireless and Simply Mac. Last year, these new businesses contributed 30% of operating earnings.

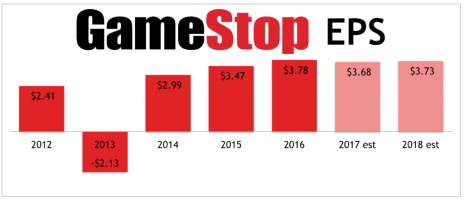

And while the old business is shrinking slowly, the new businesses are growing quickly. In the latest quarter, GameStop store sales declined 6.5%, but digital sales rose 13%, collectibles revenue rose 37% and Technology Brands sales rose 54%. Of course, the new businesses aren’t making up for the decline of the core business just yet. For the year just ended (GameStop’s fiscal year ends in January), analysts expect GameStop to report sales of $8.66 billion, 7.5% lower than in 2015. And EPS are expected to fall to $3.68, from $3.90 in 2015. But in 2017, EPS are expected to rise to $3.73. And over the next five years, analysts think GameStop can average EPS growth of 7% per year. In the meantime, the stock yields 6.0%.

Hersha Hospitality Trust (HT) – Dividend Yield 6.0%

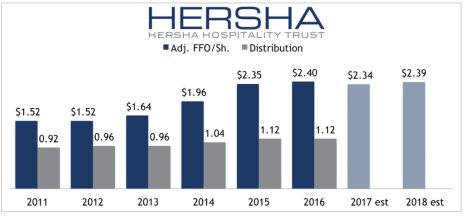

HT is a REIT, or real estate investment trust, that owns hotels in major East Coast cities. Hersha’s adjusted funds from operations, the best measure of REIT cash flow, are expected to decline slightly this year but to increase steadily after that. Distributions are paid directly out of FFO, and Hersha also occasionally pays special dividends. However, as we saw with Apollo, some of the distributions are considered return of capital.

For investors who don’t mind the tax consequences, HT offers a generous yield of 6.0%.

Mattel (MAT) – Dividend Yield 6.0%

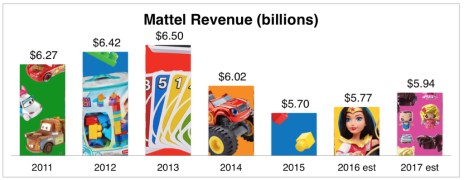

Another 6%-yielder, Mattel also made it on to my list of the highest paying dividend stocks in the S&P 500. Toys aren’t a traditionally high-yielding industry—Mattel’s operating margins are less than 10%—but the stock is cheap because revenues and earnings have been falling since 2013. Barbie’s sales started falling in 2012, and then Mattel lost the license to Disney’s “Princess” dolls at the end of 2015. Bigger picture, Mattel has been slow to adapt to internet-era shifts in the toy industry—like the growing need to drive toy sales with entertainment properties, for example. Mattel’s management is working on a turnaround, and though it’s taking longer than expected, analysts finally expect revenue and earnings growth to return this year. In the meantime, MAT yields 6.0%, and though the dividend payout ratio is currently unsustainably high, it should decline as earnings rebound.

Welltower (HCN) – Dividend Yield: 5.3%

Welltower, another pick from among the S&P high yielders, rounds out our five top stocks with dividends over 5%. The sixth-largest public U.S. REIT, Welltower owns a large health care-focused real estate portfolio. The company’s thousand-plus properties fall into three categories: senior housing, post-acute care centers and outpatient centers. They focus on private-pay customers and on keeping patients out of more expensive hospital settings. Demand is benefiting from the dual trends of the aging U.S. population and the fight to keep health care costs down. Funds from operations have increased by an average of 6% per year since 2011. The company has paid dividends since 1992, and increases the dividend by about 5% per year (10-year average). However, since Welltower is a REIT, the distributions don’t qualify for the lower dividend tax rate.

If I were going to buy one of these stocks with dividends over 5% today, I’d opt for GameStop. The retailer pays qualified dividends, is trading at a bargain-basement P/E under 7, and could become a huge winner if management’s turnaround plan works out.

For any future updates on these stocks or to find out about high-quality stocks I have in our Cabot Dividend Investor portfolio, consider taking a trial subscription to the advisory.

[author_ad]