Growth and Income Stocks Seem Like a Contradiction. But You Can Have Your Cake and Eat It Too. Here are 7 that I Like.

When I talk about growth and income stocks, there’s a certain type of investor who only hears “dividend,” and she zones out, because she’s looking for growth. But clearly, I said “growth,” and I said it for a reason.

There’s an abundance of growth stocks available to investors – great capital gain opportunities – that also pay quarterly dividends. What’s more, some of these companies even raise the dividend annually! So let’s explore the concept of growth stocks with big dividends, in case you’re unnecessarily leaving money on the table.

[text_ad]

We buy stocks so that our assets grow faster than they would in bonds or money market funds, right? Stocks increase our investment portfolio’s value in two ways: they can deliver capital gains (i.e. share price growth) and they can pay dividends (i.e. cash that lands in your account each quarter).

Let’s say that you’re looking to invest in a company that’s expected to grow their profits 12% in 2020. You want that stock because you believe the company’s profit growth will translate into share price growth. What if I offered you shares of a different company that’s also expected to grow their profits by 12% in 2020, but additionally pays shareholders a 3% dividend yield? Who would say “No” to that scenario?!

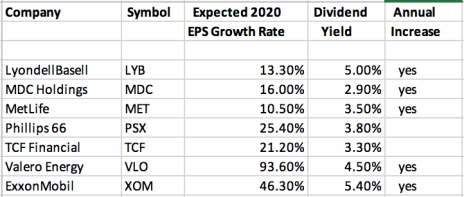

That, my friends, is the essence of a growth and income stock. Here are a few excellent examples of growth and income stocks that could enhance your net worth in 2020:

7 Growth Stocks with Big Dividends

All of these companies have been pre-screened for good financial health. None of them carries an astronomical price/earnings (P/E) ratio or a balance sheet that’s overloaded with debt. These are the types of stocks that I offer investors every day in Cabot Undervalued Stocks Advisor, where you’ll also find classic growth stocks like Netflix (NFLX) and GUESS?, Inc. (GES).

Another benefit of growth stocks with big dividends is that the dividend can lower the risk associated with stock investing. That’s because when market corrections come along, people are far less likely to panic and sell a stock that’s paying them a big quarterly dividend than they are to sell a stock that doesn’t pay any dividends at all.

Less panicked selling means less of a share price correction when other stocks are suffering. And of course, when you own shares of healthy, growing companies, you can go on vacation without worrying that the share price is going to be cut in half while you’re on the beach. When you own shares of MetLife (MET), for example, the company’s going to be around for another 10 or 100 years.

Want more excellent ideas for growth stocks with big dividends? I suggest you subscribe to my Cabot Undervalued Stocks Advisor, which is chock full of them.

To learn more, click here.

[author_ad]