Today, I have three high-yield REITs to recommend—conservative stocks that are perfect for this kind of crisis environment. But first, let’s talk about the crisis…

How the Market Responded to Previous Outbreaks

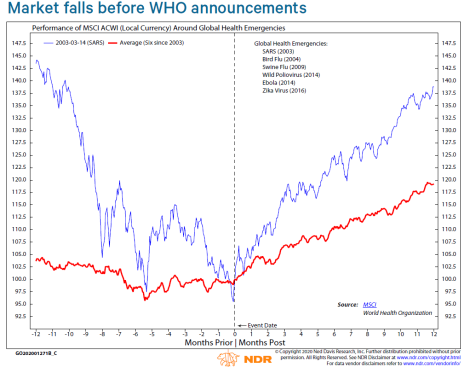

While it’s emotionally wracking to see the stock market take the huge swings we’ve seen in the past couple of weeks, it’s not unprecedented. As you can see from this chart that was compiled by Ned Davis Research, disease outbreaks normally roil the markets. But what the chart also shows is that these are temporary phenomena.

The chart depicts the before and after of the World Health Organization (WHO) declaring “global emergencies” during each outbreak. That happened with the coronavirus on January 30. The markets are still very much in crazy swing-mode (my own term!), which will probably continue until we reach peak stage. Global health experts believe that China and South Korea have peaked, although they warn there could be a second outbreak.

[text_ad]

And while this virus is horrible in its impact on individuals, economies, and certain industries, it’s important to put it into perspective: through Tuesday, there were 119,487 confirmed cases globally and 4,302 deaths from coronavirus. In contrast, the WHO says flu kills 291,000-646,000 people every year.

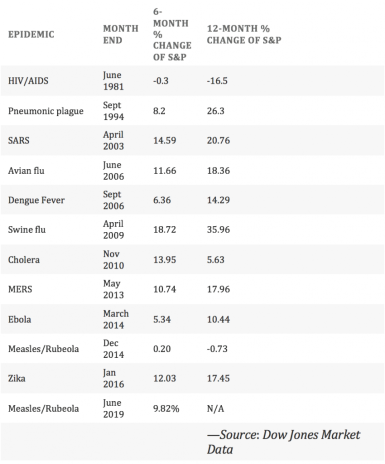

History tells us that this too shall end. And as the table below illustrates, historical disease outbreaks are usually followed by significant market gains.

So, what should you do now? My advice: probably nothing. Trading stocks in this kind of market can be a crap shoot, as it’s panic selling, which rarely works out well for the individual investor. Friends who sold their stocks during the 2007-2009 recession (against my advice) are very sorry today. Right now, you have paper losses; if you sell at these lower prices, you will incur real money losses.

The market will spring back—that’s what you need to know. However, it is a great time to buy, as Warren Buffett would say, when “there is blood in the streets.” But you want to be judicious in your purchases. Until this shakes out, I would avoid stocks in the following sectors:

- Entertainment

- Cruise lines

- Airlines

- Hotels

But once the market begins to show signs of sustainable growth, those sectors may look pretty interesting, as many stocks will have pulled back to very buyable levels.

Every single sector in the U.S. is currently down for the year, with Energy (-65.1%) and Basic Materials (-28.0%) losing the most and Utilities (-5.5%) and Healthcare (-12.1%) losing the least.

You could certainly take a gamble on some healthcare stocks that may be in the run for a coronavirus antidote or vaccine, but that could be a pretty risky bet (biotech stocks usually are). Or you could buy Netflix (NFLX), like many investors have, as folks are staying in right now, but that is probably a temporary bounce.

3 High-Yield REITs to Buy

Instead, in times like these, if you’re determined to buy stocks, why not bet on the tried and true—conservative stocks like these high-yield REITs?

- Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI), dividend yield 4.06%, analyst ranking 2.1

- Physicians Realty Trust (DOC), dividend yield 4.82%, analyst ranking 2

- Medical Properties Trust, Inc. (MPW), dividend yield 4.61%, analyst ranking 2.1

That way, you’ll collect some steady cash flow while we wait for the market to shake off coronavirus.

[author_ad]