This week, the Federal Reserve performed its annual stress test on 34 of the largest banks in America. All 34 passed. Within hours, bank dividends across the board got a major boost.

Here were some of the biggest post-stress test increases in bank dividends:

Citigroup (C): Doubled its quarterly dividend to $0.32 from $0.16

Bank of America (BAC): Boosted its quarterly dividend 60%, to $0.12 from $0.075

Morgan Stanley (MS): Boosted its quarterly dividend 25%, to $0.25 from $0.20

JPMorgan Chase (JPM): Boosted its quarterly dividend to $0.56 from $0.50

Wells Fargo (WFC): Plans to raise its quarterly dividend by a penny

Dividends were only part of the banks’ shareholder-friendly spending spree. Many of them are buying back shares too. JPMorgan Chase ($19.4 billion) and Citigroup ($15.6 billion) announced record share repurchase programs. Bank of America is buying back $12 billion of its own stock; Wells Fargo as much as $11.5 billion; and Morgan Stanley will repurchase between $3.5 billion and $5 billion.

[text_ad use_post='129632']

On average, banks will spend close to 100% of their expected earnings over the next year on stock buybacks, up from 65% in the past 12 months.

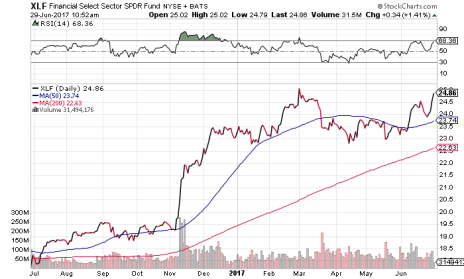

Naturally, all of this spending has been good for financial stocks: the Financial Select Sector SPDR ETF (XLF) was up more than 3% in the two days since. That’s a welcome turnaround for a sector that has taken it on the chin after making a huge move in the months following Donald Trump’s election. From the start of November to the beginning of March, bank stocks advanced nearly 30%. They promptly tumbled 9% in March and the first half of April. But after this week’s upmove, the XLF is on the brink of matching its March highs.

The higher yields could make the banks more attractive to income investors going forward. Citigroup’s modest 1% yield now looks much more substantial at nearly 2%. Morgan Stanley just boosted its yield above 2%. And JPMorgan Chase’s is now up to about 2.5%.

The huge, in some cases record-setting, share repurchases should help even more. And if the XLF pushes above its March high just above 25, then look for another extended rally in bank stocks to begin in earnest. Gaining the federal stamp of approval to spend more money makes the financial sector feel like less of a risk. While the higher yields and share repurchases are certainly nice, the psychological hurdle of deemed in good financial standing could be the sector’s biggest catalyst at least in the short term.

Bank dividends have been pretty modest since the recession, as many of the largest financial institutions in the world have been returning cash to shareholders at a snail’s pace. Now that they’ve again gotten the greenlight to loosen the purse strings, look for a rally that had so much promise after the election to resume.

[author_ad]