Manufactured homes today don’t look anything like the mobile homes of my childhood. The industry has evolved into sustainable housing for more than 22 million folks in the U.S. That’s more than 6.5% of our total population and presents new opportunities for housing REITs! And the industry is heating up around the globe. The worldwide manufactured housing market was valued at $27,188 million in 2019, is growing at a CAGR of 6.5%, and is expected to reach $38,848 million by 2027.

Manufactured housing is quickly becoming one of the answers to our affordable housing crisis. The average price per square foot for a new manufactured home is around $85, according to Manufacturedhomes.com (although that varies by region). Alternatively, Rocketmorgage.com reports that the median price per square foot for a single-family home today is $233. Even with rising material costs (which typically pass through to buyers faster with manufactured homes), on average, you can buy a manufactured home for $135,000, compared to the average $412,000 that a stick-built home will set you back.

[text_ad]

And manufactured homes are no longer the dumpy cousins of stick-built residences. Numerous technological advances now allow homeowners to choose from different architectural styles and exterior finishes, as well as opt for two- or even three-story homes. Today, you can even jump in and customize your home, as I recently witnessed with one of my real estate customers, who bought a Clayton home. Clayton allowed her to change the configuration of the inside of the home. She removed walls, and I’m here to tell you—you couldn’t tell that it was a manufactured home!

A Growing Opportunity

According to Commercial Property Executive, today’s manufactured homes “are built with many of the same materials and construction techniques as foundational homes and are nothing like the early mobile homes” (built before 1976, when the HUD code was introduced).

Besides affordability and quality, there are several other trends that are boosting this industry, including:

- The proliferation of manufactured housing communities. There are more than 43,000 land-leased communities in the U.S. And some of them are pretty amazing, in terms of amenities: swimming pools, golf courses, tennis courts, pickleball courts—you name it.

- For the community owners, rental rates rose 3.7% compared to the previous year, which makes the ownership of such a neighborhood attractive.

- The national occupancy rate is 93.3%, with low turnover.

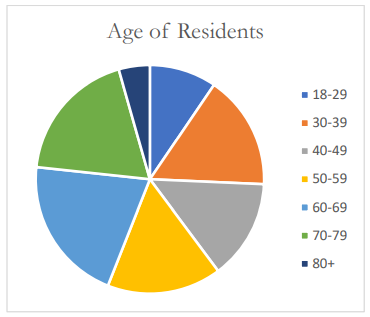

- As you can see from the following graph, baby boomers who have begun hitting their golden ages are a growing demographic. The majority of manufactured homes are owned by those 50 and older, although you can see by the graph that the younger folks are also choosing this affordable housing option. And the expected 55 million Gen Z renters by 2030 will, no doubt, be on the hunt for reasonably priced housing (I’m sure their parents will be happy to help!).

The Manufactured Housing REITs Investment Strategy

Right now, there are three housing REITs that focus on manufactured housing communities:

Sun Communities, Inc. (SUI) owns, operates, or has an interest in a portfolio of 667 communities comprising nearly 180,000 developed sites in 39 states, Canada and the U.K.

Equity LifeStyle Properties, Inc. (ELS) owns or has an interest in 450 quality properties in 35 states and British Columbia, consisting of 171,477 sites.

UMH Properties, Inc. (UMH) owns and operates 136 manufactured home communities containing approximately 25,800 developed homesites. These communities are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Michigan, and Maryland.

This year has been a tough year for REITs of all stripes, and the housing REITs were no exception (the three are all down between 20-37% since the start of 2022). UMH is off to a slow start in 2025, but has risen 10% in the last year.

While I was reviewing real estate stocks, I thought that I would also look at these two companies that make manufactured homes:

Legacy Housing Corporation (LEGH) builds, sells, and finances manufactured homes and tiny houses primarily in the southern United States. The company markets its homes under the Legacy brand through a network of 100 independent and 13 company-owned retail locations, as well as direct sales to owners of manufactured home communities in 15 states in the United States.

Champion Homes (SKY) operates as a factory-built housing company in North America. The company offers manufactured and modular homes, park models RVs, accessory dwelling units, and modular buildings for the multi-family, hospitality, and senior and workforce housing sectors.

As you can see from the following table, each one of these stocks looks pretty interesting at the moment.

| STOCK | SYMBOL | ANALYST RANKING | 52-WK RANGE ($) | DIV YLD (%) |

| Sun Communities | SUI | 1.8 | 109.22 - 147.83 | 3.06 |

| Equity Lifestyle | ELS | 2.6 | 58.86 - 76.60 | 3.28 |

| UMH Properties | UMH | 1.3 | 15.00 - 20.64 | 5.39 |

| Legacy Housing | LEGH | 2 | 21.67 - 29.31 | n/a |

| Champion Homes | SKY | 2 | 63.13 - 116.49 | n/a |

In addition to their individual merits, there are a few other reasons why investors might want to take a look at these manufactured housing investments:

- U.S. housing inventory has improved from historical lows, as you can see by this graph (courtesy of the St. Louis Fed). However, the National Association of Realtors recently reported a 4.1-month supply of existing homes at the current sales pace.

- Manufactured housing REITS have a decent yield, although the new manufacturers do not pay dividends.

So, if you’re in the market to take advantage of the evolution of manufactured housing, these ideas might just be the way to do it.

Do you prefer to invest in physical real estate or housing REITs for sector exposure?

[author_ad]

*This post is periodically updated to reflect market conditions.