This is part 2 of a two-part series. Click here for the first five monthly dividend stocks.

Monthly dividend stocks are rare, but investors like them for a good reason. If you’re retired, stocks that pay dividends monthly are a perfect source of regular income you can use to pay bills, rent or buy groceries. Non-retirees also find monthly dividends attractive because they compound faster.

But as I said, there aren’t very many monthly dividend stocks, and only a handful of them are good investments. However, the ones that are worth buying can be quite high-yielding, and offer enviably consistent monthly income.

[text_ad]

I’ve rounded up the handful that I think are worth your time, with details on the dividend, yield and background of each. Below is the second part of my list, with my next six favorite monthly dividend stocks.

6 More Monthly Dividend Stocks

Monthly Dividend Stock #6: Pembina Pipeline Corp. (PBA) – Monthly Dividend: $0.14

Pembina is a Canadian pipeline company, which transports, refines and stores oil and natural gas. PBA pays monthly dividends in Canadian dollars; the current dividend of 17 Canadian cents per share is worth about 14 U.S. cents at current exchange rates, for a yield of 5.1%.

Pembina is completing a number of capital improvement projects this year, which are expected to boost revenues and earnings significantly. The company also acquired Veresen earlier this summer, making it the third-largest pipeline network in Canada.

Since converting from an income trust to a corporation in 2010, Pembina has paid dividends every month, and has raised the dividend every year. Pembina also paid monthly dividends for 13 years before converting to a corporation, and has never decreased the dividend.

Please note that dividends Canadian companies pay to U.S. residents are usually subject to a 15% Canadian withholding tax, unless the shares are held in a qualified retirement account.

Monthly Dividend Stock #7: Permian Basin Royalty Trust (PBT) – Monthly Dividend: Variable

For the bargain hunters and gamblers out there, PBT combines a low price with an unpredictable monthly dividend. But it yields 7.7%!

The trust owns oil- and gas-producing assets in Texas, and distributes cash to unitholders monthly, based on income. That means distribution amounts are affected by production levels, energy prices and capital expenditures. The stock price tends to track the price of WTI crude oil fairly closely. (PBT is currently trading at just over 8.) If you’re intrigued, just be aware that distributions are considered royalty income and are subject to ordinary income taxes.

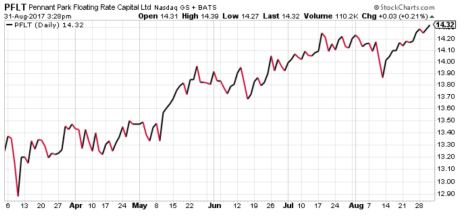

Monthly Dividend Stock #8: PennantPark Floating Rate Capital (PFLT) – Monthly Dividend: $0.10

PennantPark is a New York-based investment company that runs two business development companies: PennantPark Floating Rate Capital (PFLT), which pays dividends monthly, and PennantPark Investment Corp (PNNT), which only pays dividends quarterly.

PennantPark Floating Rate Capital finances middle-market private companies, which often don’t qualify for financing from larger lenders. Typically, PennantPark provides its portfolio companies with investments of between $2 million and $20 million, and invests for three to 10 years. Most of the company’s loans are floating rate, so their income can increase when rates rise.

Right now, PFLT yields a competitive 8%, and trades in a fairly low-volatility range between 14 and 14.5.

Monthly Dividend Stock #9: Shaw Communications (SJR) – Monthly Dividend: $0.08

Shaw Communications is a major Canadian telecom. The company provides phone, internet, TV and mobile service, mostly in British Columbia and Alberta.

Shaw has paid monthly dividends since 2005. While U.S. investors will see their dividends vary a bit from month to month due to exchange rates, Shaw has steadily grown the dividend over the past 12 years, and now yields 4.1%.

The stock ran into trouble in 2015, but bottomed in early 2016 and has been steadily advancing since.

Monthly Dividend Stock #10: Stag Industrial (STAG) – Monthly Dividend: $0.12

Stag Industrial is a REIT that owns industrial properties across the U.S. The company is benefiting from the e-commerce boom thanks to its large portfolio of warehouses. Warehouse space is in high demand as Amazon and online competitors expand. Stag is investing accordingly, and revenues have increased steadily every year since the REIT came public in 2012.

Stag passes most of that cash on to investors. Stag has paid monthly dividends since 2013, and has increased its dividend every year for the past six years. STAG’s current monthly payout of 12 cents per share yields 5.1% at current prices.

Monthly Dividend Stock #11: Student Transportation (STB) – Monthly Dividend: $0.04

Student Transportation is exactly what it sounds like: the third-largest provider of student transportation in North America. The company is based in Ontario but the majority of revenues come from the U.S., and STB reports in U.S. dollars.

Revenues have increased steadily in each of the past five years, but cash flow is less even. Operating margins declined from 6% in 2010 to 3% in 2015, although they’ve begun to improve. Earnings per share can also be choppy, though they’ve risen every year since 2014.

STB’s dividend is also not the most reliable; the company decreased the dividend in 2015. However, at current prices, the four-cent monthly payout yields 7.4%.

[author_ad]