Tech stocks are leading the stock market lower. Five days of declines in the Nasdaq culminated in a 6.8% plunge in Facebook (FB) stock on Monday, following news that a political intelligence firm accessed 50 million user profiles without permission. The drop pulled the Nasdaq lower by over 2%. On top of that, the European Commission introduced a proposal to tax tech companies based on where their users are located, further shaking the sector.

But the pain isn’t limited to tech stocks. The Dow and S&P 500 both declined 1.4% on Monday, following a week of losses. Industrials and materials stocks are sliding amid fears of a global trade war, and financials are falling as investors rotate into risk-off mode.

It’s still not a full-market rout though. There are pockets of stocks—some of them surprising!—holding up quite well. Most provide a marked contrast to the Facebooks of the world; they’re conservative, pay dividends, and have been around for over 15 years.

[text_ad]

If you’re looking for a less heartburn-inducing replacement for Facebook or one of the other FANG stocks (or if the red ink is simply making you nervous), consider adding one of these six resilient, lower-risk, dividend-paying stocks to your portfolio.

Utilities

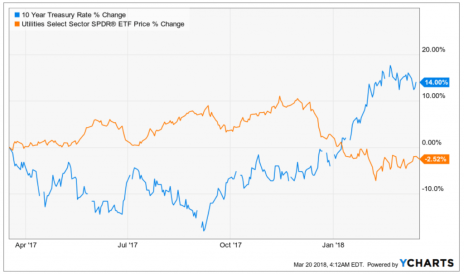

Utility stocks have been the unlikely winners of the past week—unlikely because Treasury yields hit a 10-year high just last month. Utilities typically move inversely to fixed income yields, because utility companies have high debt and their stocks are seen as bond alternatives. From December 1 to February 1, as the yield on the 10-year Treasury rose from 2.42% to 2.72%, the utilities index fell 10%.

But utilities bottomed on February 8 and have tacked on modest gains over the past five weeks, even though rates didn’t peak until February 21, and have remained elevated since.

Part of the explanation is a flight to safety—when volatility increases and investors get nervous, conservative sectors like utilities see inflows.

In addition, utilities tend to track interest rate expectations more closely than actual interest rates. Utilities can tank when investors decide there’s a rate hike coming, for example, but often their reaction to the actual rate hike is muted. So the sector tends to bottom before rates peak—which could be what we saw in February.

Investors who want to hide out in utilities will be in good company, and can collect reassuring dividends from stalwarts like ConEd (ED), which has paid dividends every year since 1975.

ConEd typically delivers low-single-digit EPS growth each year, which the utility passes on to investors through annual dividend increases averaging 2%.

More growth-oriented (or eco-conscious) investors should check out Xcel Energy (XEL), a Minnesota-based utility. The company already provides the most wind power of any U.S. utility, and plans to generate 30% of its power from wind farms by 2021.

REITs

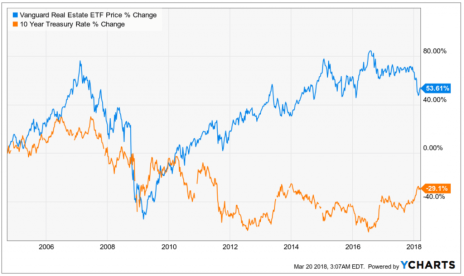

Like utilities, real estate investment trusts (REITs) usually move inversely to interest rates. Rising rates make life more expensive for REITs, because they finance their large real estate purchases with borrowing. (Mortgage REITs’ fortunes are even more closely tied to rates, but let’s set them aside for now, because I don’t recommend buying mortgage REITs in the current interest rate environment.)

But, like utilities, REITs can be more sensitive to expectations of interest rates (and their direction) than actual rates. And so REITs have risen 4% over the past month, versus an 0.8% decline for the Dow. That makes REITs an interesting option for investors looking to add some counter-cyclical exposure to the stock market to their portfolios.

Since the start of March, data center REITs, which lease server space to cloud companies like Amazon, have outperformed all other types of REITs, rising 7.5% on average. Trailing them are apartment REITs, up 6.7%, and health care REITs, with a 5.9% average gain since the start of the month. Industrial and office REITs are also doing well—up 5.2% and 4.8%—as are hotel and hospitality REITs, which are typically the most responsive to economic conditions.

One of the better performers has been Host Hotels & Resorts (HST), which owns Marriotts, Westins and Ritz-Carltons. The stock pulled back about 15% between the end of January and the start of March, but has since bounced back to its 200-day moving average. The REIT has a short but strong history of dividend growth: the dividend was suspended in 2009 but reinstated in 2010, and has increased 20-fold since then.

In the industrial space, I’ve been watching STAG Industrial (STAG) for some time. The company owns industrial properties across the U.S. and is a rare monthly dividend payer. SATG’s portfolio includes plenty of warehouse space, which is in high demand as Amazon and online competitors expand.

“Old School” Tech Stocks

While Facebook might have an outsized impact on the Nasdaq—and in headlines—it’s not the only tech stock in town. Some less-trendy tech stocks rode out Monday’s big wipeout just fine. Think hardware companies like Cisco (CSCO)—down just 1.6%—or Intel (INTC), which fell only 0.66%, less than the S&P 500.

Intel is pretty resilient to corrections these days, after spending most of the last three years consolidating. The stock finally started a new uptrend in September, and after a few pieces of good news, INTC broke out to a new 10-year high earlier this year.

One potential wrinkle is the company’s connection to self-driving car technology. Intel acquired self-driving tech leader Mobileye this summer. If the recent Uber fatality triggers a selloff in self-driving related stocks, INTC could see some collateral damage.

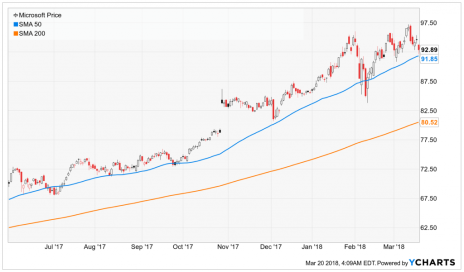

Alternatively, consider Microsoft (MSFT), which has been trending up just above its 50-day moving average for the past year and pulled back a reasonable 1.8% on Monday. As one of the oldest tech giants, Microsoft has a much stronger dividend history than many of its peers: the company has paid dividends since 2003 and increased its dividend in each of the past 13 years. Today, Microsoft’s dividend is nearly double what it was five years ago.

For more low-risk, dividend paying stock ideas like these (with lots more detail and weekly updates) try a trial subscription to Cabot Dividend Investor, my premium advisory for retirees and anyone else looking to generate income from their investment portfolios. Click here to join.

[author_ad]