The Federal Reserve is almost certain to raise interest rates next month during its final meeting of the year on December 13-14. Options traders now assign about a 94% probability to it. But if you’re an income investor, I wouldn’t sell your dividend stocks and go diving into Treasury bonds and CDs just yet.

For starters, like last December, the Fed’s impending rate hike—which would be just its second since the subprime mortgage-induced recession—is sure to be modest. Last year, Janet Yellen and company hiked the federal funds rate by a mere quarter of a percentage point, from near zero to a range of 0.25 to 0.50. Expect a similar hike this year, to a range of 0.50 to 0.75.

That’s not likely to do much for Treasury bonds; the current yield on a 10-year U.S. Treasury Note is 2.36%, marginally higher than the 2.15% yield at this time a year ago. Yields on certificates of deposit are similarly mediocre, with none yielding higher than the 1.76% interest rate on your average 5-year CD.

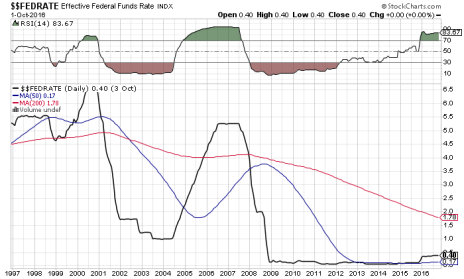

Though no longer at or near zero, short-term interest rates are still woefully low. Take a look at this 20-year chart of the federal funds rate:

Even a bump up to the 0.75 range would still put interest rates lower than their 1997-through-2007 nadir. So, unless the Fed unexpectedly hikes the rates a full point, a December rate hike is not a reason to abandon your dividend stocks in search of higher yielding U.S. Treasury bonds or CDs. The average S&P 500 stock yields just over 2%, and that includes the 75 or so that don’t pay a dividend at all.

Plus, dividend stocks have actually performed quite well of late—particularly consistent dividend growers, like Dividend Aristocrats. The ProShares S&P 500 Dividend Aristocrats (NOBL) ETF, which tracks the price of Dividend Aristocrats (companies that have grown their dividend payouts every year for at least 25 straight years), is up 9.4% this year, outpacing both the S&P 500 and the Nasdaq.

Here’s the chart:

So, this year at least, you get both dividend growth AND market-beating share price appreciation when you invest in a Dividend Aristocrat. But you don’t have to own a Dividend Aristocrat to net a better a return than bonds. Most dividend stocks offer a better total return than either of those income alternatives.

And the climate for dividend stocks is only getting better. According to FactSet, aggregate quarterly payouts increased 0.8% in the second quarter, payout ratios (39.5%) are at a post-recession peak, and dividends per share ($44.23) among large-cap stocks is at a decade high.

If you’re an income investor, dividend stocks are still the place to be to build wealth. And if you want to some of the best dividend-stock recommendations (plus a few, non-Treasury-related bonds), you’d be wise to subscribe to Chloe Lutts Jensen’s Cabot Dividend Investor advisory. The CDI portfolio currently features six stocks with a total return of better than 20%!

[author_ad]