If you asked 50 investment pros if they preferred a company to pay out dividends or repurchase shares, the answers might be split pretty evenly. I happen to love both stock buybacks and dividends—if they are done for the right reason. Dividends are utilized in a couple of ways:

- To attract new investors with steady cash flow

- To reward existing investors with occasional dividend increases, and sometimes special dividends.

[text_ad]

And according to SP Global, since 1926, dividends have contributed almost one-third of total return for the S&P 500, with about 68% coming from the stock’s appreciation. Think of it as a profit-sharing plan for a company’s investors. The downside is that dividends are paid out after tax by corporations, and then shareholders are taxed when they receive them. That’s called double-taxation. The advantages of dividends are obvious—free money, and if you hold those stocks in a retirement plan, you can defer the taxes until your golden years, when your tax bite will probably be lower.

Alternatively, a buyback is simply when a company repurchases its own stock just like you and I would do—in the market. Investors like stock buybacks because they reduce the number of outstanding shares and also enhance the company’s per-share profitability measures, such as EPS, Return on Equity and cash flow per share. Over time, those better ratios will often lead to higher share prices, adding to investors’ pocketbooks. And, very importantly, the buyback isn’t taxed until the stockholder sells his shares.

From a corporate standpoint, buybacks are optional, but are often done for two reasons:

- The company has excess cash. If excess cash is the impetus, the company has the choice of what to do with its extra cash—it is not obligated to repurchase shares. It can just plow the money back into the company.

- Its share price—in its estimation—is cheap. If the company’s C-suite thinks the shares are undervalued, they may use buybacks as a way to (hopefully) improve the share price.

The timing of a stock buyback is also important. Companies want their buybacks to look like a show of strength—confidence in the company’s future. And while share prices can—and often do—rise after a buyback, if, for some reason, they took a dive, the buyback may be considered a failure.

And if the shareholders believe the company should be investing its excess cash back into the growth of the company instead of repurchasing shares, the buyback could backfire.

There are some disadvantages of a stock buyback:

- The company doesn’t see a better use of its cash, such as buying the competition or investing in new products or technology. That may raise some questions as to the company’s confidence in future growth—and for investors, appreciation of their stock.

- The buyback process can be time-consuming and expensive, as a company must provide stock exchanges and regulators reams of disclosures, and usually, it also has to hire investment bankers.

In addition, a company might use stock buybacks to camouflage the number of shares it’s handing out to its top executives in the form of stock options. The buybacks may balance out the options issuance, keeping the total number of shares constant, and essentially not benefiting the shareholders.

Which Method Rewards Shareholders the Most?

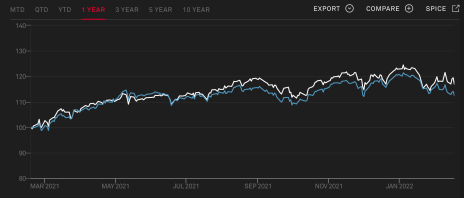

It’s often a toss-up, as you can see in the following graph. Since 2013, the shares of companies that have repurchased their shares (as represented by the SPDR S&P 500 Buyback ETF (SPYB)—the white line) have performed just about the same as the S&P 500 Dividend Aristocrats (represented by S&P 500 Dividend Aristocrats (SPDAUDP—the blue line). Aristocrats are stocks that have raised dividends for at least 25 years.

However, you will also note that in 2021, buybacks—as a whole—had better returns than the Aristocrats.

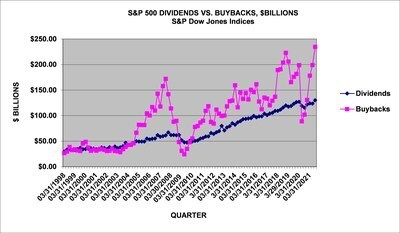

With the economic recovery, it should be no surprise that companies used their cash last year to pay dividends and to buy back shares, as depicted in the following graph.

Stock Buybacks had a Record Year in 2021

Last year, total stock buybacks hit $850 billion, surpassing the record 2018 buybacks of $806 billion.

The biggest repurchases were in finance and technology, and four out of the five largest buybacks were tech companies. And the top five companies accounted for some 30% of total buybacks during quarter three:

- Apple $20.4 billion

- Meta Platforms $15 billion

- Alphabet $12.6 billion

- Bank of America $9.9 billion

- Oracle $8.8 billion

Source: S&P Dow Jones Indices

It just makes sense that the tech companies would lead the stock buybacks. After all, they are bastions of cash, and they have to do something with all that money, or their shareholders would get restless.

And since Financials have had a comeback recently (shares were up 21.8% for the past year), they, too, are sitting on heaps of cash. Their balance sheets are strong, and rising interest rates should widen their margins. For the 12 months ended in the third quarter 2021, financial buybacks added up to $152.7 billion, up from the prior period of $117.3 billion.

2022 Looks Like Another Good Buyback Year

With corporate profits forecast to grow 10% or more this year, companies will have lots more cash to disburse, and many will most likely use it for some judicious repurchasing of their shares.

According to rttnews.com, there have already been 32 stock buybacks announced this year, ranging from $25 million (Apollo Investment, AINV) to $15 billion (Cisco Systems, CSCO).

Just remember, a buyback—or lack thereof—is not the primary reason to buy or sell a stock. Further investigation is always needed.

Which is why I wanted to take a look at a few of the financial companies on the 2022 stock buyback list.

Here’s a sampling of what I found:

| Company | Symbol | P/E | Analyst Rank | Technical Indicator |

| Primerica | PRI | 14.53 | 2.3 | Sell |

| Apollo Investment | AINV | 7.34 | 2.8 | Weak Buy |

| Zions Bancorp | ZION | 10.57 | 2.4 | Strong Buy |

In addition to being the highest rated, Zions beat earnings estimates by $0.03 last quarter, and is expected to grow 15.8% next year. Zions is a Utah-based bank that has offices in Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington, and Wyoming.

Apollo, a business development company, surpassed earnings predictions by a penny, but is expected to grow at a negative rate of -2.1% in 2023.

Primerica, a life insurance company, missed EPS estimates last quarter by $0.28 and analysts are forecasting growth of 11.1% for next year.

Now, I’ve not done a deep dive on any of these companies, but if I were inclined to buy financial stocks (which I am), I would definitely take a second look at Zions.

[author_ad]