In 2016, there was no question as to which retail giant had the better year. Shares of Wal-Mart (WMT), America’s largest retailer, soared 14.4%—its best performance since 2013. Meanwhile, shares of Target (TGT), America’s second-largest retailer, were stuck in the mud, beginning the year at 72 and finishing it at 72. But things are looking much better for TGT stock than for WMT stock in 2017.

TGT Stock vs. WMT Stock: By the Numbers

For starters, TGT has been the better-performing stock—and company—for quite some time. Even with a net decline over the past two years, TGT stock has still averaged a 7.6% annual return since 2012, compared to WMT stock’s 4.9% average return. TGT stock boasts the better yield, too, at 3.3%, compared to WMT’s 2.9%. Perhaps most importantly, Target’s earnings are growing (by 10.7% in the third quarter) while Wal-Mart’s are shrinking (-8.2% in the third quarter). Target stock is also cheaper, trading at less than 13 times earnings, while WMT carries a P/E of 15.

[text_ad]

Self-inflicted wounds have plagued Target over the past few years. In 2013, there was the massive breach of customers’ credit and debit card information, then its botched Target Canada launch, and most recently, its controversial decision to allow transgender customers to use the bathroom of their choice, which our Crista Huff chronicled in a very pointed criticism last year.

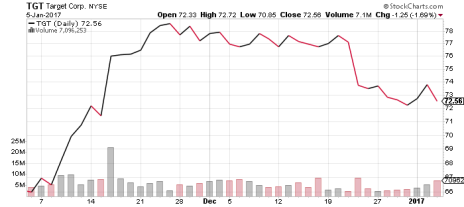

Now that those public embarrassments and controversies are (hopefully) behind them, I think TGT stock is poised for a breakout this year. In fact, it’s already doing so. Just look at what the stock has done since the presidential election:

After bouncing off long-term support at 66 on November 4, TGT stock shot all the way to 78 in exactly three weeks. It has since cooled off, testing new support at 72. But short-term consolidation after such a fast run-up should be expected.

Meanwhile, Wal-Mart shares are down slightly since the election (and, more damningly, since Black Friday). WMT now trades below its 50- and 200-day moving averages.

However, while Target’s earnings growth is expected to remain solid (11% for full-year 2016, another 5.8% in 2017), its sales have been lagging. Analysts expect a 5.3% decline in 2016, and a mild (1.7%) improvement in 2017. Same-store sales are the main culprit, tumbling each of the last two quarters. The store just doesn’t have the same buzz it did in its “Tar-jay” heyday.

That said, Walmart’s sales have been equally uninspiring, failing to reach more than 1% growth for seven straight quarters. Putting the string of embarrassing headlines aside, Target has the same problems as its much larger competitors: Americans are turning their backs on the big-box stores in favor of the convenience of online shopping.

Therefore, the key for Target stock to return to growth is online sales. Right now, online sales account for less than 5% of Target’s total sales, despite a 26% uptick in the third quarter, ahead of Walmart’s 20.6% digital growth. In fact, Target has routinely defeated Walmart in that department, and it should continue to do so given that the average Target shopper is younger than the average Walmart shopper. (Target’s customers also make about 25% more money than Walmart’s customers do, which means they’re more likely to swallow the extra shipping costs that come with online shopping.)

And while Walmart is investing heavily to improve its e-commerce sales, with plans to spend more than $2 billion in digital improvements this year and next and its recent buyout of online marketplace startup Jet.com, Target’s customer demographics should still give it a leg up on future digital sales growth.

TGT a Play on Consumer Confidence

The name Target still means something in the retail world. As more consumers do their shopping online in the years to come, that name recognition should attract more shoppers to the company’s website.

Truth be told, I don’t love retail stocks that rely heavily on in-store sales in the age of online shopping. But 2016 results aside, TGT stock is a better buy than WMT stock right now.

Ultimately, Amazon.com (AMZN) is a better long-term growth stock that either TGT or WMT. But if you prefer value and income in your stocks (two things AMZN doesn’t offer), and are looking to add a retailer to your portfolio as a play on swelling consumer confidence, TGT stock is a good bet.

[author_ad]