Costco (COST) stock is perking up ahead of tonight’s July sales numbers release. The stock is still more than 10% below its highs from June, before Amazon (AMZN) announced its decision to buyWhole Foods (WFM). So is it time to buy Costco stock, or is there more downside in the cards?

Costco Stock: The Chart

Let’s start with the chart. Costco was trading at an all-time high before the Whole Foods announcement—but the stock’s advance was already looking a bit long in the tooth.

For one thing, after a seven-year advance, COST stalled out in 2016: the stock opened at 159 in January 2016 and closed out the year just one dollar higher—at 160. And over the past 12 months, COST stock suffered several high-volume selloffs—first in September 2016, when August sales numbers disappointed, and again this past March, after second-quarter results missed estimates.

But the selloff after the Whole Foods announcement was the worst yet. You can see on the chart that volume remained extremely elevated for over a week, as heavy selling pushed the stock down. COST dropped almost 14% and broke through both its 50- and 200-day moving averages to the downside, where it remains.

[text_ad]

At this point, COST looks broken, meaning that the selloff after the Whole Foods announcement broke the stock’s uptrend and created an obstacle that will be very hard for the stock to surmount going forward.

Costco Stock: The Numbers

Of course, the chart is only half the story. What about the numbers?

Analysts expect Costco to deliver 7.8% sales growth and 8.3% EPS growth this year. However, estimates have fallen since the start of the year, when analysts were expecting growth closer to 10%. And sales growth is expected to decelerate next year, to 5.4%. Analysts do expect EPS growth to accelerate, to over 10%, but estimates have been falling, with five downward revisions in the past 60 days.

The culprit, again, is Amazon. While Costco’s warehouse model has helped the company thrive for longer than most competitors, investors are increasingly concluding that no bricks and morter retailer is immune from the Amazon effect.

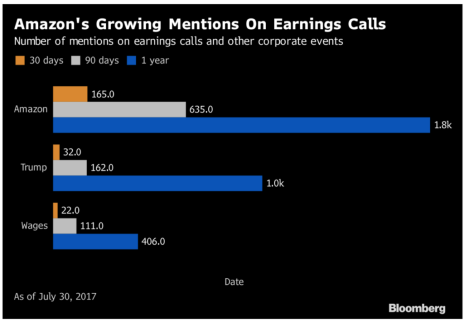

According to a recent Bloomberg study, Amazon has corporate America more worried than even President Trump. Amazon was mentioned on earnings calls 165 times over the past month, while Trump was mentioned only 32 times. And over the past year—which includes Trump’s election and inauguration—Amazon garnered 800 more mentions than the President.

If the Whole Foods purchase was just the latest salvo in Amazon’s gradual domination of the entire consumer sector, no one is safe.

Value investors will want to keep that in mind when deciding whether Costco stock is a bargain today. COST is currently trading at a P/E of 27.5, which is lower than its average 2016 P/E of 29. But it’s not historically low, it’s right in line with Costco stock’s five-year average P/E ratio of 27.6.

Costco’s forward P/E is also lower than it was last year—24.6 vs. 26.8—but in line with its five-year average of 24.2. And if earnings estimates continue to fall, COST’s forward P/E will gradually increase.

Why You Should Avoid Costco Stock

Even after the Whole Foods announcement, Costco still isn’t exactly a bargain stock.

Estimates don’t paint a particularly strong growth picture.

And the chart suggests more downside is more likely than a rebound.

In other words, the bounce in COST over the past few days is probably nothing more than that—a bounce—and investors should continue to avoid the stock.

Editor’s Note: Chloe added Costco (COST) to the Dividend Growth Tier of the Cabot Dividend Investor portfolio in February 2014, and sold the stock in March 2017 for a 49% gain.

[author_ad]