The last eight years haven’t exactly been a picnic for income investors, and now, the search for yield has somehow become even harder. The sharp post-election selloff in fixed income has not only crushed the prices of bonds and bond funds, it has also triggered a sympathy selloff in high yield stocks. Sure, fixed income yields are rising, but that doesn’t help much as you’re watching prices plummet.

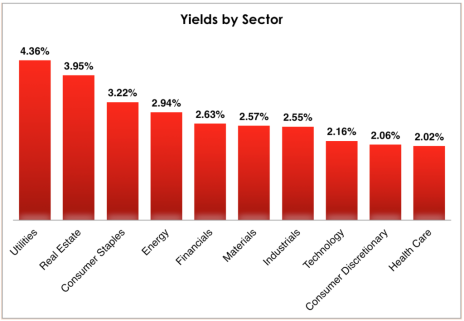

My prescription for the situation is to ignore fixed income and look beyond traditional high yield sectors. That means avoiding yield-oriented investments like MLPs and REITs. I’d also encourage skepticism of interest rate-sensitive sectors, like utilities. Even high yield stocks in defensive, dividend-oriented sectors—including consumer staples stocks like grocery and cigarette companies—have been left behind by the recent rally.

Ignoring utilities, real estate and consumer staples names may take some of the usual suspects off the table, but it can lead you to some hidden gems in less-visited corners of the high yield world.

[text_ad]

For example, financial stocks can offer fat dividends, with the fifth-highest yields of any sector. And now is a great time to invest in financials, which will benefit from rising interest rates, are expected to enjoy lower regulation in coming years, and whose stocks have spent most of the last three years consolidating.

Three of the highest-yielding names in the sector right now are The Blackstone Group (BX), with a yield of 6.0%, Fortress Investment Group (FIG), with a yield of 6.9%, and AllianceBernstein (AB), which yields a whopping 7.7%. None are low risk—all have faced company-specific challenges recently—but all have many more macro factors working in their favor today than similar-yielding utilities or REITs.

Of course, searching for high yield stocks in non-yield sectors will often turn up companies whose yields are high because their prices are low after years of serious corporate or macro challenges. The list of tech sector companies with yields over 5% reads like a catalog of obsolescence, from 5.9%-yielding Nokia (NOK) to 8.9%-yielding CenturyLink (CTL), a landline telephone company. Many of these companies will never come back—eventually, their dividends will be reduced and those high yields will disappear.

But sifting through the near dead for companies facing more temporary issues is a great way to lock in high yields that would otherwise be unavailable. These yields will also disappear eventually, but ideally, it will be because the stock price has rebounded.

I’m thinking of high yield stocks like Las Vegas Sands (LVS), which is yielding 5.1% because of the downturn in Macau—likely a temporary situation. Or Mattel (MAT), the owner of Barbie, which is in the middle of a turnaround that’s already showing results, but still yields 5.3%. Or my latest Cabot Dividend Investorrecommendation, which is also in a cyclical growth industry, yields north of 5%, and is in the middle of a major turnaround. It also has a compellingly low P/E of less than 7. I can’t tell you the name of the company until my premium members have had a chance to buy it, but if you’d like to receive it tomorrow, just click here to learn more about Cabot Dividend Investor.

[author_ad]