Natural gas stocks have been lackluster investments in recent years, depressed by consistently low natural gas prices. But that’s all changed in the pandemic era, with natural gas prices hitting levels not seen since 2014. Natural gas stocks have benefitted, and are worth a look as temperatures fall and Covid cases rise across the country.

Natural gas prices are sensitive to weather, because the fuel is widely used to generate electricity. Many U.S. coal plants have been converted to cleaner-burning natural gas in recent years. Normally, gas prices decline in the fall, as cooler weather reduces air conditioner usage and electricity consumption. That was the case again this past fall, as natural gas futures peaked at $4.88/MMBtu in early October, and plummeted as low as $3.50 by the end of December.

A new year has brought a renewed rise in nat. gas prices, however, with futures rising to $4.43/MMBtu as of this writing. The bigger-picture rise is even more impressive. After bottoming at $1.00 in June 2020 on the heels of Covid-induced shutdowns and the swift crash in everything from stock prices to energy prices, natural gas prices have since more than quadrupled, driven by the global economic recovery, U.S. inflation and other factors, including the intense cold in parts of the U.S. this year.

[text_ad]

Natural gas stocks have ridden the coattails of nat. gas prices. While very few of them have risen four-fold since the June 2020 bottom, many have outperformed the S&P 500 by a wide margin - and should continue to do so now that natural gas prices are back on the uptick.

Let’s examine at a few options that look especially appealing right now.

Top 3 Natural Gas Stocks To Buy

Investors who want to bet on the bull market in natural gas will find plenty of options, and you could invest in the leading natural gas ETF, the First Trust ISE-Revere Natural Gas Index Fund (FCG), which is up 89% in the last year. But this ETF holds (or shorts) oil and gas companies as well as pure natural gas plays. If you just want to be in natural gas, you have to do it by buying individual stocks.

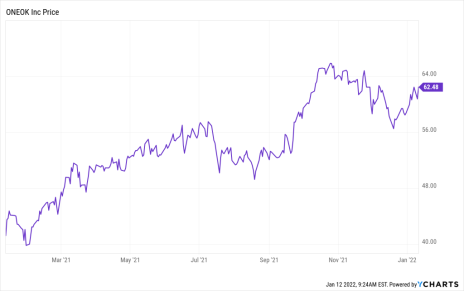

Natural Gas Stock #1: ONEOK Inc. (OKE)

My favorite pure-play natural gas stock is ONEOK (OKE), pronounced “one-oak.” ONEOK owns and operates over 38,000 miles of natural gas and natural gas liquids (NGL) pipelines, running from North Dakota to Texas and from Kansas to Illinois. ONEOK also owns natural gas and NGL storage, processing and fractionation facilities in Kansas, Oklahoma, North Dakota, Wyoming, Montana and Texas. (Fractionation is the breaking down of NGLs into component liquids like ethane and propane.)

This terrific midstream energy stock has also bounced back as virus concerns have subsided. Prospects look good for this year as business is strong and the stock is still undervalued. It has been a solid performer of late, up 51% in the last year, including a 10% jump since December 20. The recent move higher is a good opportunity to buy on momentum.

Natural Gas Stock #2: Atmos Energy (ATO)

Atmos Energy is one of the largest natural gas distributors in the U.S., and hit a new 52-week high last week. The company owns a large natural gas pipeline and storage system in Texas, and distributes natural gas to customers in nine states. Atmos’ distribution activities are tightly regulated by utility rate-setting commissions, and cash flow is reliable.

Atmos passes much of that steady cash flow on to investors. The company has a 38-year history of dividend growth, raising the dividend every year since 1983. At the current annual rate of $2.72 per share, ATO yields 2.6%.

2021 was Atmos’ best year for sales growth (20.8%) since 2014. Analysts anticipate more modest top-line growth (9.3%) this year, though the expected 7.2% earnings per share would surpass last year’s 4.7% improvement.

As for the stock, it’s up 19% in the last year despite some peaks and valleys, and just hit new 52-week highs last week. You can buy here, or wait for the stock to retreat a bit more before dipping a toe.

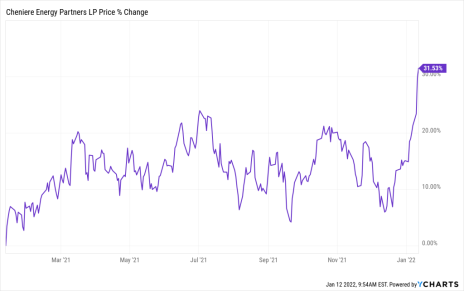

Natural Gas Stock #3: Cheniere Energy Partners L.P. (CQP)

Finally, from Houston, Texas, comes Cheniere Energy Partners L.P. (CQP), which, as you can tell from the initials at the end of its name, is a master limited partnership, or MLP. Cheniere is leading the development of the nascent natural gas export industry in the U.S.

Before being exported, natural gas is cooled to -260° F, at which point it becomes a liquid, known as liquefied natural gas, or LNG. In 2016, Cheniere became the first company to ship LNG from a commercial facility in the contiguous U.S.

LNG is transported in specially-designed double-hulled ships at very low temperatures, and unloaded at LNG terminals with insulated tanks and regasification facilities.

Cheniere is expanding rapidly, and 2021 is expected to be its best year for sales growth (40%) since 2018 (full-year earnings aren’t due out until late February). Analysts estimate another 16.6% revenue growth this year, with 43.5% EPS growth.

Meanwhile, the company pays a hefty dividend (5.6% yield) and the stock trades at a mere 10 times this year’s earnings estimates despite the 43% EPS growth projected. CQP shares are up 31% in the last year, and have been on a tear of late, rising 24% in the last month alone. Buy on dips.

One thing to note: There are some tax complications associated with owning MLPs, so if you’re not familiar with them, do a little research before buying the stock.

Do you own any natural gas stocks in your portfolio? Tell us about them in the comments below.

[author_ad]

*This post has been updated from an original version, published in 2018.