The biggest takeaway from Janet Yellen’s Capitol Hill appearance on Tuesday was that the Federal Reserve chair said it would be “unwise” for the Federal Open Market Committee (FOMC) to wait too long to increase interest rates again. Translation: expect another rate hike soon. That said, if you’re an income investor, I wouldn’t sell your dividend stocks and go diving into Treasury bonds and CDs just yet.

For starters, who knows what “waiting too long” means in the Fed’s mind. Odds of a rate hike in March bumped up from 30% to 36% within minutes of Yellen’s prepared testimony. But that’s still barely more than a one-in-three chance it will happen before spring. More likely, the next rate hike will come sometime in the second quarter.

Furthermore, like the past two rate hikes, the Fed’s next rate increase is sure to be modest. Based on Yellen’s repeated intention of “gradual increases,” the next one will almost certainly be another quarter of a point, which would take the federal funds rate to a range of 0.75 to 1.00.

[text_ad]

That’s not likely to do much for Treasury bonds; the current yield on a 10-year U.S. Treasury Note is roughly 2.4%, near its 52-week highs of 2.6% but in line with where it was 18 months ago and lower than where it was three years ago (2.8%). Yields on certificates of deposit are similarly mediocre, with none yielding higher than the 1.76% interest rate on your average five-year CD.

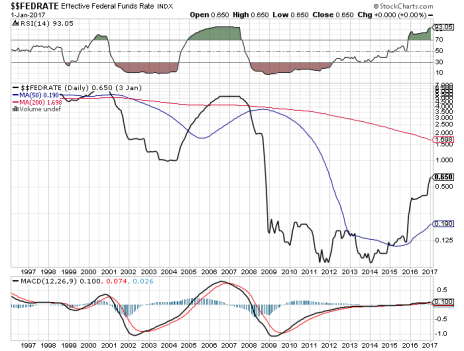

Though no longer at or near zero, short-term interest rates are still woefully low. Take a look at this 20-year chart of the federal funds rate:

Even a bump up to the 0.75-to-1.00 range would still put interest rates lower than their 1997-through-2007 apex. So, unless the Fed unexpectedly hikes the rates a full point, a March (or later) rate hike is not a reason to abandon your dividend-paying stocks in search of higher-yielding U.S. Treasury bonds or CDs. The average S&P 500 stock yields just under 2%, and that includes the 75 or so that don’t pay a dividend at all.

Plus, dividend stocks give you the potential for growth beyond the sub-2% yield of a CD. Though they’ve trailed the outstanding returns of the market in the past year, Dividend Aristocrats—i.e., companies that have raised their dividend payouts every year for at least 25 straight years—have risen a very respectable 14% during that time.

But you don’t have to own a Dividend Aristocrat to net a better a return than CDs or bonds. Most dividend stocks offer a better total return than either of those income alternatives.

And the climate for dividend stocks is only getting better. According to FactSet, aggregate quarterly payouts increased 1.2% in the third quarter; payout ratios are at a post-recession peak (40.2%); and dividends per share among large-cap stocks is at a decade high ($44.80).

If you’re an income investor, dividend stocks are still the place to be to build wealth. And if you want to some of the best dividend-stock recommendations (plus a few, non-Treasury-related bonds), you’d be wise to subscribe to Chloe Lutts Jensen’s Cabot Dividend Investor advisory. The CDI portfolio currently features seven stocks with a total return of better than 20%!

[author_ad]