Everybody knows that when the stock market is going up, you buy, and that when the market is going down, you sell. Well, almost everybody. There are a few growth stock investors who think that some beaten down growth stocks (like Baidu stock) look like juicy bargains. Let me explain why they aren’t.

Market in Free Fall

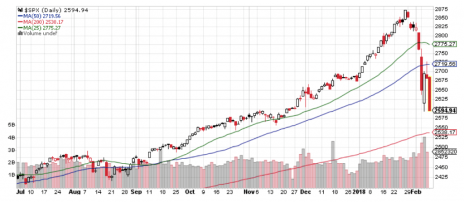

On January 29, the S&P 500 tipped over into a normal-looking pullback, slipping lower for a few days but staying well above its rising 25-day moving average. So far, so good.

[text_ad]

Then came February 2 (a Friday) and February 5 (the following Monday), when the S&P really got serious about correcting on heavy trading volume. On Monday alone, measured from its Friday close, the S&P slipped 4.27%. And after a heartening bounce on Tuesday, the index marked time on Wednesday, then fell another 3.8% on Thursday. This is what it looked like.

And the Nasdaq, not surprisingly, retreated in parallel with the S&P, only worse. The tech-heavy index was down 3.9% on Thursday.

And yet, despite this graphic evidence that markets are in an ugly mood and want to take somebody’s leg off, I have been getting emails from subscribers asking if a particular stock looks like a good buy!

Avoid Baidu Stock

There has been a great interest in Baidu (BIDU), the Chinese online search giant whose stock has been in free fall since January 29. As of the market’s close on Thursday, Baidu stock was down 18.5% from its January 26 close, trading right around 212. The last time BIDU traded at 212 was in late July as the stock was gapping up after a great earnings report. Here’s the chart.

I advised my Cabot Global Stocks Explorer subscribers to sell the last half of our position in BIDU in a Special Hotline on January 5. And if they followed my advice, they got a nice bounce on February 6 to sell into.

But I know that there are investors out there who look at BIDU’s chart and think, “Hmmm, this is a $275 stock (BIDU’s high in mid-October) and it’s now selling at $212. What a bargain!”

And they may be right. The stock might just dig its heels in, stop its decline and stage a rebound that will stun everyone in the cafeteria.

But I doubt it. Momentum can always be reversed, but the odds favor either more losses or a long, slow process of building a new base before investors are ready to jump back into BIDU stock.

There is often a reason market clichés are clichés, and the one that applies to this situation is, “Don’t try to catch a falling knife.” To take the metaphor seriously, just remember that while you might grip the handle, you might also grab the blade. And it’s a very sharp blade when you’re grabbing a stock that just lost 4.7% of its value in one day.

There will be plenty of time to return to buying once the market’s mood improves and a few wounds are healed. In a market like this one, patience and cash are the approved approach to portfolio management, at least for growth investors.

Baidu is a big, strong company, and it will likely be ready for buying some time in the next year. Don’t push your luck.

I will be keeping an eye on the stock and when it resumes its uptrend, Cabot Global Stocks Explorer subscribers will be the first ones to know. To become one of them, click here. Our portfolio has good stocks that are on track to deliver solid gains in 2018.

[author_ad]