Emerging market stocks are known for their volatility. But what happened to Brazilian stocks last week, and one Brazil ETF in particular, was somewhat shocking.

The Bovespa, Brazil’s benchmark stock index, was down more than 7,000 points, from 68,684 to 61,597, in just two trading sessions last week. Its 8.8% decline last Thursday was the worst one-day drop-off for the index since October 22, 2008, during the depths of the global recession.

What caused such carnage? Brazil’s new president is embroiled in an ugly scandal (sound familiar?). President Michel Temer is being accused of bribing a jailed former politician, and Brazilian media group Globo reportedly has a secret recording of Temer authorizing the bribe. Now Temer, just nine months into his presidency, is being asked to resign.

[text_ad]

Brazil ETF Plummets

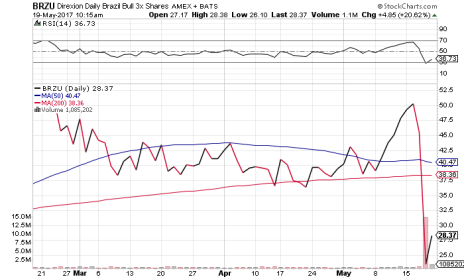

The news sent shockwaves through Brazilian markets. But the BRZU, a bullish, triple-leveraged Brazil ETF, took the worst of it. The exchange-traded fund plummeted from 50 to 23 on Wednesday and Thursday. It rebounded a bit on Friday after bouncing off 52-week lows, but not nearly enough to repair the damage.

Here’s what losing more than 50% in two days looks like on a three-month chart:

Yikes. While that kind of overnight nosedive is extreme, wild swings in the Brazilian stock market have become all too common in recent years. After a promising recovery from the global recession, Brazil’s economy hit a wall about four years ago. The country’s GDP hasn’t grown since 2014, and the decline has actually picked up steam in the last couple of quarters.

Meanwhile, the country is becoming the poster child for political scandal: Temer’s predecessor, Dilma Rousseff (Brazil’s first female president), was impeached last August. Given the seriousness of Temer’s infraction and the apparent evidence against him, it’s entirely possible that Brazil will cycle through three presidents in less than a year.

That’s not good for business. And it’s especially not good for Brazilian stocks, which prior to last week had been making some very encouraging strides, rising more than 25% in the last year and 13% year to date. Going back to last January, the Bovespa was up nearly 60%. The rebound in Brazilian stocks came on the heels of a rough few years dating back to the start of 2013, right when the country’s economy began to backslide.

Hard to Trust Brazilian Stocks

The 18-month rally in Brazilian stocks convinced our emerging markets investing expert Paul Goodwin to recommend a half position in LATAM Airlines Group (LTL) to his Cabot Global Stocks Explorer subscribers in late March. But last week, LTL broke down along with the rest of the Brazilian market, and Paul promptly advised selling the stock.

So it goes for Brazilian stocks these days. It seems that every time the Brazilian market starts to look good, the country encounters a scandal that threatens to derail the whole thing.

If you like emerging markets stocks, there are better (and safer) places to find them than Brazil right now. To see which emerging markets stocks Paul is currently recommending to his subscribers, click here.

[author_ad]